Canadian Dollar Forecast: Minority Government Impact

Table of Contents

Political Instability and its Effect on the CAD

A minority government inherently brings a higher degree of political instability, which significantly impacts the Canadian dollar. This uncertainty creates ripples throughout the financial markets.

Increased Volatility and Uncertainty

The possibility of snap elections, coalition collapses, and shifting government priorities introduces considerable uncertainty into the market, directly impacting CAD volatility. This makes it challenging to predict the currency's future trajectory with accuracy.

- Examples: The 2008 Canadian federal election, which saw the Conservatives form a minority government, led to periods of increased CAD volatility as investors reacted to the political uncertainty. Similar volatility was observed during other minority government periods in Canadian history.

- This uncertainty affects investor sentiment negatively. Foreign investors, hesitant about unpredictable policy changes, may reduce their investments in Canadian assets, putting downward pressure on the CAD.

Impact on Government Spending and Fiscal Policy

Minority governments often face challenges in passing budgets and implementing major economic reforms. The need for compromise and negotiation can lead to delays, reduced spending, or even policy reversals.

- Potential Scenarios: A minority government might prioritize social programs, leading to increased government spending and potentially inflationary pressures. Conversely, if fiscal restraint is prioritized, it could lead to slower economic growth and potentially affect the CAD negatively.

- Changes in government spending directly impact inflation and interest rates, two key factors influencing the CAD's value. Increased spending can fuel inflation, prompting the Bank of Canada to raise interest rates to control it. Conversely, reduced spending could lead to lower inflation and potentially lower interest rates.

Risk Premium and the CAD

Increased political risk associated with a minority government leads to a higher risk premium on Canadian assets. This means investors demand a higher return for holding Canadian investments to compensate for the increased uncertainty.

- Illustrative Example: If investors perceive a higher risk of political instability in Canada, they'll demand a higher yield on Canadian bonds compared to bonds from countries perceived as more politically stable.

- This higher risk premium weakens the CAD's exchange rate as investors seek safer alternatives. The currency becomes less attractive, leading to a decrease in its value.

Economic Policy Uncertainty and its Influence on the Canadian Dollar Forecast

The inherent instability of a minority government translates directly into economic policy uncertainty, creating significant headwinds for the Canadian dollar.

Difficulty in Implementing Economic Reforms

Minority governments often struggle to implement significant economic reforms due to the need for consensus-building across various political parties. This can lead to delays or watered-down policies.

- Examples: Proposed changes to tax policies, trade agreements, or environmental regulations may face prolonged debate and compromise, leading to uncertainty about the final outcome and its impact on the Canadian economy.

- Such delays and compromises can hinder economic growth, discourage investment, and negatively affect the CAD's value.

Impact on Investor Confidence

Uncertainty surrounding economic policies directly impacts investor confidence and foreign direct investment (FDI) flows into Canada. A lack of clarity about future government actions can deter both domestic and international investors.

- FDI and the CAD: Strong FDI inflows typically strengthen a country's currency, as foreign capital boosts demand for the domestic currency. Conversely, decreased FDI can weaken the CAD.

- Lack of confidence could lead to capital flight, as investors withdraw their funds from Canada to seek safer havens, further weakening the CAD.

Trade Relations and the CAD

Canada's strong trade relationship with the US is crucial for its economic health and the CAD's value. A minority government may face challenges in navigating complex trade negotiations and managing potential trade disputes.

- Trade Negotiations: Uncertainties surrounding trade policy under a minority government can make Canadian exports less competitive and weaken investor confidence, negatively affecting the CAD.

- Trade disputes with major trading partners can disrupt supply chains, impact economic growth, and negatively influence the CAD's value.

Potential Scenarios for the Canadian Dollar Under a Minority Government

Several scenarios are plausible depending on how effectively the minority government manages political challenges and economic policy.

Best-Case Scenario

In a best-case scenario, the minority government displays strong leadership, fosters collaboration, and implements effective economic policies. This could lead to sustained economic growth, increased investor confidence, and a strengthening CAD. The CAD could appreciate to, for example, 0.80 USD/CAD or even higher.

