BSE Market Surge: Stocks Up Over 10% - Sensex Gains

Table of Contents

Key Drivers Behind the BSE Market Surge

Several factors contributed to this remarkable BSE market surge and the subsequent Sensex gains. Analyzing these drivers provides crucial insights into the current market dynamics.

Positive Global Economic Indicators

Positive global economic news played a significant role in boosting investor sentiment. Easing inflation in several major economies, coupled with robust corporate earnings reports from global giants, instilled confidence in the international markets. This positive global economic growth spilled over into the Indian stock market.

- Easing Inflation: The decrease in inflation rates in the US and Europe signaled a potential slowdown in interest rate hikes, reducing concerns about global economic slowdown.

- Strong Corporate Earnings: Several multinational corporations reported better-than-expected earnings, indicating a healthy global economic outlook and fueling investor optimism.

- Increased Foreign Investment: Positive global sentiment led to an increase in foreign investment flowing into emerging markets, including India. This influx of capital further bolstered the BSE. Keywords: global economic growth, inflation rate, foreign investment.

Domestic Factors Fueling the Sensex Gains

Domestic economic factors also contributed significantly to the Sensex gains. Positive developments within the Indian economy fueled investor confidence and spurred the market rally.

- Robust Indian GDP Growth: Stronger-than-expected GDP growth figures for the previous quarter showcased the resilience of the Indian economy.

- Government Initiatives: Positive government policies aimed at boosting infrastructure development, encouraging foreign direct investment (FDI), and easing regulatory burdens created a favorable investment climate.

- Increased Domestic Investment: Rising domestic investment, driven by positive economic sentiment and government incentives, further contributed to the market surge. Keywords: Indian GDP growth, government policies, domestic investment.

Sector-Specific Performance

The BSE market surge wasn't uniform across all sectors. Some sectors outperformed others, contributing disproportionately to the overall gains.

- Information Technology (IT): The IT sector witnessed significant gains, driven by strong demand for technology services and positive global economic indicators.

- Financials: The financial sector also performed strongly, reflecting increased investor confidence and robust economic activity.

- Consumer Goods: The consumer goods sector showed healthy growth, indicating strong domestic demand and positive consumer sentiment. Keywords: sectoral performance, top-performing sectors, stock market indices.

Impact on Investors and the Indian Economy

The BSE market surge has significant implications for investors and the Indian economy as a whole.

Investor Sentiment and Market Volatility

The surge in the BSE market significantly improved investor sentiment, leading to increased risk appetite. However, such rapid gains can also lead to increased market volatility.

- Increased Investor Confidence: The Sensex gains boosted investor confidence, encouraging further investment in the stock market.

- Short-Term vs. Long-Term Investors: Short-term investors might see quick profits, while long-term investors may view this as an opportunity for strategic portfolio adjustments.

- Market Volatility: The rapid increase in the Sensex could lead to increased market volatility in the short term. Keywords: investor confidence, market volatility, risk appetite.

Broader Economic Implications

The BSE market surge has wider implications for the Indian economy.

- Economic Growth: The increase in market capitalization can contribute to overall economic growth by boosting investor confidence and attracting further investment.

- Job Creation: Increased economic activity driven by the market surge can potentially lead to job creation across various sectors.

- Foreign Direct Investment (FDI): A strong stock market can attract more FDI, fueling further economic growth and development. Keywords: economic growth, foreign direct investment, job creation.

Future Outlook and Predictions for the BSE Market

Predicting the future of the BSE market is challenging, but analyzing expert opinions and potential risks provides a clearer picture.

Analyst Predictions and Expert Opinions

Market analysts offer varying opinions on the future trajectory of the BSE market. Some remain optimistic, citing the strong fundamentals of the Indian economy, while others express caution about potential risks. Quotes from reputable financial analysts would be included here. Keywords: market forecast, expert opinion, future outlook.

Potential Risks and Challenges

Several factors could potentially impact future market performance:

- Geopolitical Instability: Global geopolitical uncertainties could negatively affect investor sentiment and market stability.

- Inflation Concerns: Persistent inflationary pressures could dampen economic growth and lead to market corrections.

- Global Economic Slowdown: A potential global economic slowdown could impact Indian markets. Keywords: market risk, geopolitical risks, inflation concerns.

Conclusion: Navigating the BSE Market Surge – What's Next?

The BSE market surge, marked by a remarkable 10%+ increase in the Sensex, was driven by a combination of positive global and domestic economic factors. This significant event has had a profound impact on investor sentiment and the broader Indian economy. While the future outlook remains uncertain, understanding the key drivers, potential risks, and expert opinions is crucial for navigating the dynamic BSE market. Stay updated on the latest BSE market trends and plan your investment strategies wisely. Monitor the Sensex gains and make informed decisions for your portfolio. Consider seeking professional investment advice to best manage your investments in this volatile but potentially rewarding market.

