Breaking: Stock Market News - Bond Market Decline, Dow Futures, Bitcoin Surge

Table of Contents

Bond Market Decline: Understanding the Downward Trend

The bond market is experiencing a noticeable downward trend, impacting various bond market indices. This decline isn't isolated; it's a reflection of broader macroeconomic factors and shifting investor sentiment. Several key factors contribute to this downward pressure:

-

Rising Interest Rates Impacting Bond Yields: The Federal Reserve's recent interest rate hikes directly impact bond yields. Higher interest rates make newly issued bonds more attractive, reducing the demand for existing bonds and consequently lowering their prices. This inverse relationship between interest rates and bond prices is a fundamental principle of bond investing.

-

Concerns about Persistent Inflation Eroding Bond Value: Persistent inflation erodes the purchasing power of fixed-income investments like bonds. As inflation rises, the real return on bonds decreases, making them less appealing to investors seeking to preserve their capital. This concern is particularly acute when inflation outpaces the yield offered by bonds.

-

Shifting Investor Preferences Towards Equities: Some investors are shifting their portfolios away from bonds and towards equities, seeking higher returns in a potentially inflationary environment. This shift in investor preference contributes to the decreased demand for bonds and further fuels the downward trend.

-

Specific Bond Market Indices Affected: The decline is evident across various bond market indices. Treasury yields, a key benchmark for the U.S. bond market, have risen significantly, reflecting the increased borrowing costs. Similarly, corporate bond yields have also increased, affecting the value of corporate bonds. For detailed data, refer to sources like the [link to relevant financial news source, e.g., Bloomberg].

Dow Futures: A Look at Pre-Market Indicators

Dow futures provide a glimpse into the potential direction of the Dow Jones Industrial Average during the upcoming trading session. Analyzing these pre-market indicators offers valuable insights into investor sentiment and market expectations. Several factors are influencing current Dow futures:

-

Global Economic News: Global economic data releases, such as GDP growth figures and inflation reports, significantly impact investor sentiment and, consequently, Dow futures. Positive economic news generally leads to higher futures, while negative news can trigger a decline.

-

Earnings Reports: Corporate earnings reports play a crucial role in shaping market expectations. Strong earnings typically boost investor confidence and push Dow futures upward, while disappointing results can lead to a negative reaction.

-

Geopolitical Events: Geopolitical events, such as international conflicts or policy changes, can introduce uncertainty and volatility into the market, influencing the direction of Dow futures.

Potential scenarios based on current Dow futures include:

-

Positive Dow Futures: Indicate a potential market upturn, suggesting investors are optimistic about the upcoming trading session.

-

Negative Dow Futures: Suggest a possible market downturn, reflecting concerns about the overall market outlook.

-

Neutral Dow Futures: Signal uncertainty and potential sideways movement, indicating a lack of clear direction in the market.

Bitcoin's Unexpected Surge: Crypto Market Volatility

Bitcoin's recent price surge has injected renewed volatility into the cryptocurrency market. While Bitcoin is known for its price fluctuations, the recent jump warrants closer examination. Several factors could be contributing to this upward movement:

-

Increased Institutional Adoption of Bitcoin: The growing acceptance of Bitcoin by institutional investors, including large corporations and investment firms, is seen as a significant driver of price increases. This increased institutional interest brings greater liquidity and stability to the market.

-

Positive News Regarding Bitcoin Regulation or Acceptance: Positive regulatory developments or announcements regarding Bitcoin's legal status in various jurisdictions can significantly impact its price. Increased regulatory clarity can boost investor confidence and attract more capital into the market.

-

Speculative Trading Driving Price Volatility: Speculative trading plays a considerable role in Bitcoin's price volatility. Market sentiment and speculation can lead to rapid price swings, independent of fundamental factors.

-

Comparison to Other Cryptocurrencies’ Performance: The performance of Bitcoin relative to other cryptocurrencies is also a crucial factor. If Bitcoin outperforms its peers, it can attract further investment, driving up its price.

The Bitcoin surge impacts the broader cryptocurrency market, influencing the prices of other digital assets. However, it's crucial to remember that investing in Bitcoin carries significant risk due to its inherent volatility.

Conclusion: Staying Informed on Breaking Stock Market News

In summary, today's stock market news reveals a complex interplay of factors impacting various asset classes. We've seen a decline in the bond market due to rising interest rates, inflation concerns, and shifting investor preferences. Dow futures offer mixed signals, reflecting the uncertainty in the market. Meanwhile, Bitcoin's unexpected surge highlights the volatility of the cryptocurrency market, driven by institutional adoption, regulatory developments, and speculative trading.

Staying informed about these market trends and volatility is crucial for informed decision-making. Careful analysis and a thorough understanding of the underlying factors are essential before making any investment choices. Remember that the stock market is inherently risky, and past performance is not indicative of future results.

Stay tuned for further updates on breaking stock market news and continue to monitor the latest developments in the bond market, Dow futures, and Bitcoin. Follow us for more in-depth analysis and insights into stock market updates, bond market analysis, Bitcoin price prediction, and Dow Jones forecast.

