Call For Regulatory Reform: Indian Insurers And Bond Forwards

Table of Contents

The Growing Importance of Bond Forwards for Indian Insurers

Indian insurance companies are increasingly utilizing bond forwards as part of their investment strategies. This trend is driven by several factors:

- Yield Enhancement: Bond forwards offer the potential for higher returns compared to traditional fixed-income investments, allowing insurers to improve their investment yields.

- Interest Rate Risk Hedging: These instruments can be effectively used to hedge against fluctuations in interest rates, protecting insurers' portfolios from adverse market movements.

- Portfolio Diversification: Bond forwards provide an avenue for diversifying investment portfolios, reducing overall risk exposure.

The growth of bond forward investments by Indian insurance companies is substantial. [Insert relevant statistics here, e.g., "Data from [Source] indicates a [Percentage]% increase in bond forward investments by Indian insurers between [Year] and [Year]."] This signifies a significant shift in investment strategies within the Indian insurance sector. While effectively managed, bond forwards can contribute significantly to the financial health and stability of Indian insurance companies, strengthening their ability to meet policyholder obligations. Keywords: Indian insurance companies, bond forward investments, interest rate risk, yield enhancement, investment strategies.

Current Regulatory Gaps and Associated Risks

The existing regulatory framework for bond forward investments in India exhibits several shortcomings. These gaps expose insurers to significant risks, including:

- Liquidity Risk: The inability to quickly unwind positions in illiquid markets can lead to substantial losses.

- Credit Risk: Default by counterparties in the bond forward contracts poses a considerable credit risk.

- Operational Risk: Internal process failures, data inaccuracies, or inadequate controls can result in significant operational losses.

- Market Risk: Unexpected shifts in interest rates or market conditions can significantly impact the value of bond forward positions.

For instance, a sudden surge in interest rates could severely impact an insurer's bond forward portfolio if adequate risk management measures are not in place. Similarly, a counterparty default could lead to substantial losses. Keywords: regulatory gaps, liquidity risk, credit risk, operational risk, market risk, Indian insurance regulation.

Proposed Regulatory Reforms for Enhanced Risk Management

To mitigate the risks associated with bond forward investments, the following regulatory reforms are crucial:

- Enhanced Capital Requirements: Higher capital requirements for bond forward positions would absorb potential losses and ensure solvency.

- Exposure Limits: Stricter limits on exposure to individual counterparties would reduce credit risk.

- Improved Reporting and Transparency: Mandatory and detailed reporting requirements would increase transparency and enable better regulatory oversight.

- Mandatory Stress Testing: Regular stress testing and robust risk assessment frameworks are crucial for identifying and mitigating potential vulnerabilities.

- Clearer Valuation Guidelines: Clearer guidelines on valuation and accounting practices for bond forward instruments would ensure consistency and accuracy.

These reforms would create a more robust risk management framework, protecting both insurers and policyholders. Keywords: regulatory reform, capital requirements, risk assessment, stress testing, transparency, risk management framework.

International Best Practices and their Applicability to India

Many countries have implemented sophisticated regulatory frameworks for managing risks associated with similar derivative instruments. Examining these international best practices can inform the development of a suitable framework for India:

- Basel Accords: The Basel Accords, while primarily focused on banking regulation, offer valuable insights into risk management techniques applicable to insurers.

- Solvency II (EU): The Solvency II framework in the European Union provides a comprehensive model for insurance regulation, including detailed capital requirements and risk management standards.

- Other Jurisdictions: Examining regulations in countries with well-developed bond markets, such as the United States and the United Kingdom, can reveal valuable lessons.

Adapting these international best practices to the specific context of the Indian insurance sector is crucial. A comparative analysis focusing on the strengths and weaknesses of different frameworks, considering the unique characteristics of the Indian market, would ensure the development of a relevant and effective regulatory framework. Keywords: international best practices, regulatory frameworks, global insurance regulation, comparative analysis.

Conclusion: A Call to Action for Robust Regulation of Bond Forwards in the Indian Insurance Sector

The increasing reliance of Indian insurers on bond forwards necessitates a robust regulatory framework to effectively manage the associated risks. The current regulatory gaps expose the sector to significant liquidity, credit, operational, and market risks. The proposed reforms—enhanced capital requirements, stricter exposure limits, improved reporting, mandatory stress testing, and clearer valuation guidelines—are vital to mitigate these risks and protect policyholders. By adopting a comprehensive approach informed by international best practices, India can create a regulatory environment that fosters innovation while safeguarding the stability and integrity of its insurance sector. We urge the regulatory authorities to implement these proposed reforms promptly. The future of the Indian insurance sector and the protection of its policyholders depend on the swift and decisive action regarding the robust regulation of bond forwards in the Indian insurance sector. Delaying this crucial regulatory reform will only exacerbate the risks and potentially undermine the long-term stability of the market.

