BSE Market Update: Sensex Rise And Top Performing Stocks

Table of Contents

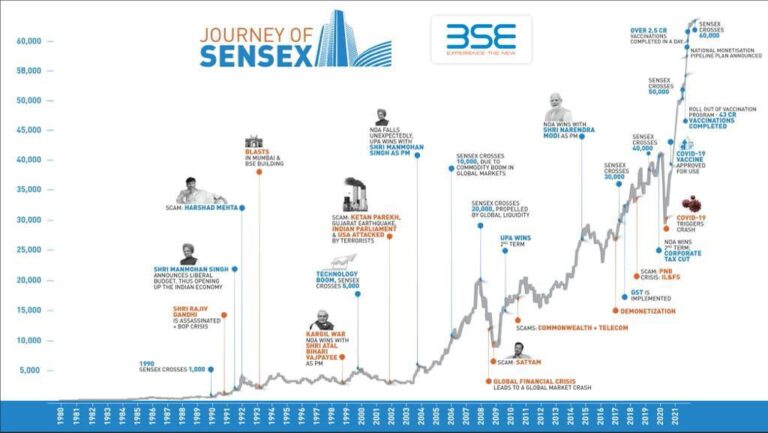

Sensex's Impressive Rise: A Detailed Analysis

The recent surge in the Sensex is a noteworthy event in the Indian stock market. Several factors have contributed to this impressive rise. Let's delve into a detailed analysis:

-

Positive Economic Indicators: India's robust economic growth, coupled with positive indicators like [mention specific indicators, e.g., GDP growth rate, industrial production figures, consumer confidence index], has boosted investor confidence. Stronger-than-expected quarterly earnings from major companies have also played a crucial role.

-

Global Market Trends: Favorable global market trends, particularly in [mention specific sectors or regions positively influencing the Sensex, e.g., technology, US markets], have had a positive spillover effect on the Indian stock market. A stable global economic outlook often translates to increased foreign investment in emerging markets like India.

-

Investor Sentiment: The prevailing bullish sentiment among investors is another key driver. Positive news surrounding government policies, infrastructure development, and easing inflation has contributed to this optimism. This positive sentiment has led to increased buying activity, pushing the Sensex higher.

-

Historical Comparison: Compared to the previous [mention time period, e.g., quarter, year], this Sensex rise is [mention significance, e.g., significantly higher, the strongest in recent years]. This underscores the strength of the current market upswing.

Bullet Points:

- Strong GDP growth exceeding expectations.

- Increased foreign institutional investor (FII) inflows.

- Positive global market sentiment driven by technological advancements.

- Sensex performance significantly outpacing previous year's growth.

Top Performing Stocks on the BSE: Sector-wise Breakdown

Several stocks across different sectors have exhibited exceptional performance during this market surge. Let's examine the top performers:

| Sector | Top Performing Stock 1 | Percentage Increase | Top Performing Stock 2 | Percentage Increase | Reason for Strong Performance |

|---|---|---|---|---|---|

| Banking | [Stock Name] | [Percentage]% | [Stock Name] | [Percentage]% | Strong loan growth, improved asset quality, positive market sentiment |

| IT | [Stock Name] | [Percentage]% | [Stock Name] | [Percentage]% | Robust deal wins, strong client demand, technological advancements |

| Pharmaceuticals | [Stock Name] | [Percentage]% | [Stock Name] | [Percentage]% | New product launches, increased demand for healthcare products |

| FMCG | [Stock Name] | [Percentage]% | [Stock Name] | [Percentage]% | Strong brand portfolio, successful marketing campaigns |

Bullet Points:

- Top 3 stocks in Banking: [Stock Names and Percentage Increases]

- Top 3 stocks in IT: [Stock Names and Percentage Increases]

- Top 3 stocks in Pharmaceuticals: [Stock Names and Percentage Increases]

- Top 3 stocks in FMCG: [Stock Names and Percentage Increases]

Understanding the Market Volatility and Future Predictions

While the current market trend is positive, it's crucial to acknowledge the inherent volatility of the stock market. Potential risks include:

- Global Economic Slowdown: A potential global economic slowdown could negatively impact investor sentiment and lead to a correction in the market.

- Geopolitical Uncertainty: Geopolitical tensions and unforeseen events can create market instability.

- Inflationary Pressures: Persistent inflationary pressures could dampen economic growth and impact stock prices.

Future predictions are inherently uncertain. However, based on current market analysis and expert opinions, we can anticipate:

- Continued Growth in Specific Sectors: Sectors like [mention sectors] are expected to continue their strong performance, driven by [mention reasons].

