CAC 40 Index: Slight Dip At Week's End, Maintaining Weekly Equilibrium (March 7, 2025)

Table of Contents

H2: Weekly Performance Overview of the CAC 40 Index

The CAC 40, a benchmark index of the 40 largest French companies listed on Euronext Paris, plays a vital role in reflecting the health of the French economy and the wider European Union. Its performance is closely monitored by investors worldwide. This past week presented a mixed bag for the CAC 40. The weekly market trends showed a degree of volatility, with the index experiencing both gains and losses across the trading days. Let’s delve into a day-by-day breakdown:

- Monday, March 3rd: The CAC 40 opened with a slight increase, fueled by positive sentiment surrounding [mention specific positive news or economic indicator if applicable].

- Tuesday, March 4th: A moderate decline was observed, primarily attributed to [mention specific reason, e.g., concerns over rising inflation or global geopolitical uncertainties].

- Wednesday, March 5th: The index saw a recovery, reaching a weekly high of [Insert Value] driven by [mention specific positive news or economic indicator, if applicable].

- Thursday, March 6th: A period of consolidation, with relatively little movement.

- Friday, March 7th: The CAC 40 experienced a noticeable dip, closing at [Insert Value], slightly below the previous week's closing value.

(Insert relevant chart/graph here visually representing the daily fluctuations of the CAC 40)

This analysis of CAC 40 performance highlights the impact of both positive and negative news impacting weekly market trends. Analyzing these fluctuations against global indices allows for a better understanding of the index’s movement.

H2: Analysis of the Friday Dip in the CAC 40 Index

The Friday dip in the CAC 40 index, while not dramatic, requires careful consideration. Several factors likely contributed to this decline:

- Global Market Sentiment: A downturn in other major global markets, such as the Dow Jones or Nasdaq, often influences investor sentiment and can lead to sell-offs in indices like the CAC 40.

- Specific Company Performance: Poor earnings reports or negative news surrounding one or more of the CAC 40's component companies could have triggered a ripple effect. [Mention specific company and news if applicable].

- Unexpected News Events: Unforeseen political or economic developments, both domestically in France and internationally, can create market volatility and lead to short-term declines.

Compared to the previous week's closing value, the Friday dip represented a [Percentage]% decrease. Market analysts attribute this volatility to [quote from relevant expert or analyst, providing a source]. This emphasizes the need to remain vigilant and monitor market changes to make educated investments.

H2: Maintaining Weekly Equilibrium: Implications for Investors

Despite the Friday dip, the CAC 40 managed to maintain its weekly equilibrium, a testament to its underlying strength and resilience. This outcome presents both opportunities and challenges for investors:

- Short-Term Strategies: The slight dip might present a buying opportunity for short-term traders looking to capitalize on potential rebounds.

- Long-Term Outlook: The overall weekly equilibrium suggests a degree of market stability, reinforcing the long-term growth potential of the CAC 40 for long-term investors.

- Risk Assessment: Investors need to carefully assess the risks associated with investing in the CAC 40, considering factors like geopolitical uncertainty and economic fluctuations.

For investors considering the CAC 40, a well-diversified portfolio and a long-term investment strategy are crucial. The recent volatility underscores the importance of robust risk management techniques.

H3: Conclusion: The CAC 40 Index – Looking Ahead

In summary, the CAC 40 index showcased a week of mixed performance, culminating in a slight dip on Friday but ultimately maintaining its weekly equilibrium. This seemingly small fluctuation highlights the dynamic nature of the market and the importance of continuous monitoring. The causes ranged from global market sentiment to the performance of individual constituent companies. While the Friday dip raises questions regarding market stability, the maintained equilibrium suggests a potential for continued growth.

The CAC 40 index remains a significant indicator of the French and broader European economies. Understanding its fluctuations is paramount for investors.

Stay updated on the latest CAC 40 index fluctuations and insightful analysis by subscribing to our newsletter or following our blog. Keep a close eye on the CAC 40 index for valuable insights into market trends.

