China's Steel Production Cuts: Impact On Iron Ore Prices And Global Markets

Table of Contents

The Drivers Behind China's Steel Production Cuts

China's decision to curtail steel production stems from a confluence of factors, each playing a crucial role in shaping the current market landscape.

Environmental Regulations

China's government has increasingly tightened environmental regulations aimed at reducing carbon emissions and pollution from the steel industry. These stringent policies are part of a broader national effort to achieve carbon neutrality targets.

- Examples of specific regulations: Implementation of stricter emission standards for blast furnaces, limitations on production during peak pollution seasons, and mandatory upgrades to pollution control equipment.

- Penalties for non-compliance: Heavy fines, production halts, and even factory closures for steel mills failing to meet environmental standards. This has led to significant operational disruptions for smaller, less compliant mills.

- Impact on smaller steel mills: Smaller steel mills, often lacking the resources to invest in expensive upgrades, have been disproportionately affected, leading to closures and consolidation within the industry. This contributes to the overall reduction in steel production. Keywords: Carbon emission reduction, environmental protection, steel industry regulations.

Addressing Overcapacity

For years, China has grappled with significant overcapacity in its steel industry. This excess production capacity has led to price wars, reduced profitability, and inefficient resource allocation. Production cuts are a strategic move to address this issue and improve market efficiency.

- Statistics on China's steel production capacity: China's steel production capacity has consistently exceeded domestic demand, leading to exports and price pressure in global markets. (Insert relevant statistics here, citing credible sources).

- Impact of overcapacity on prices: Overcapacity has driven down steel prices, squeezing profit margins and making the industry less competitive.

- Government initiatives to consolidate the industry: The Chinese government has implemented policies encouraging mergers and acquisitions within the steel industry, aiming to streamline operations and reduce redundant capacity. Keywords: Steel overcapacity, market efficiency, industry consolidation.

Economic Slowdown and Reduced Demand

A slowing Chinese economy and reduced domestic demand for steel have also contributed to the production cuts. Weakening construction activity and a general economic slowdown have decreased the overall need for steel.

- Data on construction activity in China: A decline in infrastructure projects and real estate development has directly impacted steel consumption. (Insert relevant data and sources here).

- Global economic outlook: The global economic slowdown also plays a role, reducing export demand for Chinese steel.

- Impact on steel consumption: The combined effects of reduced domestic and global demand have resulted in a decrease in overall steel consumption, necessitating production cuts. Keywords: Chinese economy, global demand, construction sector.

Impact on Iron Ore Prices

The reduction in China's steel production has had a significant and immediate impact on iron ore prices, a key raw material in steelmaking.

Decreased Demand for Iron Ore

The direct relationship between steel production and iron ore demand is undeniable. As China produces less steel, its demand for iron ore decreases proportionately.

- Impact of reduced steel production on iron ore consumption: The reduction in steel production directly translates into lower iron ore consumption, impacting both seaborne and domestic iron ore markets.

- Analysis of price fluctuations in response to production cuts: Iron ore prices have experienced volatility, with a general downward trend reflecting the decreased demand. (Include charts and data to illustrate price fluctuations). Keywords: Iron ore demand, price volatility, supply and demand dynamics.

Price Volatility and Market Uncertainty

The production cuts have introduced considerable uncertainty into the iron ore market, making price forecasting challenging.

- Analysis of short-term and long-term price predictions: Experts have varying opinions on the short-term and long-term impact of production cuts on iron ore prices, reflecting the complexity of the situation. (Include a summary of different predictions and their rationale).

- Impact on iron ore trading: Market participants are adjusting their trading strategies to account for the increased volatility and uncertainty.

- Hedging strategies employed by market players: Companies involved in iron ore trading are increasingly using hedging strategies to mitigate the risks associated with price fluctuations. Keywords: Price prediction, market volatility, iron ore trading.

