Canadian Housing Crisis: High Down Payments Price Out Buyers

Table of Contents

The Impact of High Down Payments on Affordability

The seemingly insurmountable hurdle of a large down payment is at the heart of the Canadian housing crisis. The sheer cost of entry into the housing market is disproportionately impacting aspiring homeowners.

Increasing House Prices and Down Payment Requirements

The relationship between house prices and required down payments is exponential. As house prices soar, so do the minimum down payment requirements, creating a vicious cycle of increasing inaccessibility.

- Average house price increases in major cities: Toronto, Vancouver, and Montreal have seen astronomical increases in average house prices over the past decade, far outpacing wage growth.

- Minimum down payment percentages for different purchase prices: For homes priced over $500,000, the minimum down payment is significantly higher, requiring a substantial upfront investment. This creates a significant barrier for first-time buyers.

- Impact on mortgage affordability: Even with a large down payment, the monthly mortgage payments can be crippling, especially with rising interest rates. This further limits the pool of potential buyers. For example, a 5% increase in interest rates can significantly increase monthly payments, making even those with substantial savings struggle to afford a mortgage.

The Disproportionate Impact on First-Time Homebuyers

High down payments disproportionately affect first-time homebuyers, who often lack the substantial savings needed for a substantial down payment. This is particularly true for younger generations, who are often burdened by student debt and other financial obligations.

- Challenges faced by young adults and families: Young professionals and families find it increasingly difficult to save enough for a down payment, often delaying or forgoing homeownership altogether.

- The role of inheritance and family support: Many first-time buyers rely on financial assistance from family, highlighting the growing inequality in access to homeownership.

- The impact on economic mobility: The inability to access homeownership limits economic mobility, trapping individuals and families in a cycle of renting, making it difficult to build wealth and achieve financial security. Government programs like the First-Time Home Buyers' Incentive aim to assist, but often have limitations and strict eligibility requirements, leaving many still ineligible.

Contributing Factors to the Canadian Housing Crisis

The Canadian housing crisis is a multifaceted problem stemming from a confluence of factors beyond just high down payments.

Limited Housing Supply

A chronic shortage of housing units across Canada, especially in major urban centers, is a key driver of high house prices and the need for large down payments.

- Insufficient new construction: The rate of new housing construction has not kept pace with population growth and demand, leading to a significant housing deficit.

- Zoning regulations: Restrictive zoning regulations in many municipalities limit the density of new developments, hindering the construction of affordable housing options.

- Land scarcity: The limited availability of developable land in urban areas further exacerbates the supply shortage, driving up land prices and contributing to higher housing costs.

- Impact on competition and pricing: The limited supply fuels intense competition among buyers, driving up prices and making it even harder for first-time buyers to compete. Statistics Canada reports a significant housing deficit across many provinces, further emphasizing this point.

Rising Interest Rates

Higher interest rates significantly impact mortgage affordability and the size of down payments needed. The Bank of Canada's monetary policy plays a crucial role here.

- The relationship between interest rates and monthly mortgage payments: Even a small increase in interest rates can lead to substantially higher monthly mortgage payments, reducing borrowing power and making larger down payments necessary.

- Impact on borrowing power: Higher interest rates decrease the amount individuals can borrow, requiring larger down payments to compensate.

- Increased demand for larger down payments: Lenders often demand larger down payments at higher interest rates to mitigate their risk, further exacerbating the affordability challenge. The Bank of Canada's recent interest rate hikes have had a demonstrable impact on the housing market, increasing the difficulty of securing a mortgage.

Investor Activity

Investor activity in the Canadian real estate market has contributed to driving up house prices and making homeownership harder for average Canadians.

- The proportion of investor-owned properties: A significant portion of properties in major cities are owned by investors, reducing the supply available to first-time homebuyers.

- Strategies employed by investors: Investors often employ strategies like leveraging multiple properties and short-term rentals, further tightening the housing supply and driving up prices.

- The impact on supply and demand: Increased investor activity intensifies competition and drives up prices, making it increasingly difficult for ordinary Canadians to afford a home. Data from the Canadian Real Estate Association (CREA) shows a notable increase in investor activity in recent years.

