CFP Board CEO Stepping Down: A Look Ahead For Financial Planning

Table of Contents

Impact on CFP Certification and Standards

The CFP certification is a hallmark of professionalism and expertise in the financial planning industry. Maintaining its integrity is paramount for the continued success and credibility of CFP professionals.

Maintaining the Integrity of the CFP Mark

The CFP mark represents a commitment to rigorous standards and ethical conduct. Upholding these standards is crucial for client trust and the overall reputation of the financial planning profession. The new CEO will need to ensure:

- Maintaining exam rigor: The CFP certification exam must continue to challenge candidates and ensure only highly qualified individuals earn the designation. This requires ongoing review and updates to the curriculum to reflect the evolving needs of the financial planning landscape.

- Ongoing professional development requirements: CFP professionals must engage in continuous learning to stay abreast of the latest industry trends, regulations, and best practices. Strengthening these requirements will enhance professional competency.

- Ethical conduct enforcement: The CFP Board's commitment to enforcing its Code of Ethics and Standards of Conduct must remain unwavering. This ensures client protection and maintains the high ethical standards expected of CFP professionals.

The leadership transition presents an opportunity to reassess and refine these processes, potentially enhancing the value and prestige of the CFP designation in the competitive financial services market. Any changes must carefully balance accessibility with maintaining the rigorous standards that define the CFP mark.

Addressing Ongoing Challenges to the Profession

The financial planning profession faces several significant challenges, including:

- Increased competition: Robo-advisors and other technology-driven platforms are disrupting traditional financial planning models, increasing competition for clients.

- Technological advancements: The rapid pace of technological change necessitates continuous adaptation and investment in new tools and platforms. Financial advisors must remain current to serve their clients effectively.

- Regulatory scrutiny: Increased regulatory oversight and compliance requirements demand greater attention to detail and potentially higher costs for CFP professionals.

The incoming CEO will need to develop strategies to address these challenges proactively. This may involve exploring new partnerships, advocating for regulatory reforms, and promoting the unique value proposition of human financial advisors who provide holistic wealth management and retirement planning.

Future Direction of the CFP Board

The CFP Board plays a critical role in shaping the future of the financial planning profession. The new CEO will have a significant influence on the Board's strategic priorities and its effectiveness in advocating for financial planners.

Strategic Priorities for the New CEO

The new CEO will likely focus on several key areas:

- Growth initiatives: Expanding the reach and recognition of the CFP certification both domestically and internationally.

- Technological advancements: Embracing and integrating technology to enhance the efficiency and effectiveness of the CFP Board's operations. This includes potentially leveraging technology for improved education and exam administration.

- Diversity and inclusion: Promoting diversity, equity, and inclusion within the CFP profession to better reflect the diverse client base.

- International expansion: Exploring opportunities to expand the CFP certification globally and increase its international recognition.

Successfully navigating these areas requires a visionary leader capable of fostering collaboration and driving innovation. The new CEO's ability to execute these strategic priorities will significantly shape the future of the CFP Board and the profession as a whole.

Advocacy for Financial Planning

The CFP Board plays a vital role in advocating for the financial planning profession and protecting consumers.

- Legislative changes: The Board must actively engage in legislative processes to influence policies that affect the financial planning industry and its clients. This includes advocating for policies that support consumer protection and promote financial literacy.

- Public awareness campaigns: Raising public awareness of the value and importance of financial planning through targeted marketing and educational initiatives. This is crucial for building public trust and confidence in CFP professionals.

- Consumer protection: Continuously working to enhance consumer protection measures and ensure ethical conduct within the profession.

The incoming CEO's leadership will significantly impact the CFP Board's effectiveness in these areas. Strong advocacy is crucial to securing the long-term growth and success of the financial planning industry and ensuring that clients receive high-quality, ethical financial advice.

Opportunities for Financial Planners

The changes within the CFP Board present both challenges and opportunities for individual financial planners. Adapting to the evolving industry landscape is crucial for success.

Adapting to Industry Changes

CFPs must embrace change and adapt to the shifting dynamics of the financial planning industry.

- Embracing fintech: Integrating financial technology tools and platforms into their practices to enhance efficiency and client service.

- Focusing on client experience: Providing personalized and exceptional client experiences to build loyalty and attract new clients.

- Providing holistic financial planning: Offering comprehensive financial planning services that address clients' diverse needs beyond investment management, such as retirement planning, tax planning, and estate planning.

By proactively adapting to these changes, CFPs can strengthen their competitive advantage and position themselves for continued success in the evolving financial landscape.

Strengthening Client Relationships

Building strong and lasting client relationships is critical for the success of any financial planner.

