Broadcom's VMware Acquisition: AT&T Faces A Staggering 1,050% Price Increase

Table of Contents

The VMware Acquisition and its Impact on Pricing

Understanding the Broadcom-VMware Deal

Broadcom's acquisition of VMware, finalized in late 2022, represents a significant consolidation in the enterprise software market. Broadcom, known for its semiconductor and infrastructure software businesses, aims to expand its portfolio into the lucrative enterprise software space. The stated goals of the acquisition include:

- Market Consolidation: Gaining a dominant position in the virtualization and cloud computing markets.

- Expansion into Enterprise Software: Diversifying Broadcom's revenue streams and reducing reliance on the semiconductor market.

- Potential Synergies: Integrating VMware's technologies with Broadcom's existing offerings to create a more comprehensive and powerful solution.

AT&T's Dependence on VMware

AT&T, a major player in the telecommunications industry, heavily relies on VMware's virtualization technologies for its network infrastructure and services. VMware's solutions are critical for:

- Network Virtualization: Enabling efficient management and scalability of AT&T's vast network infrastructure.

- Cloud Computing: Supporting AT&T's cloud-based services and applications.

- Data Center Optimization: Improving resource utilization and reducing operational costs within AT&T's data centers. Specific VMware products like vSphere, NSX, and vCenter are likely integral to AT&T's operations. The scale of their deployment is substantial, deeply integrating with existing systems.

The 1050% Price Increase: Fact or Fiction?

Reports of a 1050% price increase for specific VMware services for AT&T have understandably caused alarm. While precise contract details remain confidential, several factors could contribute to such a substantial increase:

- Renegotiation of contracts: Post-acquisition, Broadcom may be leveraging its market power to renegotiate contracts with existing clients, including AT&T, at significantly higher prices.

- Bundled services: The price increase may relate to bundled services, making it difficult to isolate the increase for individual components.

- New licensing models: Broadcom may be implementing new licensing models that result in higher costs for AT&T. Understanding the specifics of which service is impacted, and gaining access to contract details would be crucial in validating the claim.

Implications for AT&T and the Telecom Industry

Financial Impact on AT&T

The 1050% price increase, if accurate, represents a significant financial burden for AT&T. This could lead to:

- Increased operational costs: Directly impacting profitability and potentially leading to increased service charges for AT&T's customers.

- Impact on profitability: Reducing AT&T's profit margins and potentially affecting its ability to invest in future technologies and infrastructure.

- Potential cost-cutting measures: AT&T might be forced to implement cost-cutting measures, which could impact employee numbers or service quality.

Competitive Disadvantage

The substantial price increase could put AT&T at a significant competitive disadvantage:

- Impact on service offerings: AT&T may need to reduce the scope of its service offerings or increase prices to consumers to offset the increased costs.

- Pricing strategies: The company might be forced to raise prices, making it less competitive against other telecom providers.

- Potential loss of market share: Higher prices and reduced service offerings could lead to a loss of market share to competitors who are not experiencing similar cost increases.

Broader Industry Concerns

The Broadcom-VMware acquisition raises several broader concerns for the telecom industry:

- Increased pressure on margins: Other telecom companies relying heavily on VMware may face similar price increases, putting significant pressure on their profit margins.

- Potential for consolidation: The increase in cloud computing costs could accelerate industry consolidation as smaller players struggle to compete.

- Search for alternative virtualization solutions: Telecom companies will likely intensify their search for alternative virtualization solutions to reduce their dependence on VMware and Broadcom.

