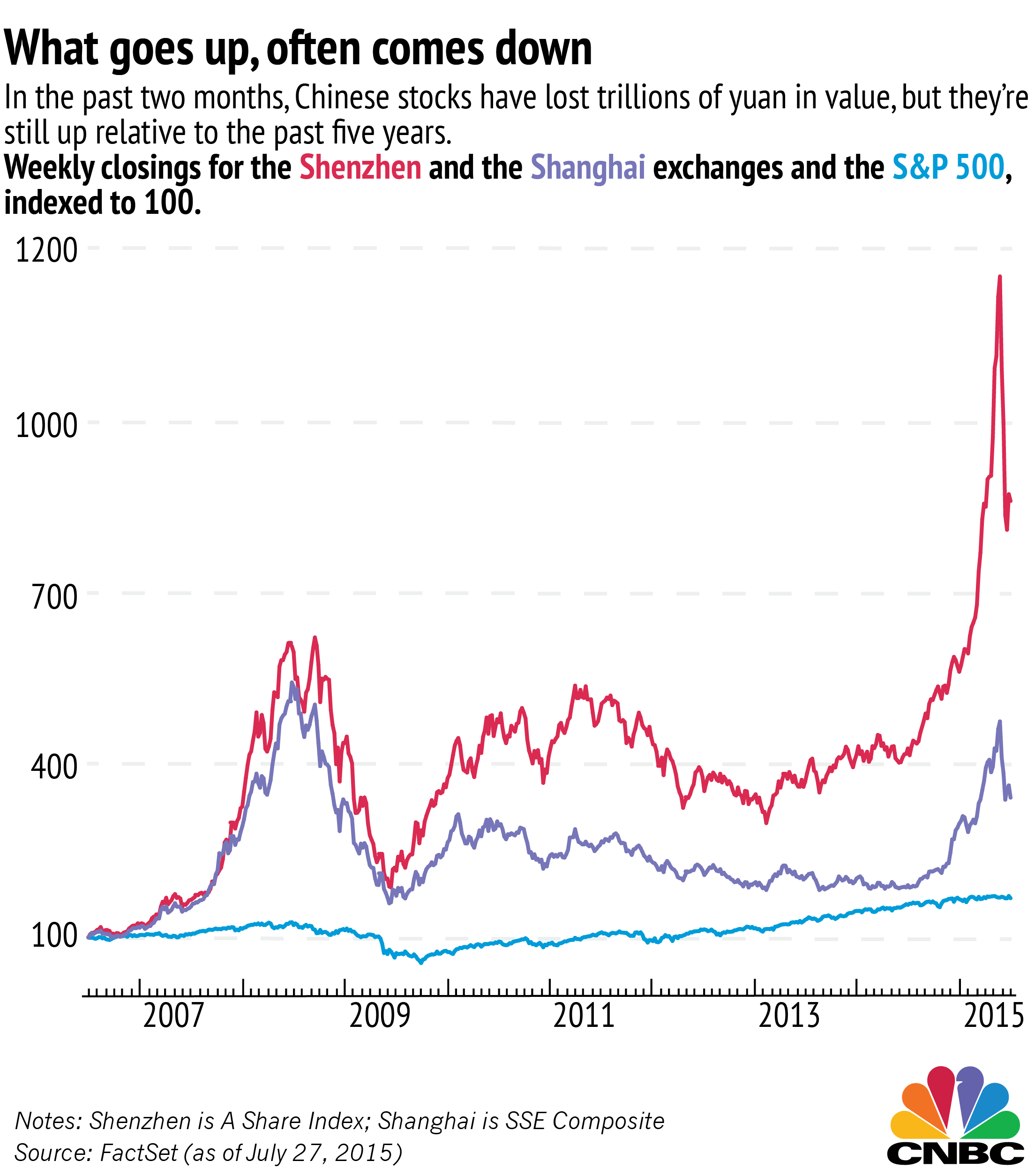

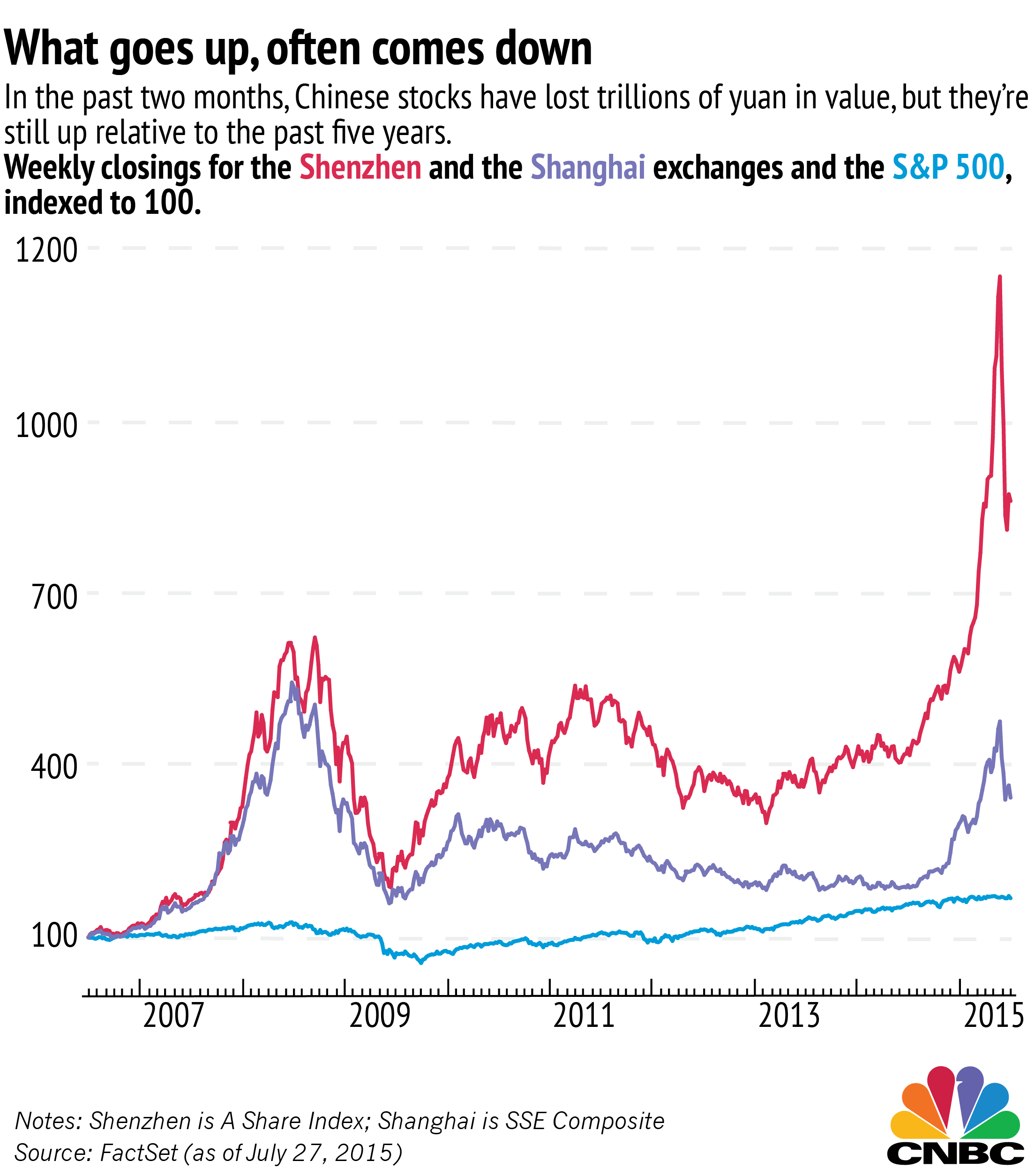

Chinese Stock Market Shows Strength: Post-Correction Growth Driven By US Discussions And Data

Table of Contents

H2: Positive US-China Discussions Boost Investor Confidence

Improved US-China relations are significantly bolstering investor confidence in the Chinese stock market. Reduced trade tensions and increased diplomatic engagement are easing concerns about geopolitical risk, creating a more favorable environment for investment. This improved sentiment translates into increased foreign investment and greater market stability.

-

Examples of recent positive US-China discussions and agreements: The recent high-level talks between the two nations, focusing on areas such as climate change and technological cooperation, have helped alleviate anxieties about escalating trade conflicts. Agreements on specific trade issues also contribute to this positive shift.

-

Analysis of how these discussions eased concerns among foreign investors: The reduction in uncertainty regarding trade policies has encouraged foreign investors to increase their exposure to the Chinese market. This inflow of capital further fuels market growth.

-

Explanation of the ripple effect on various sectors of the Chinese stock market: Improved relations positively impact various sectors, including technology, manufacturing, and consumer goods, leading to a broader market rally.

