Cenovus CEO: Low Probability Of MEG Bid Due To Organic Growth Focus

Table of Contents

Cenovus's Focus on Organic Growth: A Strategic Shift

Prioritizing Internal Expansion over External Acquisitions

Cenovus's decision to prioritize organic growth represents a significant strategic shift, prioritizing internal expansion and capital allocation over the uncertainties and complexities associated with external acquisitions. This approach offers several key advantages:

- Increased Control: Organic growth allows Cenovus to maintain complete control over its development and expansion, aligning projects with its long-term vision and risk tolerance.

- Reduced Risk: Internal expansion minimizes the risks associated with integrating a new company, avoiding potential cultural clashes, operational inefficiencies, and unforeseen liabilities.

- Higher Potential Returns: By focusing on its core competencies and existing assets, Cenovus can potentially achieve higher returns on investment (ROI) compared to the often-diluted returns from M&A activity.

- Long-Term Strategy Alignment: Organic growth allows for a more gradual, sustainable expansion, better aligning with Cenovus’s long-term strategic objectives.

Cenovus's past successes in organic growth, such as [Insert specific example of a successful organic growth initiative and quantifiable results], demonstrate the effectiveness of this approach. Their projected growth rates [Insert projected growth rates with source] further solidify the confidence in this strategic direction. Keywords: organic growth strategy, internal expansion, capital allocation, return on investment (ROI), risk mitigation.

Cenovus's Existing Assets and Development Plans

Cenovus boasts a robust portfolio of assets, primarily focused on oil sands and upstream operations, providing a solid foundation for sustained organic growth. Key areas of focus include:

- [Specific Oil Sands Project]: This project involves [brief description of the project and its potential for production growth].

- [Specific Upstream Operation]: Cenovus is investing in [brief description of the project and its anticipated impact on production].

- [Technology/Innovation]: Cenovus is actively exploring and implementing new technologies to enhance efficiency and reduce environmental impact in its operations.

These developments, coupled with ongoing exploration and resource development, position Cenovus for significant production growth in the coming years. Keywords: oil sands, upstream operations, production growth, capital expenditure, resource development.

Financial Strength and Operational Efficiency

Cenovus's strong financial position underpins its commitment to organic growth. The company enjoys [mention key financial metrics such as strong cash flow, manageable debt levels, and profitability]. Furthermore, Cenovus is actively implementing initiatives aimed at enhancing operational efficiency and reducing costs, such as [mention specific cost optimization strategies]. This financial prudence allows Cenovus to invest strategically in its organic growth initiatives without compromising its financial stability. Keywords: financial performance, cash flow generation, debt reduction, operational efficiency, cost optimization.

Dismissing the MEG Energy Bid: Reasons and Implications

Why a MEG Energy Acquisition is Unlikely

Cenovus's CEO has explicitly stated the low probability of a MEG Energy bid. This decision stems from several factors:

- Strategic Fit: A merger with MEG Energy may not align strategically with Cenovus's long-term objectives and core competencies.

- Valuation Concerns: The perceived valuation of MEG Energy might not be considered favorable by Cenovus's management team.

- Integration Challenges: Integrating two large energy companies presents significant operational and logistical challenges, potentially disrupting ongoing projects and impacting profitability.

These considerations, combined with the attractive prospects of organic growth, make a MEG Energy acquisition an unlikely scenario for Cenovus. Keywords: MEG Energy, acquisition target, valuation, strategic fit, synergy, integration challenges.

Impact on the Energy Sector and Investors

Cenovus's focus on organic growth carries implications for the broader energy sector and its investors:

- Market Impact: Cenovus’s decision could influence the overall M&A activity in the Canadian energy sector.

- Stock Price: MEG Energy’s stock price might experience volatility in response to Cenovus’s announcement. However, Cenovus’s commitment to organic growth may positively influence its own stock valuation.

- Investor Sentiment: Investors will likely react differently depending on their investment strategies and risk tolerance. Those favoring stable, organic growth may view Cenovus's strategy favorably.

Keywords: market impact, stock price, investor sentiment, energy market outlook.

Conclusion: Cenovus's Commitment to Organic Growth Remains Strong

In summary, Cenovus Energy's CEO has made it clear: organic growth is the primary driver of the company's strategy, making a MEG Energy acquisition highly improbable. This decision is rooted in a strong financial position, a robust asset portfolio, and a desire to maintain control and mitigate risk. While the implications for the energy sector and investors are multifaceted, Cenovus's unwavering commitment to its organic growth strategy positions the company for sustained success. To stay informed about Cenovus's progress and future developments in its organic growth strategy, visit their investor relations page: [Insert Link to Cenovus Investor Relations Page]. Keywords: Cenovus Energy, organic growth strategy, MEG Energy, future outlook, investor relations.

