Broadcom's VMware Acquisition: AT&T Highlights Extreme Price Increase Concerns

Table of Contents

AT&T's Concerns Regarding Price Increases Post-Acquisition

AT&T, a telecommunications giant heavily reliant on VMware's virtualization technologies, has voiced strong concerns about the potential for substantial price hikes following the Broadcom-VMware merger. This acquisition has far-reaching implications for AT&T's operational budget and its ability to maintain its extensive network infrastructure.

Increased Licensing Costs

AT&T's dependence on VMware products is significant, making it particularly vulnerable to post-merger price increases.

- Specific VMware products used by AT&T: VMware vSphere, vCenter, NSX (network virtualization), and vSAN (storage virtualization) are likely key components of AT&T's infrastructure.

- Estimates of potential price increases: Industry analysts predict price increases ranging from 15% to 30% for vSphere licenses alone, with similar increases anticipated for other VMware products. These aren't mere speculations; analysts are basing these figures on Broadcom's historical pricing strategies following past acquisitions.

- Impact on AT&T's operational budget: Such significant increases would represent a substantial additional expense for AT&T, potentially impacting its ability to invest in other crucial areas like network upgrades, research and development, and customer service initiatives. The sheer scale of AT&T's operations means even a small percentage increase translates into millions, if not billions, of dollars in added costs.

Reduced Competition and Innovation

The Broadcom-VMware merger significantly reduces competition in the virtualization market. This consolidation raises concerns about several key areas.

- VMware's market position: VMware holds a dominant market share in server virtualization, making it a key player in the enterprise IT landscape. The acquisition eliminates a significant competitor, potentially leading to reduced innovation.

- Potential for monopolistic practices: With less competition, Broadcom may have the incentive and ability to engage in monopolistic practices, leveraging its market power to dictate prices and limit choices for customers like AT&T.

- Impact on the development of alternative virtualization technologies: The reduced competition could stifle the development and adoption of open-source or alternative virtualization technologies, leaving customers with fewer choices and less bargaining power.

Impact on AT&T's Network Infrastructure

The increased costs associated with VMware licensing could directly impact AT&T's ability to maintain and upgrade its vast network infrastructure.

- Details on AT&T's network infrastructure: AT&T's infrastructure is incredibly complex and relies heavily on virtualization to manage its diverse network of servers, applications, and services.

- The role of VMware in its operations: VMware products are crucial for managing and optimizing AT&T's network resources, ensuring efficient operations and high service availability.

- Potential consequences of increased costs: Higher licensing fees could force AT&T to make difficult choices, potentially delaying crucial upgrades, impacting service quality, and hindering its ability to compete effectively in a dynamic market.

Broader Implications of the Broadcom-VMware Deal

The Broadcom-VMware deal has far-reaching implications beyond AT&T, impacting the entire enterprise IT landscape.

Antitrust Concerns and Regulatory Scrutiny

The acquisition is facing intense scrutiny from antitrust regulators globally.

- Relevant regulatory bodies: The Federal Trade Commission (FTC) in the US and the European Commission are among the regulatory bodies actively reviewing the merger.

- Potential legal challenges: There is a significant possibility of legal challenges and regulatory roadblocks, as concerns about monopolistic practices and reduced competition are considerable.

- Likelihood of regulatory approval: The ultimate approval or rejection of the merger remains uncertain and will heavily influence its long-term impact.

Impact on Other Enterprise Customers

The potential price hikes aren't limited to AT&T. Many other large enterprises rely heavily on VMware products.

- Potential industry-wide price increases: Similar price increases are expected across the board, impacting the IT budgets of numerous organizations.

- Impact on IT budgets: Organizations will need to factor in significantly higher IT costs, potentially diverting funds from other essential projects.

- Potential for a shift towards open-source alternatives: The price increases could accelerate the adoption of open-source virtualization solutions as companies seek more cost-effective alternatives.

Long-Term Market Dynamics

The long-term impact of the Broadcom-VMware deal on the virtualization and cloud computing markets is still unfolding.

- Potential shifts in market share: The merger could lead to significant shifts in market share, potentially favoring Broadcom and its affiliated technologies.

- The emergence of new competitors: The acquisition might incentivize the development and growth of new competitors in the virtualization space.

