Canadian Aluminum Trader's Bankruptcy: A Trade War Casualty?

Table of Contents

The Impact of Aluminum Tariffs and Trade Wars on Canadian Businesses

The aluminum industry has been embroiled in global trade disputes for years. The US-China trade war, initiated in 2018, and the imposition of Section 232 tariffs on imported steel and aluminum significantly impacted global aluminum markets. These protectionist measures, while intended to safeguard domestic industries, created ripple effects felt worldwide, including Canada. These tariffs, coupled with retaliatory measures from other countries, created an environment of instability and uncertainty for Canadian aluminum traders like NorthStar.

- Increased input costs for raw materials: Tariffs on imported aluminum raw materials, such as bauxite and alumina, directly increased NorthStar's production costs, squeezing profit margins.

- Reduced competitiveness in international markets: Higher production costs made NorthStar's aluminum less competitive in global markets, leading to a loss of market share to foreign competitors who benefited from lower input costs.

- Difficulty securing financing due to market uncertainty: The volatility caused by trade wars made it challenging for NorthStar to secure financing from lenders wary of the unpredictable market conditions.

- Loss of market share to foreign competitors: Companies in countries not subject to the same tariffs gained a significant competitive advantage, further eroding NorthStar's market position.

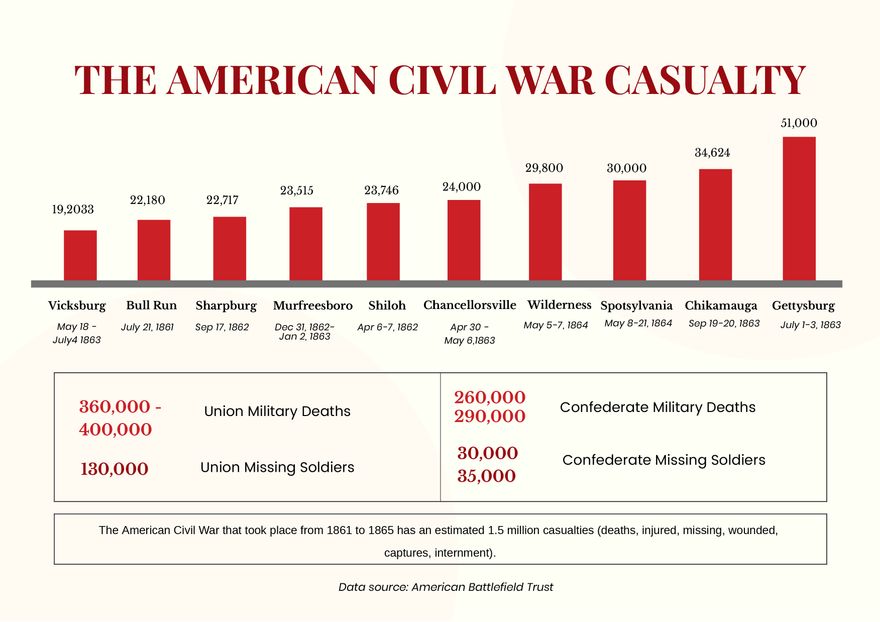

Data from the Canadian Institute for Advanced Research shows that aluminum prices fluctuated wildly during the period of escalating trade tensions, peaking in [Insert Year] and subsequently declining, significantly impacting the profitability of aluminum traders. [Cite other relevant sources with data on aluminum prices and trade volumes].

Financial Distress and Management Decisions Preceding Bankruptcy

An examination of NorthStar's financial statements reveals a clear picture of declining revenue and rising debt in the years leading up to its bankruptcy. This financial distress cannot be solely attributed to external factors. Internal weaknesses significantly contributed to the company's downfall.

- Poor risk management strategies: NorthStar may have failed to adequately assess and mitigate the risks associated with fluctuating aluminum prices and the uncertainties of international trade.

- Inefficient operations: Internal inefficiencies, such as high overhead costs and poor supply chain management, further strained the company's already-weakened financial position.

- Over-reliance on specific markets: NorthStar's dependence on specific markets, particularly those significantly impacted by trade wars, amplified the negative consequences of these external shocks.

- Lack of diversification: A lack of diversification in both product offerings and geographical markets left the company vulnerable to external economic shocks.

While there is no concrete evidence of overt mismanagement, the combination of these internal weaknesses significantly compounded the negative impact of external factors.

The Role of Global Supply Chain Disruptions

The COVID-19 pandemic further exacerbated the challenges faced by NorthStar. Global supply chain disruptions, including port congestion, transportation delays, and labor shortages, created significant hurdles for the company.