-

Mention of specific stocks that have seen significant gains: Certain technology stocks and companies involved in infrastructure development have shown impressive gains following the positive diplomatic developments.

H2: Strong Economic Data Signals Positive Growth Trajectory

Encouraging economic data from China is another significant driver of the current stock market strength. Key indicators suggest a healthy growth trajectory and a robust economic recovery.

-

Specific data points (e.g., GDP growth rate, consumer confidence index, industrial production figures): Recent reports show a higher-than-expected GDP growth rate, coupled with increases in consumer spending and industrial production. The consumer confidence index has also seen a significant uptick.

-

Explanation of the significance of these data points and their impact on the market: These figures demonstrate the resilience of the Chinese economy and suggest a continued positive growth momentum, prompting further investment.

-

Discussion of sectors particularly benefiting from this positive economic trend: Sectors such as consumer discretionary, technology, and industrial goods are experiencing significant growth fueled by this economic upswing.

-

Mention of potential challenges or risks remaining in the Chinese economy: While the outlook is positive, potential challenges such as property market regulation and global economic uncertainty need to be considered.

H3: Post-Correction Rebound: Analyzing the Market's Resilience

The recent market correction, while causing temporary volatility, ultimately showcased the resilience of the Chinese stock market. The speed and strength of the subsequent rebound demonstrate the underlying strength of the economy and investor confidence in its long-term prospects.

-

Explanation of the causes of the previous market correction: The correction was primarily driven by factors such as regulatory concerns and global market uncertainties.

-

Analysis of the speed and strength of the recovery: The market's swift recovery highlights investor confidence in the underlying fundamentals of the Chinese economy.

-

Discussion of strategies investors employed during the correction and recovery: Many investors adopted a buy-the-dip strategy, taking advantage of the temporary downturn to acquire undervalued assets.

-

Mention of sectors that recovered most significantly: Certain sectors, such as technology and consumer staples, showed particularly strong recovery, indicating their resilience and growth potential.

H2: Identifying Investment Opportunities in the Chinese Stock Market

The current positive market climate presents numerous investment opportunities. However, a balanced approach is crucial, considering both the potential rewards and associated risks.

-

Highlight specific sectors expected to see continued growth: Sectors such as renewable energy, technology, and healthcare are expected to experience significant growth in the coming years.

-

Discuss strategies for identifying promising stocks: Thorough fundamental analysis, considering factors like earnings growth, valuation metrics, and competitive landscape, is essential.

-

Emphasize the importance of thorough research and risk management: Diversification is key to mitigating risks. Investors should carefully consider their risk tolerance before making any investment decisions.

-

Offer advice on diversification and portfolio management in the context of the Chinese stock market: A well-diversified portfolio across various sectors and asset classes will help mitigate risk and optimize returns.

3. Conclusion:

The Chinese stock market's recent strength is a result of improved US-China relations, positive economic indicators, and a resilient post-correction rebound. These factors collectively paint a promising picture for investors seeking growth opportunities. While risks always exist, the potential for significant returns warrants careful consideration. Stay tuned for further updates on the Chinese stock market, and invest wisely in this growing market. Capitalize on the strength of the Chinese stock market and explore the numerous investment opportunities it presents.

