Broadcom's VMware Acquisition: AT&T Faces 1050% Price Increase

Table of Contents

The Broadcom-VMware Deal: A Closer Look

Broadcom's $61 billion acquisition of VMware, finalized in late 2022, represents one of the largest tech mergers in history. This deal significantly increases Broadcom's presence in the enterprise software market, adding VMware's industry-leading virtualization and cloud computing technologies to its existing portfolio of networking and semiconductor solutions. Broadcom's strategic goals include expanding its software offerings, leveraging VMware's strong customer base, and potentially increasing its market share in the competitive cloud infrastructure space. This level of market consolidation raises concerns about reduced competition and potential future price increases across the industry.

- Acquisition value: $61 billion

- Completion date: Late 2022

- Broadcom's existing portfolio: Semiconductors, networking infrastructure, and software solutions. VMware's addition expands its reach into enterprise software and cloud computing.

- Regulatory approvals: The deal faced scrutiny from regulatory bodies due to potential antitrust concerns, but ultimately received the necessary approvals.

AT&T's 1050% Price Increase: A Case Study

AT&T's experience serves as a stark case study illustrating the potential consequences of the Broadcom-VMware merger. The telecom giant reportedly faces a 1050% increase in VMware licensing costs, primarily impacting crucial products like vSphere (server virtualization), NSX (network virtualization), and vCenter (management platform). This dramatic surge is attributed to several factors: renegotiation of existing contracts under new ownership, a lack of readily available competitive alternatives with comparable features and scalability, and potentially, Broadcom’s strategic pricing decisions after acquiring VMware. The financial implications for AT&T are substantial, requiring significant budget reallocations and potentially impacting service delivery and future investments in network infrastructure.

- Specific VMware products impacted: vSphere, NSX, vCenter, and other related software and services.

- Pricing comparison: Reports indicate a 1050% increase in licensing costs for certain VMware products used by AT&T. The exact pricing details remain largely confidential.

- AT&T's potential responses: AT&T is likely exploring options including contract renegotiation, investigating alternative virtualization solutions (such as open-source options), and making budget cuts in other areas to offset the increased costs.

The Broader Implications for the Telecom Industry

AT&T's situation is not unique. Other major telecom companies heavily reliant on VMware's virtualization technologies are likely facing similar pricing pressures, albeit perhaps not to the same extreme degree. This acquisition significantly impacts the telecom industry's cloud adoption strategies and network virtualization plans. The increased costs could force a reevaluation of existing cloud infrastructure deployments and potentially slow down the migration to virtualized network architectures. The situation underscores the importance of exploring alternative virtualization solutions and developing more robust negotiation strategies when dealing with dominant players in the technology market.

- Other major telecom companies potentially affected: Verizon, T-Mobile, and other global telecom providers using VMware technologies.

- The future of network virtualization: The price increase could accelerate the adoption of open-source virtualization technologies and alternative cloud platforms as companies seek cost-effective solutions.

- Analysis of competitive alternatives to VMware: Companies are now actively investigating alternatives such as open-source solutions like OpenStack, Proxmox, and others, along with cloud-native platforms like AWS, Azure, and Google Cloud.

Long-Term Impacts and Future Predictions

The Broadcom-VMware deal will likely have long-lasting effects on pricing and competition within the software industry. We can expect to see potential for future price increases across VMware's product line and possibly similar behavior from other large software vendors. Regulatory bodies are likely to investigate the potential for anti-competitive practices and may implement measures to prevent future acquisitions from leading to such drastic price hikes. The overall impact on innovation remains uncertain; while consolidation can sometimes streamline processes, it also risks stifling competition and potentially slowing down the development of new technologies.

- Potential for future price increases: The AT&T case sets a concerning precedent, suggesting potential for further price increases across the VMware product portfolio and possibly influencing pricing strategies in other sectors.

- Anticipated regulatory responses and investigations: Increased scrutiny from antitrust regulators and potential investigations into Broadcom's pricing practices are likely.

- Long-term implications for technological advancements: While consolidation can bring efficiencies, it also raises concerns about the potential for reduced innovation due to stifled competition.