- Overall impact on innovation and competition: The long-term impact on innovation and competition is a significant concern, with potential implications for the entire tech industry.

Conclusion

AT&T's concerns regarding the Broadcom's VMware acquisition highlight the significant potential for crippling price increases for enterprise customers. The merger raises serious questions about competition, innovation, and the future cost of essential virtualization technologies. The ongoing regulatory review will be crucial. Stay informed about the developments surrounding the Broadcom VMware acquisition and its implications for your organization. Understanding the potential for increased costs is vital for effective budget planning and strategic IT decision-making in the coming years.

Featured Posts

-

Mariners Tigers Series Whos Out And Whos Playing March 31 April 2

May 17, 2025

Mariners Tigers Series Whos Out And Whos Playing March 31 April 2

May 17, 2025 -

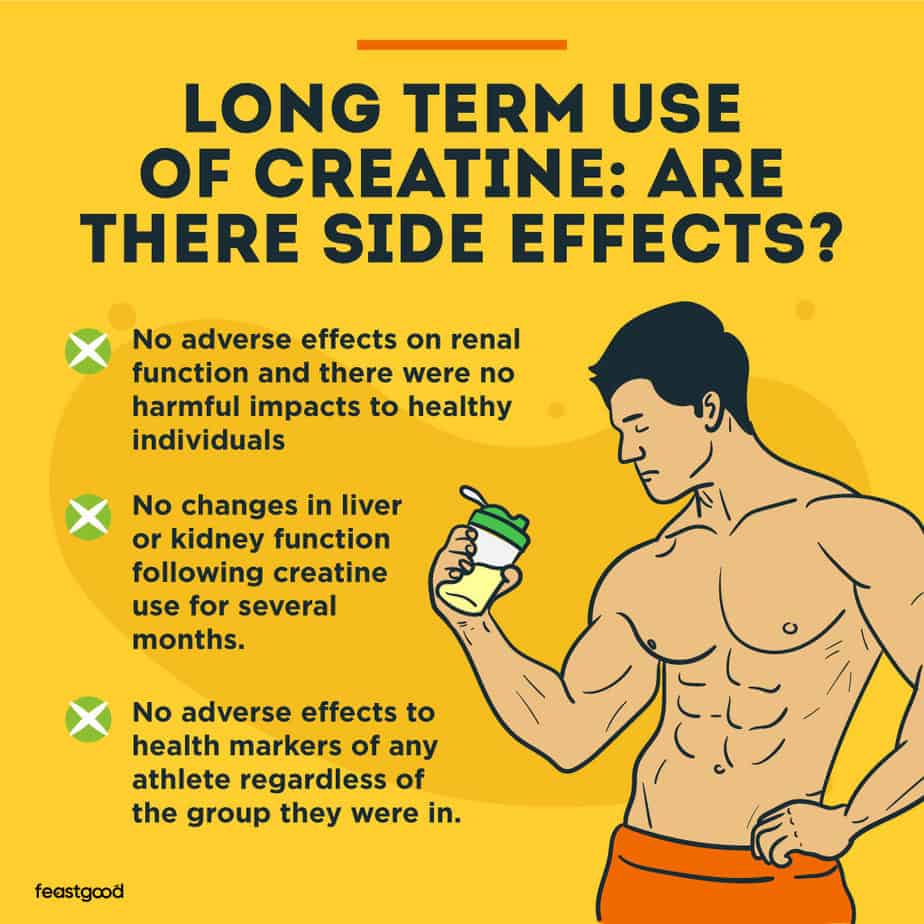

Creatine Benefits Side Effects And Who Should Use It

May 17, 2025

Creatine Benefits Side Effects And Who Should Use It

May 17, 2025 -

Police Blotter Updates Austintown And Boardman News Sports And Job Postings

May 17, 2025

Police Blotter Updates Austintown And Boardman News Sports And Job Postings

May 17, 2025 -

Exclusive Analyzing The Jalen Brunson Lady Liberty Petition

May 17, 2025

Exclusive Analyzing The Jalen Brunson Lady Liberty Petition

May 17, 2025 -

The Chicago Rematch Examining The Van Lith Reese Relationship

May 17, 2025

The Chicago Rematch Examining The Van Lith Reese Relationship

May 17, 2025