Brexit And The UK Luxury Industry: The EU Export Reality

Table of Contents

H2: Increased Export Costs and Bureaucracy

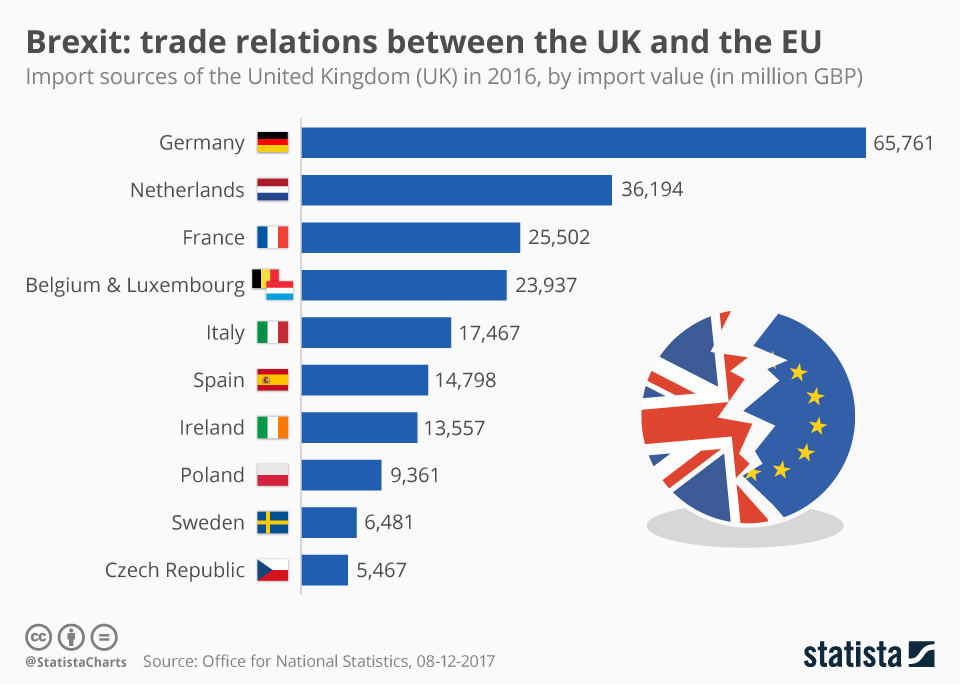

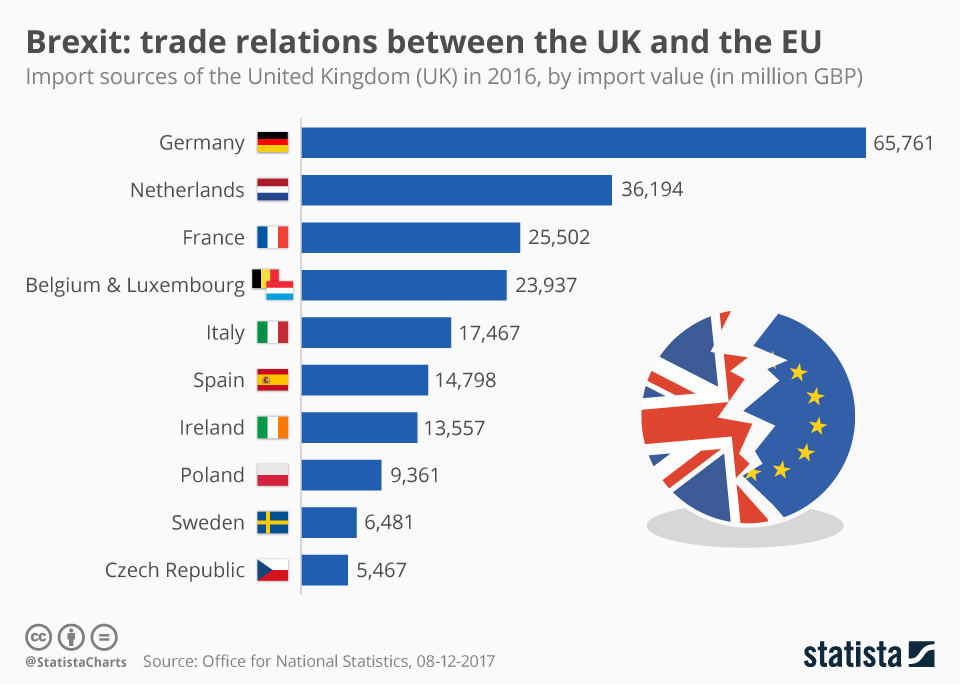

Brexit has introduced substantial barriers for UK luxury goods aiming to reach EU consumers. These obstacles manifest as both tariff and non-tariff barriers, significantly impacting the industry's competitiveness and profitability.

H3: Tariff Barriers

New tariffs and duties on luxury goods exported from the UK to the EU have directly increased costs. This translates to higher prices for EU consumers, potentially reducing demand and affecting the profitability of UK luxury businesses.

- Examples of affected goods: High-end clothing (tariff of X%), bespoke jewelry (tariff of Y%), luxury automobiles (tariff of Z%). (Note: Replace X, Y, and Z with actual or estimated tariff percentages).

- Impact on pricing and competitiveness: These tariffs directly increase the final price for the consumer, making UK luxury goods less competitive against similar products from EU-based brands. This price increase can severely impact market share, especially in price-sensitive segments of the luxury market.

H3: Non-Tariff Barriers

Beyond tariffs, Brexit introduced significant non-tariff barriers, encompassing increased administrative burdens and logistical complexities.

- Examples of bureaucratic hurdles: Customs declarations, sanitary and phytosanitary (SPS) regulations (particularly relevant for food and beverage luxury items), and origin labeling requirements. The sheer volume of paperwork and the intricacies of compliance add significant administrative overhead.

- Increased processing times and delays: The additional paperwork and customs checks cause delays in the supply chain, impacting delivery times and potentially leading to stock shortages for retailers in the EU. This delay can negatively impact customer satisfaction and brand image.

H3: Logistics and Supply Chain Disruptions

Brexit has also created significant disruptions to the logistics and supply chains of UK luxury businesses.