- Difficulty sourcing raw materials: Supply chain disruptions made it difficult for NorthStar to secure the necessary raw materials for aluminum production, leading to production delays and increased costs.

- Delays in shipments: Shipping delays led to missed delivery deadlines and frustrated customers, further impacting the company's reputation and profitability.

- Increased transportation costs: The disruption of global supply chains led to a surge in transportation costs, adding further pressure on NorthStar's already-strained margins.

- Inability to meet customer demand: The combination of increased costs and supply chain issues hindered NorthStar's ability to meet customer demand, leading to lost sales and revenue.

These supply chain disruptions interacted with the impact of trade wars, creating a perfect storm that ultimately contributed to NorthStar’s bankruptcy.

Analyzing the Interplay Between Trade Wars and Internal Factors

Isolating the impact of trade wars from other contributing factors is extremely difficult. While the trade wars undoubtedly created a challenging environment for NorthStar, internal weaknesses significantly amplified the negative effects. Some argue that the bankruptcy was primarily a result of poor internal management and a lack of adaptation to changing market conditions. Others contend that the trade wars were the primary catalyst, creating an unsustainable environment for even well-managed businesses. A comprehensive analysis requires a nuanced model that considers both internal and external factors and their complex interactions. Quantitative analysis, examining the relative contribution of each factor to the company’s decline, would be necessary to reach a definitive conclusion.

Conclusion

The bankruptcy of NorthStar Aluminum Trading highlights the intricate interplay between global trade policies, supply chain disruptions, and internal management practices. While the escalating trade wars and resulting tariffs undoubtedly created significant headwinds for the company, internal weaknesses, including poor risk management and a lack of diversification, exacerbated the situation. The question of whether the bankruptcy was solely a result of poor management or a casualty of the ongoing trade wars remains complex. A balanced assessment suggests a combination of both internal and external factors contributed to its downfall.

The case of NorthStar Aluminum Trading serves as a crucial cautionary tale for other Canadian businesses operating in globally competitive markets. Understanding the complex interplay of trade policies and internal management is vital for mitigating risk. Further research and analysis into the effects of trade wars on Canadian aluminum traders are necessary to prevent future bankruptcies. Learn more about how trade wars affect Canadian businesses and protect your own enterprise. Explore resources on [link to relevant resource, e.g., government website, industry association].

Featured Posts

-

Understanding Trumps Choice Of Rubio For European Diplomacy

May 29, 2025

Understanding Trumps Choice Of Rubio For European Diplomacy

May 29, 2025 -

Confirmed Full Lineup For Liverpool Fc Legends Charity Match At Anfield

May 29, 2025

Confirmed Full Lineup For Liverpool Fc Legends Charity Match At Anfield

May 29, 2025 -

Before Breaking Bad How Bryan Cranstons The X Files Episode Showcased His Talent

May 29, 2025

Before Breaking Bad How Bryan Cranstons The X Files Episode Showcased His Talent

May 29, 2025 -

Stranger Things 5 Sadie Sink On Challenging Filming And Character Development

May 29, 2025

Stranger Things 5 Sadie Sink On Challenging Filming And Character Development

May 29, 2025 -

Canada Us Relations Addressing The Boycott And Tourism Impact

May 29, 2025

Canada Us Relations Addressing The Boycott And Tourism Impact

May 29, 2025

Latest Posts

-

Munichs Bmw Open 2025 Zverev Battles Griekspoor In Quarter Finals

May 31, 2025

Munichs Bmw Open 2025 Zverev Battles Griekspoor In Quarter Finals

May 31, 2025 -

May Day Rally In Kingston Images Show Strength And Solidarity Daily Freeman

May 31, 2025

May Day Rally In Kingston Images Show Strength And Solidarity Daily Freeman

May 31, 2025 -

Bmw Open 2025 Zverev Griekspoor Quarter Final Showdown In Munich

May 31, 2025

Bmw Open 2025 Zverev Griekspoor Quarter Final Showdown In Munich

May 31, 2025 -

Indian Wells Surprise Zverevs First Match Exit And His Honest Assessment

May 31, 2025

Indian Wells Surprise Zverevs First Match Exit And His Honest Assessment

May 31, 2025 -

Trump Administration Loses Key Advisor Elon Musks Resignation Explained

May 31, 2025

Trump Administration Loses Key Advisor Elon Musks Resignation Explained

May 31, 2025