Changes To Your Tax Code: HMRC And Savings Income

Table of Contents

Understanding Your Tax Code and its Impact on Savings Income

Your tax code is a number assigned by HMRC that determines how much income tax is deducted from your earnings. It's crucial to understand how this code impacts your savings income, encompassing interest from savings accounts, ISAs (Individual Savings Accounts), and Premium Bonds. Your tax code dictates your tax band and, consequently, the rate at which your savings interest is taxed.

The UK operates a progressive tax system with different tax bands and thresholds:

-

Basic rate: 20% tax on earnings above the personal allowance.

-

Higher rate: 40% tax on earnings above the higher-rate threshold.

-

Additional rate: 45% tax on earnings above the additional-rate threshold.

-

How your tax code affects your overall tax liability: Your tax code directly influences the amount of tax deducted at source from your savings interest. An incorrect tax code can lead to overpayment or underpayment of tax.

-

The difference between basic rate, higher rate, and additional rate taxpayers: Taxpayers fall into different brackets based on their total income. Higher earners pay a higher percentage of tax on their savings income.

-

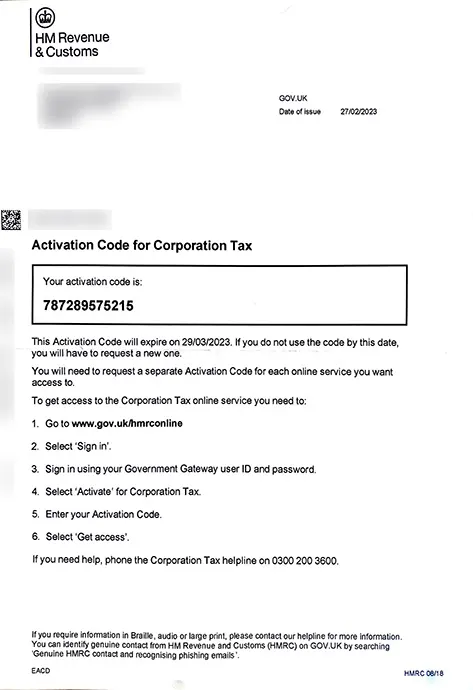

Where to find your tax code information online: You can find your tax code on your HMRC online account:

Recent Changes to HMRC's Savings Income Tax Rules

HMRC periodically updates its tax rules. Staying informed about these changes is vital for effective financial planning. Recent legislative changes might involve adjustments to tax thresholds, rates of tax applicable to savings income, or modifications to allowances.

- Specific examples of recent tax code alterations and their effect: For example, a change in the personal allowance could affect the amount of savings income taxed at the basic rate. Similarly, alterations to the higher-rate threshold influence the taxation of savings income for higher-rate taxpayers.

- Changes to the personal savings allowance (PSA): The PSA allows you to earn a certain amount of savings interest tax-free. Changes to the PSA directly impact the amount of interest you can receive without paying tax. Understanding these changes is vital for tax optimization.

- Impact on different types of savings accounts: The tax implications vary depending on the type of savings account. For example, ISAs offer tax-free savings, whereas interest from regular savings accounts is subject to income tax.

The Personal Savings Allowance (PSA) and its Implications

The Personal Savings Allowance (PSA) is a crucial aspect of understanding your HMRC savings income tax code changes. It's the amount of savings interest you can earn each tax year without paying income tax. The PSA applies to both basic-rate and higher-rate taxpayers, though the amounts differ.

- How the PSA reduces your tax bill: The PSA significantly reduces your tax liability by exempting a portion of your savings interest from tax.

- Limitations of the PSA (e.g., income thresholds): The PSA has limitations. If your savings income exceeds the allowance, the excess is taxed at your applicable rate. Furthermore, additional rate taxpayers generally do not benefit from the PSA.

- What to do if your savings income exceeds the PSA: If your savings income exceeds the PSA, you'll need to declare this on your self-assessment tax return. You might also consider exploring tax-efficient savings options.

Tax Implications of Different Savings Vehicles

Understanding the tax implications of different savings vehicles is crucial for effective financial planning. Various savings options offer varying degrees of tax efficiency.

- Tax advantages of ISAs: ISAs (Individual Savings Accounts) are popular because they offer tax-free growth and withdrawals. This makes them particularly attractive for long-term savings and investments.

- Tax treatment of interest from different accounts: Interest from regular savings accounts is taxed according to your tax code and income, while interest from ISAs is generally tax-free.

- Tax implications of withdrawing savings: Withdrawing savings typically doesn't incur additional tax unless you're withdrawing capital gains. However, understanding the specific terms of your account is critical.

HMRC Resources and Further Assistance

For detailed information and the latest updates on HMRC savings income tax code changes, utilize official HMRC resources:

- Link to the GOV.UK page on savings and tax:

- Link to the HMRC helpline contact information:

- Information on seeking professional tax advice: For complex situations or if you need personalized guidance, consider consulting a qualified financial advisor or tax professional.

Conclusion

Understanding the implications of HMRC savings income tax code changes is paramount for responsible financial management. This guide highlights the significance of your tax code, recent changes to the PSA, and the tax implications of different savings products. By staying informed about the latest HMRC updates regarding your HMRC savings income tax code, you can optimize your financial planning and avoid potential tax complications. Visit the GOV.UK website for the latest updates on HMRC savings income tax code changes and seek professional advice if needed.

Featured Posts

-

Astkhdam Aldhkae Alastnaey Lieadt Ktabt Rwayat Aghatha Krysty

May 20, 2025

Astkhdam Aldhkae Alastnaey Lieadt Ktabt Rwayat Aghatha Krysty

May 20, 2025 -

The Future Of Apples Llm Siri Challenges And Opportunities

May 20, 2025

The Future Of Apples Llm Siri Challenges And Opportunities

May 20, 2025 -

Sezonun Ilk Soku Tadic Fenerbahce Ye Veda Ediyor

May 20, 2025

Sezonun Ilk Soku Tadic Fenerbahce Ye Veda Ediyor

May 20, 2025 -

The Gretzky Loyalty Debate Examining The Fallout From Trumps Tariffs And Statehood Proposals

May 20, 2025

The Gretzky Loyalty Debate Examining The Fallout From Trumps Tariffs And Statehood Proposals

May 20, 2025 -

Manga Disaster Prediction Tourist Cancellations Surge

May 20, 2025

Manga Disaster Prediction Tourist Cancellations Surge

May 20, 2025

Latest Posts

-

Huuhkajien Uusi Valmennus Ja Tie Mm Karsintoihin

May 20, 2025

Huuhkajien Uusi Valmennus Ja Tie Mm Karsintoihin

May 20, 2025 -

Huuhkajat Mm Karsintoihin Uusi Valmennusstrategia

May 20, 2025

Huuhkajat Mm Karsintoihin Uusi Valmennusstrategia

May 20, 2025 -

Wwes Aj Styles Contract Status And Future Plans

May 20, 2025

Wwes Aj Styles Contract Status And Future Plans

May 20, 2025 -

Aj Styles Wwe Contract Latest Backstage Updates

May 20, 2025

Aj Styles Wwe Contract Latest Backstage Updates

May 20, 2025 -

Wwe Raw Zoey Stark Suffers Injury Match Cut Short

May 20, 2025

Wwe Raw Zoey Stark Suffers Injury Match Cut Short

May 20, 2025