Canadian Home Prices: Posthaste Assessment Of Correction Risks

Table of Contents

Overvalued Markets and Affordability Concerns

The current state of the Canadian housing market raises significant concerns about affordability and potential overvaluation. Two key factors contribute to this precarious situation: high home prices relative to income and the impact of rising interest rates.

High Home Prices Relative to Income

The gap between average home prices and average household incomes is widening dramatically across major Canadian cities. This affordability challenge is pushing homeownership out of reach for many Canadians. Rising interest rates exacerbate this problem, further diminishing purchasing power.

- Toronto: The average home price in Toronto far surpasses the average income, making homeownership increasingly difficult for many residents.

- Vancouver: Similarly, Vancouver's high home prices represent a significant barrier to entry for potential homebuyers, creating an intensely competitive market.

- Montreal: While relatively more affordable than Toronto and Vancouver, Montreal is also experiencing pressure on affordability, with prices rising faster than incomes for many.

- International Comparison: Comparing Canadian home prices to other international markets reveals a significant disparity, highlighting the relative high cost of housing in major Canadian cities.

Impact of Rising Interest Rates

Interest rate hikes by the Bank of Canada directly impact mortgage payments and buyer purchasing power. Higher borrowing costs lead to reduced affordability, dampening demand and potentially triggering a slowdown in the market. Furthermore, stricter stress tests on mortgage approvals further restrict access to financing.

- Historical Correlation: Historically, there's a strong negative correlation between interest rate increases and home price growth in Canada.

- Predictive Models: Various predictive models suggest a significant impact of interest rate hikes on Canadian home prices, forecasting potential price declines.

- Bank of Canada Policy: The Bank of Canada's recent policy decisions and future rate projections will play a crucial role in shaping the housing market's trajectory.

Supply and Demand Dynamics in the Canadian Housing Market

The Canadian housing market is characterized by a complex interplay of supply and demand factors that are central to understanding the risks of a price correction. A limited housing supply coupled with fluctuating buyer demand creates a volatile environment.

Limited Housing Supply

Canada faces an ongoing shortage of housing inventory across the country. This shortage is driven by several factors, including land scarcity, restrictive zoning regulations, and slow construction rates. Simultaneously, population growth fuels increased demand, exacerbating the imbalance.

- Housing Starts and Completions: Statistics on housing starts and completions reveal a significant gap between supply and demand, underscoring the housing shortage.

- Inventory Levels: Analysis of housing inventory levels in major Canadian cities shows consistently low numbers, indicating a seller's market.

- Government Policies: Government policies aimed at increasing housing supply, such as incentivizing construction and relaxing zoning regulations, are crucial for addressing this issue.

Changing Buyer Demand

Buyer demand plays a critical role in shaping Canadian home prices. Economic uncertainty can significantly impact buyer confidence, leading to fluctuations in demand. Furthermore, shifting preferences between urban and suburban living can also affect market dynamics.

- Sales-to-Listing Ratios: Sales-to-listing ratios in major markets provide valuable insights into the level of buyer demand and market competitiveness.

- Sales Data and Trends: Analyzing recent sales data and trends helps identify shifts in buyer behaviour and potential future trajectories.

- Expert Opinions: Insights from real estate experts offer valuable qualitative perspectives on current and anticipated market dynamics.

Potential Scenarios and Mitigation Strategies

Understanding potential market scenarios and exploring mitigation strategies is crucial for navigating the current uncertainty surrounding Canadian home prices.

Soft Landing vs. Hard Correction

Two main scenarios are possible: a soft landing (a gradual price decline) or a hard correction (a sharp price drop). A soft landing is more likely if demand gradually adjusts to higher interest rates, while a hard correction could occur if a significant oversupply emerges.

- Historical Precedents: Examining historical precedents of Canadian housing market corrections provides valuable insights into potential future scenarios.

- Expert Opinions: Consulting expert opinions on the likelihood of different scenarios helps assess the risks and potential impacts.

- Economic Modelling: Economic modelling can provide quantitative estimates of the potential economic consequences of both a soft landing and a hard correction.