Worst-Case Scenario

A worst-case scenario involves prolonged political instability, failed policy implementation, and decreased investor confidence, leading to economic stagnation. This could result in a weaker CAD, potentially falling below 0.70 USD/CAD.

Most Likely Scenario

The most likely scenario is a blend of the best- and worst-case scenarios. We may see periods of both economic strength and uncertainty, leading to moderate CAD fluctuations. A range between 0.75 USD/CAD and 0.80 USD/CAD may be a realistic expectation.

Conclusion: Understanding the Canadian Dollar Forecast in a Minority Government Context

The Canadian Dollar Forecast: Minority Government Impact is complex and depends significantly on the government's ability to manage political instability and maintain economic confidence. Political uncertainty and difficulties in implementing consistent economic policies could lead to increased volatility and a potentially weaker CAD. However, effective governance and successful navigation of economic challenges could result in a relatively stable or even stronger currency. To successfully navigate this complex landscape, investors and businesses need to carefully monitor economic indicators and political developments. Stay updated on the Canadian dollar's performance under a minority government and analyze the Canadian dollar's future trajectory by regularly checking reliable economic forecasts and news sources. Monitoring the Canadian dollar forecast will be crucial for informed decision-making.

Featured Posts

-

Cruise Line Complaints Permanent Bans What You Need To Know

May 01, 2025

