Can Trump's Tariffs Replace Income Taxes? 4 Key Complications

Table of Contents

Volatility of Tariff Revenue

Tariff revenue is notoriously volatile, unlike the relatively stable income tax system. Its susceptibility to fluctuations in global trade and economic conditions makes it an unreliable foundation for a national budget.

Dependence on Global Trade

Tariff revenue heavily depends on the volume of imported goods. Any disruption to global trade significantly impacts collections.

- Recessions decrease imports: Economic downturns lead to decreased consumer spending and reduced imports, causing a sharp drop in tariff revenue. This makes consistent government funding extremely difficult.

- Trade wars disrupt supply chains: Trade wars, like the one initiated during the Trump administration, can unpredictably disrupt global supply chains and drastically reduce tariff income. The resulting uncertainty makes economic planning extremely challenging.

- Changes in consumer spending habits: Shifts in consumer preferences towards domestically produced goods or substitutes also impact import volumes and, consequently, tariff revenue. This unpredictable element makes long-term forecasting impossible.

Difficulty in Forecasting

The inherent unpredictability of tariff revenue makes budgeting and fiscal planning extremely challenging.

- Unreliable revenue streams: The unreliable nature of tariff revenue makes long-term financial planning nearly impossible. Government programs relying on this income face constant threats of underfunding.

- Government services underfunded: During periods of low tariff revenue – such as during recessions or trade wars – government services could be severely underfunded, leading to cuts and reduced public services. This creates instability and negatively impacts citizens.

Distributional Inequity

Tariffs disproportionately impact lower-income households, who spend a larger percentage of their income on imported goods. This creates a regressive tax system, unlike the progressive nature of income taxes.

Regressive Nature of Tariffs

Tariffs act as a hidden tax, increasing the price of goods for consumers without providing a direct benefit comparable to government services funded by income taxes.

- Lower-income individuals bear a higher burden: Lower-income individuals bear a disproportionately higher burden of tariffs relative to their income, exacerbating existing inequalities.

- Unequal distribution of tax burden: This creates a significantly unequal distribution of the tax burden compared to a progressive income tax system, where higher earners pay a larger percentage of their income in taxes.

Impact on Specific Industries

Certain industries are more vulnerable to tariff increases than others, leading to job losses and economic hardship in specific sectors.

- Tariffs increase domestic product prices: Tariffs on imported goods can make domestic products more expensive, hurting both consumers and businesses. This reduced purchasing power impacts the entire economy.

- Retaliatory tariffs harm exports: Retaliatory tariffs from other countries can harm export-oriented industries, potentially leading to job losses and a decline in economic activity. This creates a negative feedback loop, harming overall economic health.

Limited Revenue Potential

Even during periods of robust global trade, tariff revenue may not be sufficient to replace the substantial revenue generated by income taxes.

Revenue Gap

The total amount collected through tariffs is significantly lower than the revenue generated by individual and corporate income taxes.

- Significant funding shortfall: Replacing income tax revenue with tariffs would create a massive funding shortfall that would need to be addressed through alternative means such as increased borrowing or drastic cuts in essential government programs.

- Increased national debt: Increased borrowing to cover the revenue shortfall would significantly increase the national debt, burdening future generations with the cost of this unsustainable fiscal policy.

Trade Deficits

A substantial trade deficit limits the potential revenue generated from tariffs, as fewer imports mean less revenue from tariffs.

- Trade deficits reduce tariff potential: Large trade deficits significantly reduce the potential for substantial tariff revenue, making the policy even less viable.

- Difficult to reduce trade deficits: Strategies to reduce trade deficits, such as restricting imports or promoting exports, can be complex and may not always be successful.

Negative Economic Consequences

Widespread use of tariffs can trigger trade wars, harming international trade relations and causing negative economic spillovers.

Retaliation and Trade Wars

Other countries may impose retaliatory tariffs, leading to a cycle of escalating trade disputes.

- Reduced exports and higher prices: Trade wars lead to reduced exports, harming domestic businesses, and higher prices for consumers due to reduced competition and increased costs.

- Disrupted supply chains: Trade wars disrupt global supply chains, creating uncertainty and impacting businesses' ability to operate effectively.

Stifled Economic Growth

The uncertainty generated by tariffs can deter investment, hinder economic growth, and increase inflation.

- Reduced business investment: Businesses hesitate to invest in expansion or new projects due to the unpredictability and risks associated with tariffs.

- Higher inflation: Higher prices for imported goods contribute to higher inflation, eroding purchasing power and further impacting economic growth.

Conclusion

Replacing income taxes with tariffs presents significant challenges. The volatility of tariff revenue, its regressive nature, limited revenue potential, and the potential for negative economic consequences make this a highly impractical and potentially devastating policy option. A well-designed and sustainable tax system requires a far more nuanced and comprehensive approach than simply relying on tariffs. Further research into effective and equitable taxation policies is crucial to ensure economic stability and growth. Consider carefully the complex implications of tariff-based fiscal policy before advocating for such a significant shift away from established income tax systems. A balanced approach, considering the limitations of relying solely on Trump tariffs or similar policies for revenue, is essential for a healthy economy.

