BP Executive Pay: A 31% Reduction Explained

Table of Contents

The Financial Performance of BP and its Impact on Executive Pay

The decision to reduce BP executive compensation is intrinsically linked to the company's recent financial performance. While BP has seen periods of profitability, recent results have fallen short of expectations and industry benchmarks. This underperformance directly influenced the decision to curtail executive bonuses and overall pay packages.

- Profit Margins: Compared to previous years and competitors, BP's profit margins have been comparatively lower, impacting overall profitability.

- Revenue Fluctuations: Fluctuations in oil prices, a key factor affecting BP's revenue streams, have created financial uncertainty and impacted shareholder returns.

- Energy Transition Investments: Significant investments in the energy transition, while crucial for long-term sustainability, have placed short-term pressure on profitability. This directly impacts the resources available for executive compensation.

- Stock Performance: Underperformance in stock price also reflects negatively on overall financial health, affecting shareholder confidence and influencing decisions about executive pay.

The relationship between financial performance and executive bonuses is clear: lower profitability translates into lower bonuses, reflecting a direct link between performance and reward.

Shareholder Pressure and the Role of Activist Investors

Shareholder activism played a significant role in prompting BP to reconsider its executive compensation strategy. Growing concerns regarding executive pay disparity and a lack of transparency have fueled shareholder resolutions and campaigns focused on reducing executive compensation. This highlights the increasing emphasis on corporate governance and responsible executive pay practices.

- Shareholder Votes: Several shareholder votes concerning executive pay demonstrated significant opposition to the previous structure, highlighting the disconnect between management and investor expectations.

- Activist Investor Influence: Activist investor groups have actively engaged with BP, advocating for changes to executive compensation, pushing for greater alignment between executive pay and company performance.

- Negative Media Coverage: Negative media coverage and public scrutiny regarding excessive executive pay in the energy sector significantly influenced BP's decision, adding pressure to adjust its compensation structure.

BP's Commitment to Sustainability and its Influence on Executive Pay

BP's commitment to sustainability goals, encompassing decarbonization efforts and broader Environmental, Social, and Governance (ESG) initiatives, has significantly impacted its approach to executive pay. Aligning executive compensation with sustainability targets incentivizes responsible behavior and long-term strategic alignment.

- Sustainability Initiatives: BP's investment in renewable energy sources, carbon capture technologies, and emission reduction strategies demonstrates a clear commitment to sustainability.

- ESG Performance Metrics: The inclusion of ESG performance metrics in executive compensation packages reflects a shift towards rewarding executives for their contributions to environmental and social responsibility.

- Climate-Related Risks: Recognizing the potential financial impact of climate-related risks, BP has integrated sustainability considerations into its executive compensation structure to mitigate these risks.

The Breakdown of the 31% Reduction: Salaries, Bonuses, and Long-Term Incentives

The 31% reduction in BP executive pay wasn't a uniform cut across the board. The implementation involved adjustments to several components of the executive compensation packages:

- Base Salaries: While base salaries were adjusted, the magnitude of the reduction varied depending on the role and individual performance.

- Bonuses: Significant reductions were applied to annual bonuses, reflecting the company's underperformance.

- Long-Term Incentives: Stock options and other long-term incentive plans were also affected, reflecting a recalibration of incentives toward long-term sustainability goals.

The impact of the reduction varies for individual executives, impacting their total compensation packages significantly, though details regarding specific figures remain confidential.

Conclusion: Analyzing the Future of BP Executive Pay

The 31% reduction in BP executive pay is a multifaceted decision, driven by a confluence of factors. Financial underperformance, shareholder pressure, and a strengthened commitment to sustainability played crucial roles. This decision signifies a notable shift in BP's corporate governance and emphasizes the growing importance of aligning executive compensation with long-term value creation and societal expectations. To gain a deeper understanding, we encourage you to further research BP's financial reports and sustainability initiatives to fully grasp the context of this BP executive pay reduction. Follow BP's executive compensation trends, analyze BP's approach to executive pay, and stay updated on BP executive salary changes to remain informed about this evolving situation.

Featured Posts

-

Espn On The Bruins Decisive Offseason Moves And Their Franchise Implications

May 22, 2025

Espn On The Bruins Decisive Offseason Moves And Their Franchise Implications

May 22, 2025 -

Shifting Priorities The Future Of Otter Management In Wyoming

May 22, 2025

Shifting Priorities The Future Of Otter Management In Wyoming

May 22, 2025 -

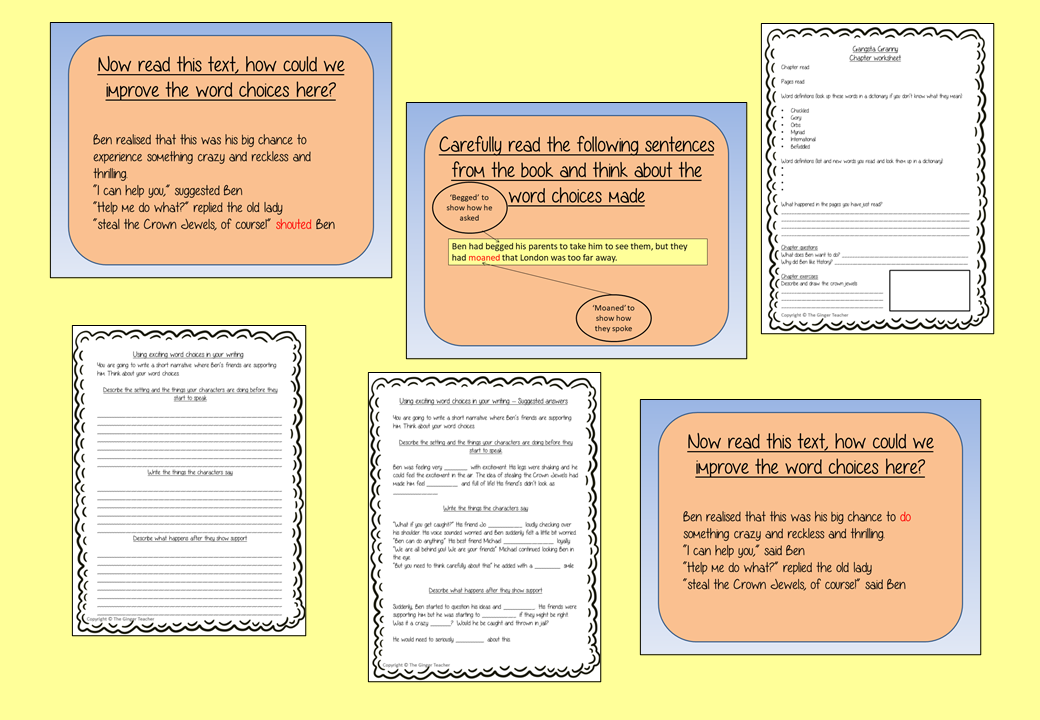

Gangsta Granny Read Aloud Tips For Parents And Educators

May 22, 2025

Gangsta Granny Read Aloud Tips For Parents And Educators

May 22, 2025 -

Dropout Kings Singer Adam Ramey Passes Away At 32

May 22, 2025

Dropout Kings Singer Adam Ramey Passes Away At 32

May 22, 2025 -

Ancelotti Nin Yerini Klopp Un Doldurabilecegi Konular

May 22, 2025

Ancelotti Nin Yerini Klopp Un Doldurabilecegi Konular

May 22, 2025