Cruise Line Complaints Permanent Bans What You Need To Know

May 01, 2025 -

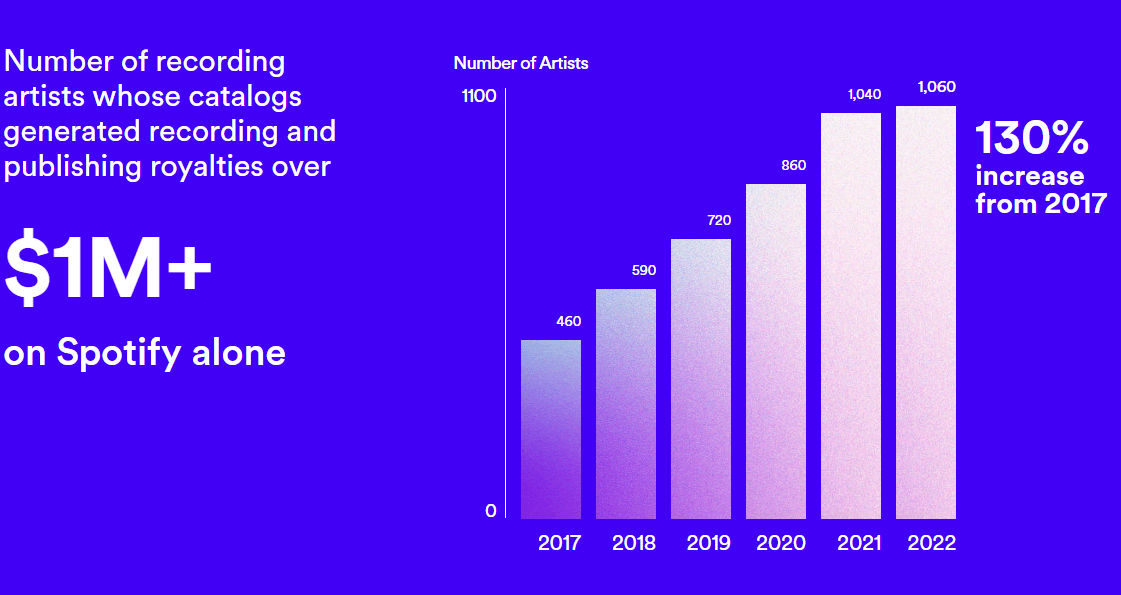

Spotify Reports 12 Jump In Subscribers Outperforming Projections Spot

May 01, 2025

Spotify Reports 12 Jump In Subscribers Outperforming Projections Spot

May 01, 2025 -

Rugby Match Analysis France Vs Italy Duponts Impact On The 11 Point Victory

May 01, 2025

Rugby Match Analysis France Vs Italy Duponts Impact On The 11 Point Victory

May 01, 2025 -

Samoas Miss Pacific Islands 2025 Victory

May 01, 2025

Samoas Miss Pacific Islands 2025 Victory

May 01, 2025 -

Hollywood Mourns The Loss Of Actress Priscilla Pointer At 100

May 01, 2025

Hollywood Mourns The Loss Of Actress Priscilla Pointer At 100

May 01, 2025

Latest Posts

-

Heavy Rainfall Prompts State Of Emergency Declaration In Kentucky

May 01, 2025

Heavy Rainfall Prompts State Of Emergency Declaration In Kentucky

May 01, 2025 -

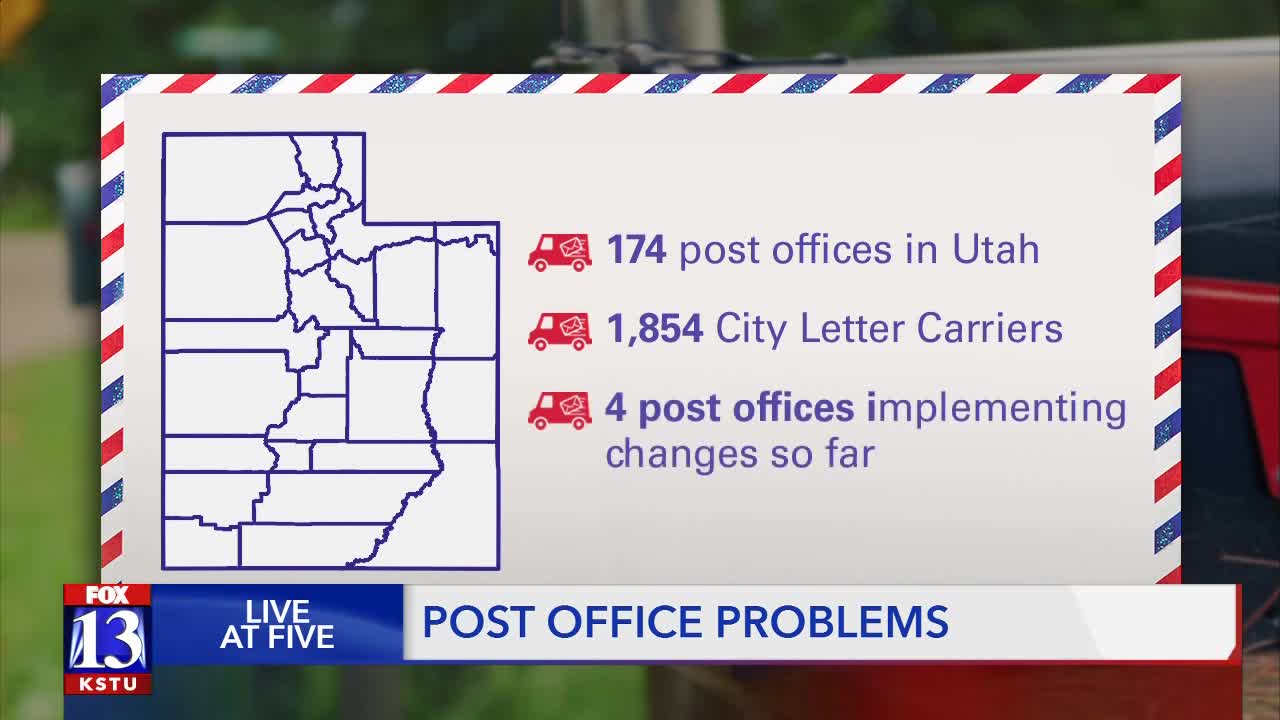

Improved Mail Delivery Expected In Louisville Following Recent Delays

May 01, 2025

Improved Mail Delivery Expected In Louisville Following Recent Delays

May 01, 2025 -

Kentucky Declares State Of Emergency Ahead Of Severe Flooding

May 01, 2025

Kentucky Declares State Of Emergency Ahead Of Severe Flooding

May 01, 2025 -

Louisville Postal Service Mail Delays Expected To Conclude Soon

May 01, 2025

Louisville Postal Service Mail Delays Expected To Conclude Soon

May 01, 2025 -

Delays In Kentucky Storm Damage Assessments Understanding The Reasons

May 01, 2025

Delays In Kentucky Storm Damage Assessments Understanding The Reasons

May 01, 2025