- Examples of logistical challenges: Port congestion, border delays due to increased customs checks, and the increased cost of transportation and insurance. These contribute to unpredictability and instability in getting goods to market on time.

- Impact on timely delivery: Delays in shipping directly affect the delivery of luxury goods to EU consumers, potentially leading to unmet orders, lost sales, and damage to reputation. For time-sensitive items, such as seasonal collections, this impact is even more profound.

H2: Impact on Brand Reputation and Consumer Perception

Brexit has also influenced the perception of UK luxury brands within the EU market, impacting their reputation and potentially their sales.

H3: Loss of "Made in the UK" Appeal in the EU

The Brexit process has, for some consumers, cast a shadow over the "Made in the UK" appeal.

- Examples of potential consumer hesitancy: Some consumers may perceive additional complexities and costs associated with purchasing UK luxury goods, potentially leading them to choose alternatives from within the EU.

- Impact on brand image: The perception of increased difficulty and expense in acquiring British luxury items could damage the image of UK brands and their desirability in the EU market.

H3: Shifting Consumer Preferences

The added complexities and costs associated with Brexit have the potential to shift consumer preferences towards luxury brands from other EU countries or global luxury hubs.

- Evidence of market share shifts: Market research data and sales figures may reveal a decline in the market share of some UK luxury brands within the EU, indicating a shift in consumer preferences.

- Potential long-term consequences: Continued shifts in consumer preference could lead to a permanent decline in the UK luxury industry's market share within the EU, requiring significant adaptation and long-term strategies for recovery.

H2: Strategies for UK Luxury Brands to Navigate the New Reality

UK luxury businesses need to adapt to this new reality and implement effective strategies to mitigate the negative impacts of Brexit.