Featured Posts

-

Lightning Defeat Oilers 4 1 Behind Kucherovs Strong Performance

May 10, 2025

Lightning Defeat Oilers 4 1 Behind Kucherovs Strong Performance

May 10, 2025 -

Demolition Of Beloved Broad Street Diner To Make Way For New Hyatt

May 10, 2025

Demolition Of Beloved Broad Street Diner To Make Way For New Hyatt

May 10, 2025 -

Jeanine Pirros North Idaho Visit Date Location And What To Expect

May 10, 2025

Jeanine Pirros North Idaho Visit Date Location And What To Expect

May 10, 2025 -

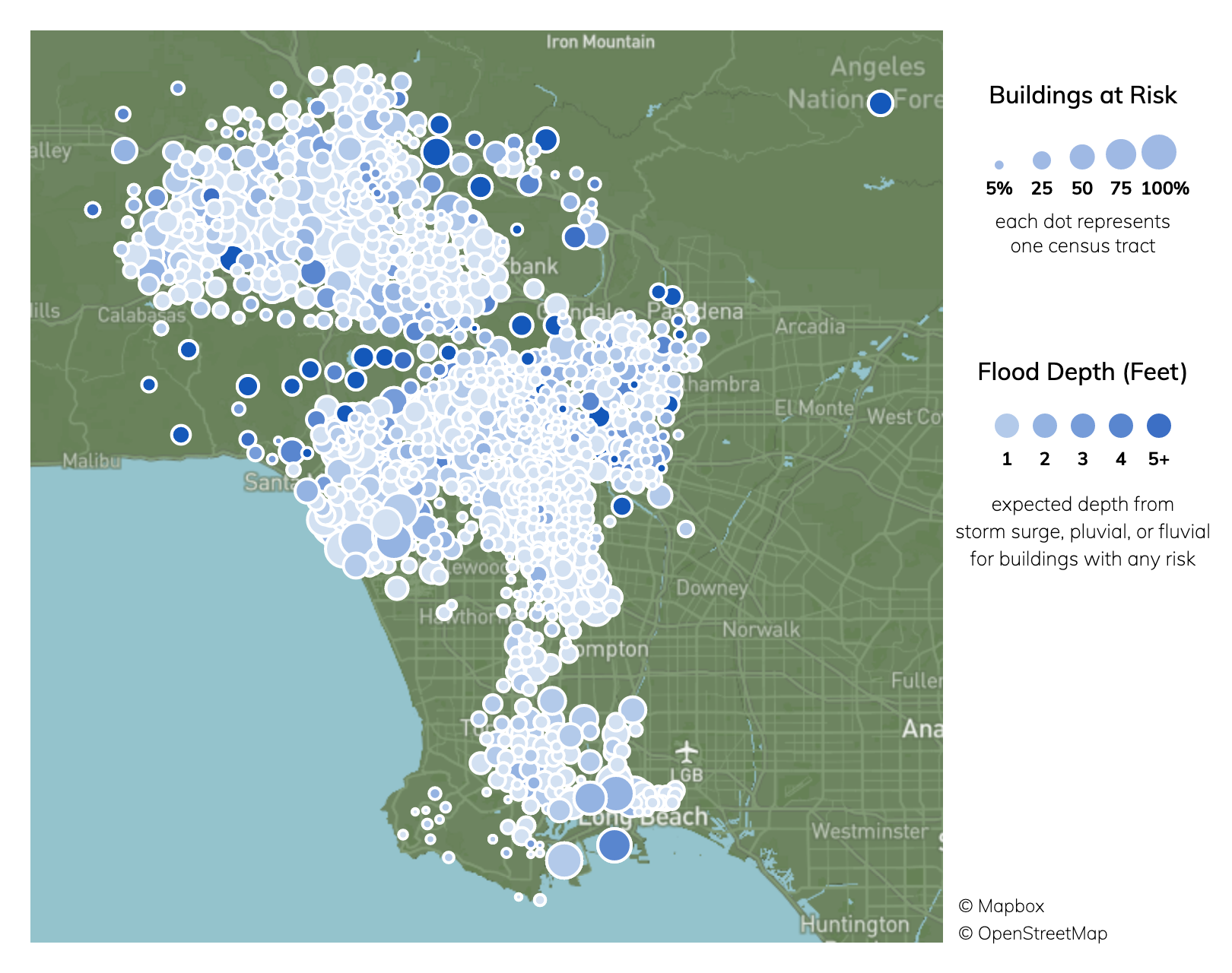

Los Angeles Wildfires And The Growing Market For Disaster Betting

May 10, 2025

Los Angeles Wildfires And The Growing Market For Disaster Betting

May 10, 2025 -

Morgans 5 Dumbest Moments In High Potential Season 1

May 10, 2025

Morgans 5 Dumbest Moments In High Potential Season 1

May 10, 2025