Bundestag Elections And The DAX: Understanding The Correlation

Table of Contents

Historical Analysis of DAX Performance Around Bundestag Elections

Pre-Election Volatility

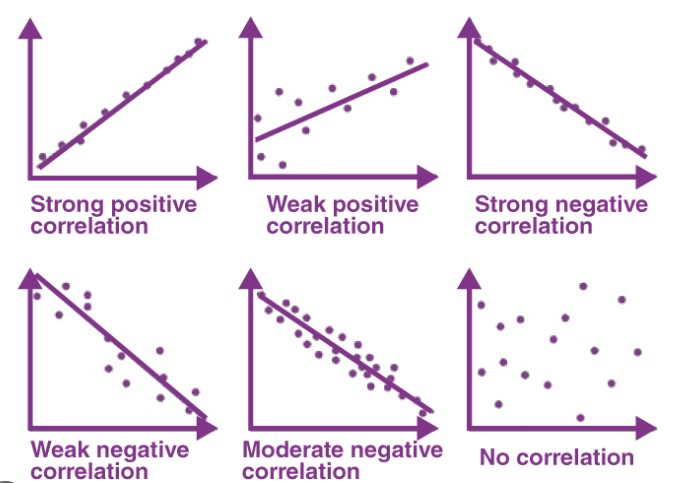

The months leading up to previous Bundestag elections have often witnessed increased volatility in the DAX. This pre-election uncertainty stems from several factors, including intense policy debates and the often unpredictable nature of coalition negotiations. Examining past election cycles reveals a consistent pattern: as the election nears, the DAX becomes increasingly sensitive to news and announcements.

Analyzing data from previous elections clearly illustrates this heightened volatility. Charts showcasing DAX performance in the months preceding elections reveal increased trading volume and a greater susceptibility to even minor political developments. This heightened sensitivity reflects investor sentiment, which tends to become more cautious and risk-averse as uncertainty grows.

- Increased trading volume: Investors react to shifting political landscapes by increasing their trading activity.

- Heightened market sensitivity to news: Even small news items can trigger significant price swings.

- Potential for short-term corrections: The market may experience temporary dips as investors reassess their positions.

Post-Election Market Reactions

The DAX's response to election results is equally fascinating. Immediate post-election market reactions are often influenced by the winning party or coalition. A clear victory by a party with well-defined economic policies often leads to a more predictable market response compared to situations involving protracted coalition negotiations. Specific policy announcements, such as tax changes or planned fiscal spending, have a direct impact on investor confidence and, consequently, the DAX.

For example, pro-business policies generally result in positive market reactions, while announcements suggesting significant regulatory changes or increased government intervention might lead to temporary setbacks. The formation of a stable coalition government typically brings about a period of market stabilization, as uncertainty diminishes.

- Positive reactions to pro-business policies: Policies that promote economic growth and reduce regulatory burdens tend to boost the DAX.

- Negative reactions to policy uncertainty: Prolonged coalition negotiations and unclear policy agendas can negatively impact investor sentiment.

- Market stability after coalition formation: Once a government is formed, and its policies become clearer, market volatility tends to decrease.

Key Factors Influencing the Correlation

Policy Uncertainty and Investor Sentiment

Policy uncertainty is a major driver of DAX fluctuations during election periods. Investors thrive on predictability; the ambiguity surrounding potential policy changes discourages investment and reduces market confidence. Conversely, clear signals from a winning party regarding its economic plans can significantly boost market confidence and lead to increased investment. Changes in taxation, regulation, or government spending directly affect various sectors, influencing the overall DAX performance.

- Uncertainty discourages investment: Unclear policy agendas cause investors to adopt a wait-and-see approach.

- Clear policy signals boost market confidence: Well-defined economic plans create a positive market outlook.

- Impact of potential regulatory changes: Changes in regulations can significantly impact specific sectors and the DAX overall.

Government Stability and Economic Outlook

Government stability plays a crucial role in influencing investor sentiment and consequently, the DAX. A strong majority government generally provides greater predictability and stability, fostering investor confidence. Conversely, coalition negotiations and the potential for governmental instability can create uncertainty and negatively impact the market. Coupled with economic forecasts and growth projections, these factors shape investor expectations and influence trading activity.

- Strong coalitions lead to predictability and stability: A clear mandate from the electorate enables swift policy implementation.

- Coalition negotiations create uncertainty: Prolonged negotiations can delay crucial policy decisions, causing market uncertainty.

