Broadcom's VMware Acquisition: AT&T Highlights Extreme Price Surge

Table of Contents

The Broadcom-VMware Deal: A Deep Dive

Broadcom's acquisition of VMware, finalized in late 2022, was a landmark deal valued at approximately $61 billion. The rationale behind Broadcom's purchase centered on expanding its enterprise software portfolio and solidifying its position in the rapidly growing market for cloud infrastructure and data center solutions. VMware, a dominant player in virtualization technology with a vast customer base and a market-leading position, was a highly attractive target.

- Acquisition cost: Approximately $61 billion

- Completion date: Late 2022

- Broadcom's goals: Expanding enterprise software portfolio, strengthening cloud infrastructure offerings, and achieving greater synergy between its existing hardware and software businesses.

- VMware's market share: VMware holds a significant market share in server virtualization, cloud management, and networking solutions.

- Key VMware products: vSphere, vSAN, NSX, vRealize, and VMware Cloud on AWS.

- Potential Synergies: Integration of VMware's software with Broadcom's existing hardware infrastructure could lead to increased efficiency and performance for customers. However, concerns remain about potential conflicts of interest and monopolistic practices.

SEO Keywords: Broadcom VMware acquisition cost, VMware market share, Broadcom acquisition strategy, VMware vSphere pricing, VMware vSAN pricing

AT&T's Experience: A Case Study in Price Increases

AT&T, a major telecommunications company relying heavily on VMware's virtualization technologies, has reported substantial price increases following the acquisition. While precise figures haven't been publicly released by AT&T, industry sources suggest percentage increases in the double digits for certain VMware products.

- Specific VMware products affected: Reports indicate price hikes across various VMware offerings, impacting AT&T's data center operations and network infrastructure.

- AT&T's official statements: AT&T has not issued a public statement specifically addressing the price increases.

- Impact on AT&T's operational costs: The price increases represent a significant added expense for AT&T, potentially affecting operational costs and profitability.

- Comparison with other companies: Other large enterprises are likely experiencing similar price increases, though the extent may vary based on their individual contracts and negotiations.

SEO Keywords: AT&T VMware pricing, VMware price increase, impact of Broadcom acquisition, VMware licensing costs

The Ripple Effect: Impact on the Broader Market

The price increases experienced by AT&T are not an isolated incident. The Broadcom VMware acquisition has the potential to significantly impact various sectors, including cloud computing, data centers, and numerous industries heavily dependent on VMware technologies.

- Impact on small and medium-sized businesses (SMBs): SMBs may face disproportionately large impacts due to their smaller budgets and limited negotiating power.

- Increased competition from alternative virtualization platforms: The price hikes could accelerate the adoption of alternative virtualization solutions such as Citrix, Microsoft Hyper-V, and open-source options.

- Long-term implications for software licensing costs: The acquisition raises concerns about potential future price increases and the overall trajectory of software licensing costs in the virtualization market.

- Regulatory scrutiny and potential antitrust concerns: The merger has drawn regulatory scrutiny in various jurisdictions concerning potential antitrust issues and the impact on competition.

SEO Keywords: VMware pricing impact, cloud computing costs, virtualization alternatives, antitrust concerns, Citrix vs VMware, Microsoft Hyper-V pricing

