Broadcom's VMware Acquisition: AT&T Reveals A Staggering 1,050% Price Hike

Table of Contents

Broadcom's VMware Acquisition: A Deeper Dive

The Deal's Significance and Implications

Broadcom's acquisition of VMware, a colossal deal valued at approximately $61 billion, represents a significant shift in the enterprise software and cloud computing markets. This merger combines two industry giants, creating a behemoth with unparalleled market power. The resulting entity controls a vast portfolio of software and hardware solutions, raising concerns about potential monopolistic practices and stifling competition.

Broadcom's primary goals in acquiring VMware included:

- Expanding its enterprise software portfolio: VMware's leading virtualization and cloud management technologies significantly bolster Broadcom's existing offerings.

- Strengthening its position in the cloud market: The acquisition provides Broadcom with a much stronger foothold in the rapidly growing cloud infrastructure market.

- Achieving greater synergy and economies of scale: Combining operations should lead to cost reductions and increased efficiency.

- Diversifying revenue streams: VMware brings a stable and diverse revenue stream to Broadcom, reducing reliance on specific product lines.

Antitrust Scrutiny and Regulatory Hurdles

The sheer size and potential impact of the Broadcom-VMware merger naturally drew intense scrutiny from antitrust regulators worldwide. The deal faced significant hurdles during the approval process, with various regulatory bodies raising concerns about potential anti-competitive behavior.

Some of the challenges Broadcom faced included:

- Investigations by the European Commission: Thorough reviews were undertaken to assess potential anti-competitive impacts on the European market.

- Scrutiny by the U.S. Department of Justice: The DOJ investigated potential violations of antitrust laws before giving its approval.

- Concerns about market dominance: Regulators worried about the combined entity's ability to manipulate prices and limit choices for customers.

Impact on the Tech Landscape

The long-term impact of the Broadcom-VMware merger on the technology landscape is still unfolding. However, several key implications are already becoming apparent:

- Increased prices: The AT&T price hike serves as a stark example of how the merger could lead to increased prices for related products and services.

- Reduced competition: The consolidation of market power could stifle innovation and limit consumer choice.

- Shift in market dynamics: The merger could force other players in the market to adapt and innovate to stay competitive.

Potential winners in this scenario might include Broadcom itself and companies that successfully integrate VMware technologies into their offerings. Potential losers are smaller competitors that may struggle to compete with the combined entity's market dominance.

AT&T's 1050% Price Hike: Unpacking the Details

The Specifics of the Price Increase

AT&T's announcement of a 1050% price increase on specific VMware products shocked customers. While the exact products affected weren't initially publicized extensively, reports suggest that certain virtualization and cloud management services experienced these dramatic price jumps. AT&T's justification for this increase remains unclear, though speculation points to increased licensing costs resulting from the Broadcom acquisition.

A hypothetical comparison of old vs. new pricing might look like this:

- Old Price: $100 per month

- New Price: $1050 per month (a 1050% increase)

Consumer and Business Impact

This unprecedented price hike has severe implications for AT&T's customers, especially businesses heavily reliant on VMware solutions. Many companies are facing significant budget constraints and could be forced to:

- Reduce VMware service utilization: Finding ways to decrease their dependency on these expensive services.

- Switch to alternative providers: Explore competitors' offerings in search of more affordable solutions.

- Negotiate pricing: Attempt to renegotiate contracts with AT&T to secure more favorable terms.

The financial consequences could be substantial for businesses whose operations heavily depend on VMware products.

AT&T's Response and Future Actions

At the time of writing, AT&T has yet to issue a comprehensive statement adequately explaining the price hike. The lack of transparency has fueled customer dissatisfaction and calls for regulatory intervention. Without a clear explanation and potential mitigations, AT&T risks facing significant customer churn and reputational damage.

Conclusion: Navigating the Post-Acquisition Landscape

The Broadcom VMware acquisition and the subsequent AT&T price hike represent a significant turning point in the tech industry. The merger's long-term effects are still unfolding, but early indications suggest a potential for increased prices, reduced competition, and a reshaping of the market landscape. The 1050% price increase serves as a potent reminder of the potential consequences of such large-scale mergers.

It is crucial to stay informed about the developments surrounding the Broadcom VMware acquisition and its ongoing consequences. Keep an eye on regulatory actions, price changes, and responses from affected businesses and customers. Stay updated through reputable technology news sources and industry publications to navigate the complexities of this evolving situation effectively.

