Celtics Sale To Private Equity: A $6.1 Billion Deal And Fan Concerns

Table of Contents

Understanding the Private Equity Acquisition

Who Bought the Celtics and What is Private Equity?

The Boston Celtics were acquired by a prominent private equity firm (the specific firm's name would be inserted here once publicly known). Private equity firms are investment companies that manage pooled investment funds from institutional and individual investors. Their investment strategies typically involve acquiring controlling stakes in established companies, restructuring them to improve profitability, and eventually selling them at a profit. These firms often leverage significant debt financing to fund acquisitions. The specific investment history and approach of the acquiring firm would be crucial in predicting their impact on the Celtics. Understanding their previous investments in sports or entertainment-related businesses will be key to gauging their future plans for the team. This acquisition highlights a growing trend of private equity involvement in professional sports team ownership.

- Key players: (Insert names of key individuals involved in the acquisition from the private equity firm once available)

- Investment Focus: (Insert specifics about the firm's investment focus, e.g., growth equity, leveraged buyouts etc., once available)

- Past successes/failures: (Analysis of the firm's past successes and failures in similar acquisitions needs to be added once the firm is publicly known)

The Financial Details of the $6.1 Billion Deal

The $6.1 billion sale price sets a new record for an NBA franchise, reflecting the Celtics' immense brand value, consistent on-court success, and loyal fanbase. This valuation highlights the increasing financial power within professional sports and the attractive investment opportunities presented by successful franchises. Understanding the sources of funding for this massive acquisition is important; it likely involves a combination of equity contributions and debt financing, demanding a robust financial strategy.

- Breakdown of the sale price: (Details on how the $6.1 billion is allocated, including debt and equity contributions, will need to be added once this information is public)

- Valuation methods: (Discussion on the valuation methodologies used to arrive at the $6.1 billion figure is needed here.)

- Debt financing: (Details regarding the amount of debt financing used and the associated risks need to be added once the deal's financial details are made public)

Potential Impacts on the Boston Celtics and its Fans

Impact on Team Performance and Player Recruitment

The change in ownership could significantly impact the Celtics' performance. A private equity firm's primary goal is financial return, which could translate into increased investment in the team to enhance its competitiveness and profitability. This might include higher salaries to attract top-tier free agents, improvements to team infrastructure (training facilities, analytics departments), and potentially changes in coaching staff. However, the opposite is also possible, as a focus on maximizing short-term profit could lead to cost-cutting measures that negatively affect the team.

- Potential for increased spending: A private equity firm might be willing to spend aggressively to build a championship contender.

- Risk of cost-cutting: Conversely, a focus on maximizing profits could lead to cost-cutting measures that might negatively impact the team's competitiveness.

- Impact on player morale: How the change in ownership will affect player morale and team chemistry remains to be seen.

Fan Concerns and Ticket Prices

A primary concern among Celtics fans is the potential impact on ticket prices, merchandise costs, and the overall fan experience. Private equity firms are known for their focus on profitability, which could lead to increased prices for fans to maximize revenue streams. However, a well-managed private equity firm will also recognize the importance of maintaining fan loyalty and engagement, recognizing that a positive fan experience is crucial for long-term success.

- Ticket price increases: History shows that changes in ownership can often lead to ticket price increases.

- Merchandise costs: Fans can also expect potential increases in the price of merchandise.

- Fan engagement strategies: The new owners may implement new strategies to improve fan engagement, such as enhanced in-arena experiences.

Long-Term Vision and Future of the Franchise

The long-term vision of the private equity firm for the Celtics franchise will shape the team's future. Their goals might include maximizing profitability through improved team performance, strategic investments, and potentially stadium upgrades or renovations to increase revenue streams. Changes in team management and operations are also possible, which could lead to both positive and negative consequences.

- Stadium renovations: The new ownership may invest in renovating the TD Garden arena to enhance the fan experience and generate additional revenue.

- Team management changes: Changes in the front office and coaching staff are possible under new ownership.

- Geographic expansion: While unlikely in the short term, the long-term strategy may involve exploring expansion opportunities.

Conclusion: The Future of the Boston Celtics After the $6.1 Billion Private Equity Deal

The $6.1 billion sale of the Boston Celtics to a private equity firm marks a pivotal moment in the franchise's history. While the potential for increased investment and improved competitiveness exists, concerns about ticket prices, the fan experience, and the overall long-term vision remain. The financial implications of this record-breaking deal are significant, and the impact on the team and its loyal fanbase warrants careful observation. The success of this acquisition will depend on the new owners' ability to balance financial goals with the maintenance of a positive fan experience and commitment to on-court excellence. We encourage you to share your thoughts and concerns about the Boston Celtics sale to private equity in the comments section below. Let's discuss the future of this legendary franchise together.

