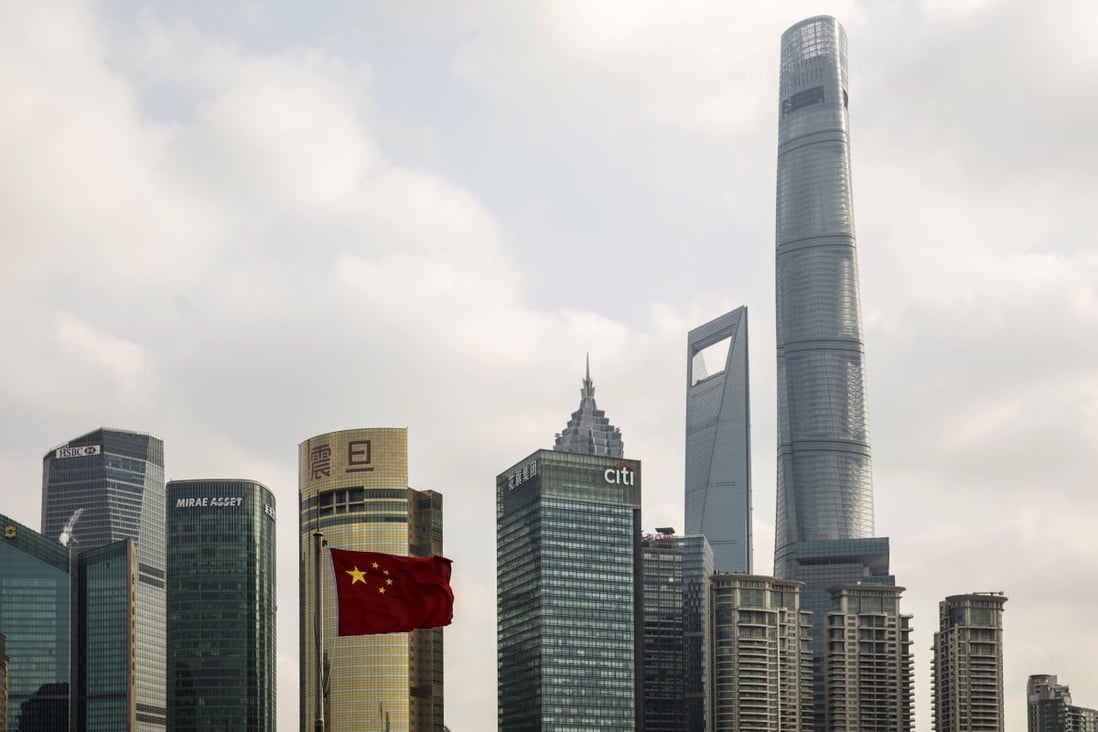

China Eases Monetary Policy Amidst Trade Tensions: Lower Rates And Increased Lending

Table of Contents

Interest Rate Cuts and Their Impact

The PBOC's recent actions involve substantial cuts to key interest rates, a clear signal of monetary easing aimed at injecting stimulus into the slowing economy. These cuts directly impact borrowing costs, influencing both businesses and consumers. The hope is to encourage increased investment and consumer spending, thereby bolstering economic activity.

- Specific Reductions: The benchmark lending rate (LPR) and the policy rate have seen significant percentage reductions (insert specific percentages here if available, citing a credible source).

- Impact on Borrowing Costs: Lower interest rates translate to reduced borrowing costs for businesses, making it cheaper to secure loans for expansion, investment in new technologies, and hiring. Consumers also benefit from lower interest rates on mortgages and other loans, potentially increasing consumer spending.

- Effect on Investment and Spending: The expectation is that lower borrowing costs will encourage businesses to invest more aggressively and consumers to increase their spending, thus driving economic growth. However, the effectiveness will depend on various factors, including consumer and business confidence.

- Comparison to Previous Cuts: (Compare the current cuts to previous instances, analyzing their effectiveness and any differences in the current economic climate).

Increased Lending and Credit Availability

Alongside interest rate cuts, the PBOC has implemented measures to increase credit availability. This involves injecting liquidity into the financial markets and encouraging banks to lend more freely. The aim is to provide crucial financial support to businesses, especially those affected by the trade war.

- Measures to Boost Lending: The PBOC has utilized several tools, including adjustments to the reserve requirement ratio (RRR) – the amount of capital banks must hold in reserve – and the introduction of targeted lending programs to specific sectors. (Specify details on the RRR adjustments and targeted programs, citing sources).

