Can Palantir Reach A Trillion-Dollar Valuation By 2030?

Table of Contents

Palantir's Growth Potential and Market Opportunity

Palantir's success is deeply intertwined with its ability to capitalize on significant market opportunities. Its growth potential stems from two primary sources: robust government contracts and expanding commercial sector adoption.

Government Contracts and Expansion

Palantir has established a strong presence in the government sector, particularly within defense and intelligence agencies. These contracts are a cornerstone of its revenue stream.

- Existing Contracts: Palantir's existing contracts provide a stable base for future growth, offering recurring revenue and the opportunity to expand services.

- Expansion Strategy: The company is actively pursuing new government contracts both domestically and internationally, targeting areas such as cybersecurity, public health, and law enforcement. This international expansion is vital to achieve a trillion-dollar valuation.

- Data Analytics for Government: Palantir's platforms are uniquely positioned to help government agencies analyze vast datasets, improve operational efficiency, and enhance national security. The increasing demand for sophisticated data analytics solutions within governments worldwide fuels this growth potential.

Commercial Sector Adoption and Growth

While government contracts form a substantial portion of Palantir's revenue, its commercial sector expansion is crucial for achieving a trillion-dollar valuation.

- Expanding Commercial Partnerships: Palantir is actively forging partnerships with major corporations in sectors such as finance, healthcare, and energy. Success here hinges on demonstrating tangible ROI for these partners.

- Big Data Analytics and AI Solutions: Palantir's offerings, leveraging big data analytics and artificial intelligence, offer significant value propositions for commercial clients, helping them optimize operations, manage risk, and gain a competitive edge.

- Case Studies and Success Stories: Showcasing successful implementations and quantifiable results for commercial clients is critical for building trust and attracting further partnerships. Highlighting these success stories will be key for investor confidence.

Competitive Landscape and Market Challenges

The big data analytics and artificial intelligence market is fiercely competitive. Palantir faces challenges from established tech giants and nimble startups.

Key Competitors and Their Strategies

Palantir competes with major players like Microsoft, Google, Amazon, and smaller, specialized firms.

- Competitor Analysis: A thorough understanding of competitor strategies, strengths, and weaknesses is crucial for Palantir's continued success. This necessitates ongoing market intelligence and adaptation.

- Big Data Analytics Competition: The competitive landscape is dynamic, with competitors constantly innovating and expanding their offerings. Palantir needs to differentiate its products through superior data management and AI capabilities.

- Market Dominance: Achieving market dominance requires not only technological superiority but also effective go-to-market strategies and strong customer relationships.

Technological Advancements and Disruption

The rapid pace of technological innovation presents both opportunities and threats.

- Technological Disruption: New technologies and approaches in AI and data analytics could disrupt Palantir's existing offerings, necessitating constant adaptation and innovation.

- AI Innovation: Staying at the forefront of AI innovation is paramount. This requires substantial investment in R&D and attracting top talent.

- Future of Big Data: Predicting and adapting to the future needs of big data analytics is essential for maintaining a competitive edge.

Financial Projections and Valuation Analysis

Achieving a trillion-dollar valuation requires substantial and sustained revenue growth and profitability.

