BP Chief Aims To Double Company Valuation: No US Listing Planned, Reports FT

Table of Contents

BP's Target: Doubling Company Valuation – The Strategy

BP's current market capitalization stands at [Insert Current Market Cap – find the most up-to-date figure]. The CEO's ambitious goal is to double this figure, representing a substantial increase in shareholder value. This aggressive target necessitates a multi-pronged strategy focusing on several key areas:

-

Increased Investment in Renewable Energy: BP plans to significantly ramp up its investments in renewable energy sources like wind and solar power. This move aligns with the global shift towards sustainable energy and positions BP for growth in a rapidly expanding market. This diversification is crucial for enhancing the overall BP company valuation.

-

Operational Efficiency and Cost Reduction: Streamlining operations and reducing costs across the board are paramount. This involves optimizing existing oil and gas production, improving supply chain management, and implementing technological advancements to boost efficiency. These cost-saving measures directly contribute to a healthier bottom line and improved BP company valuation.

-

Exploration and Development of New Oil and Gas Reserves: While transitioning to renewables, BP will continue to explore and develop new oil and gas reserves responsibly. The company will emphasize environmentally conscious practices and adhere to strict sustainability guidelines throughout this process. This ensures a balanced approach to energy production, impacting long-term BP company valuation positively.

-

Strategic Acquisitions and Mergers: Strategic acquisitions of companies with complementary assets and technologies will accelerate growth and expand BP's market share in both traditional and renewable energy sectors. This inorganic growth strategy is a key component of the plan to improve BP company valuation.

-

Technological Advancements: Investment in cutting-edge technologies will enhance production efficiency, reduce the environmental footprint of operations, and create new revenue streams. This commitment to innovation is essential for maintaining a competitive edge and influencing the future BP company valuation.

No US Listing Planned – The Reasons Behind the Decision

The decision to forgo a US listing, despite the potential access to a vast pool of capital, is a significant strategic choice. Several factors contribute to this decision:

-

Regulatory Hurdles and Compliance Costs: Navigating the complex regulatory landscape and compliance requirements of the US stock market would entail substantial costs and administrative burdens.

-

Potential Dilution of Shareholder Value: A US listing might necessitate issuing new shares, potentially diluting the existing shareholders' ownership and returns.

-

Focus on Existing Investor Base and Market Presence: BP has a strong and established investor base in other regions, and expanding into the US market may not be the most efficient allocation of resources at this stage.

-

Strategic Considerations Regarding Capital Allocation and Growth Priorities: The company likely assessed that investing in growth initiatives within its existing markets offers a higher return than pursuing a US listing.

-

Desire to Maintain Control and Independent Decision-Making: A US listing could subject BP to greater scrutiny and influence from US investors and regulators, potentially hindering its strategic decision-making processes.

Investor Reactions and Market Analysis – Implications for BP Stock

The market's reaction to BP's ambitious plan and the decision against a US listing will likely be mixed.

-

Short-Term Market Volatility: In the short term, the announcement could trigger some market volatility and fluctuations in BP's stock price as investors assess the strategy's implications.

-

Long-Term Growth Potential: However, the long-term outlook hinges on the successful execution of the strategic initiatives outlined above. If BP can effectively deliver on its renewable energy investments, cost-reduction measures, and exploration plans, investor confidence should grow, positively impacting the BP company valuation.

-

Impact on BP's Credit Rating and Access to Capital Markets: The strategy's success will influence BP's credit rating and its ability to access capital markets for future investments.

-

Competitor Strategies: The competitive landscape within the energy sector will significantly influence the success of BP's strategy. The actions of competitors and market trends will play a crucial role.

-

Expert Opinions: Analyst forecasts and expert opinions on the feasibility of doubling BP's company valuation vary, highlighting the inherent risks and uncertainties involved in this ambitious undertaking.

Conclusion

BP's ambitious plan to double its company valuation involves a multifaceted strategy encompassing significant investments in renewable energy, operational efficiency improvements, strategic acquisitions, and technological advancements. The decision against a US listing reflects strategic considerations regarding regulatory compliance, shareholder value, and maintaining operational control. The success of this strategy hinges on the execution of these initiatives and navigating the evolving energy landscape. The impact on BP's stock price and long-term valuation remains to be seen, but the plan represents a bold commitment to growth and adaptation within the energy sector.

Call to Action: Stay informed about the progress of BP's ambitious plan to double its company valuation. Follow our updates for further analysis and insights into the future of BP and the energy sector. Keep an eye on how this bold strategy, without a US listing, impacts BP's company valuation and market position.

Featured Posts

-

Antiques Roadshow Leads To Arrest Couple Charged With Trafficking National Treasure

May 21, 2025

Antiques Roadshow Leads To Arrest Couple Charged With Trafficking National Treasure

May 21, 2025 -

Adios Enfermedades Cronicas Este Superalimento Promueve La Salud Y La Longevidad

May 21, 2025

Adios Enfermedades Cronicas Este Superalimento Promueve La Salud Y La Longevidad

May 21, 2025 -

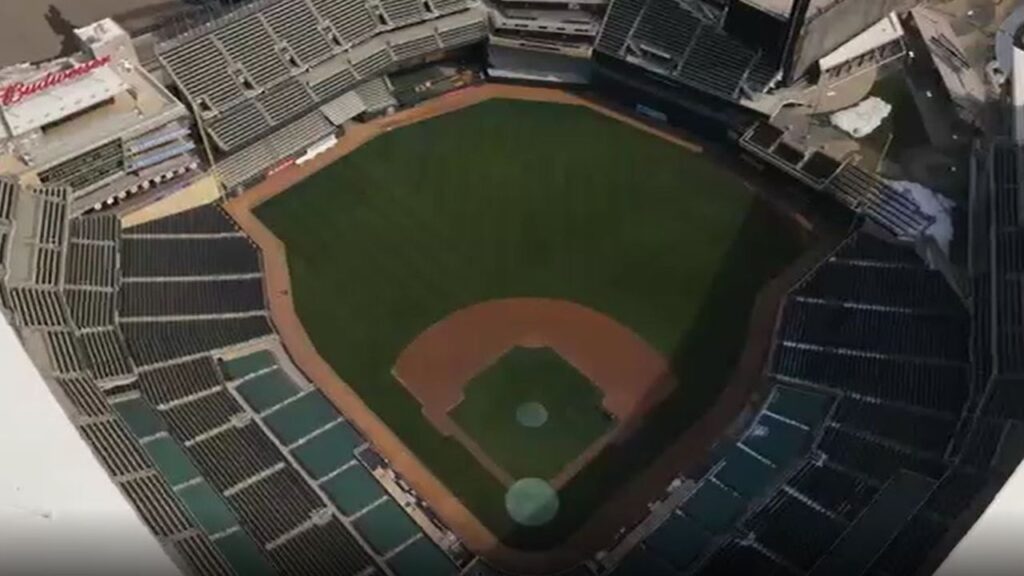

Minnesota Twins Baseball On Kcrg Tv 9 This Season

May 21, 2025

Minnesota Twins Baseball On Kcrg Tv 9 This Season

May 21, 2025 -

Najbolja Kombinacija Vanja I Sime Osvajaju Fanove Gospodina Savrsenog

May 21, 2025

Najbolja Kombinacija Vanja I Sime Osvajaju Fanove Gospodina Savrsenog

May 21, 2025 -

The Goldbergs Behind The Scenes And The Shows Creative Process

May 21, 2025

The Goldbergs Behind The Scenes And The Shows Creative Process

May 21, 2025