Buffett's Apple Investment: Navigating The Impact Of Trump-Era Tariffs

Table of Contents

The Magnitude of Berkshire Hathaway's Apple Stake

Berkshire Hathaway's Apple holdings are not just substantial; they're monumental. This investment forms a cornerstone of Berkshire's portfolio, significantly impacting its overall financial health. At its peak, Apple represented a staggering percentage of Berkshire's total holdings, far surpassing many other significant investments. The sheer size of this stake highlights the profound influence Apple's performance has on Berkshire's bottom line.

- Specific numbers: At its peak, Berkshire Hathaway held over $100 billion in Apple stock, representing a significant percentage (around 40-45% at different points) of its equity portfolio.

- Comparison to other holdings: This dwarfs Berkshire's investments in other major companies, emphasizing Apple's disproportionate influence on the conglomerate's financial performance.

- Timing of the investment: The timing of Berkshire's initial investment and subsequent increases coincided with the period leading up to and during the implementation of Trump-era tariffs, raising questions about potential impacts.

Trump-Era Tariffs and Their Impact on Apple's Supply Chain

The Trump administration implemented various tariffs, primarily targeting goods imported from China. These tariffs directly impacted Apple, a company heavily reliant on Chinese manufacturing for many components and the final assembly of its products. Increased costs for components like processors, memory chips, and other essential parts significantly affected Apple's production costs. This increase raised concerns about potential price increases for consumers and reduced profit margins for Apple itself.

- Specific examples: Tariffs affected various Apple products, potentially increasing the cost of iPhones, iPads, and MacBooks, which rely on components manufactured or assembled in China.

- Sources for tariff information: Official government publications, such as those from the Office of the United States Trade Representative (USTR), detail the specific tariffs imposed on various goods.

- Supply chain adjustments: Apple has undertaken various strategies to mitigate the impact of tariffs, including exploring alternative manufacturing locations and negotiating with suppliers.

Berkshire Hathaway's Response to Tariff-Related Risks

Given the massive investment in Apple, Berkshire Hathaway likely had to consider the potential risks posed by the Trump-era tariffs. While the precise details of their risk mitigation strategy remain largely undisclosed, several potential approaches are plausible.

- Potential diversification strategies: Berkshire Hathaway is known for its diversified portfolio. The sheer size of the Apple investment might have necessitated adjustments to balance out exposure to potential tariff-related downturns in the tech sector.

- Evidence of hedging strategies: While unlikely to publicly disclose specific hedging strategies, Berkshire might have employed financial instruments to offset some of the potential negative impacts of fluctuating trade policies.

- Long-term perspective: Berkshire Hathaway is renowned for its long-term investment approach. This long-term strategy likely contributed to its ability to weather the short-term volatility caused by tariff-related market fluctuations.

The Overall Financial Impact on Berkshire Hathaway

Determining the precise financial impact of tariffs on Berkshire Hathaway's Apple investment is difficult. The influence of tariffs is intertwined with other market forces, making isolation of the impact challenging. However, considering Apple's overall financial performance during this period, the impact likely wasn't as detrimental as initially feared, thanks in part to Apple's own mitigation strategies and the overall resilience of the Apple brand.

- Financial data: While precise numbers isolating tariff impact are scarce, Apple's overall financial reports during this period can offer insights.

- Comparison to other market fluctuations: The impact of tariffs needs to be considered alongside other factors influencing Berkshire's performance, like broader market trends and economic conditions.

- Expert opinions: Analyzing financial commentary and expert opinions on Berkshire's investment strategy during this period provides context and further insights.

Conclusion: Buffett's Apple Investment and the Lessons Learned from Tariffs

Berkshire Hathaway's Apple investment, despite the backdrop of Trump-era tariffs, showcases the importance of a diversified portfolio and a long-term investment strategy. While the tariffs undoubtedly presented risks to Apple's supply chain and profitability, Berkshire's massive holding suggests a confidence in Apple's ability to navigate these challenges. The overall impact seems to have been relatively minor in the grand scheme of Berkshire's overall investment strategy. This highlights the importance of understanding and mitigating the risks associated with global trade policies for large-scale investments.

