Chime's New $500 Instant Loans: A Game Changer For Direct Deposit Users

Table of Contents

Understanding Chime's $500 Instant Loan

What is it?

Chime's $500 instant loan is a small, short-term loan designed to provide eligible Chime users with quick access to funds during emergencies. It's a convenient alternative to traditional payday loans, often offering more favorable terms.

- Instant access to funds: Receive the money directly into your Chime account almost immediately upon approval.

- Flexible repayment terms: Repayment is typically structured to align with your next payday, making it manageable. Specific terms will be outlined during the application process.

- No hidden fees: Chime is upfront about its fees and charges; there are no surprise costs associated with this loan product. This contrasts sharply with many payday lenders.

- Comparison to SpotMe: While SpotMe offers smaller, overdraft-like protection, the $500 instant loan provides a significantly larger sum for more substantial financial needs.

Eligibility Requirements

To qualify for Chime's $500 instant loan, you'll need to meet certain criteria. These requirements are designed to ensure responsible lending and to protect both Chime and its users.

- Direct deposit history: You must have a consistent history of receiving direct deposits into your Chime account. The frequency and amount of these deposits will be considered.

- Account age: Your Chime account must be active for a certain period. This timeframe helps Chime assess your account history and financial behavior.

- Spending habits: Chime analyzes your spending patterns to evaluate your ability to repay the loan. Responsible spending habits are crucial for approval.

- Credit score impact: Importantly, this loan doesn't typically impact your credit score. This is a significant advantage over traditional loans that can negatively affect your credit rating.