- Moderate Volatility: While significant corrections are unlikely in the short term, some degree of market volatility should be expected.

Bullet Points:

- Short-term outlook: Moderate volatility expected, but overall positive trend likely to continue.

- Long-term outlook: Continued growth projected for the Indian stock market, particularly in technology and infrastructure sectors.

- Potential risks: Global economic slowdown, geopolitical instability, inflation.

- Disclaimer: This is not investment advice. Conduct thorough research before making any investment decisions.

Conclusion: Stay Updated on the BSE Market – Sensex and Top Stocks

The BSE market has experienced a remarkable Sensex rise, driven by positive economic indicators, global market trends, and strong investor sentiment. Several stocks across various sectors have shown exceptional performance. However, investors should remain aware of potential market risks and volatility. To stay informed about the BSE Sensex and monitor top BSE stocks, regularly check for market updates and consider subscribing to our newsletter for the latest insights. Track your BSE investments closely and make informed decisions based on your risk tolerance and investment goals. Staying updated on the BSE market is crucial for making sound investment choices.

Featured Posts

-

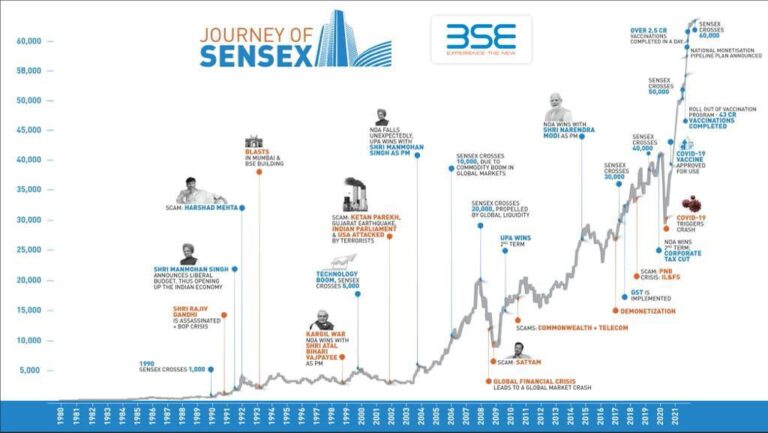

Dijital Veri Tabani Isguecue Piyasasi Rehberi Ledra Pal Carsamba Guenue

May 15, 2025

Dijital Veri Tabani Isguecue Piyasasi Rehberi Ledra Pal Carsamba Guenue

May 15, 2025 -

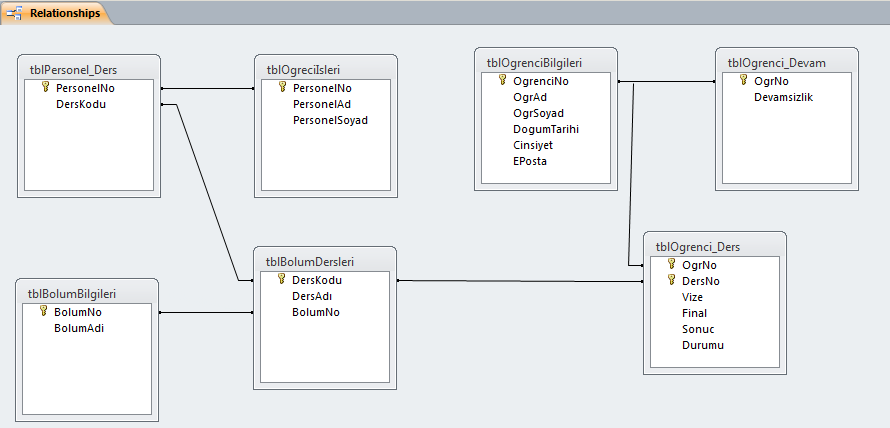

Nhl Draft Lottery Rules Explained Addressing Fan Frustration

May 15, 2025

Nhl Draft Lottery Rules Explained Addressing Fan Frustration

May 15, 2025 -

Ufc 314 Paddy Pimbletts Post Fight Message To His Critics

May 15, 2025

Ufc 314 Paddy Pimbletts Post Fight Message To His Critics

May 15, 2025 -

Examining The Reality Behind Trumps Egg Price Claims

May 15, 2025

Examining The Reality Behind Trumps Egg Price Claims

May 15, 2025 -

Nba And Nhl Playoffs Your Best Bets For Round 2

May 15, 2025

Nba And Nhl Playoffs Your Best Bets For Round 2

May 15, 2025