Featured Posts

-

Andor Season 2 A Recap Of Season 1 And What To Expect

May 15, 2025

Andor Season 2 A Recap Of Season 1 And What To Expect

May 15, 2025 -

Hyeseong Kims Mlb Debut Imminent Dodgers Recall

May 15, 2025

Hyeseong Kims Mlb Debut Imminent Dodgers Recall

May 15, 2025 -

Wade Weighs In Butlers Exit From The Miami Heat

May 15, 2025

Wade Weighs In Butlers Exit From The Miami Heat

May 15, 2025 -

Urgent Police Response To Armed Individual Report Near Gsw Campus

May 15, 2025

Urgent Police Response To Armed Individual Report Near Gsw Campus

May 15, 2025 -

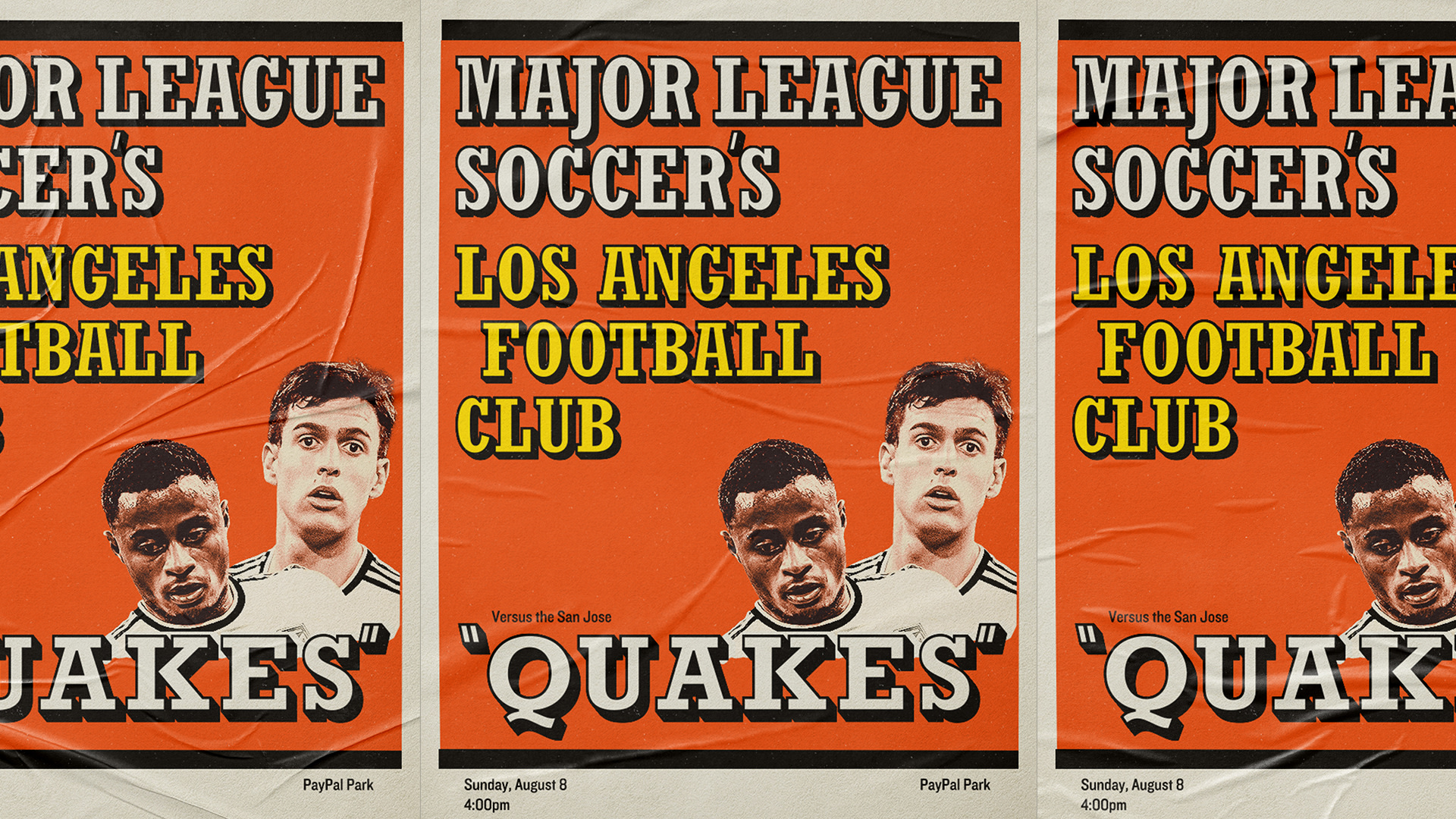

Daniels Injury A Turning Point In San Jose Earthquakes Loss To Lafc

May 15, 2025

Daniels Injury A Turning Point In San Jose Earthquakes Loss To Lafc

May 15, 2025