Conclusion

Broadcom's acquisition of VMware has undeniably created significant market shifts, with AT&T's 1050% price increase serving as a stark example of the potential consequences. The implications extend far beyond a single company, impacting the entire telecom landscape and potentially altering the future of cloud computing and network virtualization. Understanding the implications of the Broadcom VMware acquisition is crucial for businesses relying on virtualization technologies. Stay informed about the evolving market dynamics and explore alternative solutions to mitigate the risks associated with escalating VMware pricing. Learn more about navigating the complexities of the Broadcom VMware acquisition and finding cost-effective virtualization strategies.

Featured Posts

-

U S Employment Situation April 2023 Report Shows 177 000 Jobs Added 4 2 Unemployment

May 05, 2025

U S Employment Situation April 2023 Report Shows 177 000 Jobs Added 4 2 Unemployment

May 05, 2025 -

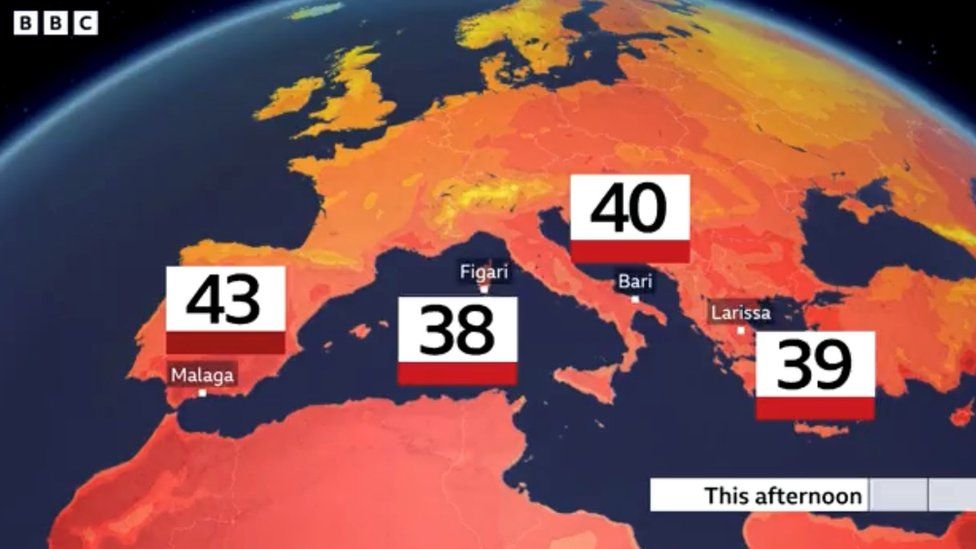

Urgent Weather Update Heatwave Sweeps Across Four West Bengal Districts

May 05, 2025

Urgent Weather Update Heatwave Sweeps Across Four West Bengal Districts

May 05, 2025 -

Turning Poop Into Prose How Ai Digests Repetitive Scatological Documents For Podcast Production

May 05, 2025

Turning Poop Into Prose How Ai Digests Repetitive Scatological Documents For Podcast Production

May 05, 2025 -

Kentucky Derby 151 Pre Race Day Checklist And Information

May 05, 2025

Kentucky Derby 151 Pre Race Day Checklist And Information

May 05, 2025 -

Stanley Cup Ratings Fall In Us But 4 Nation Face Off Provides A Boost

May 05, 2025

Stanley Cup Ratings Fall In Us But 4 Nation Face Off Provides A Boost

May 05, 2025

Latest Posts

-

Volkanovski Vs Lopes Ufc 314 Main Event Opening Odds Breakdown

May 05, 2025

Volkanovski Vs Lopes Ufc 314 Main Event Opening Odds Breakdown

May 05, 2025 -

The Dress That Broke The Internet Emma Stones Snl Appearance

May 05, 2025

The Dress That Broke The Internet Emma Stones Snl Appearance

May 05, 2025 -

Emma Stones Popcorn Butt Lift Inspired Dress At Snl

May 05, 2025

Emma Stones Popcorn Butt Lift Inspired Dress At Snl

May 05, 2025 -

Emma Stones Quirky Snl Dress A Popcorn Butt Lift Moment

May 05, 2025

Emma Stones Quirky Snl Dress A Popcorn Butt Lift Moment

May 05, 2025 -

Indy Car On Fox A New Era For Open Wheel Racing

May 05, 2025

Indy Car On Fox A New Era For Open Wheel Racing

May 05, 2025