Can Investing In XRP (Ripple) Help You Achieve Your Financial Goals?

Table of Contents

Understanding XRP (Ripple) and its Potential

What is XRP?

XRP is a cryptocurrency designed to facilitate fast and low-cost cross-border payments through the Ripple network. Unlike Bitcoin, which relies on a decentralized network, XRP operates on a distributed ledger technology that's more centralized. This allows for significantly faster transaction speeds and lower fees compared to many other cryptocurrencies. This speed and efficiency are key selling points for institutional adoption.

Ripple's Technology and Partnerships

Ripple's technology, RippleNet, is a global payment network connecting banks and financial institutions. It leverages XRP to enable instant, low-cost international money transfers. Ripple's strategic focus on institutional clients, rather than individual retail investors, sets it apart. They've secured partnerships with major banks globally, significantly increasing the potential for widespread adoption and, consequently, XRP's value.

- RippleNet: This network facilitates near real-time settlement of payments across borders, bypassing traditional banking infrastructure.

- Key Partnerships: Ripple boasts partnerships with numerous financial institutions worldwide, including Santander, Bank of America, and several other major players.

- Future Growth Potential: Continued partnerships and expansion of RippleNet could significantly boost XRP's adoption and market capitalization.

Assessing the Risks of Investing in XRP

Volatility and Market Fluctuations

The cryptocurrency market is notoriously volatile, and XRP is no exception. Its price can experience dramatic swings, influenced by market sentiment, regulatory developments, and overall crypto market trends. Investing in XRP requires a high risk tolerance due to its unpredictable nature.

Regulatory Uncertainty

XRP faces significant regulatory uncertainty, particularly in the United States. The ongoing SEC lawsuit against Ripple creates substantial legal and price risk. The outcome of this lawsuit could significantly impact XRP's value and trading availability in certain jurisdictions. Different countries have different regulatory frameworks for cryptocurrencies, adding another layer of complexity.

Technological Risks

Like all cryptocurrencies, XRP is subject to technological risks. These include potential security breaches, scalability challenges, and the risk of unforeseen technical issues impacting the functionality of the Ripple network.

- Price Volatility Examples: Review historical XRP price charts to witness the significant price fluctuations experienced in the past.

- Regulatory Landscapes: Research varies widely across countries; some have embraced crypto, others have imposed stringent regulations or outright bans.

- Security Risks: Cryptocurrency investments are vulnerable to hacking and theft; understanding and mitigating these risks is crucial.

Developing a Sound Investment Strategy for XRP

Diversification

Never put all your eggs in one basket. Diversifying your investment portfolio across different asset classes (stocks, bonds, real estate, etc.) is crucial to mitigate risk. XRP should be a small portion of a diversified portfolio, not your entire investment strategy.

Risk Tolerance

Before investing in XRP or any cryptocurrency, honestly assess your risk tolerance. Are you comfortable with potentially losing a significant portion of your investment? If not, XRP might not be a suitable investment for you.

Long-Term vs. Short-Term Investments

Both long-term and short-term XRP investment strategies exist. Long-term investors bet on the future growth of Ripple and its technology, while short-term traders aim to profit from quick price swings. Both carry significant risk.

- Diversification Examples: Consider a diversified portfolio including stocks, bonds, ETFs, and alternative investments, with a small allocation for XRP.

- Risk Tolerance Assessment: Use online tools or consult a financial advisor to determine your appropriate risk level.

- Investment Strategies: Understand the differences between buy-and-hold (long-term) and day trading (short-term) strategies and their associated risks.

XRP and Your Financial Goals

Aligning XRP Investment with Financial Objectives

Incorporating XRP into a well-diversified investment strategy could potentially contribute to various financial goals. For example, it might play a small role in a long-term retirement plan or wealth-building strategy. However, it shouldn't be the sole foundation of your financial planning.

Realistic Expectations

It's crucial to maintain realistic expectations. While XRP has the potential for significant growth, it also carries the risk of substantial losses. Don't expect overnight riches or guaranteed returns.

- Examples of Financial Goals: XRP could supplement, but not replace, traditional retirement savings or other long-term investments.

- Realistic Targets: Set achievable, moderate goals, avoiding unrealistic expectations driven by hype.

- Financial Advisor Consultation: Seek professional advice from a qualified financial advisor before making any significant investment decisions.

Conclusion

Investing in XRP (Ripple) presents both opportunities and significant risks. Its potential for growth is linked to the success of Ripple's technology and its adoption by major financial institutions. However, the volatility of the cryptocurrency market, regulatory uncertainty, and inherent technological risks must be carefully considered. A well-diversified investment strategy, a realistic assessment of your risk tolerance, and careful research are essential before considering any XRP investment. Consider if investing in XRP (Ripple) aligns with your financial goals and risk tolerance. Learn more about XRP (Ripple) and its potential to contribute to your financial future, but always prioritize responsible investment practices.