Potential Solutions to Address the Crisis

Addressing the Canadian housing crisis requires a comprehensive strategy involving government intervention, industry collaboration, and long-term planning.

Government Policies and Interventions

The government can play a crucial role in mitigating the crisis through various policies and interventions.

- Increasing housing supply: Implementing policies to encourage the construction of more affordable housing units, including streamlining approval processes and relaxing zoning restrictions.

- Tax incentives: Offering tax incentives for developers to build affordable housing and for first-time homebuyers to purchase homes.

- Down payment assistance programs: Expanding and improving existing down payment assistance programs to make them more accessible and effective. Examples from other countries with successful housing policies can offer valuable insights. The implementation of such policies however, must consider long-term sustainability and avoid unintended consequences.

Industry Initiatives and Private Sector Solutions

The private sector can also contribute to solutions through innovative approaches.

- Innovative construction methods: Utilizing modular construction and other innovative methods to reduce construction costs and increase the speed of development.

- Alternative financing options: Exploring alternative financing options, such as shared equity mortgages and rent-to-own programs, to make homeownership more accessible.

- Promoting sustainable housing development: Focusing on sustainable and energy-efficient housing development to reduce long-term costs and environmental impact.

Long-Term Strategies for Sustainable Housing

Long-term planning and sustainable solutions are crucial to prevent future housing crises.

- Urban planning strategies: Implementing comprehensive urban planning strategies to encourage densification and mixed-use developments.

- Investment in infrastructure: Investing in public transportation and other infrastructure to make it easier and more affordable to live in areas with more housing options.

- Community development initiatives: Supporting community development initiatives to create vibrant and affordable neighborhoods.

Conclusion

The Canadian housing crisis, fueled by high down payments, is a complex issue with far-reaching consequences. Addressing this crisis requires a multifaceted approach involving government policies, private sector engagement, and long-term planning. From increasing housing supply and implementing effective down payment assistance programs to promoting sustainable housing development and addressing investor activity, a collaborative effort is vital.

Understanding the factors contributing to the Canadian housing crisis and high down payments is the first step towards finding effective solutions. Let's work together to find sustainable solutions to make homeownership attainable for all Canadians and mitigate this ongoing Canadian Housing Crisis.