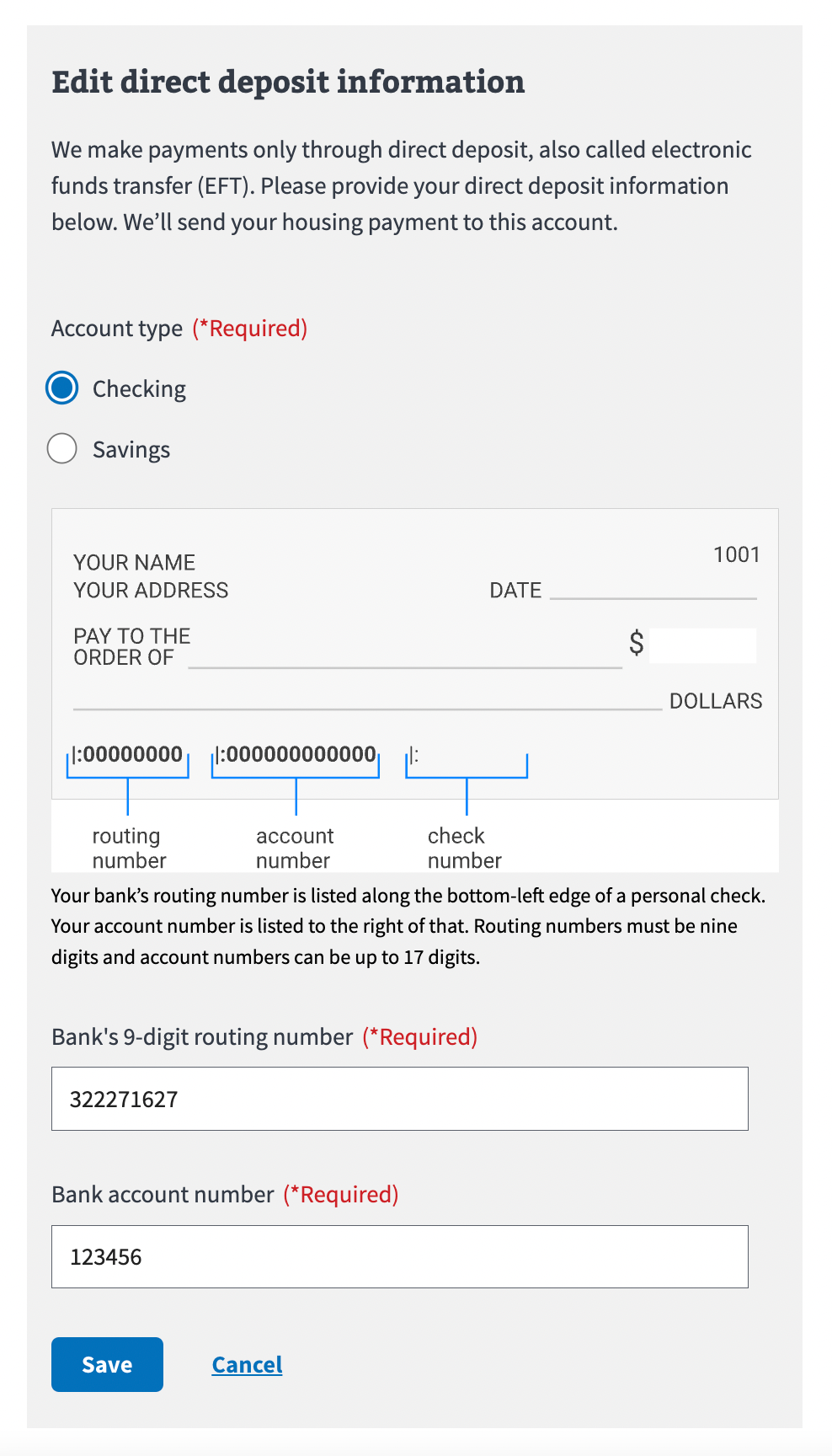

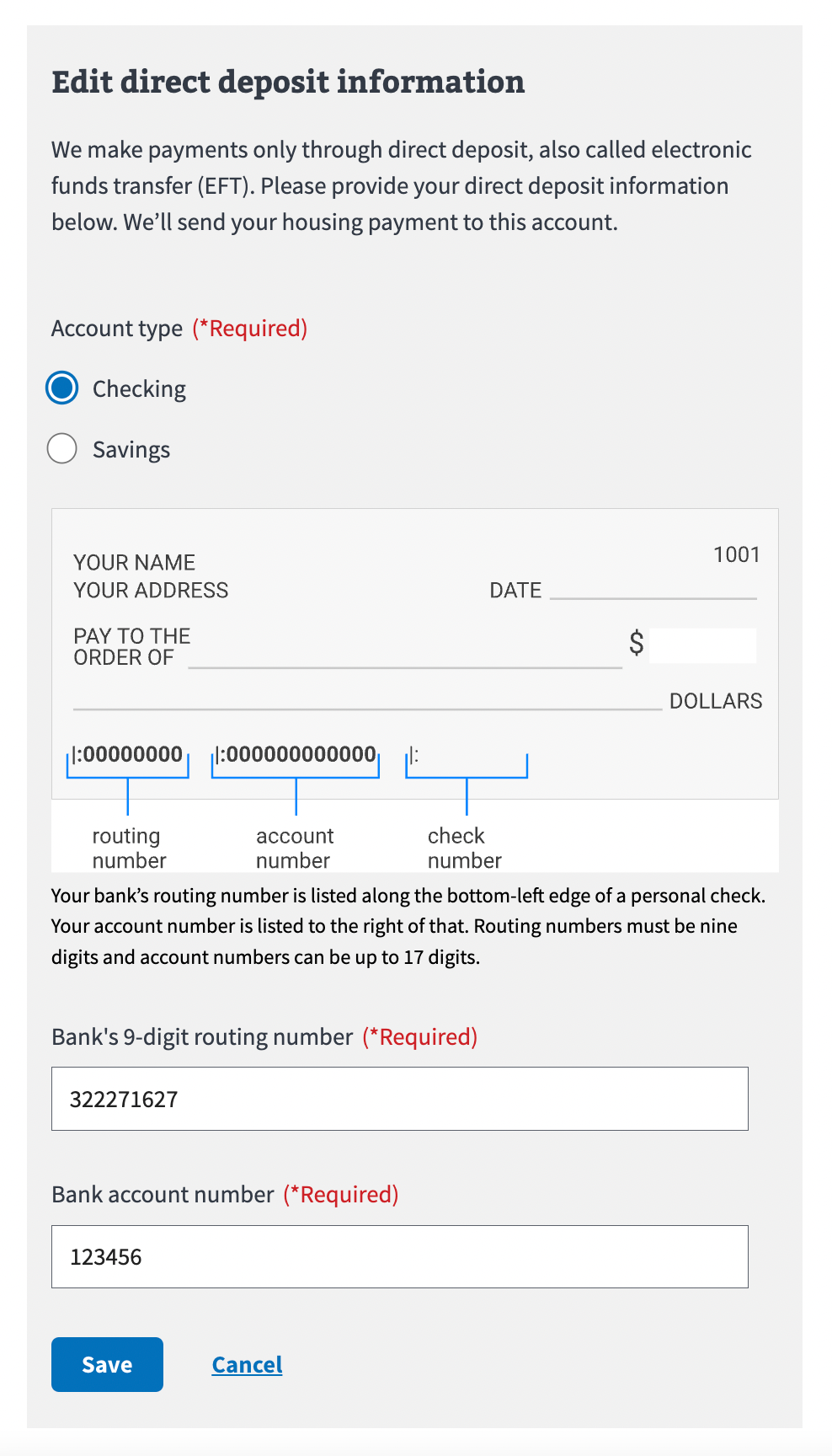

How to Apply

Applying for Chime's $500 instant loan is a straightforward process conducted entirely through the Chime mobile app.

- App navigation: Simply open your Chime app and look for the "Instant Loan" or similar section.

- Required information: You'll be asked to provide basic personal and financial information to complete the application. This information is used to verify your eligibility.

- Application approval process: Chime's system processes the application quickly. You'll typically receive a decision almost immediately.

- Funds disbursement time: Upon approval, the funds are usually transferred to your Chime account within minutes, providing almost instant access to the cash you need.