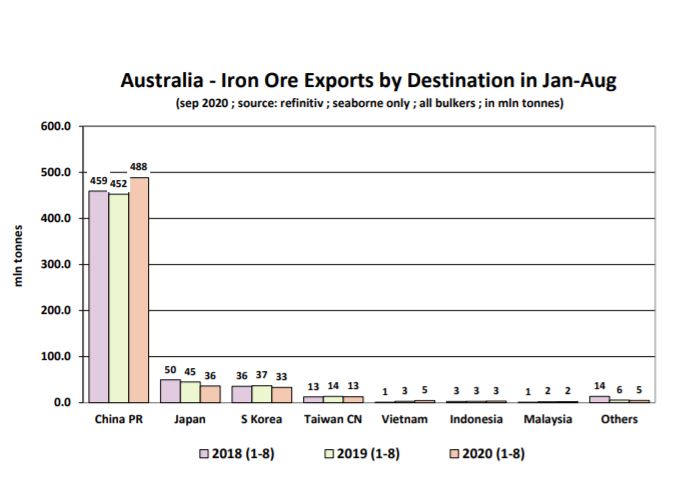

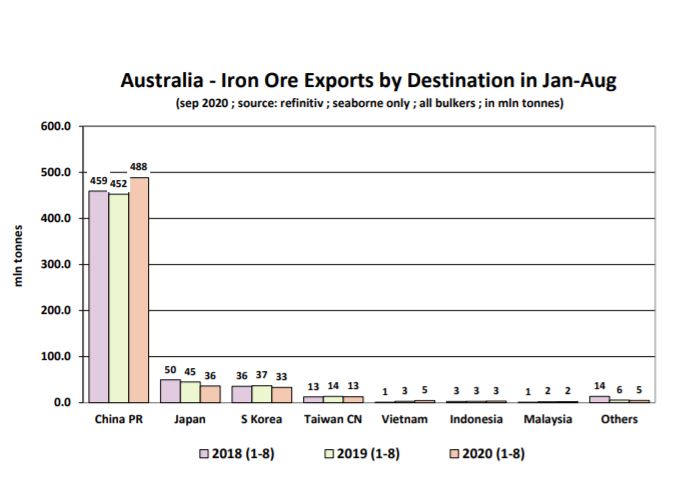

Impact on Iron Ore Producing Countries

Major iron ore exporters, such as Australia and Brazil, are feeling the impact of China's production cuts.

- Effects on their economies: Reduced demand from China affects export revenues and economic growth in these countries.

- Export volumes: Export volumes of iron ore from Australia and Brazil have been affected, forcing adjustments in production and shipping strategies.

- Adjustments to their production strategies: Iron ore producers are adjusting their strategies, including potential production cuts, to respond to the reduced demand. Keywords: Australian iron ore, Brazilian iron ore, mining industry.

Wider Implications for the Global Steel Market

China's reduced steel production has far-reaching consequences for the global steel market.

Global Steel Supply and Prices

The decrease in Chinese steel production affects the global supply chain and prices.

- Analysis of global steel prices: Global steel prices have been influenced by the reduced supply from China. (Include data and analysis of global steel price trends).

- Impact on competing steel producers: Other steel-producing nations may see opportunities to increase their market share.

- Shifts in market share: The global steel market is experiencing shifts in market share as various players adapt to the changed supply dynamics. Keywords: Global steel market, steel prices, international trade.

Geopolitical Ramifications

China's actions have potential geopolitical ramifications.

- Impact on trade relations: The production cuts may influence trade relations between China and other countries.

- Potential for trade disputes: There is a risk of increased trade disputes as countries compete for market share.

- Responses from other steel-producing nations: Other steel-producing nations are formulating strategies to respond to the changes in the global steel market. Keywords: Global trade, international relations, trade policy.

Conclusion

China's steel production cuts have created a ripple effect across the global iron ore market, impacting prices, supply chains, and the broader global steel industry. The drivers behind these cuts are multifaceted, ranging from environmental regulations and overcapacity to economic slowdown. The consequences for iron ore producers, steel manufacturers, and global trade are significant and far-reaching. Iron ore prices have experienced volatility, and market participants are adapting their strategies to navigate this uncertainty. The geopolitical implications are also notable, with potential for trade disputes and shifts in market share.

