BP Chief Executive's Pay Sees Significant 31% Decrease

Table of Contents

The Magnitude of the Pay Cut

The reduction in Bernard Looney's compensation represents a substantial decrease in BP CEO pay. While the exact figures may vary depending on the reporting period and inclusion of certain bonuses, reports indicate a significant drop from his previous compensation package. This 31% decrease, impacting his annual remuneration for [Insert Year], is not merely a symbolic gesture but a considerable financial adjustment.

- Specific dollar amount of the pay cut: [Insert the specific dollar amount of the pay cut. Source this information appropriately]. This represents a [Calculate the percentage change] decrease from his previous year's salary of [Insert previous year's salary].

- Comparison to previous years' compensation: A detailed comparison with the CEO's compensation in previous years will reveal the magnitude of this reduction within the broader context of his tenure at BP. [Insert data for comparison. Source this information appropriately]

- Breakdown of compensation components affected: The 31% reduction likely affects multiple components of Looney's compensation, including his base salary, bonuses, and potentially long-term incentives such as stock options. A detailed breakdown of which components were affected and to what extent is crucial for a full understanding of this significant pay cut.

Reasons Behind the BP CEO Pay Decrease

BP has cited various reasons for the reduction in Looney's compensation, though the exact weighting of these factors remains unclear. The official statements should be carefully considered when evaluating the motivations behind this decision.

-

Company performance (profitability, stock price): BP's recent financial performance, encompassing profitability and stock price, might have played a role. While BP has seen periods of success, challenges within the energy sector have undoubtedly influenced the board's decision regarding executive compensation. [Insert data on BP's financial performance. Source this information appropriately].

-

Scrutiny of executive pay in the context of the energy transition: The energy industry is undergoing a significant transformation with a shift towards renewable energy sources. This transition brings increased scrutiny of executive pay, particularly in the context of environmental, social, and governance (ESG) concerns. The reduction in Looney's pay could be interpreted as a response to this growing pressure.

-

Possible impact of the Macondo oil spill (if relevant): While this is unlikely to be a direct cause, any lingering effects of past events, including the Macondo oil spill, might indirectly influence public and investor perceptions of executive compensation and contribute to the decision-making process.

-

Direct quotes from BP's official statements: [Insert direct quotes from BP's official press releases or statements regarding this pay cut].

-

Analysis of the company's financial performance: [Provide an analysis of BP's financial performance in the relevant period, using reliable sources].

-

Mention of any external pressures influencing the decision: [Discuss any external factors like shareholder activism or regulatory pressure].

Industry Comparisons and Implications

Comparing BP's CEO pay to that of its competitors sheds light on whether this reduction aligns with broader industry trends or represents a unique response to specific circumstances.

- Table comparing CEO salaries of competing energy firms: [Insert a table comparing BP CEO salary (pre and post-reduction) to those of CEOs at Shell, ExxonMobil, Chevron, and other major energy companies. Source this information appropriately].

- Discussion of potential future trends in executive compensation: The BP CEO pay cut might signal a broader shift in executive compensation within the energy industry, particularly as companies increasingly focus on sustainability and ESG factors.

- Analysis of the impact on investor sentiment: This significant pay cut could influence investor sentiment, potentially viewed as a positive sign of responsible corporate governance and a focus on long-term sustainability. However, the effect on investor confidence requires careful analysis.

Public and Stakeholder Reactions

The public reaction to the BP CEO pay decrease has been varied, with different stakeholders holding diverse perspectives.

- Summary of shareholder votes or statements: [Summarize any shareholder votes or statements regarding the compensation package. Source this information appropriately].

- Quotes from relevant media articles: [Include quotes from relevant news articles and analyses from reputable media sources].

- Analysis of public opinion based on available data (e.g., social media): [Analyze public opinion based on social media sentiment and other public data, where available].

Conclusion

The 31% decrease in BP's Chief Executive's pay highlights a significant shift in executive compensation within the energy industry. Factors such as company performance, increased scrutiny, and the broader energy transition have all seemingly played a role in this substantial reduction. Comparing this to other energy companies provides further context for understanding the future of executive pay in this sector. The long-term implications for BP CEO pay and its impact on the wider energy industry remain to be seen, but this significant pay cut certainly marks a notable moment.

Call to Action: Stay informed about the evolving landscape of BP CEO pay and executive compensation within the energy industry. Follow us for the latest updates on BP executive compensation and other relevant news in the oil and gas sector.