Revenue Growth and Profitability

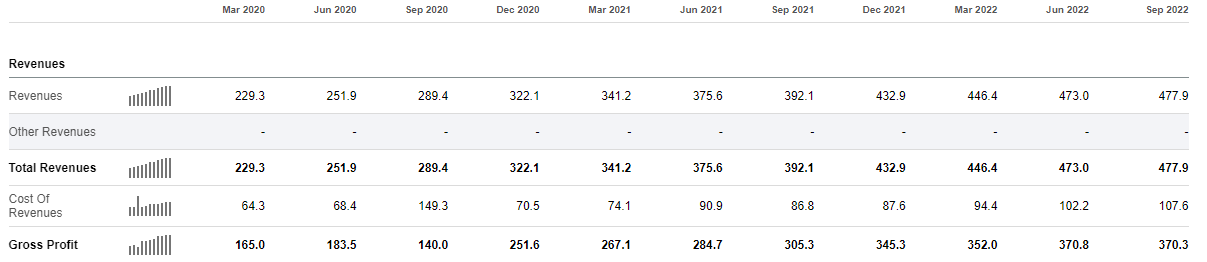

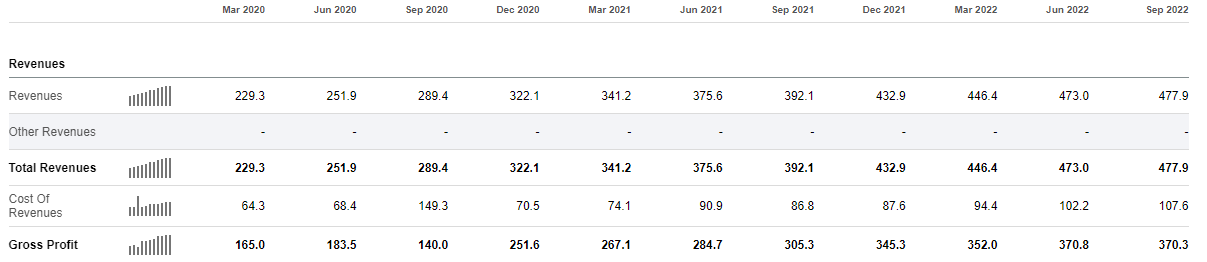

Palantir's historical financial performance provides a baseline for future projections.

- Revenue Growth: Sustained and significant revenue growth across both government and commercial sectors is essential.

- Profitability: Improving profitability requires efficient operations, effective cost management, and successful product diversification.

- Financial Projections: Realistic financial projections, accounting for market trends and competitive pressures, are needed to assess the feasibility of a trillion-dollar valuation.

Valuation Metrics and Market Sentiment

Assessing Palantir's potential involves analyzing its valuation metrics and investor sentiment.

- Market Capitalization: The current market cap provides a starting point, but achieving a trillion-dollar valuation requires a significant increase in stock price and market share.

- Stock Valuation: Various valuation models, considering future revenue growth, profitability, and risk, are needed to estimate the likelihood of reaching a trillion-dollar valuation.

- Investor Sentiment: Positive investor sentiment is crucial for driving stock price appreciation. This requires transparency, consistent performance, and a compelling growth narrative.

Conclusion: Palantir's Path to a Trillion-Dollar Valuation - A Realistic Assessment

Palantir's journey to a trillion-dollar valuation by 2030 presents a significant challenge, but not an impossible one. Success hinges on sustained revenue growth, effective competition management, and adapting to rapid technological changes. While the government sector provides a stable foundation, commercial sector expansion is paramount. The competitive landscape is intense, and maintaining a technological edge is crucial. Careful financial planning and positive investor sentiment are also essential. While reaching a trillion-dollar valuation within this timeframe is ambitious, Palantir's potential is undeniable. To further explore Palantir's future and the intricacies of its trillion-dollar valuation prediction, we encourage you to conduct further research on Palantir investment analysis and remain updated on the company's progress.

Featured Posts

-

Strictly Katya Jones Quits Was Wynne Evans Involved

May 09, 2025

Strictly Katya Jones Quits Was Wynne Evans Involved

May 09, 2025 -

Elon Musks Net Worth A Comparative Analysis Of The First 100 Days Under Trump

May 09, 2025

Elon Musks Net Worth A Comparative Analysis Of The First 100 Days Under Trump

May 09, 2025 -

7 Year Reunion High Potential Finale Features Familiar Faces

May 09, 2025

7 Year Reunion High Potential Finale Features Familiar Faces

May 09, 2025 -

Brekelmans En India Een Analyse Van De Samenwerking

May 09, 2025

Brekelmans En India Een Analyse Van De Samenwerking

May 09, 2025 -

Sensex And Nifty Live Updates Market Performance And Analysis

May 09, 2025

Sensex And Nifty Live Updates Market Performance And Analysis

May 09, 2025