Potential Strategies for Businesses Facing Price Increases

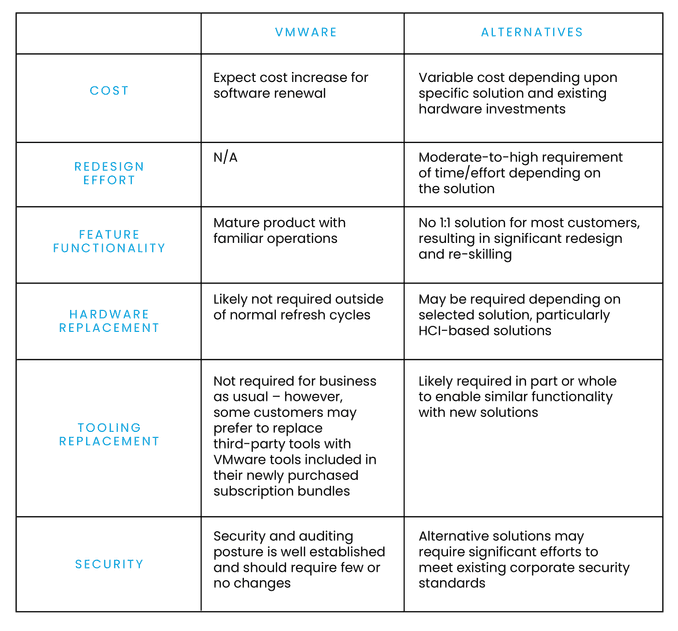

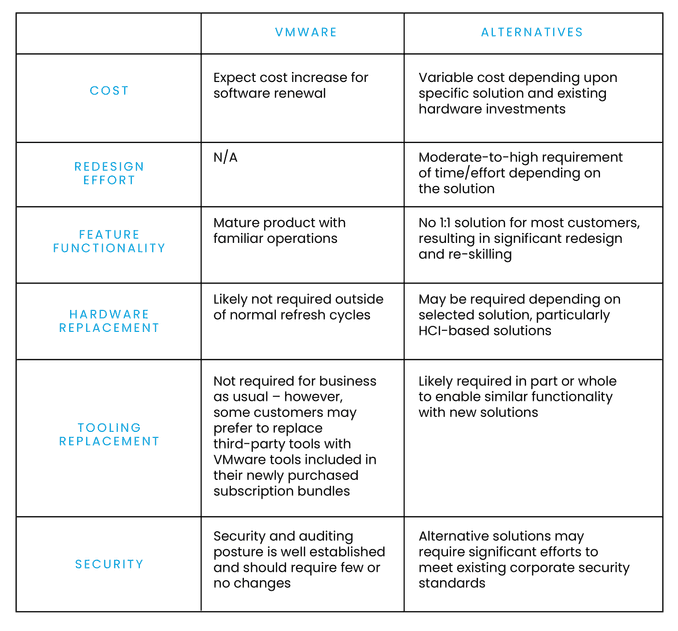

Businesses facing price increases due to the Broadcom-VMware merger need to proactively adapt their strategies.

- Negotiating contracts: Aggressively negotiate contracts with VMware or Broadcom to secure more favorable pricing.

- Exploring alternative pricing models: Investigate alternative licensing models to potentially reduce costs.

- Evaluating alternative virtualization solutions: Consider migrating to alternative virtualization platforms to mitigate vendor lock-in and reduce costs.

- Implementing cost-saving measures: Optimize IT infrastructure and resource utilization to reduce overall costs.

- Long-term planning: Develop a long-term strategy to mitigate future price fluctuations and ensure business continuity.

SEO Keywords: VMware cost optimization, virtualization cost savings, alternative virtualization solutions, VMware licensing negotiation

Conclusion

Broadcom's acquisition of VMware has resulted in significant price increases for some customers, as evidenced by AT&T's experience. This has broad implications for the entire industry, impacting businesses of all sizes and potentially leading to increased competition in the virtualization market. Businesses must proactively address these changes by exploring alternative solutions, negotiating contracts, and implementing cost-saving measures. Staying informed about the evolving landscape and actively monitoring VMware licensing costs in light of the Broadcom VMware merger impact is crucial for maintaining a competitive edge. Understanding the potential implications of the Broadcom VMware price changes and actively monitoring VMware costs is essential for businesses to navigate this new reality. Take control of your IT spending and explore your options regarding the Broadcom VMware merger impact.

Featured Posts

-

Paddy Pimbletts Shocking 35 Second Knockout Loss

May 16, 2025

Paddy Pimbletts Shocking 35 Second Knockout Loss

May 16, 2025 -

Playing Ps 1 Games On Steam Deck Verified Titles And How To Find Them

May 16, 2025

Playing Ps 1 Games On Steam Deck Verified Titles And How To Find Them

May 16, 2025 -

Rockies Vs Padres Colorado Seeks To End Losing Streak

May 16, 2025

Rockies Vs Padres Colorado Seeks To End Losing Streak

May 16, 2025 -

Fc Barcelona Issues Strong Statement Against Javier Tebas And La Liga

May 16, 2025

Fc Barcelona Issues Strong Statement Against Javier Tebas And La Liga

May 16, 2025 -

San Diego Padres Historic Mlb Victory After 134 Years

May 16, 2025

San Diego Padres Historic Mlb Victory After 134 Years

May 16, 2025