China's Economic Strategy: Special Bonds To Combat Trade War Impact

Table of Contents

The Role of Fiscal Stimulus in China's Response to the Trade War

Faced with the trade war's headwinds, China relied heavily on fiscal stimulus as a countermeasure. This involved a significant increase in government spending designed to boost economic activity and offset the decline in export-oriented industries. This expansionary fiscal policy aimed to maintain economic growth and employment levels. The increased government spending had a ripple effect, stimulating various sectors of the economy.

- Increased government expenditure on infrastructure projects: Massive investments were channeled into transportation networks, energy grids, and digital infrastructure.

- Tax cuts and subsidies for businesses: These measures aimed to encourage investment, prevent business closures, and support employment.

- Expansion of social welfare programs: This provided a safety net for vulnerable populations and supported consumer spending.

This proactive fiscal stimulus, fueled by increased government spending and strategic investments, aimed to counteract the negative impacts of the trade war on China's economic growth and maintain overall stability. Effective fiscal policy is a crucial component of China's economic policy.

Special Bonds: A Key Instrument of Fiscal Expansion

Special bonds played a pivotal role in financing the ambitious infrastructure projects central to China's fiscal expansion. Unlike traditional government bonds, special bonds are often earmarked for specific projects, offering greater transparency and accountability in their allocation. These bonds allowed the government to channel funds efficiently towards pre-determined objectives, providing a targeted approach to fiscal stimulus.

- Types of special bonds issued: Local government special bonds were predominantly utilized, allowing regional governments to undertake crucial infrastructure projects.

- Allocation of funds across different sectors: Significant funds were allocated to transportation (high-speed rail, roads), energy (renewable energy projects), and technology (5G infrastructure, digitalization).

- Mechanisms for oversight and accountability: While mechanisms existed, concerns regarding debt management and potential risks associated with large-scale issuance needed careful monitoring.

This targeted approach to infrastructure financing via special bonds proved to be a crucial mechanism within China's fiscal policy and debt management strategies.

Infrastructure Development: A Catalyst for Economic Growth

The infrastructure investment fueled by special bonds acted as a powerful catalyst for economic growth. Projects created numerous jobs, stimulated related industries (cement, steel, construction equipment), and boosted overall economic activity. This approach aimed to not only counter the immediate impact of the trade war but also to lay the foundation for long-term sustainable development.

- Examples of major infrastructure projects funded by special bonds: The expansion of high-speed rail networks, the development of renewable energy sources, and the construction of new smart cities are prime examples.

- Job creation in construction and related sectors: Millions of jobs were created directly and indirectly through these infrastructure projects, mitigating unemployment pressures.

- Contribution to long-term productivity gains: Improved infrastructure enhances efficiency, connectivity, and logistics, leading to increased productivity and economic competitiveness in the long run.

Investing in infrastructure, a cornerstone of China's long-term growth strategy, proved to be a successful strategy in mitigating the trade war's immediate negative effects and creating a foundation for sustainable development.

Assessing the Effectiveness and Long-Term Implications of China's Special Bond Strategy

China's special bond strategy, while effective in mitigating the short-term impact of the trade war, also presents long-term challenges. While GDP growth was positively impacted, the increase in government debt requires careful management to ensure debt sustainability. The long-term effects on China's economic structure and its global position remain a subject of ongoing analysis.

- Positive impacts on GDP growth: Special bonds contributed to maintaining a relatively stable growth rate during a period of significant external economic pressure.

- Potential challenges related to debt sustainability: The rapid increase in government debt necessitates prudent fiscal management and careful monitoring of potential risks.

- Long-term effects on industrial policy and economic diversification: The strategy’s effectiveness in promoting economic diversification and long-term structural reforms remains to be fully assessed.

Evaluating the overall success requires considering both the positive short-term effects and the potential long-term implications for China’s economic stability and its role in the global economic outlook.

Conclusion: Understanding China's Economic Strategy: Special Bonds and Future Outlook

China employed special bonds as a crucial component of its economic strategy to counter the negative impact of the trade war. Fiscal stimulus and strategic infrastructure development, financed through special bonds, played a significant role in maintaining economic growth and stability. The strategy's long-term implications, particularly regarding debt sustainability and economic diversification, require continued monitoring. This strategy's effectiveness provides valuable insights for other nations facing similar economic challenges. To further your understanding of China's economic response, delve deeper by searching for terms like "China's fiscal policy," "China's infrastructure investment," or "impact of trade war on China." Understanding China's economic strategy, especially the role of special bonds, is crucial for comprehending its ongoing economic trajectory and global influence.