Advantages of Chime's $500 Instant Loan over Traditional Payday Loans

Lower Interest Rates (or lack thereof)

Chime's $500 instant loan aims to offer a significantly more affordable alternative to traditional payday loans. While specific interest rates can vary, they are often substantially lower than those charged by payday lenders.

- Interest rate comparisons: Research shows that payday loans often have APRs exceeding 400%, whereas Chime's offering is designed to be much more manageable.

- APR: Chime's APR will be clearly stated during the application process, ensuring transparency.

- Fee structures: Unlike payday loans with numerous hidden fees, Chime maintains a simple and transparent fee structure.

- Avoidance of debt cycles: The repayment structure helps avoid the trap of rolling over loans, a common problem with payday lenders that can lead to a cycle of debt.

Improved Financial Transparency

Chime prioritizes transparency in its loan terms, offering a stark contrast to the often-confusing and opaque practices of payday lenders.

- Easy-to-understand terms and conditions: All terms and conditions are clearly outlined, with no hidden clauses or confusing jargon.

- No hidden charges: You'll know exactly what you're paying upfront – there are no surprise fees added later.

- Accessible repayment information: Chime makes it easy to track your payments and understand your repayment schedule.

Convenience and Accessibility

Accessing funds through Chime's instant loan is remarkably convenient and accessible compared to traditional lending options.

- Instant loan disbursement: Get the funds you need almost immediately, without waiting days or weeks for approval.

- 24/7 accessibility: Apply for the loan at any time, day or night, through the Chime app.

- No physical paperwork: The entire process is digital, eliminating the need for paperwork and physical visits to a lender's office.

Responsible Borrowing with Chime's Instant Loan

Budgeting and Financial Planning

While Chime's instant loan offers a helpful financial solution, responsible borrowing habits are crucial.

- Creating a budget: Develop a detailed budget to track your income and expenses, ensuring you can afford the loan repayments.

- Tracking expenses: Monitor your spending carefully to identify areas where you can cut back and save money.

- Prioritizing repayments: Treat the loan repayment as a high priority to avoid late fees and potential negative consequences.

- Avoiding overspending: Use the loan only for essential expenses and avoid using it for non-essential purchases.

Alternatives to Instant Loans

Before applying for an instant loan, explore alternative solutions for managing unexpected expenses.

- Emergency savings fund: Building an emergency fund is the best way to handle unforeseen financial challenges.

- Negotiating with creditors: If facing bill payments, try negotiating with creditors for extended payment plans.

- Seeking assistance from non-profit organizations: Many non-profit organizations offer financial assistance and counseling to those in need.

Conclusion

Chime's $500 instant loan offers a convenient and potentially less expensive alternative to traditional payday loans for eligible direct deposit users facing unexpected financial challenges. Understanding the eligibility criteria and practicing responsible borrowing habits are crucial for maximizing the benefits of this service.

Call to Action: Is a $500 instant loan the solution to your immediate financial needs? Check your Chime app today to see if you qualify for Chime's instant loan and take control of your finances! Learn more about Chime’s instant loan options and how to access financial relief quickly.

Featured Posts

-

End Of Ryujinx Nintendo Contact Leads To Emulator Shutdown

May 14, 2025

End Of Ryujinx Nintendo Contact Leads To Emulator Shutdown

May 14, 2025 -

Lindts Central London Chocolate Shop A Sweet Escape

May 14, 2025

Lindts Central London Chocolate Shop A Sweet Escape

May 14, 2025 -

Ocio En Sevilla Miercoles 7 De Mayo De 2025

May 14, 2025

Ocio En Sevilla Miercoles 7 De Mayo De 2025

May 14, 2025 -

Scotty Mc Creerys Sons Adorable George Strait Tribute A Must Watch Video

May 14, 2025

Scotty Mc Creerys Sons Adorable George Strait Tribute A Must Watch Video

May 14, 2025 -

Italian Open Sinner Reaches Last 16 Osaka Eliminated

May 14, 2025

Italian Open Sinner Reaches Last 16 Osaka Eliminated

May 14, 2025

Latest Posts

-

Exploring Vince Vaughns Ethnicity Italian Or Not

May 14, 2025

Exploring Vince Vaughns Ethnicity Italian Or Not

May 14, 2025 -

Untold Judd Family Stories Wynonna And Ashleys Docuseries

May 14, 2025

Untold Judd Family Stories Wynonna And Ashleys Docuseries

May 14, 2025 -

Is Vince Vaughn Of Italian Descent A Look At His Family Roots

May 14, 2025

Is Vince Vaughn Of Italian Descent A Look At His Family Roots

May 14, 2025 -

Vince Vaughns Heritage Unpacking His Ancestry

May 14, 2025

Vince Vaughns Heritage Unpacking His Ancestry

May 14, 2025 -

Wynonna And Ashley Judd A Familys Untold Story In New Docuseries

May 14, 2025

Wynonna And Ashley Judd A Familys Untold Story In New Docuseries

May 14, 2025