Key takeaways: Navigating global trade risks requires a multi-faceted approach, including diversification, strategic hedging, and a long-term perspective. The resilience of Apple, and Berkshire's faith in it, demonstrates the power of a strong brand and efficient adaptation within a dynamic global market.

Call to action: Learn more about Buffett's Apple investment strategy and understand the impact of tariffs on global investments by researching further into the effects of trade policies on major corporations and evaluating the effectiveness of different risk mitigation techniques. Analyze other large-scale investments and their responses to similar trade events to gain a deeper understanding of navigating international trade complexities.

Featured Posts

-

Darwin Police Arrest Teen After Fatal Stabbing In Nightcliff

May 25, 2025

Darwin Police Arrest Teen After Fatal Stabbing In Nightcliff

May 25, 2025 -

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 25, 2025

Trumps Tariff Increase Sends Amsterdam Stock Exchange Down 2

May 25, 2025 -

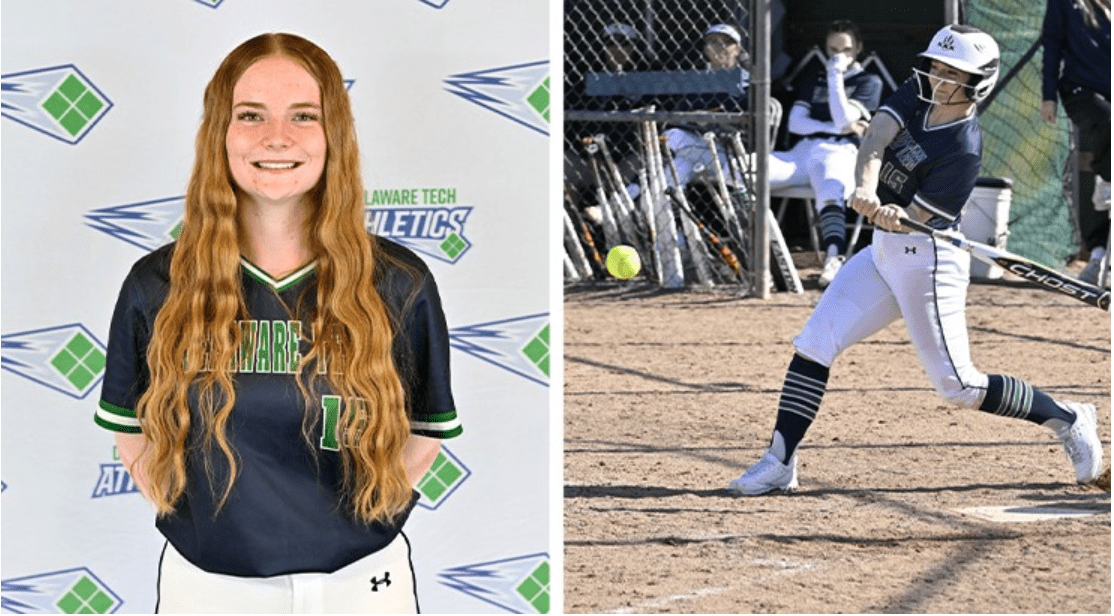

Terrapins Softball Edges Delaware In 5 4 Thriller

May 25, 2025

Terrapins Softball Edges Delaware In 5 4 Thriller

May 25, 2025 -

Porsche Cayenne Gts Coupe Szczegolowa Recenzja Po Jazdach Testowych

May 25, 2025

Porsche Cayenne Gts Coupe Szczegolowa Recenzja Po Jazdach Testowych

May 25, 2025 -

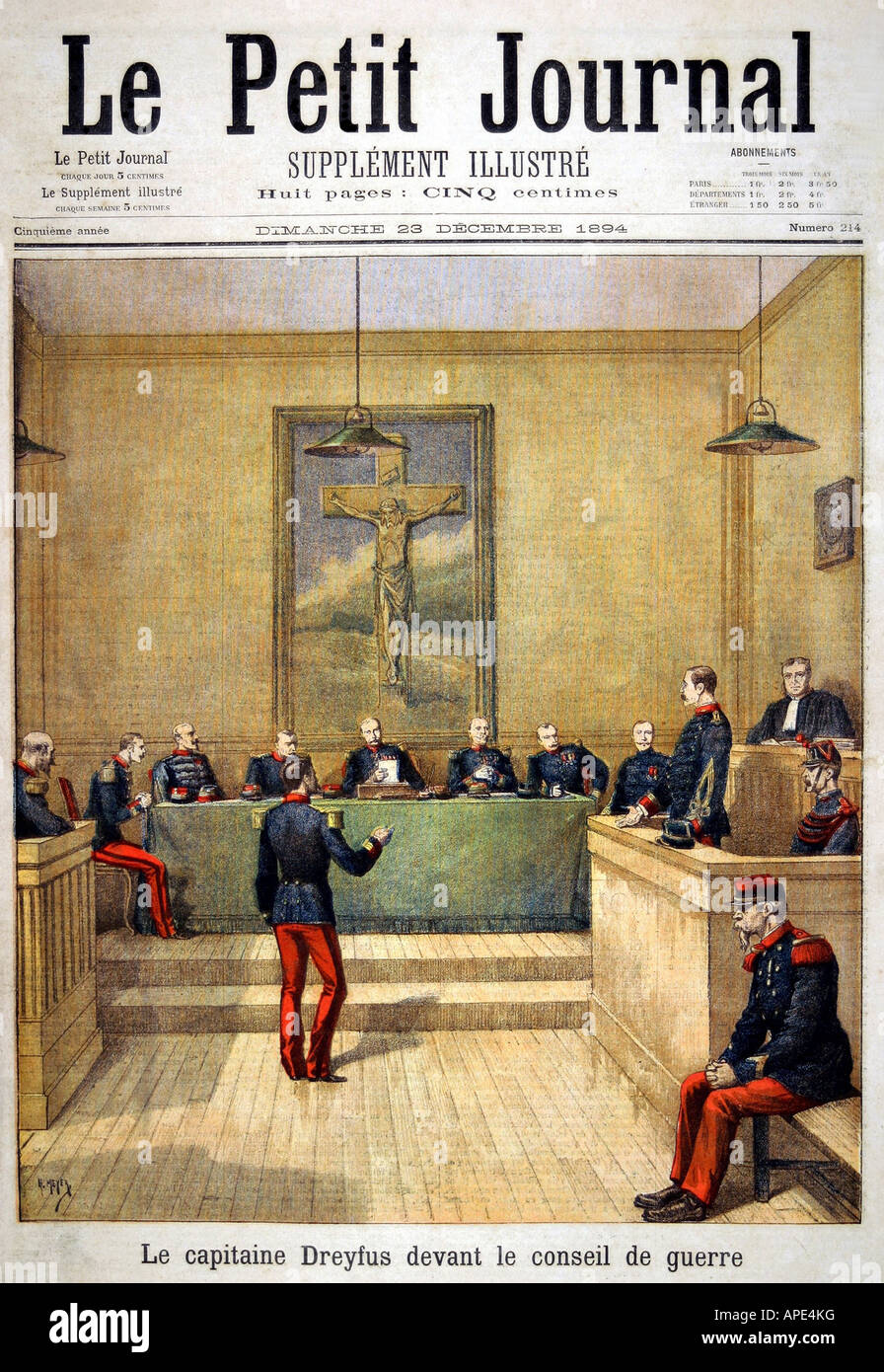

France To Honor Dreyfus Parliament Debates Posthumous Promotion

May 25, 2025

France To Honor Dreyfus Parliament Debates Posthumous Promotion

May 25, 2025

Latest Posts

-

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 25, 2025

