BP CEO's 31% Pay Cut: Impact And Future Implications

Table of Contents

Analyzing the 31% Reduction: What Does it Mean?

The 31% reduction in BP's CEO's compensation is a dramatic move with multifaceted implications. Let's analyze its short-term and long-term impacts.

Short-Term Impact on BP's Financial Performance

The immediate effect of this BP CEO's pay cut is a considerable saving for the company. While the exact figure may not be publicly disclosed, the reduction represents a substantial amount in executive compensation.

- Cost Savings: This substantial saving can be reallocated to other areas of the business, potentially boosting investment in renewable energy projects or bolstering research and development efforts.

- Impact on Employee Morale: The pay cut, while impacting the CEO significantly, could potentially influence employee morale, depending on how it's communicated and perceived. A well-managed communication strategy emphasizing shared responsibility and commitment to navigating economic challenges could foster positive sentiment. Conversely, if perceived as unfair, it could negatively affect employee motivation.

- Public Relations Strategy: BP can leverage this move as a positive public relations initiative, showcasing a commitment to responsible corporate governance and shared sacrifice during difficult times. This can help rebuild trust with stakeholders after past controversies.

Long-Term Implications for Executive Compensation

This bold step by BP could significantly influence future executive compensation practices, not just within the company but across the energy industry.

- Changes in Compensation Structures: We may see a shift towards more performance-based incentives, tying executive pay more closely to company performance and sustainability goals. This could include a greater emphasis on environmental, social, and governance (ESG) metrics.

- Increased Focus on Performance-Based Incentives: The move highlights a growing trend towards linking executive remuneration directly to demonstrable achievements, rather than solely relying on fixed salaries and bonuses.

- Impact on Attracting and Retaining Top Talent: The reduction might make it slightly more challenging to attract and retain top talent. However, a strong company culture, compelling mission, and other attractive benefits could mitigate this risk. The long-term benefits of a company perceived as responsible and ethically-minded could outweigh the initial challenges.

The Broader Context: Societal and Political Influences

The BP CEO's pay cut didn't happen in a vacuum. Societal and political factors played a significant role.

Public Perception and Stakeholder Pressure

The public and stakeholder reaction to the pay cut has been mixed.

- Positive Responses: Many view the move as a sign of responsible leadership, demonstrating solidarity with employees and acknowledging the economic realities facing the company and the world. This aligns with growing public expectations for corporate social responsibility.

- Negative Responses: Others argue that the cut is insufficient, particularly given the CEO's overall compensation package. There may also be concerns that this sets a precedent for future salary reductions for other employees.

- Role of Social Media: Social media has played a critical role in disseminating information about the pay cut and shaping public opinion. The quick spread of news and diverse perspectives underscores the importance of corporate transparency in today's digital age. The BP CEO's pay cut became a trending topic, showcasing the impact of social media on corporate reputation management.

Regulatory and Legal Considerations

While not directly mandated, the BP CEO's pay cut may reflect a response to evolving regulatory pressures and ethical considerations.

- Relevant Legislation: Growing awareness of income inequality and increasing scrutiny of executive compensation have led to stricter regulations in some jurisdictions. While this specific pay cut might not be directly linked to specific legislation, it reflects a broader trend towards greater transparency and accountability in executive pay.

- Legal Challenges: While unlikely to face legal challenges for this specific decision, the cut demonstrates a proactive approach to managing reputational risks associated with excessive executive compensation.

Future Outlook: Predicting the Trajectory of Executive Pay

The BP CEO's pay cut has significant implications for the future.

Predicting Future Executive Compensation at BP

Based on this precedent, future executive compensation at BP is likely to become more closely tied to performance, sustainability targets, and ethical considerations.

- Performance-Based Bonuses: We might see a greater emphasis on performance-based bonuses linked to hitting specific sustainability goals.

- Clawback Provisions: BP might introduce stricter clawback provisions, allowing the company to reclaim bonuses if performance targets are not met or unethical behavior is discovered.

- Transparency: Greater transparency in executive compensation packages will likely be implemented.

Setting a Precedent for Other Energy Companies

The BP CEO's pay cut could indeed set a precedent for other energy companies.

- Domino Effect: Other companies might follow suit, either proactively reducing executive pay or implementing stricter performance-related pay structures.

- Corporate Social Responsibility: This decision underlines the increasing importance of corporate social responsibility (CSR) and stakeholder engagement.

- Long-Term Effects: The long-term effect could be a more equitable distribution of wealth within companies and a greater focus on sustainable business practices.

Conclusion

The 31% BP CEO's pay cut is a significant event with far-reaching implications. It demonstrates a shift towards greater accountability in executive compensation, influenced by economic realities, public pressure, and evolving corporate governance standards. The short-term impact includes cost savings and a potential boost to BP's public image. The long-term effects could reshape executive compensation practices within BP and the broader energy industry, potentially leading to a greater focus on performance-based incentives and ethical considerations.

What are your thoughts on this significant BP CEO's pay cut? Share your insights in the comments below! Let's discuss the future of BP CEO compensation and executive pay in the energy sector.

Featured Posts

-

The Goldbergs A Comprehensive Review Of Every Season

May 21, 2025

The Goldbergs A Comprehensive Review Of Every Season

May 21, 2025 -

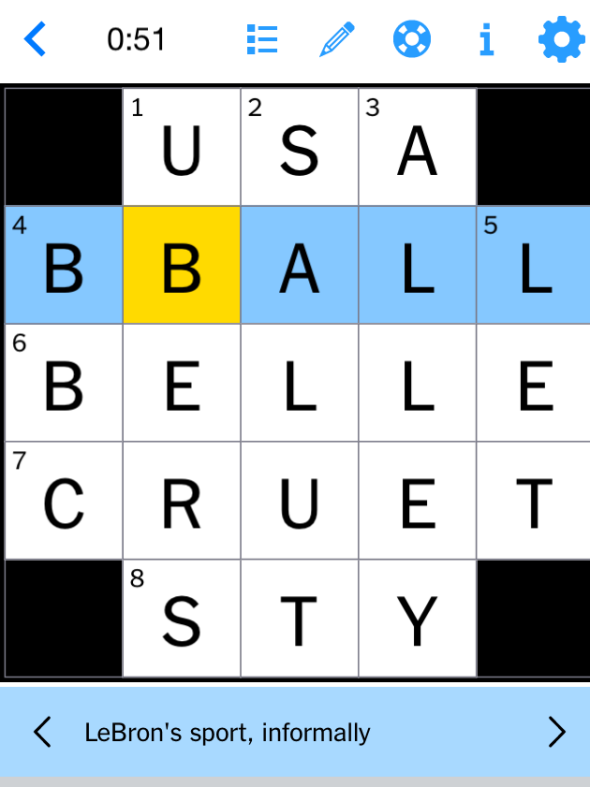

New York Times Crossword Puzzle Solutions April 25 2025

May 21, 2025

New York Times Crossword Puzzle Solutions April 25 2025

May 21, 2025 -

April 18 2025 Nyt Mini Crossword Puzzle Answers And Hints

May 21, 2025

April 18 2025 Nyt Mini Crossword Puzzle Answers And Hints

May 21, 2025 -

Wwe Raw Rollins Breakker Target Zayn

May 21, 2025

Wwe Raw Rollins Breakker Target Zayn

May 21, 2025 -

Historic Night New Womens Tag Team Champions On Wwe Raw

May 21, 2025

Historic Night New Womens Tag Team Champions On Wwe Raw

May 21, 2025