Featured Posts

-

The Arcade Is Back A Comprehensive Guide To Nhl 25s Arcade Mode

May 07, 2025

The Arcade Is Back A Comprehensive Guide To Nhl 25s Arcade Mode

May 07, 2025 -

Microsoft Confirms Gears Of War Remaster For Play Station And Xbox

May 07, 2025

Microsoft Confirms Gears Of War Remaster For Play Station And Xbox

May 07, 2025 -

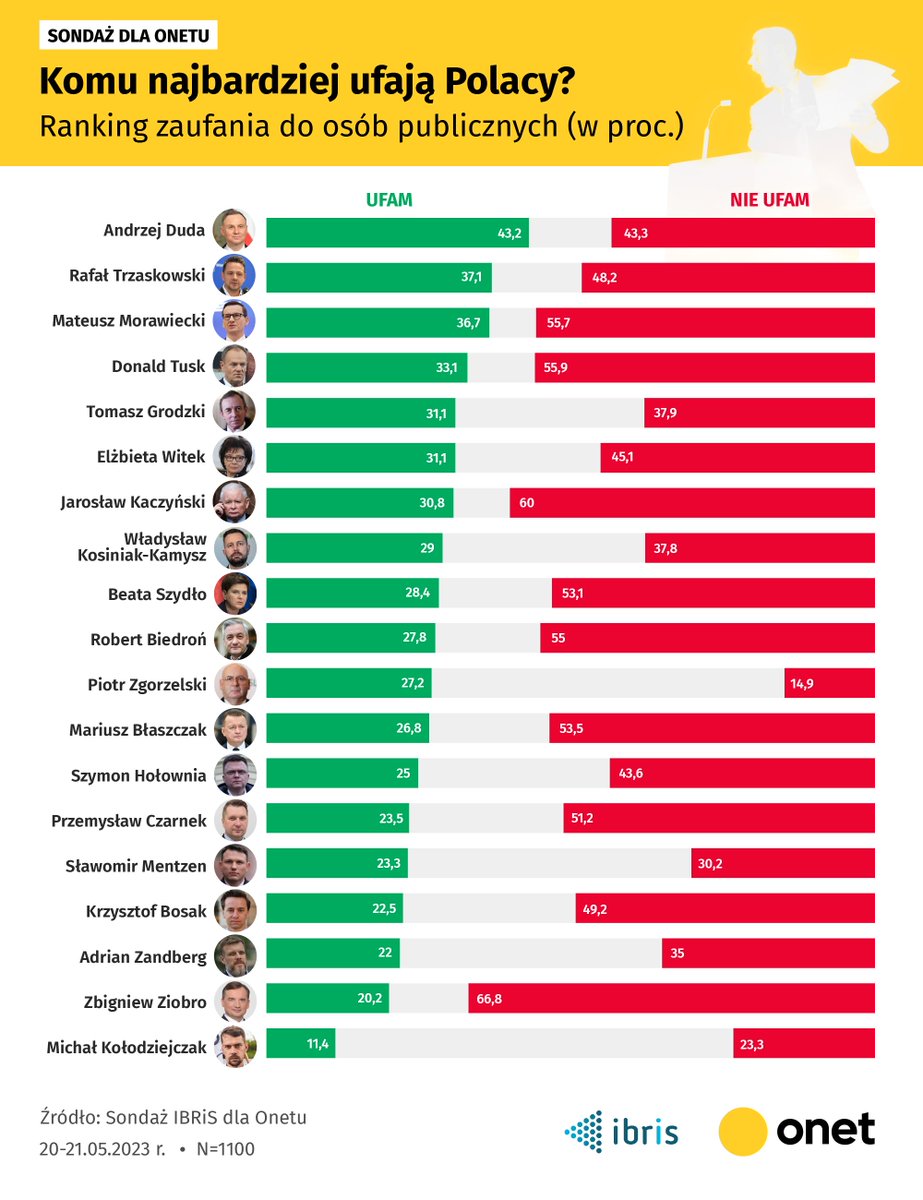

Sondaz Ib Ri S Dla Onetu Zaufanie Do Politykow Najnowsze Dane

May 07, 2025

Sondaz Ib Ri S Dla Onetu Zaufanie Do Politykow Najnowsze Dane

May 07, 2025 -

Simone Biles Honeymoon Photos A Glimpse Into South Africa

May 07, 2025

Simone Biles Honeymoon Photos A Glimpse Into South Africa

May 07, 2025 -

Ms Hokej Svedi S Hvezdnou Nhl Sestavou Cesi Narazi Na Nemecko

May 07, 2025

Ms Hokej Svedi S Hvezdnou Nhl Sestavou Cesi Narazi Na Nemecko

May 07, 2025

Latest Posts

-

Accelerating Ldc Graduation A Comprehensive Guide For Achieving Ca

May 07, 2025

Accelerating Ldc Graduation A Comprehensive Guide For Achieving Ca

May 07, 2025 -

142 105 Blowout Mitchell And Mobley Fuel Cavaliers Win Against Knicks

May 07, 2025

142 105 Blowout Mitchell And Mobley Fuel Cavaliers Win Against Knicks

May 07, 2025 -

Zambia To Host Ldcs Future Forum 2025 Shaping A Sustainable Future For Least Developed Countries

May 07, 2025

Zambia To Host Ldcs Future Forum 2025 Shaping A Sustainable Future For Least Developed Countries

May 07, 2025 -

Ldcs Future Forum 2025 Zambia Hosts Crucial Summit For Least Developed Countries

May 07, 2025

Ldcs Future Forum 2025 Zambia Hosts Crucial Summit For Least Developed Countries

May 07, 2025 -

20 Ai

May 07, 2025

20 Ai

May 07, 2025