- Positive economic outlook boosts the DAX: Positive growth projections and economic forecasts usually lead to increased investor confidence.

Global Economic Factors and their Interplay

It's important to remember that global economic events can significantly influence the DAX, sometimes overshadowing domestic election impacts. Global recessions, international trade tensions, and overall global market trends are all external factors that can have a substantial effect on the German stock market, regardless of election outcomes.

- Global recessions: A global downturn can negatively affect the DAX irrespective of domestic political developments.

- International trade tensions: Trade disputes can disrupt supply chains and negatively influence German exports, impacting the DAX.

- Global market trends: Overall global market sentiment plays a significant role in influencing the DAX.

Strategies for Investors During Bundestag Election Periods

Risk Management Techniques

During periods of election-related uncertainty, employing effective risk management strategies is crucial. Diversifying investments across different asset classes and sectors reduces the impact of potential market downturns. Hedging strategies can also be used to protect portfolios against significant losses. Remember that long-term investment strategies generally outperform short-term reactions to market volatility.

- Diversification: Spreading investments across various asset classes reduces overall portfolio risk.

- Hedging: Employing strategies to offset potential losses from market fluctuations.

- Careful analysis of risk tolerance: Investors should assess their ability to withstand market downturns.

Opportunities for Informed Investing

While election periods present risks, they also offer opportunities for informed investors. By carefully analyzing the potential policy implications of different election outcomes, investors can identify sectors likely to benefit from specific policy changes. This allows for the development of targeted investment strategies that capitalize on the potential shifts in the market.

- Targeted investment strategies: Focusing investments on sectors expected to benefit from specific policy changes.

- Understanding the potential impact of specific policy proposals: Analyzing how different policy proposals could affect various sectors.

Conclusion

The correlation between Bundestag elections and the DAX is complex, shaped by policy uncertainty, government stability, and global economic conditions. While historical data offers valuable insights, precise market predictions remain elusive. Investors should balance risk management strategies with the identification of potential opportunities arising from election outcomes and policy changes. Understanding the interplay between Bundestag elections and the DAX is crucial for effective navigation of the German stock market. Continue learning about the impact of Bundestag elections on the DAX and refine your investment strategies accordingly.

Featured Posts

-

Pne Groups German Expansion Permits Granted For Two Wind Farms And A Solar Plant

Apr 27, 2025

Pne Groups German Expansion Permits Granted For Two Wind Farms And A Solar Plant

Apr 27, 2025 -

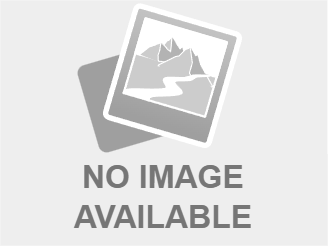

Microsofts Design Chief On The Future Of Human Centered Ai

Apr 27, 2025

Microsofts Design Chief On The Future Of Human Centered Ai

Apr 27, 2025 -

Chillin In Alaska Ariana Biermanns Romantic Trip

Apr 27, 2025

Chillin In Alaska Ariana Biermanns Romantic Trip

Apr 27, 2025 -

Nosferatu The Vampyre On Now Torontos Detour Film Analysis

Apr 27, 2025

Nosferatu The Vampyre On Now Torontos Detour Film Analysis

Apr 27, 2025 -

Nintendo Switch 2 My Game Stop Preorder Story

Apr 27, 2025

Nintendo Switch 2 My Game Stop Preorder Story

Apr 27, 2025

Latest Posts

-

A Professional Look At Ariana Grandes Latest Style Update

Apr 27, 2025

A Professional Look At Ariana Grandes Latest Style Update

Apr 27, 2025 -

Ariana Grandes Transformation Professional Styling And Body Art

Apr 27, 2025

Ariana Grandes Transformation Professional Styling And Body Art

Apr 27, 2025 -

Get Professional Help Understanding Ariana Grandes Style Choices

Apr 27, 2025

Get Professional Help Understanding Ariana Grandes Style Choices

Apr 27, 2025 -

Hair And Tattoo Transformations Ariana Grandes Bold New Image

Apr 27, 2025

Hair And Tattoo Transformations Ariana Grandes Bold New Image

Apr 27, 2025 -

Celebrity Style Examining Ariana Grandes Recent Transformation

Apr 27, 2025

Celebrity Style Examining Ariana Grandes Recent Transformation

Apr 27, 2025