Brookfield's Opportunistic Investment Strategy Amid Market Volatility

Table of Contents

Identifying Undervalued Assets: The Core of Brookfield's Strategy

Brookfield's success is fundamentally rooted in its ability to pinpoint undervalued assets across various sectors. This isn't a matter of luck; it's a carefully orchestrated process built on rigorous research and a deep understanding of market dynamics.

Deep Due Diligence and Market Analysis

Brookfield employs a multi-faceted approach to due diligence, leveraging expert teams across its diverse asset classes, including real estate, infrastructure, renewable power, and private equity. This ensures a comprehensive evaluation of potential investments.

- Extensive financial modeling and valuation: Sophisticated financial models are used to assess the intrinsic value of assets, going beyond simple market pricing.

- In-depth market research and macroeconomic analysis: Brookfield’s analysts conduct thorough research, considering broader economic trends and their potential impact on specific sectors.

- Proprietary data and analytics capabilities: Access to proprietary data and advanced analytics provides Brookfield with a competitive edge in identifying hidden opportunities and assessing risk.

- Long-term investment horizon allowing for value appreciation: Brookfield takes a long-term view, recognizing that value appreciation often takes time and requires patience. This contrasts with shorter-term trading strategies.

Focusing on Specific Market Sectors

Brookfield doesn't adopt a scattergun approach. Instead, they strategically target sectors poised for future growth, even within a volatile market environment. This focused strategy helps mitigate risk and maximize returns.

- Infrastructure investments in growing economies: Investing in essential infrastructure projects in developing nations provides strong growth potential.

- Renewable energy projects addressing climate change demands: The increasing global focus on sustainability positions renewable energy as a high-growth sector.

- Real estate development in high-demand urban areas: Investing in prime real estate locations in growing cities provides strong rental income and capital appreciation potential.

- Private equity investments in resilient sectors: Brookfield carefully selects private equity investments in sectors less vulnerable to economic downturns.

Leveraging Market Volatility for Advantageous Acquisitions

Brookfield's opportunistic investment strategy truly shines during periods of market turmoil. They actively seek opportunities arising from market corrections and uncertainty, recognizing these as prime buying moments.

Counter-cyclical Investing

Brookfield is a master of counter-cyclical investing. They view market downturns not as threats, but as opportunities to acquire high-quality assets at discounted prices.

- Strategic acquisitions of distressed assets: They actively seek out assets facing financial difficulties, often acquiring them at significantly reduced prices.

- Capitalizing on forced seller situations: Brookfield can often negotiate favorable terms when sellers are under pressure to divest assets quickly.

- Negotiating favorable terms due to market conditions: Market uncertainty often leads to more favorable negotiation terms for buyers like Brookfield.

Strategic Partnerships and Joint Ventures

Brookfield understands the power of collaboration. They actively forge strategic partnerships and joint ventures to leverage shared resources and expertise.

- Collaboration with local developers and operators: Partnering with local experts provides invaluable market insights and operational efficiencies.

- Access to specialized knowledge and market insights: Joint ventures grant access to specialized knowledge and a broader network of contacts.

- Reduced risk through shared investment and responsibility: Sharing the investment burden and responsibilities mitigates the overall risk.

Long-Term Value Creation and Active Portfolio Management

Brookfield's success isn't solely about acquiring assets; it's about actively managing and enhancing their value over the long term.

Operational Expertise and Value Enhancement

Brookfield possesses significant operational expertise across its various asset classes. They actively work to improve the performance and value of their holdings.

- Asset repositioning and redevelopment: They strategically reposition assets to maximize their potential and adapt to changing market demands.

- Operational improvements and cost reductions: Brookfield actively seeks to streamline operations and reduce costs to enhance profitability.

- Active leasing and property management: Efficient leasing and property management strategies maximize rental income and occupancy rates.

- Strategic capital improvements: Targeted capital improvements enhance asset value and extend their useful life.

Patient Capital and Long-Term Vision

Brookfield's long-term investment horizon is a key differentiator. They are willing to withstand short-term market fluctuations, focusing on the long-term appreciation of their investments.

- Commitment to long-term growth and sustainability: They prioritize investments that offer sustainable, long-term growth prospects.

- Resilience to short-term market pressures: Their long-term perspective allows them to weather short-term market volatility.

- Focus on delivering consistent, long-term returns: Their primary goal is to deliver consistent, long-term returns to their investors.

Conclusion

Brookfield's opportunistic investment strategy is a powerful blend of deep market understanding, rigorous due diligence, and a patient, long-term approach. By skillfully identifying undervalued assets and leveraging market volatility, Brookfield consistently delivers strong returns for its investors. Their success stems from a combination of factors—from shrewd acquisitions to active portfolio management and a commitment to long-term value creation. To learn more about Brookfield's impressive track record and how their opportunistic investment strategy contributes to their success, explore their investor relations resources. Understanding Brookfield's opportunistic investment strategy can provide invaluable insights into navigating the complexities of the alternative investment landscape.