H3: Adapting to New Regulations

Compliance with new EU regulations is paramount.

- Investment in customs expertise and compliance software: Luxury brands must invest in specialized expertise and technological solutions to streamline customs processes and minimize errors.

- Streamlined processes: Efficient processes and systems are critical to minimizing delays and ensuring compliance with all relevant regulations. This might involve establishing new partnerships with customs brokers and logistics providers.

H3: Diversifying Export Markets

Reducing reliance on the EU market is vital.

- Target markets: Focusing on expanding into new markets, such as Asia (particularly China), North America, and the Middle East, can lessen dependence on the EU.

- Market entry strategies: Developing tailored strategies for each target market is critical, considering cultural nuances, consumer preferences, and local regulations.

H3: Enhancing Brand Storytelling and Value Proposition

Reinforcing the unique value proposition of UK luxury brands is essential.

- Marketing strategies: Focus on the quality, craftsmanship, heritage, and unique selling propositions of UK luxury goods, emphasizing their enduring value and desirability.

- Strengthened brand identity: A clear and compelling brand narrative that emphasizes tradition, innovation, and exclusivity is essential to counter negative perceptions potentially linked to Brexit.

3. Conclusion

Brexit has presented significant challenges for the UK luxury industry, including increased export costs, bureaucratic hurdles, and potential damage to brand reputation within the EU. However, by adapting to new regulations, diversifying export markets, and enhancing their brand storytelling, UK luxury brands can navigate these challenges and secure their long-term success. Understanding the nuances of "Brexit and the UK luxury industry" is crucial for survival and growth. We urge you to conduct further research into the specific implications for your niche within the sector and consider seeking expert advice to develop a robust Brexit strategy. Proactive adaptation is key to thriving in this new export landscape.

Featured Posts

-

Suki Waterhouses Daring Met Gala 2025 Look Black Tuxedo Dress And Sideboob

May 20, 2025

Suki Waterhouses Daring Met Gala 2025 Look Black Tuxedo Dress And Sideboob

May 20, 2025 -

Actors And Writers Strike The Impact On The Hollywood Entertainment Industry

May 20, 2025

Actors And Writers Strike The Impact On The Hollywood Entertainment Industry

May 20, 2025 -

Nyt Mini Crossword Answers March 13 Solutions And Solving Tips

May 20, 2025

Nyt Mini Crossword Answers March 13 Solutions And Solving Tips

May 20, 2025 -

Valentino Haute Couture Suki Waterhouses Unexpectedly Chic Look

May 20, 2025

Valentino Haute Couture Suki Waterhouses Unexpectedly Chic Look

May 20, 2025 -

Ris Zachary Cunha Transitions To Private Law Practice

May 20, 2025

Ris Zachary Cunha Transitions To Private Law Practice

May 20, 2025

Latest Posts

-

I Kakodaimonia Ton Sidirodromon Istoriki Anadromi Kai Sygxrones Prokliseis

May 20, 2025

I Kakodaimonia Ton Sidirodromon Istoriki Anadromi Kai Sygxrones Prokliseis

May 20, 2025 -

O Giakoymakis Kai To Mls Pithanotites Epistrofis

May 20, 2025

O Giakoymakis Kai To Mls Pithanotites Epistrofis

May 20, 2025 -

I Xronia Kakodaimonia Ton Sidirodromon Stin Ellada Aities Kai Lyseis

May 20, 2025

I Xronia Kakodaimonia Ton Sidirodromon Stin Ellada Aities Kai Lyseis

May 20, 2025 -

Epistrofi Giakoymaki Sto Mls To Oneiro Ton Amerikanon

May 20, 2025

Epistrofi Giakoymaki Sto Mls To Oneiro Ton Amerikanon

May 20, 2025 -

Pasxa Kai Protomagia Sto Oropedio Evdomos Plirofories Kai Protaseis

May 20, 2025

Pasxa Kai Protomagia Sto Oropedio Evdomos Plirofories Kai Protaseis

May 20, 2025