What Is A Flash Flood Understanding Flood Warnings And Alerts

May 25, 2025 -

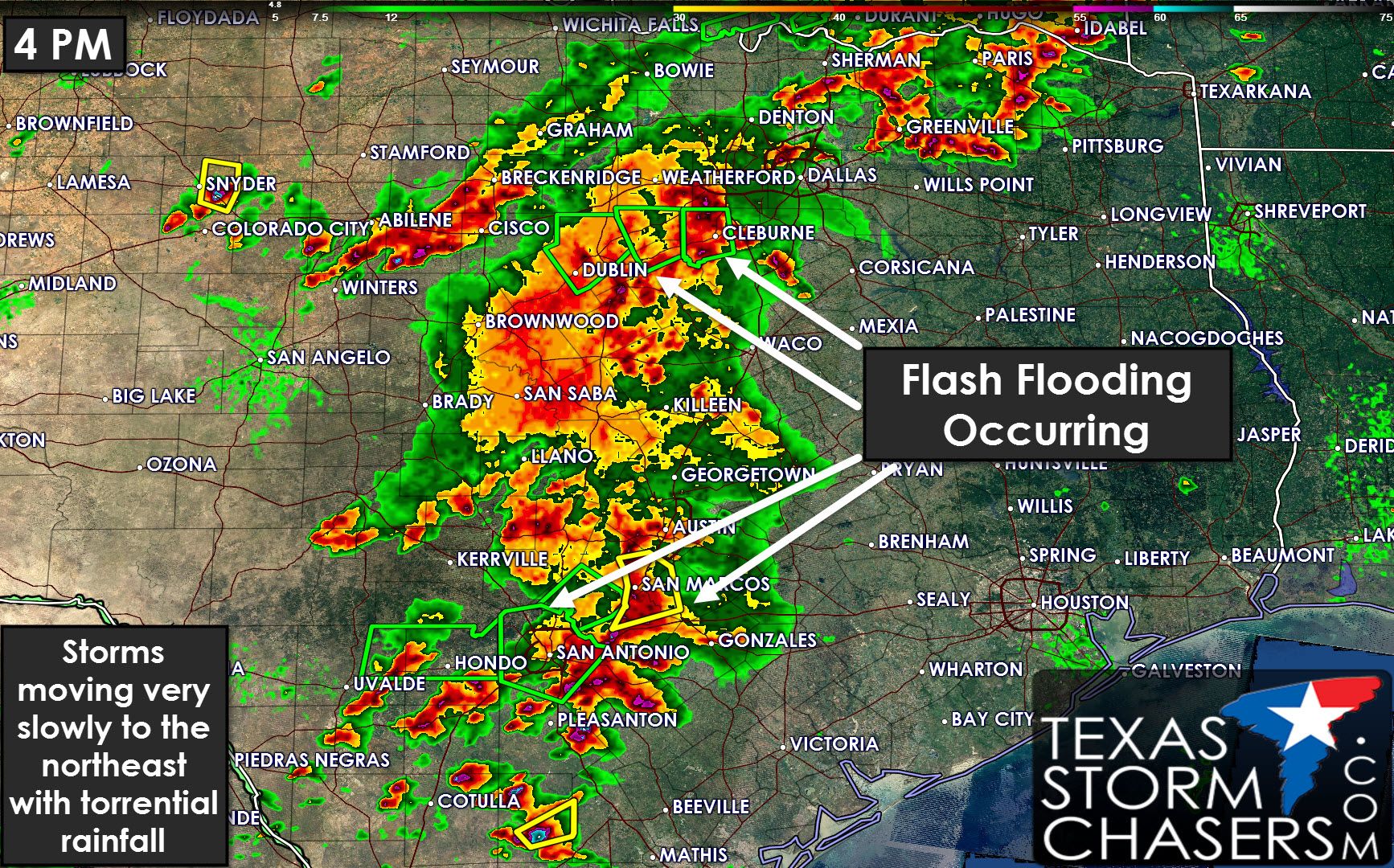

Urgent Flash Flood Warning Issued For Parts Of North Central Texas

May 25, 2025

Urgent Flash Flood Warning Issued For Parts Of North Central Texas

May 25, 2025 -

Flash Flood Threat Bradford And Wyoming Counties On High Alert Until Tuesday

May 25, 2025

Flash Flood Threat Bradford And Wyoming Counties On High Alert Until Tuesday

May 25, 2025 -

Severe Thunderstorms Bring Flash Flood Warning To Bradford And Wyoming Counties

May 25, 2025

Severe Thunderstorms Bring Flash Flood Warning To Bradford And Wyoming Counties

May 25, 2025 -

Flash Flood Warning Texas North Central Texas Braces For Severe Storms

May 25, 2025

Flash Flood Warning Texas North Central Texas Braces For Severe Storms

May 25, 2025