Cenovus CEO Downplays Merger With MEG Energy, Prioritizes Internal Expansion

Table of Contents

Cenovus's Stance on the MEG Energy Merger

Cenovus Energy has officially released statements refuting the likelihood of a near-term merger with MEG Energy. The CEO's reasoning centers on the belief that internal expansion offers a more efficient and strategically sound path to long-term growth and profitability compared to the complexities and potential risks associated with a major acquisition. While a merger could bring immediate scale, the CEO has stressed the inherent challenges of integrating two large organizations, including potential cultural clashes and operational disruptions. He emphasized the potential for unforeseen costs and delays that could ultimately hinder value creation.

- Specific statements made by the CEO: The CEO explicitly stated that Cenovus is "fully focused on executing our existing strategic plan, which prioritizes organic growth and maximizing value from our existing assets." Further statements emphasized the company's confidence in its ability to achieve its production and profitability targets through internal initiatives.

- Financial implications: A detailed financial analysis suggests that internal expansion projects offer a higher return on investment (ROI) compared to the acquisition of MEG Energy, considering the potential premiums associated with a merger.

- Strategic considerations: The CEO highlighted the strategic advantages of maintaining operational control and focusing on synergistic development within their existing infrastructure. A merger would introduce significant integration risks, potentially disrupting established workflows and efficiencies.

Cenovus's Internal Expansion Strategy

Cenovus's internal expansion strategy is multi-faceted, targeting key areas within its oil sands operations. This involves significant investments aimed at boosting production, improving operational efficiency, and leveraging technological advancements to enhance profitability and reduce environmental impact. The company's commitment to organic growth is evident in several key projects.

- Key projects: These include investments in upgrading facilities to produce higher-value products, optimizing existing oil sands extraction processes, and implementing advanced technologies to improve recovery rates and reduce operating costs. Exploration for new reserves within existing lease areas is also a primary focus.

- Investment figures and timelines: Cenovus has committed significant capital expenditure to these projects, with detailed timelines outlining phased implementation over the next several years. Specific investment figures are publicly available through Cenovus's financial reports and investor presentations.

- Expected increase in production capacity: These internal initiatives are projected to significantly enhance production capacity, potentially exceeding the anticipated gains from a MEG Energy merger, without the associated risks and complexities.

- Environmental impact: Cenovus is incorporating sustainability initiatives into its internal expansion plan, focusing on emissions reduction strategies and responsible resource management. This commitment aligns with evolving environmental regulations and growing investor interest in ESG (Environmental, Social, and Governance) factors.

Market Analysis and Competitive Landscape

The decision to prioritize internal expansion reflects a careful analysis of the current oil and gas market. Oil prices remain volatile, creating uncertainty about future returns. This, coupled with the intense competition within the Canadian oil sands industry, makes a cautious approach to capital allocation crucial. Major players like Suncor Energy and Canadian Natural Resources are also pursuing diverse strategies, emphasizing both organic growth and strategic acquisitions.

- Current oil prices and market volatility: The fluctuating nature of oil prices necessitates a conservative approach to capital allocation, favoring investments with demonstrable ROI. Internal expansion allows for greater control and adaptability to changing market conditions.

- Analysis of competitor strategies: While competitors may pursue mergers, Cenovus's focus on organic growth allows for a more targeted and efficient approach, maximizing the value of its existing resources.

- Impact of government regulations and environmental policies: The increasingly stringent environmental regulations in Canada necessitate sustainable practices. Cenovus's internal expansion strategy incorporates these factors, ensuring compliance and minimizing environmental impacts.

- Long-term outlook: The long-term outlook for the oil sands industry remains positive, but subject to various uncertainties. Cenovus's internal expansion strategy positions it to adapt to these uncertainties and maintain a strong competitive position.

Cenovus Prioritizes Organic Growth Over MEG Energy Merger: A Strategic Shift

In conclusion, Cenovus Energy's decision to prioritize internal expansion over a merger with MEG Energy reflects a strategic shift focused on long-term value creation through controlled growth and efficient resource management. The company's commitment to organic growth, supported by substantial investments in key projects, positions it for sustained success within the dynamic Canadian oil sands market. This strategy minimizes integration risks, allowing Cenovus to capitalize on its strengths and adapt to evolving market conditions. The focus on operational efficiencies, technological advancements, and sustainability further strengthens its competitive position. To stay informed about Cenovus Energy's progress and the evolution of its internal expansion strategy, follow Cenovus's announcements and stay updated on their growth plans. Learn more about Cenovus's future plans by subscribing to industry news and following their official channels.

Featured Posts

-

Milan San Remo 2024 Van Der Poels Stunning Victory Over Pogacar

May 26, 2025

Milan San Remo 2024 Van Der Poels Stunning Victory Over Pogacar

May 26, 2025 -

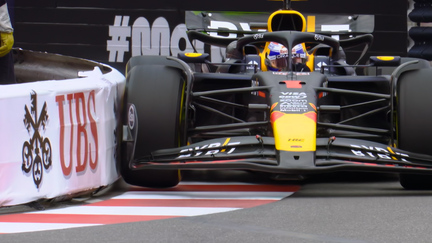

Verstappen And Leclerc Battle Heats Up Monaco Gp Fp 1 Results

May 26, 2025

Verstappen And Leclerc Battle Heats Up Monaco Gp Fp 1 Results

May 26, 2025 -

Nonton Balap Moto Gp Inggris 2025 Sprint Race Live Streaming Jam 20 00 Wib

May 26, 2025

Nonton Balap Moto Gp Inggris 2025 Sprint Race Live Streaming Jam 20 00 Wib

May 26, 2025 -

Jrymt Mrwet Fy Frnsa Aktshaf Jthth Mdfwnt Dakhl Mnzl Almthm

May 26, 2025

Jrymt Mrwet Fy Frnsa Aktshaf Jthth Mdfwnt Dakhl Mnzl Almthm

May 26, 2025 -

The 2009 Brawn Gp Car Jenson Buttons Championship Ride

May 26, 2025

The 2009 Brawn Gp Car Jenson Buttons Championship Ride

May 26, 2025