Featured Posts

-

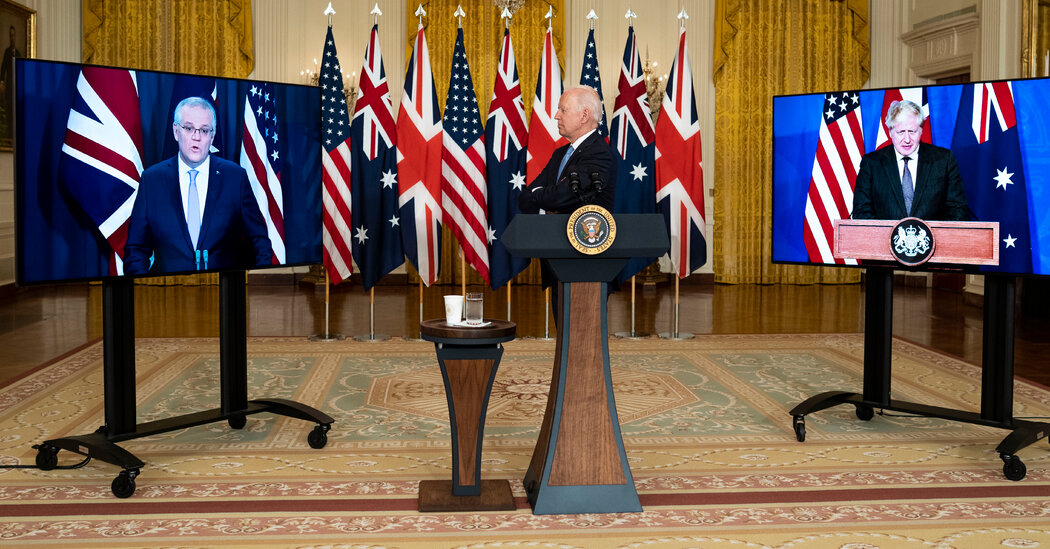

Is The Great Decoupling Inevitable Exploring The Potential Scenarios

May 09, 2025

Is The Great Decoupling Inevitable Exploring The Potential Scenarios

May 09, 2025 -

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Premiere

May 09, 2025

Dakota Johnson Melanie Griffith And Siblings Attend Materialist Premiere

May 09, 2025 -

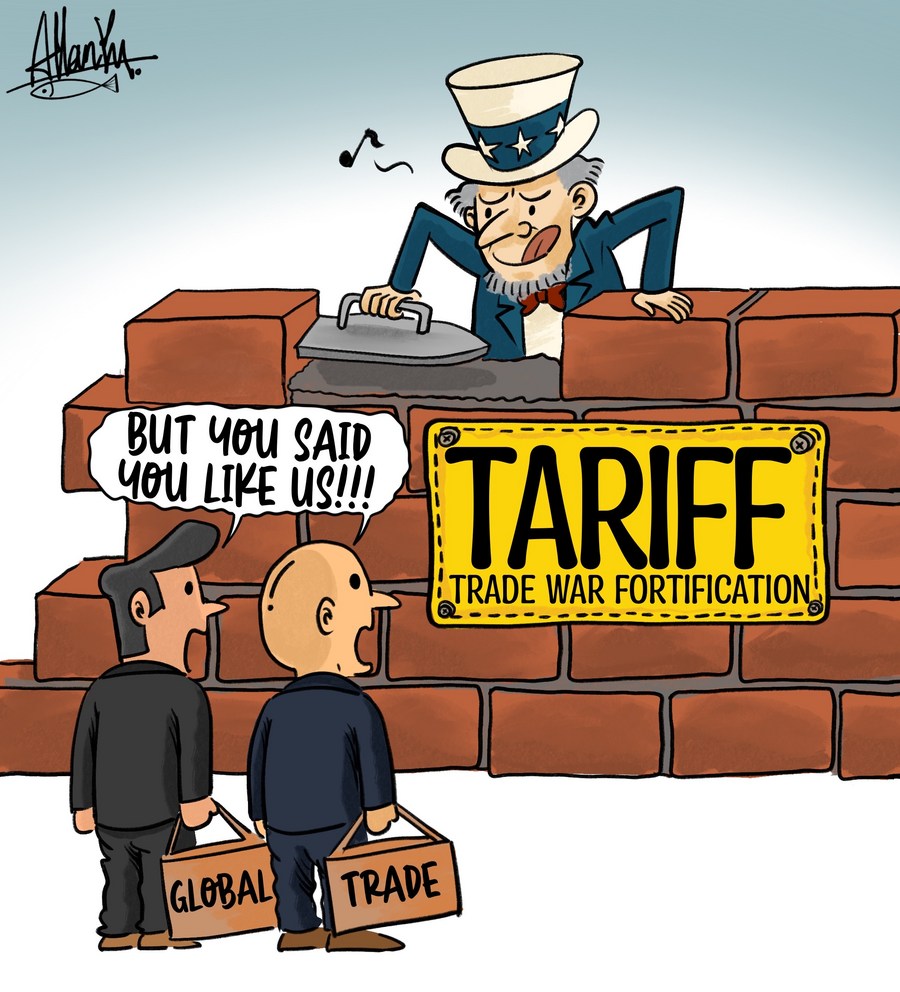

French Minister Urges Eu To Escalate Response To Us Tariffs

May 09, 2025

French Minister Urges Eu To Escalate Response To Us Tariffs

May 09, 2025 -

Strengthening The Eu Response To Us Tariffs A French Ministers Plea

May 09, 2025

Strengthening The Eu Response To Us Tariffs A French Ministers Plea

May 09, 2025 -

700 Point Sensex Jump Todays Stock Market News And Analysis

May 09, 2025

700 Point Sensex Jump Todays Stock Market News And Analysis

May 09, 2025