China Life Profitability Enhanced By Robust Investment Strategy

Table of Contents

Diversification: A Cornerstone of China Life's Investment Success

Diversification is paramount in mitigating investment risk, and China Life's strategy exemplifies this principle. By spreading investments across various asset classes, they minimize the impact of underperformance in any single sector. China Life’s investment portfolio is a testament to this approach.

- Equities: A significant portion of their portfolio is allocated to both domestic and international equities, providing exposure to diverse growth opportunities.

- Bonds: Government and corporate bonds offer stability and predictable income streams, balancing the riskier equity investments.

- Real Estate: China Life strategically invests in real estate projects, capitalizing on the long-term growth potential of the property market.

- Alternative Investments: This includes investments in private equity, infrastructure projects, and other alternative assets, enhancing diversification and potential returns.

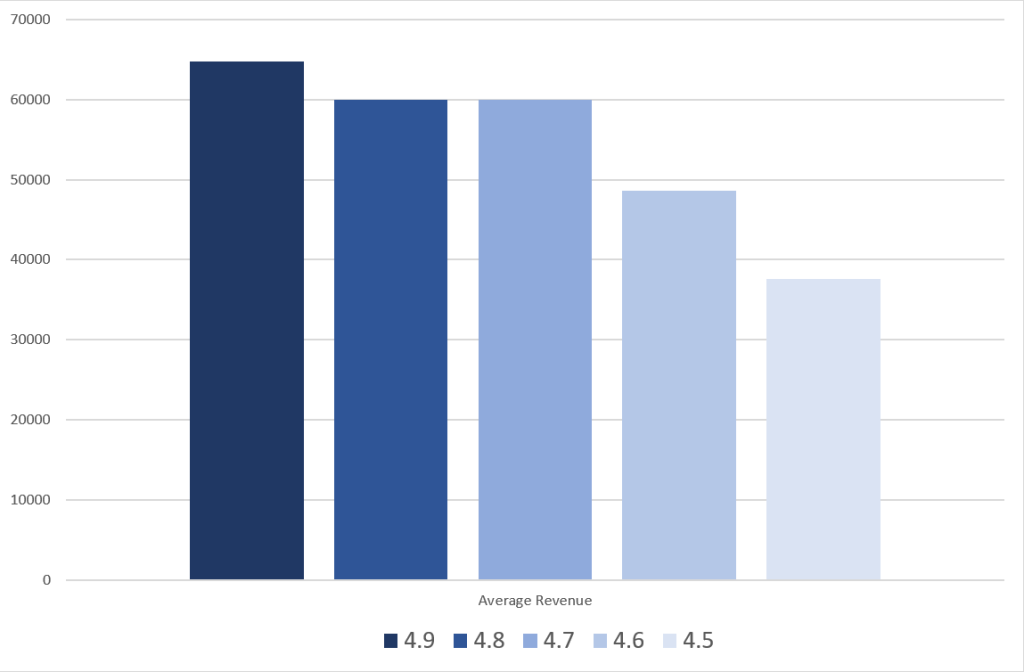

For example, a recent analysis might show a portfolio allocation like this: 40% equities (domestic and international), 30% bonds, 20% real estate, and 10% alternative investments. This balance allows for a robust China Life Investment Strategy that effectively manages risk while pursuing strong returns. Keywords: China Life Investment Strategy, Diversification, Asset Allocation, Risk Management

Strategic Asset Allocation: Maximizing Returns and Minimizing Risk

China Life doesn't simply diversify; it employs sophisticated asset allocation strategies to maximize returns while carefully managing risk. Their decisions are driven by a combination of quantitative and qualitative analysis, considering macroeconomic factors, market trends, and long-term strategic goals. They use advanced models to predict market movements and adjust their allocations accordingly.

- Quantitative Analysis: Utilizes econometric models and statistical data to identify optimal portfolio weights and risk exposures.

- Qualitative Analysis: Considers geopolitical events, regulatory changes, and industry trends to inform investment choices.

For instance, during periods of market uncertainty, China Life might shift a larger portion of its portfolio towards lower-risk assets like government bonds, preserving capital and limiting potential losses. Conversely, during periods of economic expansion, they may increase exposure to higher-growth equities. This dynamic approach contributes to China Life Investment Performance and enables them to consistently achieve strong risk-adjusted returns. Keywords: Asset Allocation Strategy, China Life Investment Performance, Risk-Adjusted Return

Sophisticated Risk Management Framework: Protecting Against Downside

China Life’s impressive profitability isn't solely due to aggressive investment; it's also a result of a proactive and robust risk management framework. This framework protects against potential losses and ensures financial stability.