Featured Posts

-

No Permanent Deal Osimhens Future Away From Galatasaray

May 27, 2025

No Permanent Deal Osimhens Future Away From Galatasaray

May 27, 2025 -

Osimhen Among The Worlds Best Strikers Says Morata

May 27, 2025

Osimhen Among The Worlds Best Strikers Says Morata

May 27, 2025 -

17

May 27, 2025

17

May 27, 2025 -

The Kanye West Taylor Swift And Super Bowl Controversy

May 27, 2025

The Kanye West Taylor Swift And Super Bowl Controversy

May 27, 2025 -

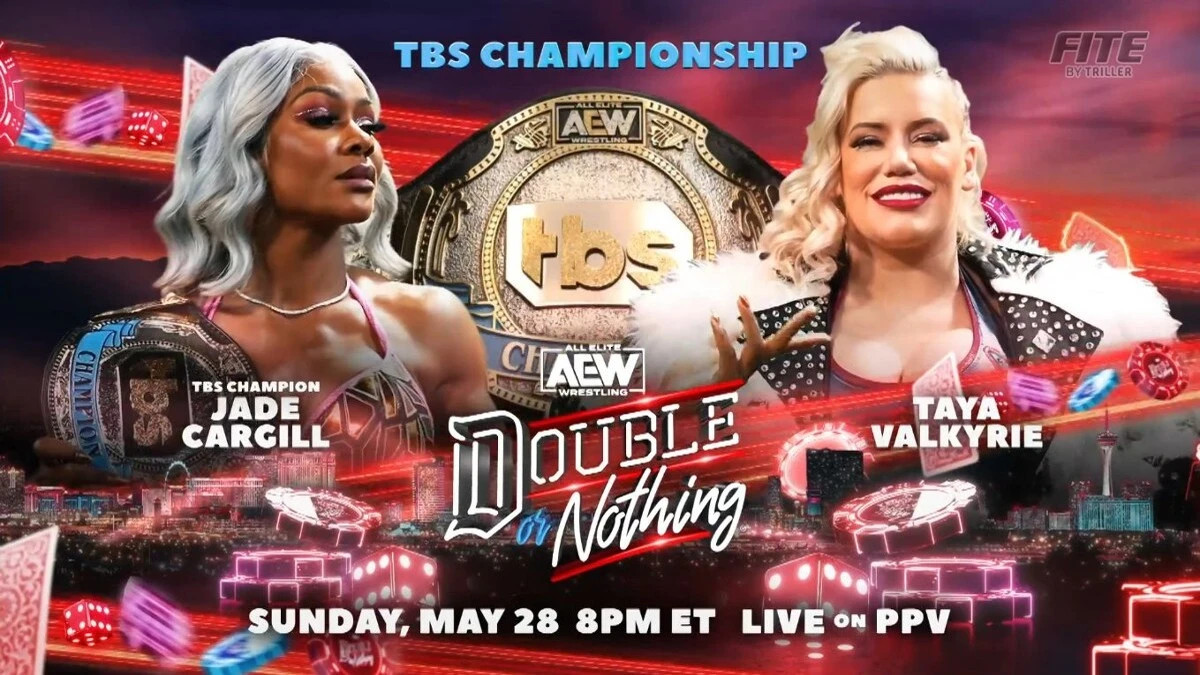

Aew Double Or Nothing 2025 Everything You Need To Know

May 27, 2025

Aew Double Or Nothing 2025 Everything You Need To Know

May 27, 2025

Latest Posts

-

Kennedy Centers Grenell Joins Live Nation Board Examining The Implications

May 29, 2025

Kennedy Centers Grenell Joins Live Nation Board Examining The Implications

May 29, 2025 -

Richard Grenell Trump Ally And Kennedy Center Head Joins Live Nation Board

May 29, 2025

Richard Grenell Trump Ally And Kennedy Center Head Joins Live Nation Board

May 29, 2025 -

I Lost My Job Heres How And Why Aussie Woman

May 29, 2025

I Lost My Job Heres How And Why Aussie Woman

May 29, 2025 -

Live Nation Appoints Richard Grenell To Board Trump Ally And Kennedy Center Head Joins

May 29, 2025

Live Nation Appoints Richard Grenell To Board Trump Ally And Kennedy Center Head Joins

May 29, 2025 -

Maltas Entertainment Scene Transformed Live Nations 356 Entertainment Acquisition

May 29, 2025

Maltas Entertainment Scene Transformed Live Nations 356 Entertainment Acquisition

May 29, 2025