Featured Posts

-

Man Transforms After 30 Stone Weight Loss A Pals Harsh Words Sparked Change

Apr 25, 2025

Man Transforms After 30 Stone Weight Loss A Pals Harsh Words Sparked Change

Apr 25, 2025 -

Winnipeg Named Hq Milgaard Family Awaits Commission Launch

Apr 25, 2025

Winnipeg Named Hq Milgaard Family Awaits Commission Launch

Apr 25, 2025 -

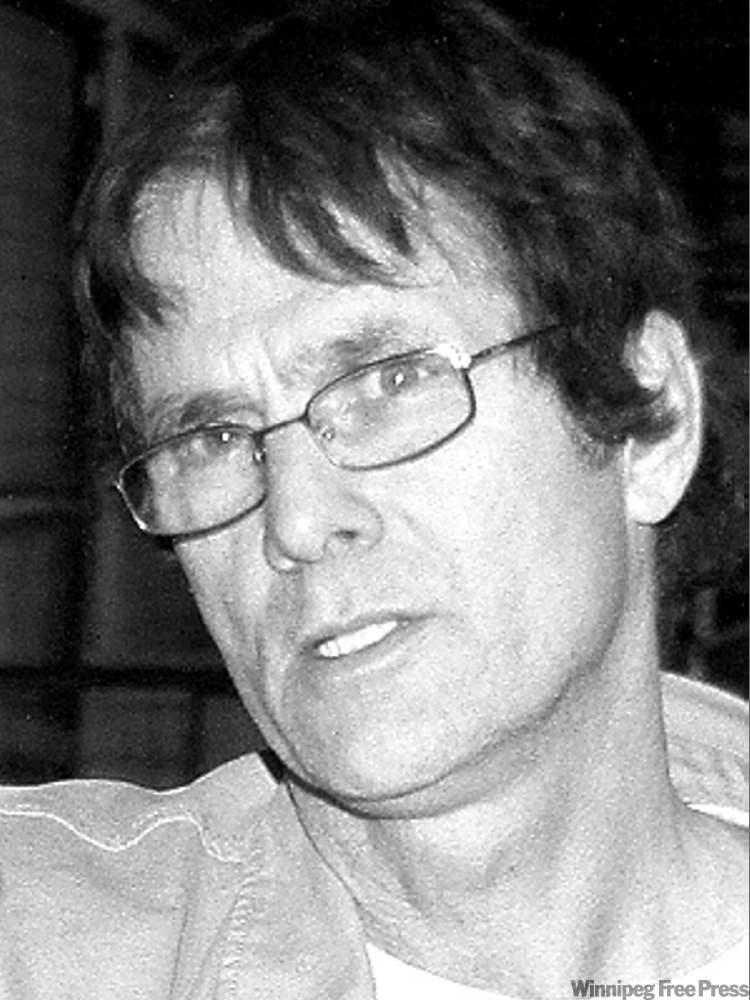

A Famous Wwii Image Revealing Hidden Narratives Of Jewish Survival

Apr 25, 2025

A Famous Wwii Image Revealing Hidden Narratives Of Jewish Survival

Apr 25, 2025 -

Trumps Crypto Connections Dinner With Leading Meme Coin Investors

Apr 25, 2025

Trumps Crypto Connections Dinner With Leading Meme Coin Investors

Apr 25, 2025 -

Judge Rules Against Section 230 Protection For Banned Chemicals On E Bay

Apr 25, 2025

Judge Rules Against Section 230 Protection For Banned Chemicals On E Bay

Apr 25, 2025

Latest Posts

-

Chris Kaba Panorama Police Watchdog Challenges Ofcom

Apr 30, 2025

Chris Kaba Panorama Police Watchdog Challenges Ofcom

Apr 30, 2025 -

Police Watchdogs Ofcom Complaint The Chris Kaba Panorama Episode

Apr 30, 2025

Police Watchdogs Ofcom Complaint The Chris Kaba Panorama Episode

Apr 30, 2025 -

Implementing A Robust System For Corrections And Clarifications

Apr 30, 2025

Implementing A Robust System For Corrections And Clarifications

Apr 30, 2025 -

Mastering Corrections And Clarifications Best Practices For Journalists And Writers

Apr 30, 2025

Mastering Corrections And Clarifications Best Practices For Journalists And Writers

Apr 30, 2025 -

Kaba Shooting Jury Delivers Not Guilty Verdict For Met Police Officer

Apr 30, 2025

Kaba Shooting Jury Delivers Not Guilty Verdict For Met Police Officer

Apr 30, 2025