Featured Posts

-

Analyse Abn Amro De Gevolgen Van Goedkope Arbeidsmigratie In De Voedingsindustrie

May 22, 2025

Analyse Abn Amro De Gevolgen Van Goedkope Arbeidsmigratie In De Voedingsindustrie

May 22, 2025 -

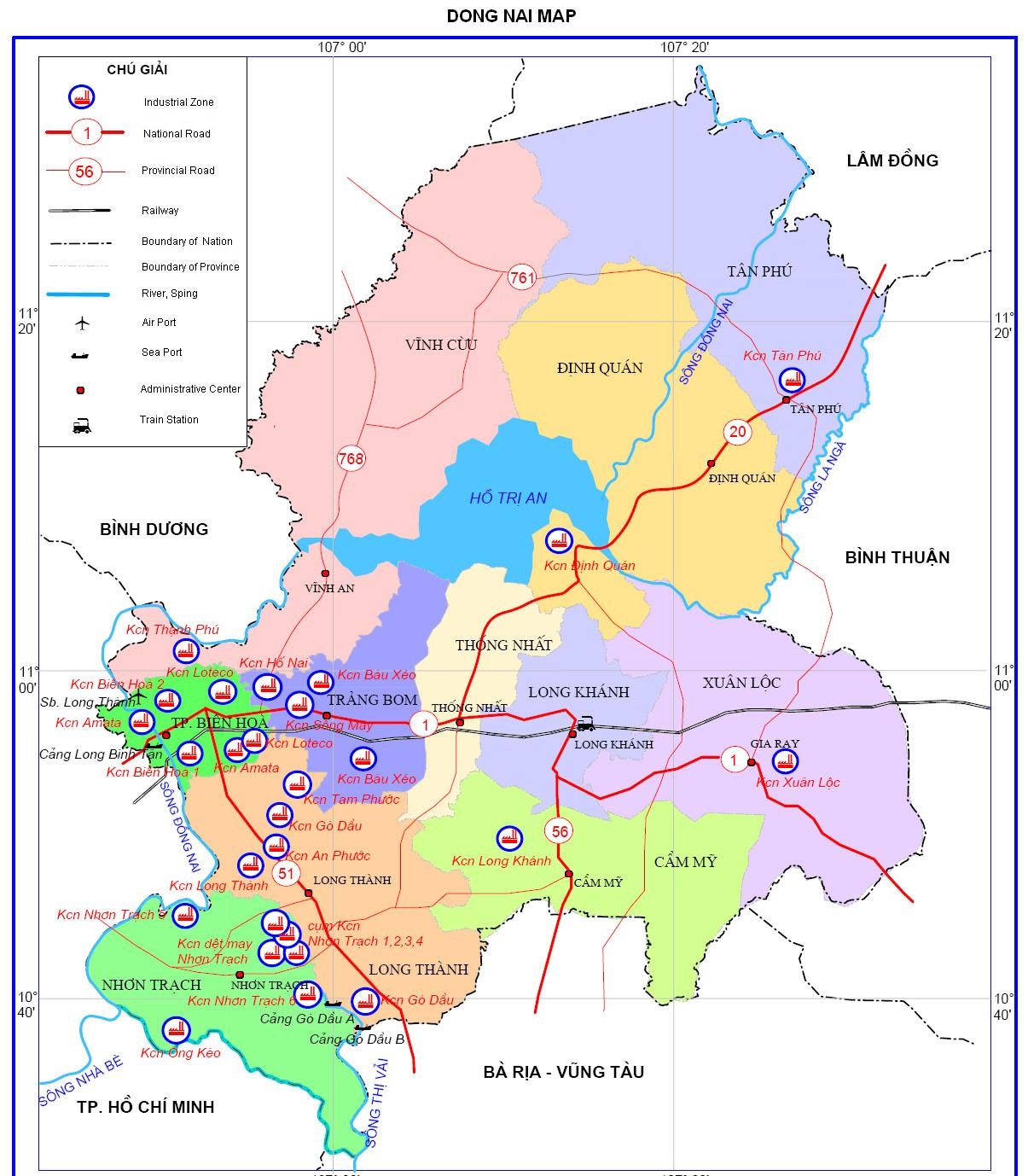

Cau Ma Da Khoi Cong Xay Dung Thang 6 Noi Lien Dong Nai Va Binh Phuoc

May 22, 2025

Cau Ma Da Khoi Cong Xay Dung Thang 6 Noi Lien Dong Nai Va Binh Phuoc

May 22, 2025 -

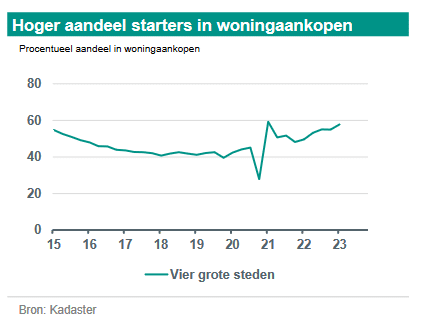

Abn Amro Voorspelt Stijgende Huizenprijzen Ondanks Renteverhogingen

May 22, 2025

Abn Amro Voorspelt Stijgende Huizenprijzen Ondanks Renteverhogingen

May 22, 2025 -

Complete Sandylands U Tv Guide Uk Air Dates And Channels

May 22, 2025

Complete Sandylands U Tv Guide Uk Air Dates And Channels

May 22, 2025 -

Dong Nai De Xuat Xay Dung Tuyen Duong 4 Lan Xe Qua Rung Ma Da Ket Noi Binh Phuoc

May 22, 2025

Dong Nai De Xuat Xay Dung Tuyen Duong 4 Lan Xe Qua Rung Ma Da Ket Noi Binh Phuoc

May 22, 2025