Government Intervention and Market Regulation

Government intervention through various policy tools can influence the housing market's stability. Tax policies, mortgage rules, and regulations impacting housing supply all play a crucial role.

- Review of Past Policies: Analyzing the effectiveness of past government interventions offers valuable lessons for current policy decisions.

- Current Government Policies: Evaluating current government policies reveals the approach being taken to address the housing market challenges.

- Potential Future Policy Changes: Discussions on potential future policy changes are essential for understanding the possible evolution of the housing market.

Conclusion

The Canadian housing market faces significant challenges, with affordability concerns and potential risks of a correction looming large. While the future trajectory of Canadian home prices remains uncertain, understanding the interplay of supply, demand, and interest rates is crucial. A careful assessment of overvalued markets, limited supply, and shifting buyer demand is essential for navigating the current climate. Staying informed about these factors and monitoring key indicators will help you make informed decisions. Continue to monitor this dynamic situation by regularly reviewing updated analyses of Canadian home prices and related market trends.

Featured Posts

-

Pilots Son Recovering After Lancaster County Crash

May 22, 2025

Pilots Son Recovering After Lancaster County Crash

May 22, 2025 -

Peppa Pig Fans Uncover 21 Year Old Mystery The Answer Revealed

May 22, 2025

Peppa Pig Fans Uncover 21 Year Old Mystery The Answer Revealed

May 22, 2025 -

Blockbusters On Bgt A Deep Dive Into The Shows Biggest Hits

May 22, 2025

Blockbusters On Bgt A Deep Dive Into The Shows Biggest Hits

May 22, 2025 -

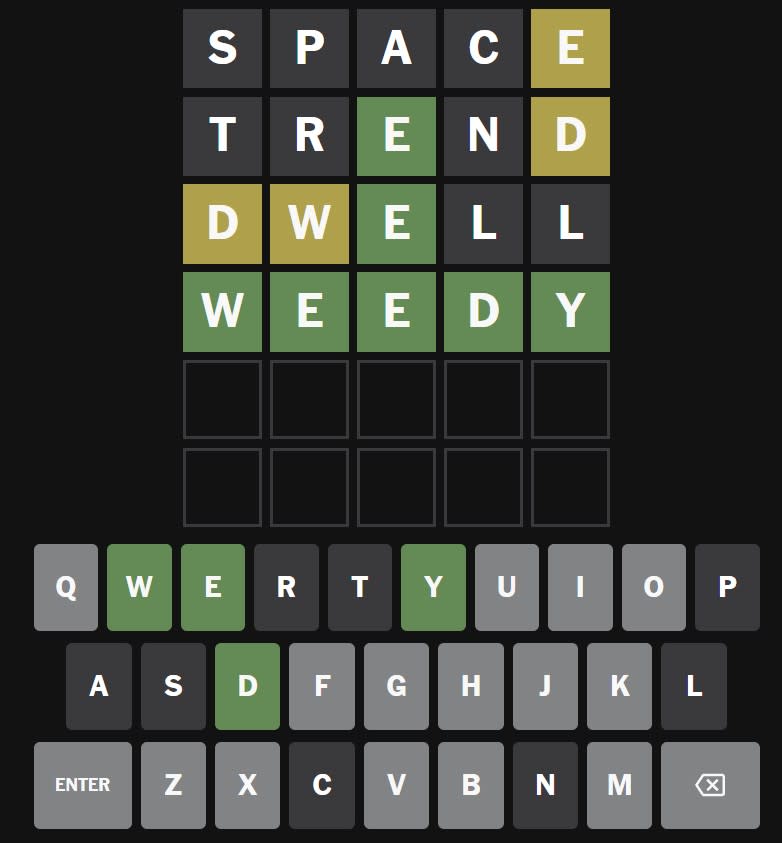

Wordle April 27th 1408 Solution And Clues

May 22, 2025

Wordle April 27th 1408 Solution And Clues

May 22, 2025 -

Googles Upgrades To Virtual Meetings A Review

May 22, 2025

Googles Upgrades To Virtual Meetings A Review

May 22, 2025