Featured Posts

-

400 Xrp Price Increase Investment Opportunities And Potential Risks

May 08, 2025

400 Xrp Price Increase Investment Opportunities And Potential Risks

May 08, 2025 -

Ripple Xrp News Brazil Greenlights First Spot Xrp Etf Trumps Ripple Endorsement

May 08, 2025

Ripple Xrp News Brazil Greenlights First Spot Xrp Etf Trumps Ripple Endorsement

May 08, 2025 -

Bitcoin Price Soars Trumps Crypto Expert Issues Surprise Forecast

May 08, 2025

Bitcoin Price Soars Trumps Crypto Expert Issues Surprise Forecast

May 08, 2025 -

James Gunns Superman Krypto The Superdog Featured In Extended Preview

May 08, 2025

James Gunns Superman Krypto The Superdog Featured In Extended Preview

May 08, 2025 -

Xrp Price Prediction Is A Parabolic Move Imminent Ripple Vs Remittix Analyzing The Ico Success

May 08, 2025

Xrp Price Prediction Is A Parabolic Move Imminent Ripple Vs Remittix Analyzing The Ico Success

May 08, 2025

Latest Posts

-

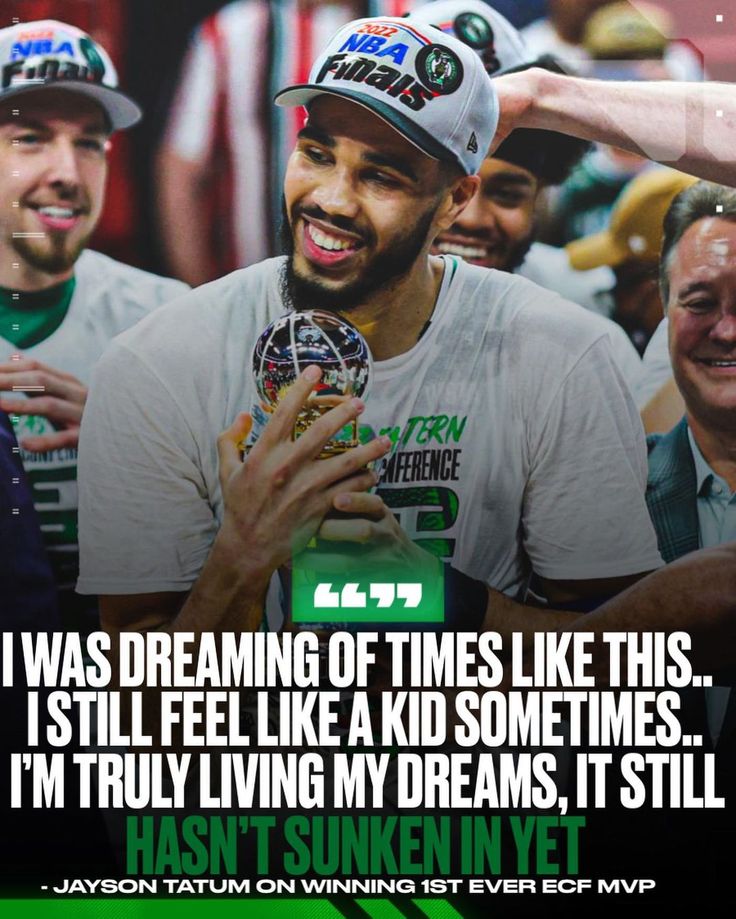

Kyle Kuzmas Thoughts On Jayson Tatums Controversial Instagram Post

May 08, 2025

Kyle Kuzmas Thoughts On Jayson Tatums Controversial Instagram Post

May 08, 2025 -

Is This The Planet Star Wars Has Teased For 48 Years

May 08, 2025

Is This The Planet Star Wars Has Teased For 48 Years

May 08, 2025 -

Star Wars Andor Book Scrapped Due To Ai Concerns

May 08, 2025

Star Wars Andor Book Scrapped Due To Ai Concerns

May 08, 2025 -

Rogue One Prequel Andor Cast Reveals Behind The Scenes Details Of Final Season

May 08, 2025

Rogue One Prequel Andor Cast Reveals Behind The Scenes Details Of Final Season

May 08, 2025 -

What Kyle Kuzma Said About Jayson Tatums Viral Instagram

May 08, 2025

What Kyle Kuzma Said About Jayson Tatums Viral Instagram

May 08, 2025