Featured Posts

-

La Orden Ejecutiva De Trump Y Su Impacto En La Industria De La Reventa De Boletos

May 30, 2025

La Orden Ejecutiva De Trump Y Su Impacto En La Industria De La Reventa De Boletos

May 30, 2025 -

Analyzing Dara O Briains Voice Of Reason Wit Intelligence And Social Commentary

May 30, 2025

Analyzing Dara O Briains Voice Of Reason Wit Intelligence And Social Commentary

May 30, 2025 -

French Open 2025 Upset Borges Defeats Ruud Amidst Knee Injury

May 30, 2025

French Open 2025 Upset Borges Defeats Ruud Amidst Knee Injury

May 30, 2025 -

Harga Lebih Murah Kawasaki Z900 Dan Z900 Se Di Indonesia Sebuah Tinjauan

May 30, 2025

Harga Lebih Murah Kawasaki Z900 Dan Z900 Se Di Indonesia Sebuah Tinjauan

May 30, 2025 -

Kg Motors Mibot A New Challenger In Japans Electric Vehicle Race

May 30, 2025

Kg Motors Mibot A New Challenger In Japans Electric Vehicle Race

May 30, 2025

Latest Posts

-

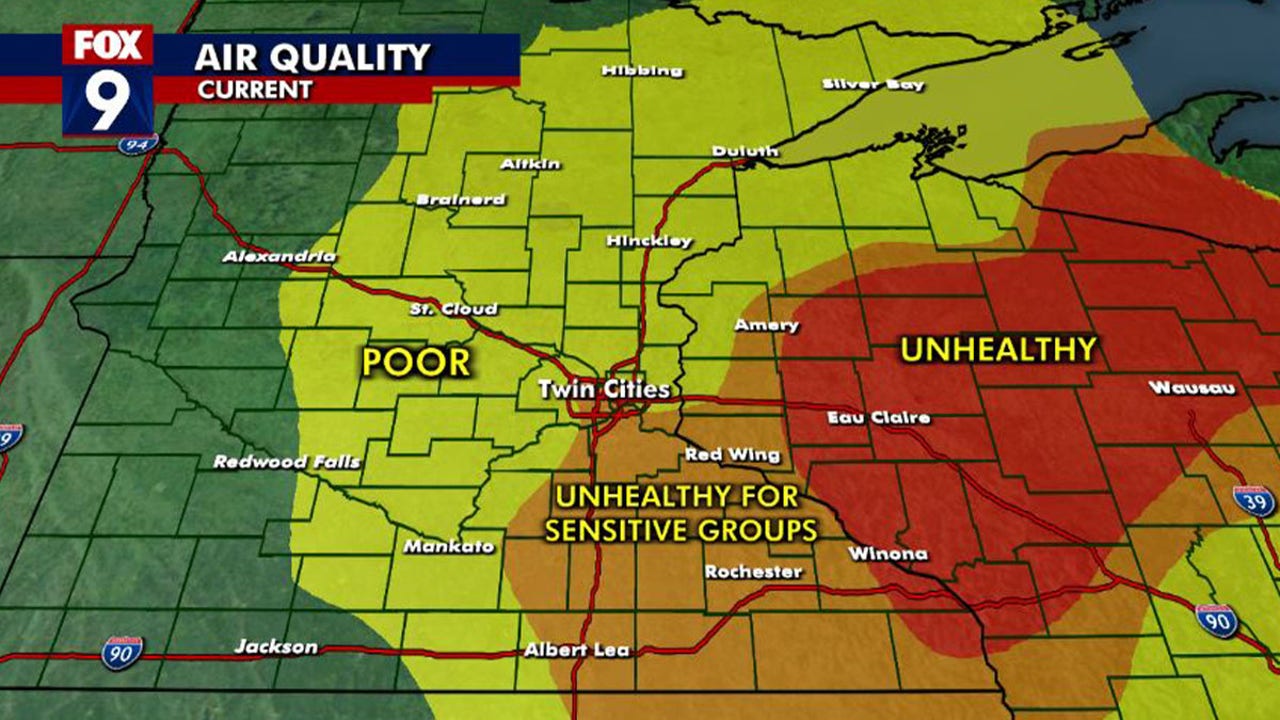

Minnesota Air Quality Crisis Impact Of Canadian Wildfires

May 31, 2025

Minnesota Air Quality Crisis Impact Of Canadian Wildfires

May 31, 2025 -

Canadian Wildfires Minnesota Air Quality Plummets

May 31, 2025

Canadian Wildfires Minnesota Air Quality Plummets

May 31, 2025 -

The Texas Panhandle Wildfire A Year Of Recovery And Rebirth

May 31, 2025

The Texas Panhandle Wildfire A Year Of Recovery And Rebirth

May 31, 2025 -

Eastern Newfoundland Wildfires A Growing Crisis

May 31, 2025

Eastern Newfoundland Wildfires A Growing Crisis

May 31, 2025 -

Update Fierce Wildfires In Eastern Manitoba

May 31, 2025

Update Fierce Wildfires In Eastern Manitoba

May 31, 2025