Featured Posts

-

Prince William A Pensive Portrait From Kensington Palace

May 01, 2025

Prince William A Pensive Portrait From Kensington Palace

May 01, 2025 -

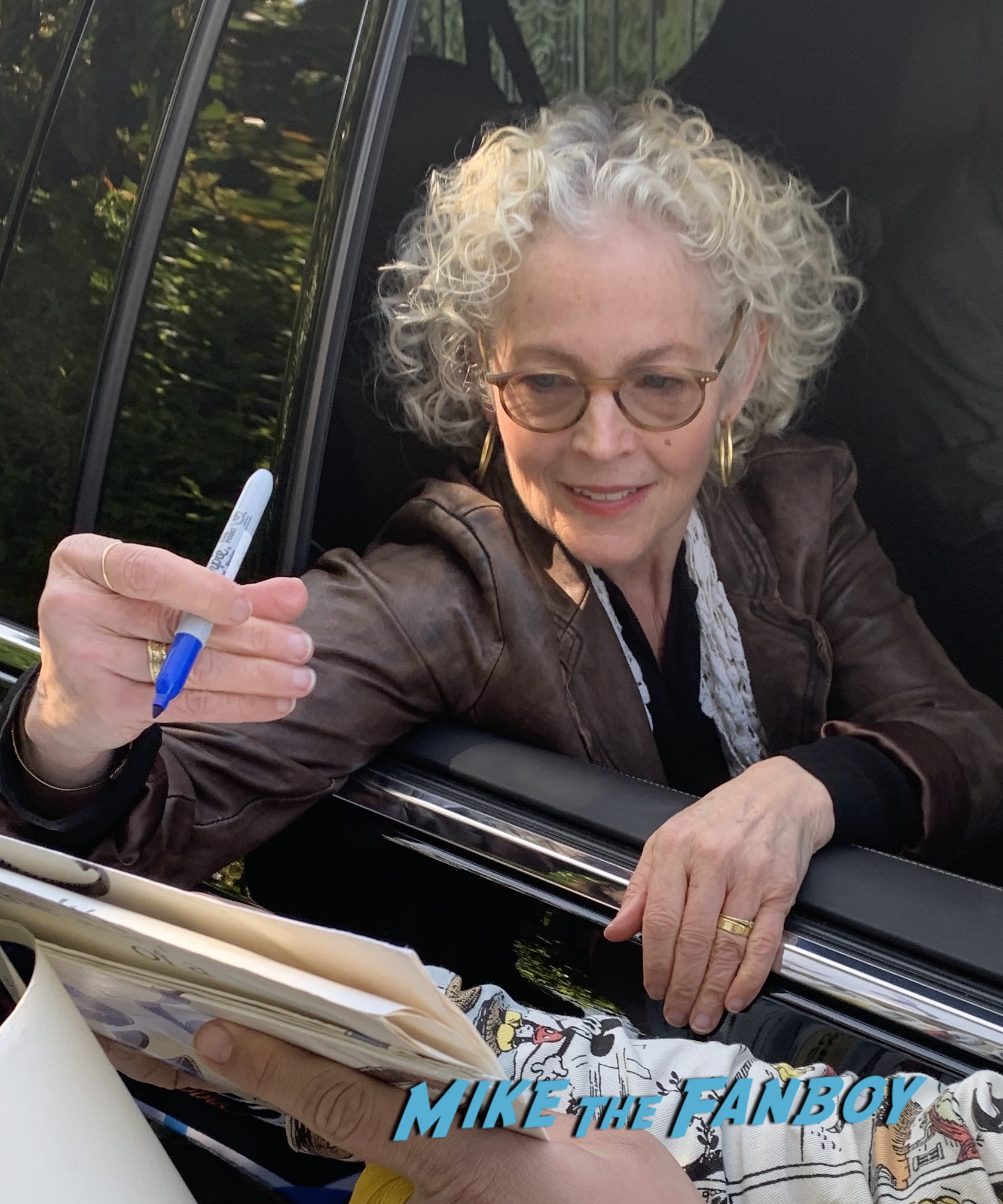

Amy Irving Mourns The Passing Of Dallas And Carrie Star

May 01, 2025

Amy Irving Mourns The Passing Of Dallas And Carrie Star

May 01, 2025 -

Game Preview Colorado Travels To Texas Tech Following Toppins Big Game

May 01, 2025

Game Preview Colorado Travels To Texas Tech Following Toppins Big Game

May 01, 2025 -

Arizonas Upset Win Over Texas Tech In Big 12 Semifinals

May 01, 2025

Arizonas Upset Win Over Texas Tech In Big 12 Semifinals

May 01, 2025 -

Binh Duong Co Dai Su Tinh Nguyen Moi Tien Linh Ngoi Sao San Co Tam Long Vang

May 01, 2025

Binh Duong Co Dai Su Tinh Nguyen Moi Tien Linh Ngoi Sao San Co Tam Long Vang

May 01, 2025

Latest Posts

-

N Kh L Obnovila Prognoz Kogda Ovechkin Pobet Rekord Grettski

May 01, 2025

N Kh L Obnovila Prognoz Kogda Ovechkin Pobet Rekord Grettski

May 01, 2025 -

Yankees Vs Guardians Alds A Comprehensive Series Recap And Key Moments

May 01, 2025

Yankees Vs Guardians Alds A Comprehensive Series Recap And Key Moments

May 01, 2025 -

Lich Thi Dau Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 Xem Ngay 10 Tran Khong The Bo Lo

May 01, 2025

Lich Thi Dau Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 Xem Ngay 10 Tran Khong The Bo Lo

May 01, 2025 -

Guardians Alds Win Over Yankees Series Analysis And Insights

May 01, 2025

Guardians Alds Win Over Yankees Series Analysis And Insights

May 01, 2025 -

Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 Cap Nhat Lich Thi Dau 10 Tran Hap Dan Nhat

May 01, 2025

Giai Bong Da Thanh Nien Sinh Vien Quoc Te 2025 Cap Nhat Lich Thi Dau 10 Tran Hap Dan Nhat

May 01, 2025