Celtics Sale To Private Equity: A $6.1B Deal And Fan Reactions

Table of Contents

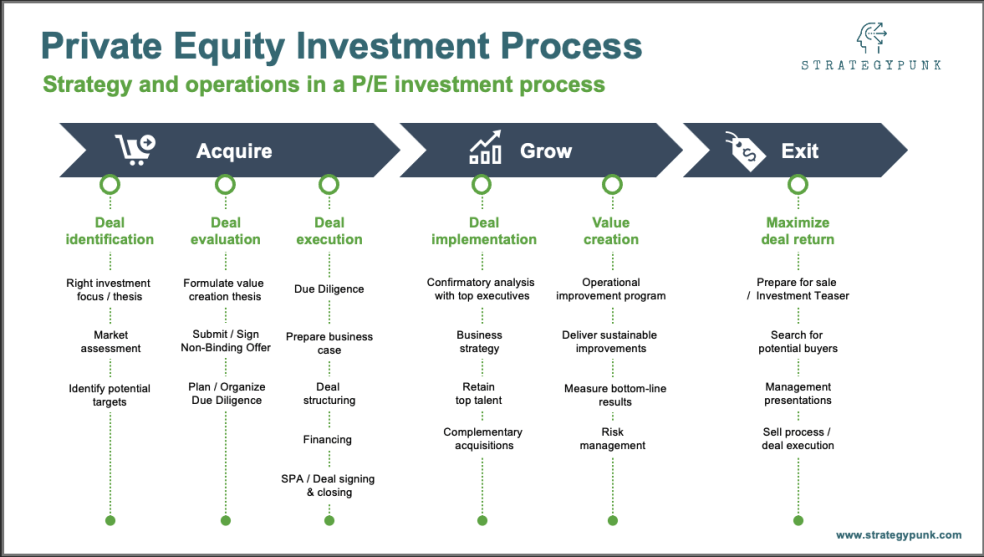

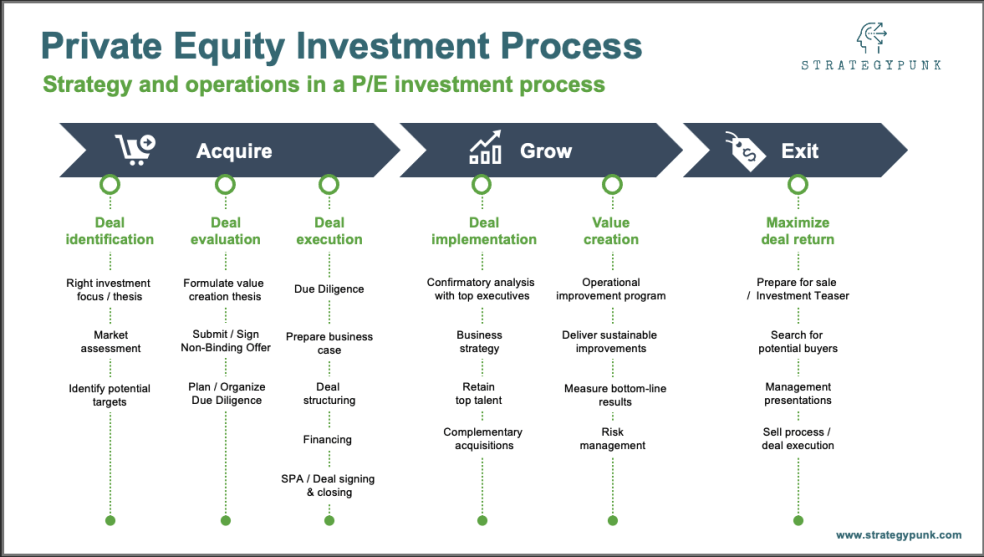

The Details of the Celtics' Private Equity Acquisition

Who Bought the Celtics?

The Boston Celtics were acquired by [Insert Name of Private Equity Firm Here], a prominent player in the private equity world with a history of significant investments across various sectors. [Provide a brief history of the firm, highlighting relevant experience in sports or large-scale acquisitions]. This acquisition represents a significant expansion of their portfolio into the lucrative world of professional sports.