- Proactive communication: Maintaining consistent and transparent communication with clients to build trust and rapport.

- Personalized service: Tailoring financial plans to meet each client's unique circumstances, needs, and goals.

- Demonstrating value: Clearly communicating the value of financial planning services and how they benefit clients.

By prioritizing strong client relationships, CFP professionals can cultivate trust and build a thriving, sustainable practice.

Conclusion

The departure of the CFP Board CEO presents a pivotal moment for the financial planning profession. The new leadership will face significant challenges and opportunities in maintaining the integrity of the CFP certification, navigating industry changes, and advocating for financial planning. The future success of the CFP Board and the broader financial planning industry will depend on adapting to technological advancements, prioritizing client relationships, and consistently delivering high-quality financial planning services. The future of financial planning rests on the ability of CFP professionals and the CFP Board to adapt and innovate. Stay informed about developments within the CFP Board and continue to prioritize excellence in providing comprehensive financial planning services to your clients. Embrace technological advancements and advocate for the profession to ensure the continued success and relevance of Certified Financial Planners. Learn more about the CFP Board and its initiatives at [link to CFP Board website].

Featured Posts

-

Doubled Donations In Kendal Poppy Atkinson Fundraiser Update

May 03, 2025

Doubled Donations In Kendal Poppy Atkinson Fundraiser Update

May 03, 2025 -

Mta Sysdr Blay Styshn 6 Melwmat Wtwqeat

May 03, 2025

Mta Sysdr Blay Styshn 6 Melwmat Wtwqeat

May 03, 2025 -

Reform Uk Leader Nigel Farage In Shrewsbury Local Pub Visit And Political Commentary

May 03, 2025

Reform Uk Leader Nigel Farage In Shrewsbury Local Pub Visit And Political Commentary

May 03, 2025 -

Pm Modis Upcoming France Trip Ai Focus And Business Discussions

May 03, 2025

Pm Modis Upcoming France Trip Ai Focus And Business Discussions

May 03, 2025 -

Riot Fest 2025 Green Day Weezer Lead The Charge

May 03, 2025

Riot Fest 2025 Green Day Weezer Lead The Charge

May 03, 2025

Latest Posts

-

Morning Coffee Oilers Canadiens Matchup Game Day Preview

May 04, 2025

Morning Coffee Oilers Canadiens Matchup Game Day Preview

May 04, 2025 -

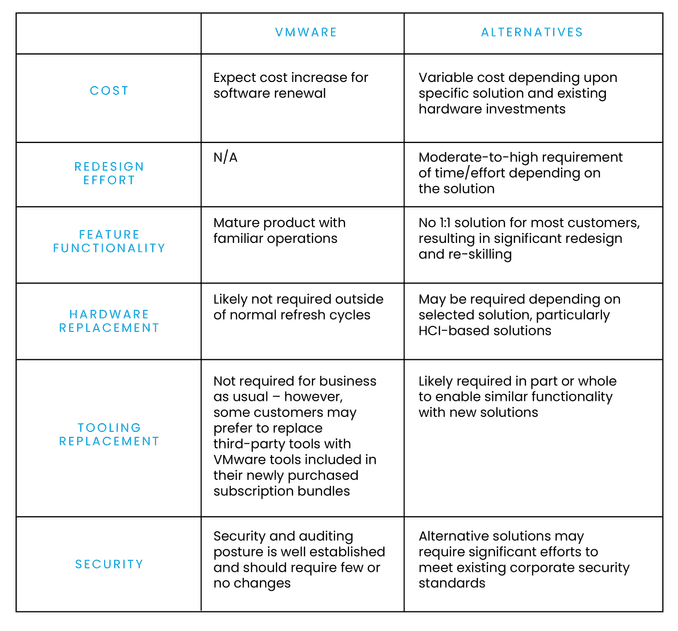

Broadcoms V Mware Acquisition At And T Details A Staggering 1050 Price Increase

May 04, 2025

Broadcoms V Mware Acquisition At And T Details A Staggering 1050 Price Increase

May 04, 2025 -

Will The Oilers Bounce Back A Morning Coffee Hockey Analysis

May 04, 2025

Will The Oilers Bounce Back A Morning Coffee Hockey Analysis

May 04, 2025 -

1050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Acquisition Costs

May 04, 2025

1050 Price Hike At And T Sounds Alarm On Broadcoms V Mware Acquisition Costs

May 04, 2025 -

Morning Coffee Oilers Chances Of Victory Against Montreal

May 04, 2025

Morning Coffee Oilers Chances Of Victory Against Montreal

May 04, 2025