Featured Posts

-

Accenture Announces 50 000 Promotions Following Delay

May 23, 2025

Accenture Announces 50 000 Promotions Following Delay

May 23, 2025 -

A Weekend Of Events Fashion Heritage Ballet And Puns Included

May 23, 2025

A Weekend Of Events Fashion Heritage Ballet And Puns Included

May 23, 2025 -

Rybakina Preodolela Vtoroy Krug Turnira V Rime

May 23, 2025

Rybakina Preodolela Vtoroy Krug Turnira V Rime

May 23, 2025 -

Kermit The Frog University Of Marylands 2025 Commencement Speaker

May 23, 2025

Kermit The Frog University Of Marylands 2025 Commencement Speaker

May 23, 2025 -

Zimbabwes Away Test Victory In Sylhet A Detailed Match Report

May 23, 2025

Zimbabwes Away Test Victory In Sylhet A Detailed Match Report

May 23, 2025

Latest Posts

-

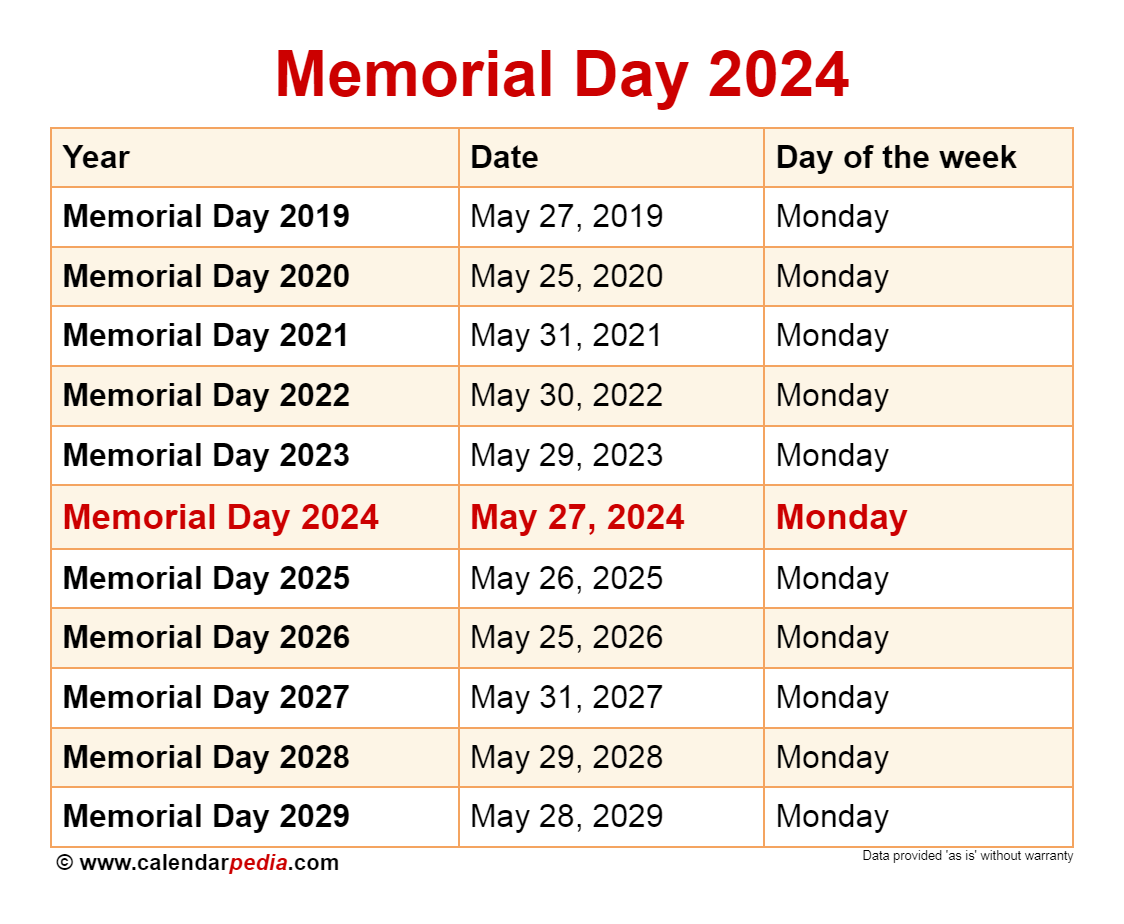

2025 Memorial Day Sales And Deals Expert Selected Top Offers

May 23, 2025

2025 Memorial Day Sales And Deals Expert Selected Top Offers

May 23, 2025 -

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 23, 2025

Memorial Day 2025 Your Guide To Unbeatable Sales And Deals

May 23, 2025 -

Review Neal Mc Donough In The Last Rodeo

May 23, 2025

Review Neal Mc Donough In The Last Rodeo

May 23, 2025 -

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 23, 2025

Memorial Day 2025 The Ultimate Guide To The Best Sales And Deals

May 23, 2025 -

Exploring Neal Mc Donoughs Character In The Last Rodeo

May 23, 2025

Exploring Neal Mc Donoughs Character In The Last Rodeo

May 23, 2025