The Sale Price and its Implications

The $6.1 billion price tag is unprecedented in NBA history, setting a new benchmark for franchise valuations. This reflects not only the Celtics' rich legacy and consistent on-court success but also the immense commercial potential of a globally recognized brand. The high valuation underscores the increasing attractiveness of sports franchises as investment vehicles for private equity firms seeking strong returns.

Key Figures Involved in the Deal

The sale involved key players from both the selling and buying sides. [Name and briefly describe the role of key figures from the previous ownership group, e.g., Wyc Grousbeck] played a crucial role in facilitating the transaction. On the buyer's side, [Name and briefly describe the role of key figures from the private equity firm] spearheaded the acquisition effort.

- Ownership Structure Post-Acquisition: [Detail the ownership structure after the sale. Is it a complete buyout, or are there any remaining minority owners?]

- Existing Minority Owners: [Mention any existing minority owners and their continued involvement, if any.]

- Financing the Deal: [Briefly explain the financing mechanism used for the acquisition: debt financing, equity, or a combination].

Potential Impacts of the Celtics Private Equity Ownership

On-Court Performance and Team Strategy

The shift in ownership could potentially influence the Celtics' on-court performance. Will the new owners prioritize immediate success through high-profile player acquisitions, or will they adopt a more long-term strategy focused on player development and team building? Their investment philosophy will significantly impact the team's trajectory.

Ticket Prices and Fan Experience

One major concern among fans is the potential impact on ticket prices and the overall fan experience. Private equity firms often seek to maximize returns, which could lead to increased ticket costs, impacting accessibility for some loyal supporters. Conversely, increased investment could improve facilities and overall game-day experiences.

Long-Term Financial Stability and Growth

Private equity ownership can bring significant long-term financial stability and growth opportunities for the Celtics. Increased investment in team infrastructure, player development programs, and marketing initiatives could lead to enhanced brand value and future revenue streams. However, the risk associated with debt financing must be carefully considered.

- Increased Investment: The new owners could potentially invest heavily in improving the team's facilities, scouting, and player development programs.

- Potential Risks: Private equity investments often involve leveraging debt, which can create financial pressure if the team's performance doesn't meet expectations.

- Private Equity Track Record: Analyzing the private equity firm's track record in sports investments can provide insights into their approach to team management and financial strategies.

Fan Reactions to the Celtics Sale: A Mixed Bag

Positive Reactions

Many fans express excitement about the potential for increased investment in the team, leading to improved on-court performance and a more competitive franchise. The prospect of significant upgrades to TD Garden and other team facilities also generates positive sentiment.

Concerns and Negative Reactions

Concerns center primarily on the potential for inflated ticket prices, reducing accessibility for long-time fans. There are also anxieties surrounding potential changes to the team's culture and identity, with fears that the new owners might prioritize short-term profits over long-term success and fan loyalty.

Social Media Sentiment Analysis

Social media platforms have become a central hub for fan discussions surrounding the Celtics sale. A quick glance at Twitter, Facebook, and other platforms reveals a mixed bag of opinions, ranging from enthusiastic optimism to apprehensive skepticism. [Link to relevant social media discussions or news articles].

- Fan Quotes: [Include quotes from fans expressing both positive and negative sentiments about the sale.]

- Social Media Links: [Provide links to relevant social media discussions and news articles].

- Overall Sentiment: [Summarize the general sentiment among fans – is it predominantly positive, negative, or a mixture?]

Conclusion: The Future of the Boston Celtics Under Private Equity Ownership

The $6.1 billion sale of the Boston Celtics marks a pivotal moment in the franchise's history. While the acquisition presents exciting possibilities for increased investment and long-term growth, it also raises valid concerns about ticket prices and potential changes to team culture. The coming years will be crucial in determining the long-term effects of this private equity acquisition on the team, its fans, and the overall NBA landscape. The impact on the fan experience and the team's on-court performance will be closely watched.