Featured Posts

-

Major Office365 Data Breach Millions Lost In Executive Email Hacks

May 08, 2025

Major Office365 Data Breach Millions Lost In Executive Email Hacks

May 08, 2025 -

March 7th Nba Thunder Vs Trail Blazers Game Time Tv And Live Stream Details

May 08, 2025

March 7th Nba Thunder Vs Trail Blazers Game Time Tv And Live Stream Details

May 08, 2025 -

New Pushback From Car Dealers On Electric Vehicle Requirements

May 08, 2025

New Pushback From Car Dealers On Electric Vehicle Requirements

May 08, 2025 -

1 Mdb Scandal Malaysias Push For Extradition Of Former Goldman Sachs Partner

May 08, 2025

1 Mdb Scandal Malaysias Push For Extradition Of Former Goldman Sachs Partner

May 08, 2025 -

The Andor Directors Near Reveal Of Rogue Ones Secretive Edit

May 08, 2025

The Andor Directors Near Reveal Of Rogue Ones Secretive Edit

May 08, 2025

Latest Posts

-

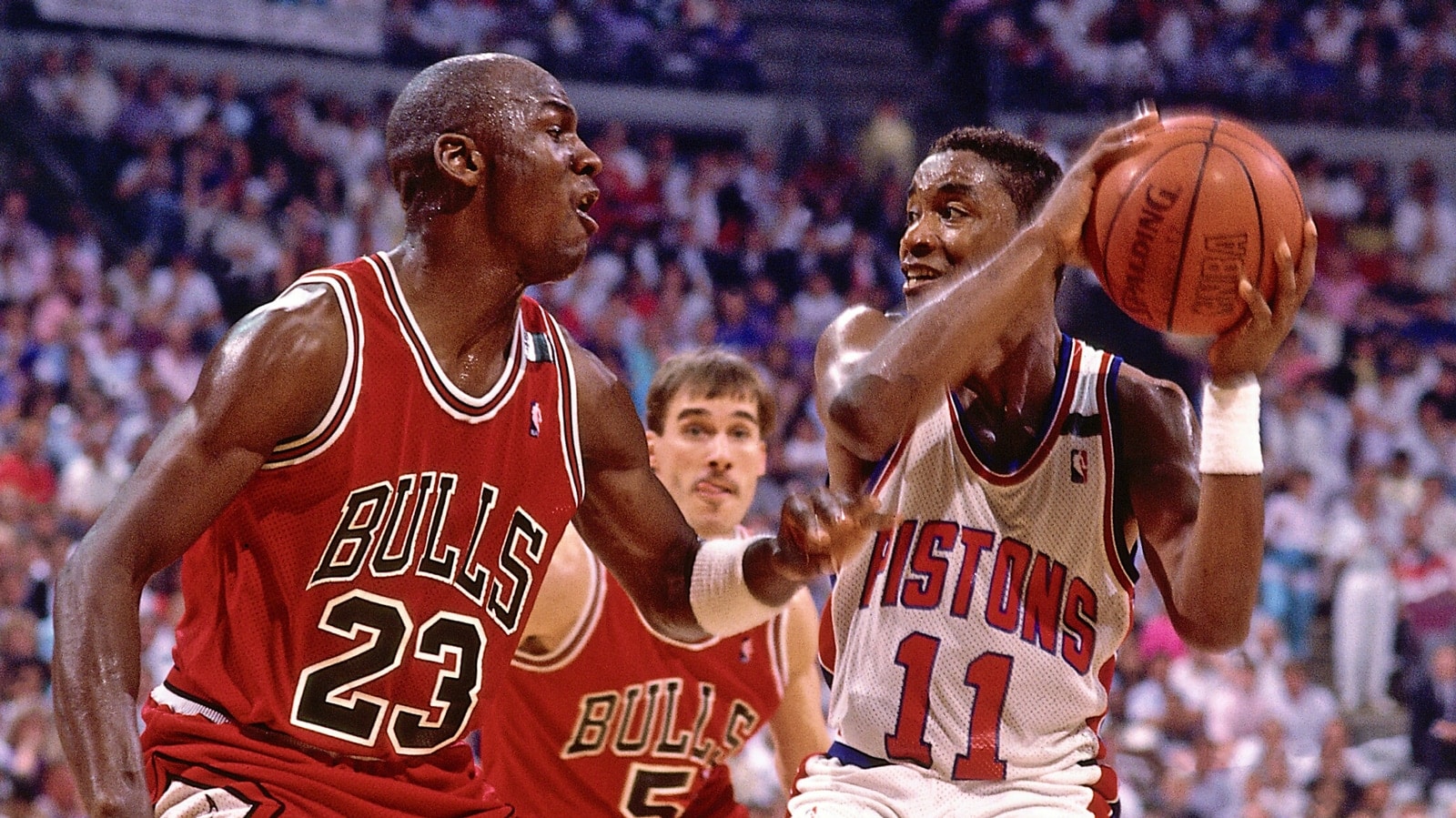

De Andre Jordans Historic Performance In Nuggets Vs Bulls Matchup

May 08, 2025

De Andre Jordans Historic Performance In Nuggets Vs Bulls Matchup

May 08, 2025 -

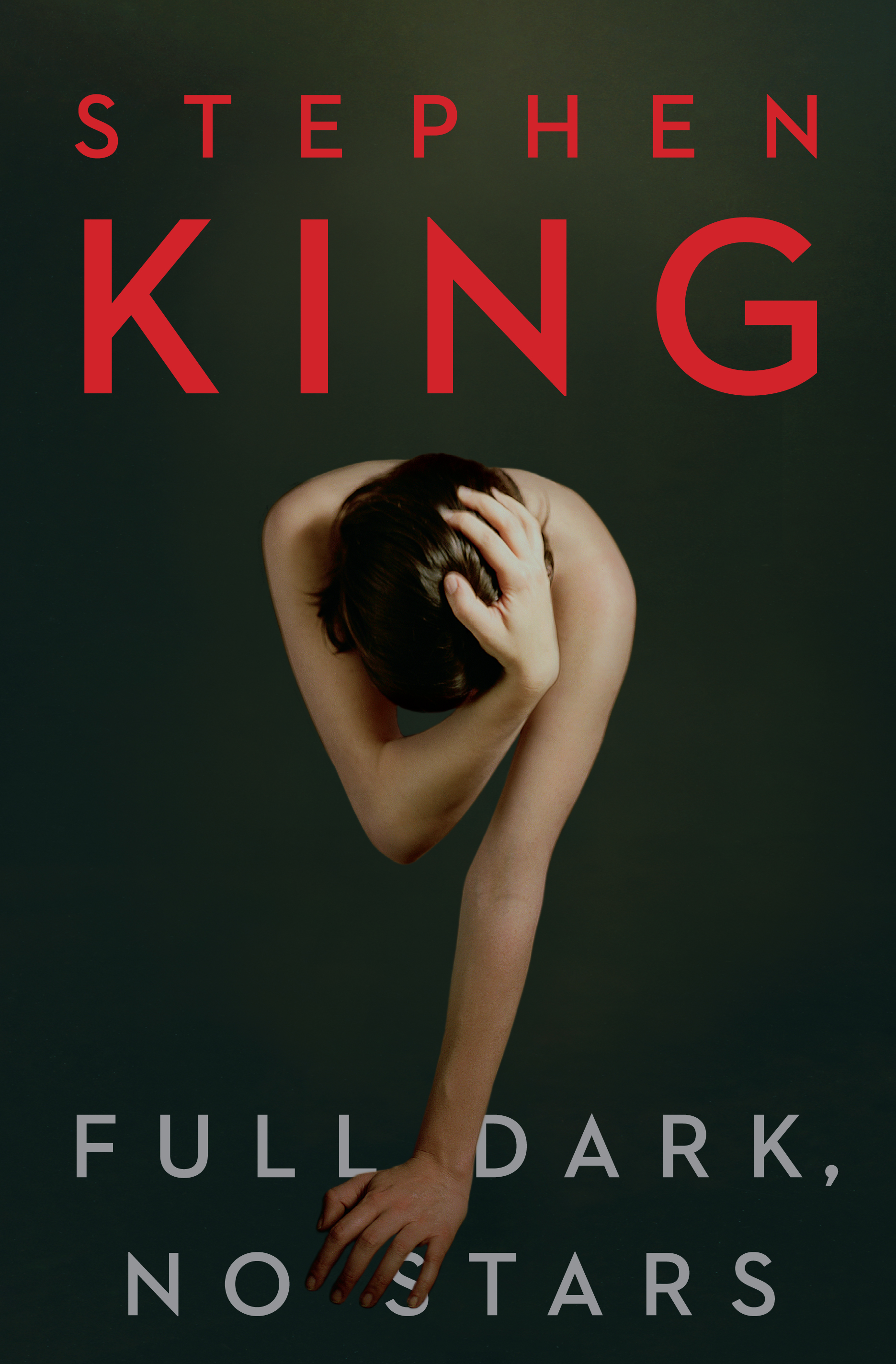

The Long Walk Stephen King Adaptation Unveils New Trailer

May 08, 2025

The Long Walk Stephen King Adaptation Unveils New Trailer

May 08, 2025 -

Nuggets Vs Bulls De Andre Jordans Record Breaking Performance

May 08, 2025

Nuggets Vs Bulls De Andre Jordans Record Breaking Performance

May 08, 2025 -

De Andre Jordans Historic Night Nuggets Vs Bulls

May 08, 2025

De Andre Jordans Historic Night Nuggets Vs Bulls

May 08, 2025 -

First Trailer Released Mark Hamill Stars In Stephen Kings The Long Walk Adaptation

May 08, 2025

First Trailer Released Mark Hamill Stars In Stephen Kings The Long Walk Adaptation

May 08, 2025