- Stress Testing: China Life regularly conducts stress tests to simulate the impact of various adverse scenarios, such as a sharp market downturn or a significant geopolitical event.

- Scenario Analysis: They develop various scenarios to assess the potential impact of different market conditions on their portfolio.

- Regulatory Compliance: Strict adherence to regulatory guidelines ensures transparency and accountability in their investment activities.

Through these mechanisms, China Life effectively mitigates potential losses, safeguarding its financial stability. This commitment to risk management is a cornerstone of their China Life Investment approach and fosters investor confidence. Keywords: Risk Management, China Life Investment, Financial Stability, Regulatory Compliance

Long-Term Vision and Strategic Partnerships: Fueling Sustainable Growth

China Life’s long-term investment horizon is a significant factor in its profitability. This approach allows for a patient investment strategy, focusing on long-term value creation rather than short-term gains. Strategic partnerships further amplify this success.

- Long-Term Investment Horizon: This patient approach allows China Life to weather market fluctuations and capitalize on long-term growth opportunities.

- Strategic Partnerships: Collaborations with other financial institutions and investment firms provide access to specialized expertise and unique investment opportunities.

These partnerships also provide valuable insights into emerging markets and innovative investment strategies, supporting sustainable growth. This commitment to long-term strategic planning and collaborative ventures contributes significantly to China Life Investments' success. Keywords: Long-Term Investment Strategy, Strategic Partnerships, Sustainable Growth, China Life Investments

Conclusion: China Life's Winning Formula: A Robust Investment Strategy for Continued Success

China Life's remarkable profitability stems from a multi-faceted investment strategy characterized by diversification, strategic asset allocation, robust risk management, and a long-term vision. Their sophisticated approach, which combines quantitative and qualitative analysis with a commitment to risk mitigation, serves as a model for achieving and sustaining strong financial performance. The success of China Life's investment strategy highlights the importance of a well-defined plan that integrates these elements. Learn more about how a robust investment strategy, like the one employed by China Life, can enhance your own financial performance.

Featured Posts

-

Dealers Intensify Fight Against Ev Sales Quotas

Apr 30, 2025

Dealers Intensify Fight Against Ev Sales Quotas

Apr 30, 2025 -

20 Increase In Airbnb Domestic Searches Canadians Favor Staycations

Apr 30, 2025

20 Increase In Airbnb Domestic Searches Canadians Favor Staycations

Apr 30, 2025 -

Ru Pauls Drag Race Uncovering An Nba Legends Hidden Connection

Apr 30, 2025

Ru Pauls Drag Race Uncovering An Nba Legends Hidden Connection

Apr 30, 2025 -

Nothings Second Gen Modular Phone Innovation And Adaptability

Apr 30, 2025

Nothings Second Gen Modular Phone Innovation And Adaptability

Apr 30, 2025 -

6 Doi Thu Thua Cuoc Tam Hop Vuon Len Trung Thau Du An Cap Nuoc Gia Dinh

Apr 30, 2025

6 Doi Thu Thua Cuoc Tam Hop Vuon Len Trung Thau Du An Cap Nuoc Gia Dinh

Apr 30, 2025

Latest Posts

-

Solid Skenes Start Not Enough As Team Falls Short

Apr 30, 2025

Solid Skenes Start Not Enough As Team Falls Short

Apr 30, 2025 -

Lich Thi Dau Va Thong Tin Vong Chung Ket Tnsv Thaco Cup 2025

Apr 30, 2025

Lich Thi Dau Va Thong Tin Vong Chung Ket Tnsv Thaco Cup 2025

Apr 30, 2025 -

Thaco Cup 2025 Lich Thi Dau Chinh Thuc Vong Chung Ket Hap Dan

Apr 30, 2025

Thaco Cup 2025 Lich Thi Dau Chinh Thuc Vong Chung Ket Hap Dan

Apr 30, 2025 -

La Flaminia Conquista La Seconda Posizione Analisi Della Rimonta

Apr 30, 2025

La Flaminia Conquista La Seconda Posizione Analisi Della Rimonta

Apr 30, 2025 -

Vong Chung Ket Tnsv Thaco Cup 2025 Xem Truc Tiep O Dau Va Khi Nao

Apr 30, 2025

Vong Chung Ket Tnsv Thaco Cup 2025 Xem Truc Tiep O Dau Va Khi Nao

Apr 30, 2025