Potential Responses and Future Outlook

AT&T's Options

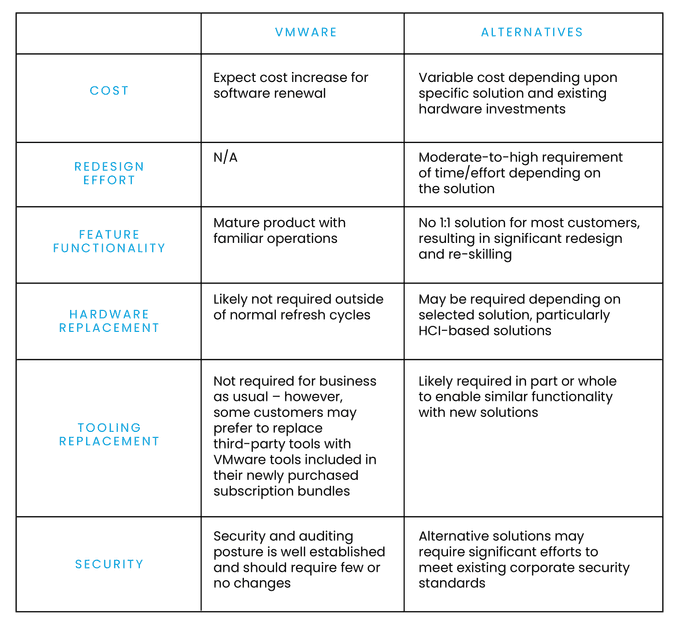

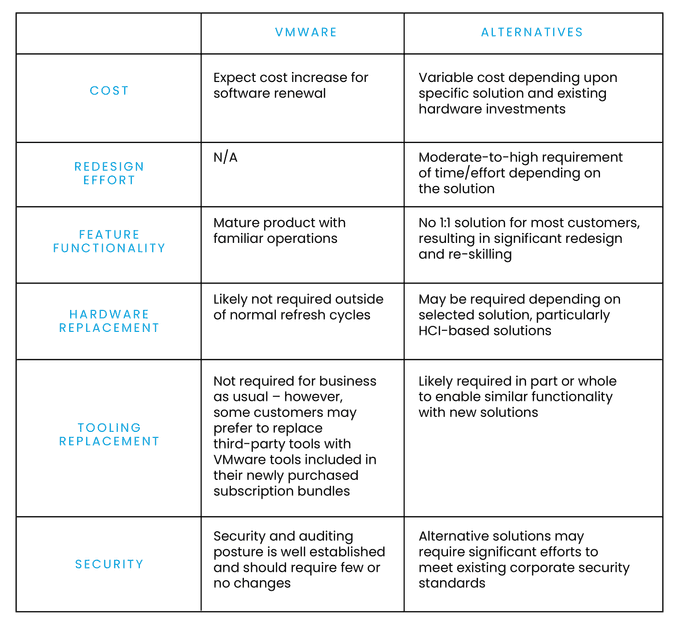

AT&T has several options to mitigate the impact of the price increase:

- Negotiation with Broadcom: Attempting to renegotiate the terms of its contract with Broadcom to secure a more favorable price.

- Exploring alternative virtualization technologies: Investigating and potentially migrating to alternative virtualization solutions offered by competitors like Citrix, Nutanix, or open-source options.

- Internal cost optimization: Implementing measures to optimize its internal operations and reduce its reliance on VMware's most expensive services.

Regulatory Scrutiny

The significant price increase may attract regulatory scrutiny:

- Potential investigations: Antitrust authorities may investigate whether Broadcom's actions constitute anti-competitive behavior.

- Legal challenges: AT&T or other affected companies might initiate legal challenges to contest the price increase.

- Public pressure: Public pressure could mount on regulators to intervene and protect consumers from potentially excessive pricing.

The Future of Cloud Computing Costs

The Broadcom-VMware acquisition highlights several potential long-term trends:

- Increased vendor consolidation: Further consolidation in the cloud computing market could lead to less competition and potentially higher prices.

- Potential for price wars: However, the acquisition could also trigger price wars as other vendors attempt to attract customers away from VMware.

- Innovation in alternative technologies: The increased costs could spur innovation in alternative technologies, leading to more affordable and competitive solutions.

Conclusion

The Broadcom VMware acquisition and the resulting potential 1050% price increase for AT&T underscores the significant risks associated with vendor lock-in and the evolving dynamics of the cloud computing market. This situation highlights the potential for dramatic cost increases impacting profitability and competitiveness within the telecom industry. The financial and competitive pressures created by this acquisition necessitate proactive measures by telecom companies. Understanding the implications of the Broadcom VMware acquisition is crucial for all businesses relying on virtualization technology. Companies must carefully evaluate vendor relationships, explore alternative solutions, and stay informed about the evolving landscape to mitigate risks related to price increases and vendor lock-in.

Featured Posts

-

Rio Tinto And The Pilbara A Response To Claims Of Environmental Damage

May 25, 2025

Rio Tinto And The Pilbara A Response To Claims Of Environmental Damage

May 25, 2025 -

Annie Kilner And Kyle Walker Social Media Fallout After Night Out Incident

May 25, 2025

Annie Kilner And Kyle Walker Social Media Fallout After Night Out Incident

May 25, 2025 -

Skandal Sorusturma Uenlue Kuluebuen Doert Yildizi Goezaltinda

May 25, 2025

Skandal Sorusturma Uenlue Kuluebuen Doert Yildizi Goezaltinda

May 25, 2025 -

Flash Flood Watch Cayuga County Residents Urged To Take Precautions

May 25, 2025

Flash Flood Watch Cayuga County Residents Urged To Take Precautions

May 25, 2025 -

Analyse Snelle Marktbeweging Europese Aandelen Vergelijking Met Wall Street

May 25, 2025

Analyse Snelle Marktbeweging Europese Aandelen Vergelijking Met Wall Street

May 25, 2025

Latest Posts

-

3 Mac Sonra Galibiyet Atletico Madrid In Zaferi

May 25, 2025

3 Mac Sonra Galibiyet Atletico Madrid In Zaferi

May 25, 2025 -

Atletico Madrid In 3 Maclik Hasreti Bitti

May 25, 2025

Atletico Madrid In 3 Maclik Hasreti Bitti

May 25, 2025 -

Atletico Madrid 3 Maclik Galibiyetsizligi Son Buldu

May 25, 2025

Atletico Madrid 3 Maclik Galibiyetsizligi Son Buldu

May 25, 2025 -

Depresyondan Sampiyonluga Atletico Madrid In Geriden Gelisi

May 25, 2025

Depresyondan Sampiyonluga Atletico Madrid In Geriden Gelisi

May 25, 2025 -

Atletico Madrid Geriden Gelip Zirveye Ulasma Yolculugu

May 25, 2025

Atletico Madrid Geriden Gelip Zirveye Ulasma Yolculugu

May 25, 2025