Featured Posts

-

Porsche Di Indonesia Classic Art Week 2025 Perpaduan Seni Dan Mobil Klasik

May 25, 2025

Porsche Di Indonesia Classic Art Week 2025 Perpaduan Seni Dan Mobil Klasik

May 25, 2025 -

M56 Motorway Closure Serious Crash Causes Traffic Delays

May 25, 2025

M56 Motorway Closure Serious Crash Causes Traffic Delays

May 25, 2025 -

Mia Farrows Plea Imprison Trump For Deporting Venezuelan Gang Members

May 25, 2025

Mia Farrows Plea Imprison Trump For Deporting Venezuelan Gang Members

May 25, 2025 -

Positief Beurzenklimaat Aex Wint Na Trumps Besluit

May 25, 2025

Positief Beurzenklimaat Aex Wint Na Trumps Besluit

May 25, 2025 -

Cac 40 Index Weeks End Market Report Minor Decline Stable Overall March 7 2025

May 25, 2025

Cac 40 Index Weeks End Market Report Minor Decline Stable Overall March 7 2025

May 25, 2025

Latest Posts

-

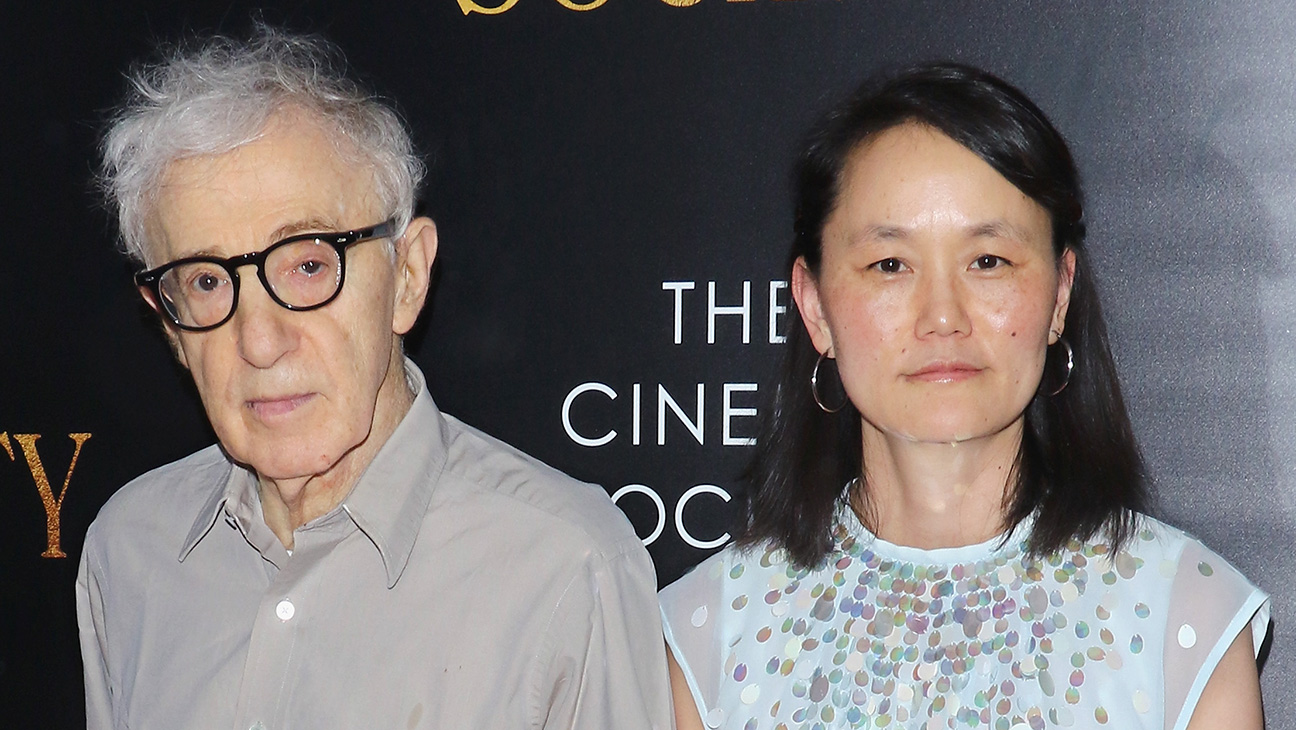

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025

Controversy Surrounding Woody Allen Sean Penn Weighs In

May 25, 2025 -

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025

Sean Penns Response To Dylan Farrows Sexual Assault Claims

May 25, 2025 -

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025

The Woody Allen Dylan Farrow Case Examining Sean Penns Doubts

May 25, 2025 -

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025

Sinatras Four Marriages Details On His Spouses And Romances

May 25, 2025 -

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025

Woody Allen Sexual Assault Allegations Sean Penns Perspective

May 25, 2025