Featured Posts

-

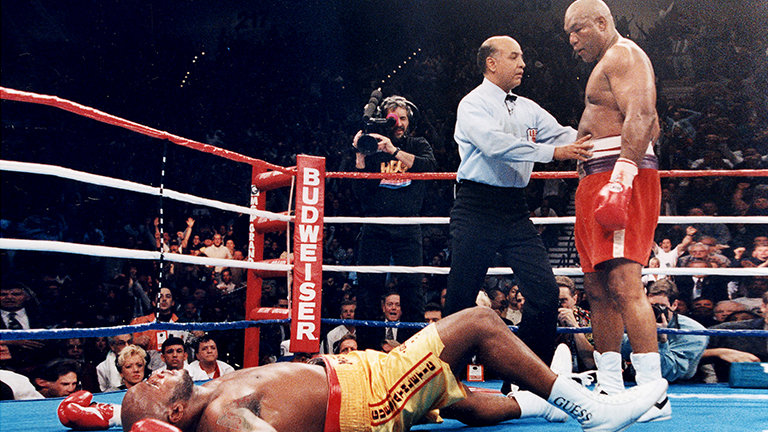

Reno Boxing Comeback A Heavyweight Champions Strategy

May 16, 2025

Reno Boxing Comeback A Heavyweight Champions Strategy

May 16, 2025 -

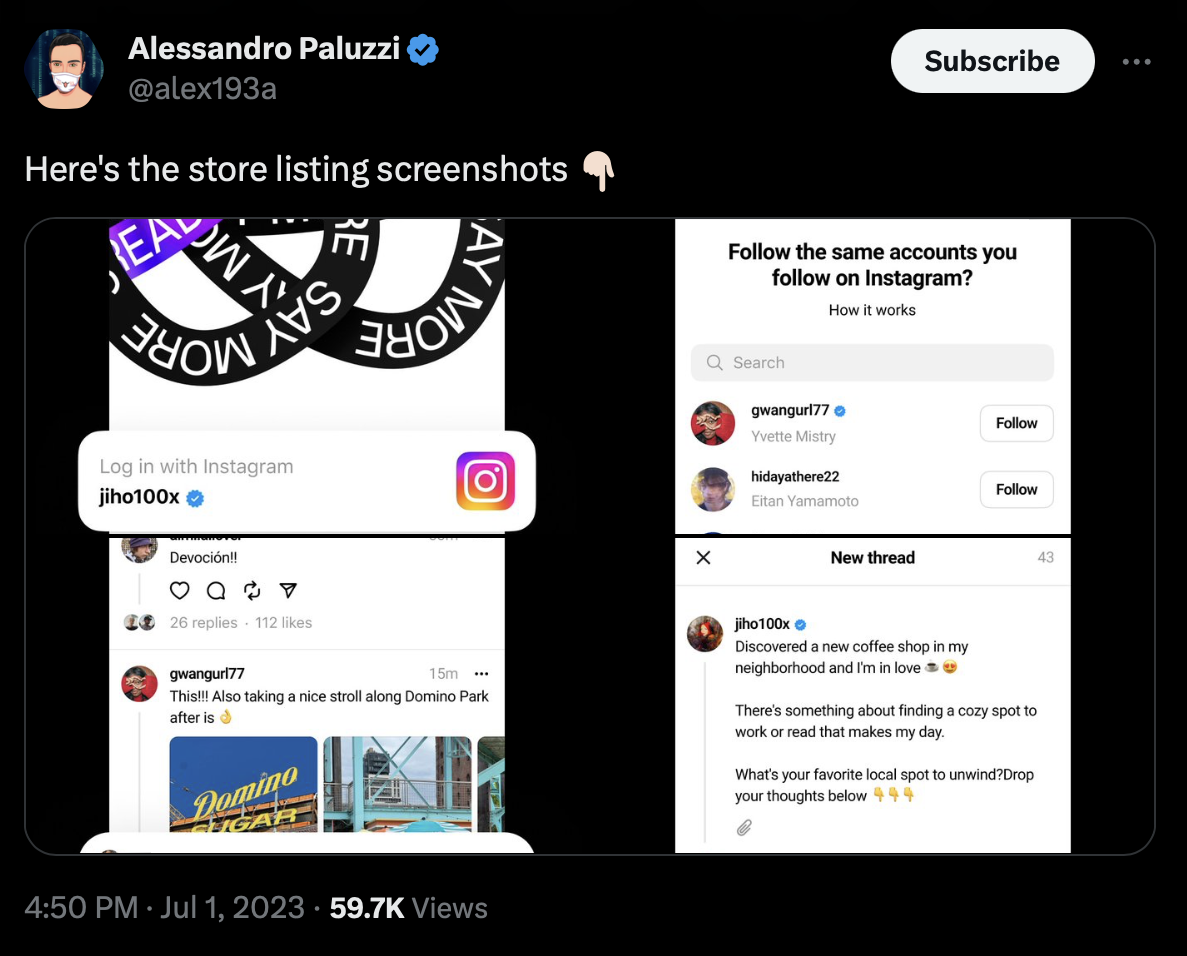

An Obscure Apps Potential To Challenge Metas Reign

May 16, 2025

An Obscure Apps Potential To Challenge Metas Reign

May 16, 2025 -

Climbing Everest In 7 Days The Dangers Of Accelerated Ascent With Anesthetic Gas

May 16, 2025

Climbing Everest In 7 Days The Dangers Of Accelerated Ascent With Anesthetic Gas

May 16, 2025 -

Did A Feud Occur Between Jill Biden And Kamala Harris Separating Fact From Fiction

May 16, 2025

Did A Feud Occur Between Jill Biden And Kamala Harris Separating Fact From Fiction

May 16, 2025 -

Is Creatine Safe And Effective A Detailed Analysis

May 16, 2025

Is Creatine Safe And Effective A Detailed Analysis

May 16, 2025