What are your predictions for iron ore prices in light of China’s recent steel production cuts? To stay informed about future developments in China's steel industry and their impact on the global iron ore market, subscribe to our updates, follow industry news, or conduct further research on the effects of China's steel production cuts.

Featured Posts

-

The Monkey Review Stephen Kings 2024 Slate Holds Even Greater Promise

May 10, 2025

The Monkey Review Stephen Kings 2024 Slate Holds Even Greater Promise

May 10, 2025 -

Exploring Gods Mercy Religious Communities Of 1889

May 10, 2025

Exploring Gods Mercy Religious Communities Of 1889

May 10, 2025 -

Who Is David Exploring The Top 5 Theories Surrounding The He Morgan Brother In High Potential

May 10, 2025

Who Is David Exploring The Top 5 Theories Surrounding The He Morgan Brother In High Potential

May 10, 2025 -

Dijon Psg Fin De Serie En Arkema Premiere Ligue

May 10, 2025

Dijon Psg Fin De Serie En Arkema Premiere Ligue

May 10, 2025 -

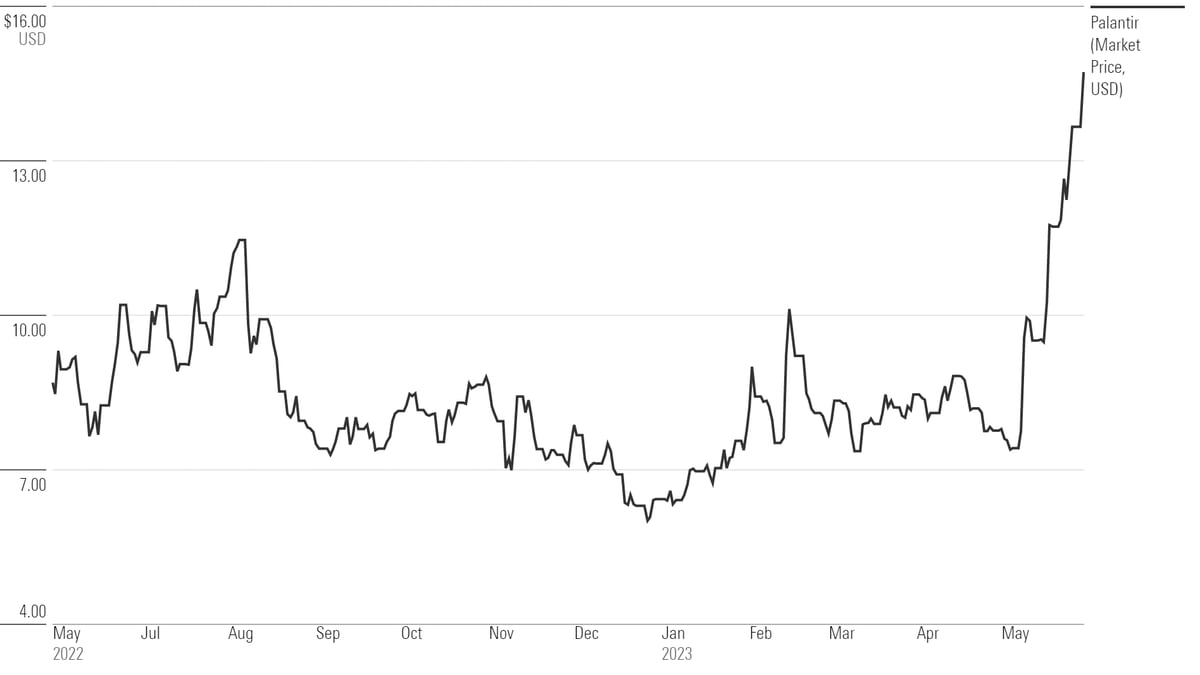

Is Palantir Stock A Smart Buy Before May 5th A Comprehensive Review

May 10, 2025

Is Palantir Stock A Smart Buy Before May 5th A Comprehensive Review

May 10, 2025