- Impact on Economic Sectors: Increased lending is expected to support various sectors, including manufacturing, real estate, and infrastructure development. However, the effectiveness and distribution of credit across these sectors will vary.

- Potential Risks: While increased credit can stimulate growth, it also carries risks. Rapid credit growth can lead to increased debt levels, potentially creating financial instability and the formation of asset bubbles. Careful monitoring and regulation are crucial to mitigate these risks.

Trade Tensions and Their Influence on Monetary Policy

The ongoing trade war between the US and China is a primary driver behind the PBOC's decision to ease monetary policy. The trade dispute has negatively impacted Chinese exports, leading to slower economic growth and increased uncertainty. The monetary easing serves as a counteractive measure to mitigate these negative impacts.

- Impact of Tariffs and Trade Restrictions: Tariffs and trade restrictions have directly impacted Chinese exports and consequently GDP growth. (Provide data and sources to illustrate this impact).

- Mitigation of Negative Impacts: The easing of monetary policy aims to offset the slowdown caused by trade tensions by stimulating domestic demand and investment.

- Potential for Further Adjustments: The future direction of China's monetary policy will largely depend on the evolution of the US-China trade relationship. Further adjustments may be necessary depending on the severity and duration of the trade tensions.

The Yuan (RMB) and Exchange Rate Implications

The monetary easing has implications for the value of the Chinese Yuan (RMB) and its exchange rate against other major currencies. Lower interest rates can potentially lead to currency depreciation as capital flows out seeking higher returns elsewhere.

- Current Exchange Rate Trends: (Discuss current trends in the RMB exchange rate, citing reliable sources).

- Impact of Lower Interest Rates on Capital Flows: Lower interest rates can make the RMB less attractive to foreign investors, potentially leading to capital outflows and depreciation of the currency.

- PBOC Intervention: The PBOC may intervene in the foreign exchange market to manage the RMB's exchange rate, aiming to maintain stability and prevent excessive volatility.

Conclusion

China's easing of monetary policy, characterized by significant interest rate cuts and increased lending, is a direct response to the economic challenges posed by escalating trade tensions. The aim is to stimulate economic growth and counteract the negative impacts on various sectors. While this approach can boost economic activity, it also carries inherent risks related to debt levels and potential currency fluctuations. Understanding the complexities of these actions and their potential consequences is crucial for navigating the evolving global economic landscape. Stay tuned for more updates on China's evolving monetary policy and its impact on trade and economic growth.

Featured Posts

-

Arsenal Vs Psg Champions League Final Hargreaves Prediction

May 08, 2025

Arsenal Vs Psg Champions League Final Hargreaves Prediction

May 08, 2025 -

Deset Pobedi Po Red Za Vesprem Triumf Nad Ps Zh

May 08, 2025

Deset Pobedi Po Red Za Vesprem Triumf Nad Ps Zh

May 08, 2025 -

Play Station Plus March 2024 Premium And Extra Game Lineup

May 08, 2025

Play Station Plus March 2024 Premium And Extra Game Lineup

May 08, 2025 -

Economists Warn Canada Needs To Address Overvalued Canadian Dollar Against The Us Dollar

May 08, 2025

Economists Warn Canada Needs To Address Overvalued Canadian Dollar Against The Us Dollar

May 08, 2025 -

The Long Walk Trailer Mark Hamill Steps Away From Luke Skywalker

May 08, 2025

The Long Walk Trailer Mark Hamill Steps Away From Luke Skywalker

May 08, 2025

Latest Posts

-

Nfl News Browns Sign Experienced Wide Receiver And Return Specialist

May 08, 2025

Nfl News Browns Sign Experienced Wide Receiver And Return Specialist

May 08, 2025 -

Jokic I Dzordan Tradicija Tri Poljupca I Uloga Bobija Marjanovica

May 08, 2025

Jokic I Dzordan Tradicija Tri Poljupca I Uloga Bobija Marjanovica

May 08, 2025 -

Westbrook Leads Nuggets In Birthday Song For Jokic

May 08, 2025

Westbrook Leads Nuggets In Birthday Song For Jokic

May 08, 2025 -

Deandre Dzordan Objasnjava Ritual Ljubljenja Sa Jokicem

May 08, 2025

Deandre Dzordan Objasnjava Ritual Ljubljenja Sa Jokicem

May 08, 2025 -

Veteran Wide Receiver Joins Cleveland Browns Roster

May 08, 2025

Veteran Wide Receiver Joins Cleveland Browns Roster

May 08, 2025