China's Steel Industry Slowdown: Implications For Iron Ore Demand And Prices

Table of Contents

Declining Construction Activity and its Impact on Steel Demand

China's voracious appetite for steel has historically been fueled by its booming construction sector, encompassing both infrastructure projects and real estate development. The relationship between construction activity and steel consumption is undeniable; a slowdown in one directly translates to reduced demand for the other. Currently, we're witnessing a significant deceleration in this crucial driver of steel demand.

- Reduced government spending on infrastructure projects: A shift in government priorities and a focus on debt reduction have led to a decrease in funding for large-scale infrastructure initiatives, impacting steel demand significantly. This is particularly evident in areas like high-speed rail and highway construction.

- Slowdown in the real estate sector due to debt concerns and regulatory changes: The Chinese real estate market, a major consumer of steel, is facing headwinds from increased debt concerns and stringent government regulations aimed at curbing excessive speculation and unsustainable growth. This has resulted in a significant decrease in new construction starts and a slowdown in overall activity.

- Impact on steel mill production quotas and operating rates: As demand weakens, steel mills are forced to reduce production quotas, leading to lower operating rates and impacting profitability across the industry. This, in turn, reduces the demand for raw materials like iron ore.

- Decreased construction activity in key regions: The slowdown isn't uniform across China. However, key regions previously experiencing rapid growth, such as tier-one and tier-two cities, are now showing demonstrable decreases in construction activity, further contributing to the overall decline in steel demand. This includes regions vital to the China construction slowdown and impacts overall infrastructure spending in China.

The Role of Government Policies in Shaping Steel Production

China's government is actively pursuing policies aimed at reducing carbon emissions and promoting sustainable development. These policies, while beneficial for the environment in the long run, are creating short-term challenges for the steel industry.

- Environmental regulations impacting steel production: Stricter environmental regulations are forcing steel mills to adopt cleaner production methods and reduce their carbon footprint. This often involves significant investments in new technologies and potentially reduced output during the transition. The China steel industry regulations are a key factor in shaping the industry’s future.

- Policies promoting green steel production and alternative materials: The government is actively encouraging the development and adoption of green steel production technologies and exploring alternative building materials to reduce reliance on steel. This shift towards green steel initiatives could fundamentally alter the industry's landscape.

- Government initiatives to curb overcapacity in the steel industry: Efforts to consolidate the steel industry and eliminate overcapacity have resulted in the closure of some less efficient steel mills, further reducing overall production. This addresses the issue of steel overcapacity in China.

- Analysis of the effectiveness of these policies: The effectiveness of these policies is still being assessed. While the environmental benefits are clear, the short-term economic impacts on the steel industry and related sectors are significant and complex.

Shifting Global Demand and the Impact on Iron Ore Prices

The slowdown in China's steel industry significantly impacts global iron ore demand and consequently, its price. China's reduced steel production directly translates into lower iron ore imports.

- Impact on iron ore prices from reduced Chinese imports: China is the world's largest importer of iron ore. Reduced Chinese imports immediately put downward pressure on iron ore prices, affecting producers and traders globally. The iron ore price forecast is heavily dependent on Chinese demand.

- Competition from other steel-producing nations: The global steel market is becoming increasingly competitive, with other nations seeking to increase their steel production and potentially offsetting some of the reduced demand from China.

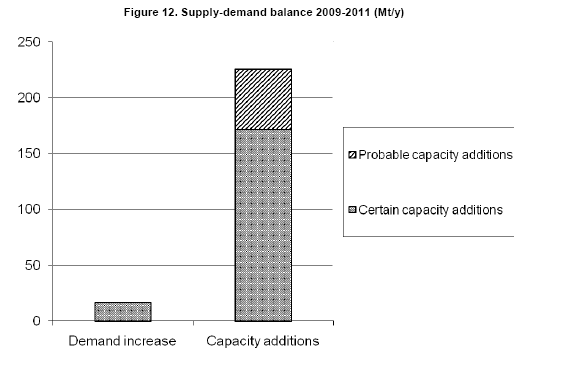

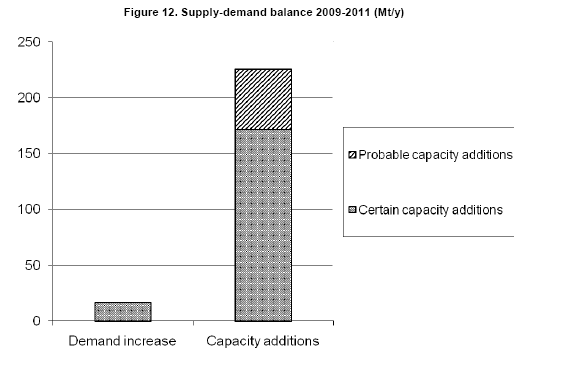

- Analysis of supply and demand dynamics in the iron ore market: The current scenario is characterized by a surplus of iron ore supply compared to demand, further exacerbating the downward pressure on prices. The iron ore demand outlook is closely tied to the global economic climate and China's domestic policies.

- Potential price volatility and forecasting: Given the interplay of various factors, the iron ore market is expected to experience considerable price volatility in the coming period. Accurate forecasting remains challenging.

Opportunities and Challenges for Iron Ore Producers

The changing market conditions present both opportunities and challenges for iron ore producers.

- Strategies to mitigate risks associated with reduced Chinese demand: Producers are actively diversifying their customer base, seeking new markets beyond China to mitigate the risk of over-reliance on a single major importer.

- Diversification of markets and customer base: This includes exploring new export markets and developing stronger relationships with steel producers in other regions.

- Investments in efficiency and cost reduction: To remain competitive in a challenging market, producers are investing heavily in efficiency improvements and cost reduction measures to maintain profitability.

- Technological advancements in iron ore extraction and processing: Innovation in mining technologies and processing techniques plays a vital role in enhancing efficiency and reducing production costs. This includes developments in iron ore mining and the broader iron ore industry trends.

Conclusion

China's steel industry slowdown has profound implications for iron ore demand and prices. The interplay of government policies aimed at environmental sustainability, the slowdown in construction, and shifting global demand create a complex and challenging environment for the iron ore market. The significance of China's steel industry slowdown on the global commodities market cannot be overstated. The reduced demand from China has created a ripple effect throughout the global economy, impacting producers, traders, and consumers alike.

Call to Action: Stay informed about the ongoing developments in China's steel industry and its implications for iron ore markets. Follow our blog for regular updates on China's steel industry slowdown and its impact on global commodity prices. Consider subscribing to receive timely analysis and insights on this crucial sector.

Featured Posts

-

Oilers Defeat Golden Knights 3 2 But Vegas Secures Playoff Berth

May 09, 2025

Oilers Defeat Golden Knights 3 2 But Vegas Secures Playoff Berth

May 09, 2025 -

Nicolas Cage Ex Wife Lawsuit Update Dismissal And Weston Cages Continued Involvement

May 09, 2025

Nicolas Cage Ex Wife Lawsuit Update Dismissal And Weston Cages Continued Involvement

May 09, 2025 -

Snow Warning Issued For Parts Of Western Manitoba Up To 20 Cm Possible

May 09, 2025

Snow Warning Issued For Parts Of Western Manitoba Up To 20 Cm Possible

May 09, 2025 -

Harry Styles On That Awful Snl Impression His Honest Reaction

May 09, 2025

Harry Styles On That Awful Snl Impression His Honest Reaction

May 09, 2025 -

Suspect In Madeleine Mc Cann Case Charged With Stalking

May 09, 2025

Suspect In Madeleine Mc Cann Case Charged With Stalking

May 09, 2025