Breaking Free: How To Overcome Lack Of Funds And Achieve Your Goals

Table of Contents

Creating a Realistic Budget and Financial Plan

Overcoming financial hardship starts with understanding where your money goes. A realistic budget and comprehensive financial plan are crucial for gaining control of your finances and working towards financial goals. Without a plan, it's like navigating without a map – you might reach your destination eventually, but it will likely take much longer and be far more challenging.

Here's a step-by-step guide to creating a functional budget:

-

Track Income and Expenses: For at least a month, meticulously record every dollar that comes in and goes out. Use budgeting apps like Mint or YNAB (You Need A Budget), or a simple spreadsheet. This gives you a clear picture of your current financial situation.

-

Categorize Spending: Once you've tracked your spending, categorize your expenses (housing, food, transportation, entertainment, etc.). This allows you to identify areas where you're overspending and potential areas for savings.

-

Identify Areas for Savings: Analyze your spending categories. Are there any non-essential expenses you can cut back on? Small changes can add up to significant savings over time.

-

Set Realistic Financial Goals: Define both short-term and long-term financial goals. Short-term goals might include paying off a credit card, saving for a vacation, or building an emergency fund. Long-term goals could include buying a house, retiring comfortably, or starting a business. Make these financial goals SMART (Specific, Measurable, Achievable, Relevant, Time-bound).

-

Regularly Review and Adjust Your Budget: Your financial situation can change, so regularly review and adjust your budget to reflect any changes in income or expenses. This ensures your plan remains relevant and effective.

- Use budgeting apps or spreadsheets.

- Track your spending for at least a month before creating a budget.

- Set realistic financial goals (short-term and long-term).

- Regularly review and adjust your budget.

Tackling Debt Effectively

High levels of debt significantly hinder your ability to achieve your financial goals. The interest payments alone can eat away at your income, making it difficult to save and invest. Effective debt management is essential for breaking free from this cycle.

Here are several strategies for handling debt:

-

Debt Snowball: Pay off your smallest debts first, regardless of interest rate, for a quick sense of accomplishment and momentum.

-

Debt Avalanche: Focus on paying off the debts with the highest interest rates first, minimizing the total interest paid over time.

-

Balance Transfers: Transfer high-interest debt to a credit card with a lower introductory APR (Annual Percentage Rate), but be mindful of balance transfer fees and ensure you pay down the balance before the introductory period ends.

-

Debt Consolidation: Consolidate multiple debts into a single loan with a lower interest rate. This simplifies payments and potentially reduces the total interest paid.

-

Prioritize high-interest debt.

-

Explore debt consolidation options.

-

Negotiate with creditors for lower interest rates.

-

Seek professional help from a financial advisor if needed.

Increasing Your Income Through Smart Strategies

While budgeting and debt management are crucial, increasing your income significantly accelerates your progress towards financial freedom. Explore various avenues to supplement your existing income:

-

Side Hustles: Identify skills you can monetize. Can you offer freelance writing, graphic design, virtual assistance, or tutoring services? Websites like Upwork and Fiverr offer platforms to connect with clients.

-

Freelance Work: Freelancing allows you to set your own hours and work on projects that align with your skills and interests. Explore various freelance platforms to find opportunities.

-

Investing: Investing your money wisely can generate passive income over time. However, it's crucial to conduct thorough research and potentially seek advice from a financial professional before investing. Consider options like stocks, bonds, or real estate, depending on your risk tolerance and investment goals.

-

Start a Small Business: If you have a business idea, starting a small business can generate substantial income, though it requires significant effort and planning.

-

Identify your skills and talents that can be monetized.

-

Explore freelance platforms and job boards.

-

Start a small business or side hustle.

-

Invest wisely in stocks, bonds, or real estate (with proper research).

Setting Realistic Goals and Staying Motivated

Setting SMART goals is essential for staying motivated and focused. Break down large goals into smaller, achievable steps to maintain momentum and prevent feeling overwhelmed.

-

Break down large goals into smaller, manageable steps. This creates a sense of accomplishment as you complete each step, encouraging you to continue working toward your larger financial goals.

-

Celebrate small wins along the way. Acknowledging your progress reinforces your commitment and motivates you to continue.

-

Surround yourself with supportive people. Share your goals with friends, family, or a mentor who can provide encouragement and accountability.

-

Seek professional coaching or mentorship if needed. A financial coach or mentor can provide guidance, support, and accountability to help you stay on track.

-

Goal setting is crucial for success.

-

Motivation is key to overcoming obstacles.

-

Achieving success requires persistence and a positive attitude.

Conclusion

Overcoming a lack of funds and achieving your goals requires a multifaceted approach. By creating a realistic budget, effectively managing debt, increasing your income, and setting SMART goals, you can break free from financial limitations and build a brighter future. Remember that consistency and perseverance are key. Start taking control of your finances today! Implement these strategies to overcome your lack of funds and begin working towards achieving your dreams. Don't let financial hardship hold you back any longer. Take the first step toward financial freedom and achieving your goals!

Featured Posts

-

Is Drier Weather Finally In Sight Your Regional Outlook

May 21, 2025

Is Drier Weather Finally In Sight Your Regional Outlook

May 21, 2025 -

Blockbusters The Bgt Special Edition What To Expect

May 21, 2025

Blockbusters The Bgt Special Edition What To Expect

May 21, 2025 -

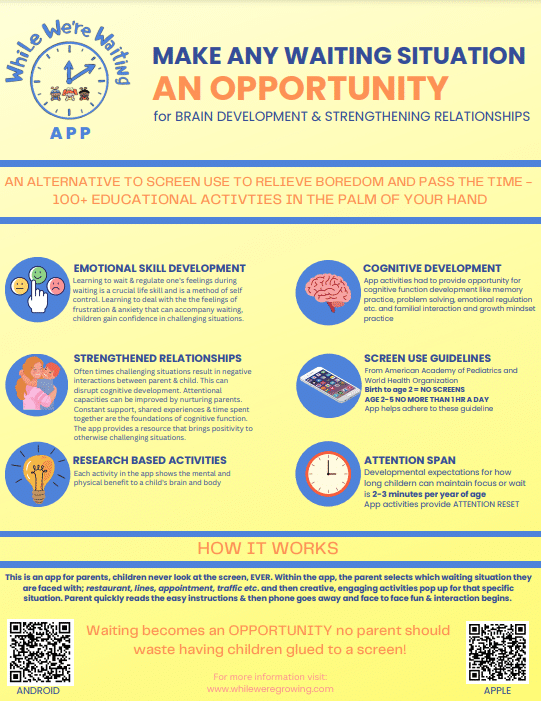

Screen Free Week With Kids A Practical Guide

May 21, 2025

Screen Free Week With Kids A Practical Guide

May 21, 2025 -

Mild Temperatures Little Rain Chance Your Weekend Forecast

May 21, 2025

Mild Temperatures Little Rain Chance Your Weekend Forecast

May 21, 2025 -

Factors Contributing To Big Bear Ai Bbai S 2025 Stock Price Decrease

May 21, 2025

Factors Contributing To Big Bear Ai Bbai S 2025 Stock Price Decrease

May 21, 2025