Stay informed about the evolving story of the Boston Celtics sale and its impact on the team and its fans. Keep following [Your Website/Source] for the latest updates and analysis on the Celtics private equity acquisition.

Featured Posts

-

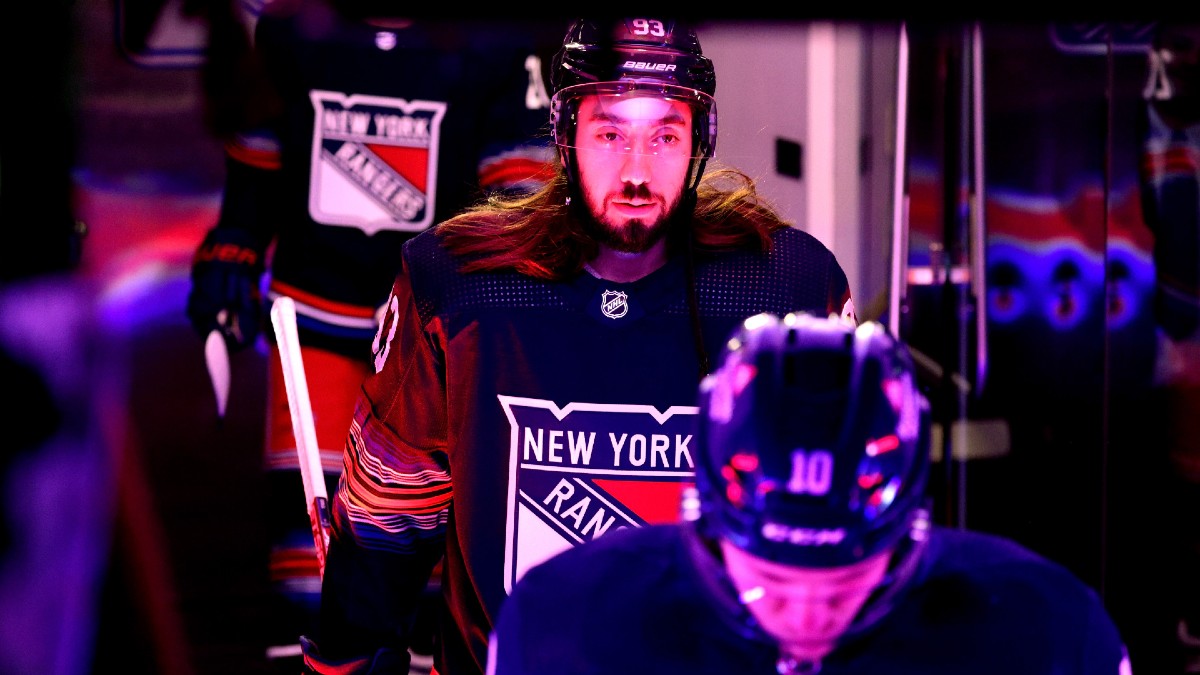

Maple Leafs Vs Rangers Prediction Picks And Odds For Tonights Nhl Game

May 15, 2025

Maple Leafs Vs Rangers Prediction Picks And Odds For Tonights Nhl Game

May 15, 2025 -

Anthony Edwards And His Baby Mama Custody Battle Details Emerge

May 15, 2025

Anthony Edwards And His Baby Mama Custody Battle Details Emerge

May 15, 2025 -

Leeflang Aangelegenheid Bruins En Npo Moeten Met Toezichthouder In Overleg

May 15, 2025

Leeflang Aangelegenheid Bruins En Npo Moeten Met Toezichthouder In Overleg

May 15, 2025 -

Can The Rockies Break Their 7 Game Skid Against San Diego

May 15, 2025

Can The Rockies Break Their 7 Game Skid Against San Diego

May 15, 2025 -

Mental Health And Transgender Individuals The Promise Of A Gender Euphoria Scale

May 15, 2025

Mental Health And Transgender Individuals The Promise Of A Gender Euphoria Scale

May 15, 2025