Chinese Stocks Surge Following US Talks And Economic Data Release

Table of Contents

Positive Developments in US-China Trade Relations

The recent improvement in US-China trade relations played a pivotal role in boosting investor confidence and driving up Chinese stock prices. This positive shift represents a potential de-escalation of the long-standing trade war between the two economic giants.

Easing Trade Tensions

Recent developments signal a thaw in the frosty relationship:

- Reduced Tariffs: Discussions have hinted at potential reductions in existing tariffs, lessening the burden on Chinese exports to the US.

- Increased Dialogue: Both sides have shown a willingness to engage in more frequent and open communication channels, fostering trust and cooperation.

- Focus on Economic Cooperation: A shift towards emphasizing areas of mutual economic benefit has been observed, signifying a move away from purely adversarial posturing. Statements from high-level officials have suggested a renewed commitment to finding common ground. These signals alleviate fears of further escalation of the trade war, a major positive for Chinese stocks. Keywords: trade war, trade deal, tariffs, bilateral relations, economic cooperation.

Improved Communication and Dialogue

The increase in high-level communication is arguably just as significant as any specific trade agreement.

- High-Level Meetings: A series of meetings between key officials from both countries have paved the way for improved understanding and resolution of contentious issues.

- Diplomatic Efforts: Increased diplomatic activity signals a commitment to resolving disagreements through peaceful means rather than through further trade sanctions.

- Commitment to Further Talks: The commitment to ongoing dialogue shows a willingness from both sides to continue working towards a more stable and predictable trading relationship, bolstering investor confidence in the stability of the Chinese economy. Keywords: diplomatic relations, communication channels, negotiations, political stability.

Encouraging Chinese Economic Data

Beyond the easing of trade tensions, strong economic data releases from China have further fueled the surge in Chinese stocks. This positive economic performance demonstrates the resilience and growth potential of the Chinese economy.

Stronger-than-Expected Growth Indicators

Several key economic indicators exceeded expectations, signaling robust economic activity:

- GDP Growth: China's GDP growth for [Insert Quarter and Year] surpassed analysts' forecasts, demonstrating continued expansion despite global economic uncertainty. (Source: [Cite reputable source, e.g., National Bureau of Statistics of China]).

- Industrial Production: Industrial production figures showed a healthy increase, indicating strong manufacturing activity and contributing to overall economic growth. (Source: [Cite source]).

- Retail Sales: Robust retail sales figures demonstrate strong consumer spending and confidence in the Chinese economy. (Source: [Cite source]).

- Consumer Confidence: Surveys indicate a rise in consumer confidence, further supporting the positive economic outlook. (Source: [Cite source]). Keywords: GDP growth, economic indicators, industrial production, retail sales, consumer spending, economic recovery.

Positive Signals for Key Sectors

Specific sectors have shown remarkable strength:

- Technology Sector: The technology sector continues to be a growth engine, with several major tech companies reporting strong earnings and expansion.

- Manufacturing Sector: Despite global supply chain challenges, the manufacturing sector demonstrated resilience, contributing significantly to overall economic growth.

- Real Estate Market: While facing some regulatory headwinds, the real estate market shows signs of stabilization, crucial for the overall health of the Chinese economy. Keywords: technology sector, manufacturing sector, real estate market, economic diversification.

Investor Sentiment and Market Reaction

The positive developments in trade relations and the strong economic data have significantly impacted investor sentiment.

Increased Investor Confidence

The confluence of positive news has led to a clear increase in investor confidence:

- Increased Foreign Investment: Foreign investors are showing renewed interest in the Chinese stock market, pouring capital into various sectors.

- Higher Stock Valuations: The surge in stock prices reflects the increased valuations placed on Chinese companies by investors.

- Increased Trading Volumes: Higher trading volumes indicate a heightened level of activity and interest in the Chinese stock market. Keywords: investor confidence, foreign investment, stock valuations, market sentiment, risk appetite.

Analysis of Stock Performance

Several sectors and individual companies experienced significant gains:

- Technology Giants: Major tech companies saw substantial percentage increases in their stock prices. (Include specific examples with percentage increases).

- Manufacturing Conglomerates: Large manufacturing firms benefited from the positive industrial production data. (Include specific examples with percentage increases).

- Consumer Goods Companies: Companies in the consumer goods sector saw strong performance driven by robust retail sales. (Include specific examples with percentage increases). Keywords: stock market performance, sector performance, market capitalization, stock prices.

Conclusion: Understanding the Surge in Chinese Stocks – Opportunities and Future Outlook

The recent surge in Chinese stocks is a direct result of the combined effects of improved US-China trade relations and strong domestic economic performance. While this presents exciting opportunities, a cautious approach is warranted. Potential risks remain, including global economic uncertainty and ongoing regulatory changes within China.

To make informed investment decisions, staying informed about Chinese stock market trends and the ongoing evolution of US-China relations is paramount. Further research into Chinese economic forecasts and global market analysis is recommended. Understanding these factors will help you better navigate the dynamics of the Chinese stock market and make investment choices aligned with your risk tolerance and financial goals. Consider monitoring key indicators, conducting thorough due diligence, and diversifying your investments to mitigate risks.

Featured Posts

-

Mhrjan Lwkarnw Alsynmayy Ykrm Jaky Shan Jayzt Injaz Alemr

May 07, 2025

Mhrjan Lwkarnw Alsynmayy Ykrm Jaky Shan Jayzt Injaz Alemr

May 07, 2025 -

Mariners Defeat Reds In 10 Innings Arozarenas Impact

May 07, 2025

Mariners Defeat Reds In 10 Innings Arozarenas Impact

May 07, 2025 -

Zendayas Half Sisters Shocking Cancer Claim A Plea For Help

May 07, 2025

Zendayas Half Sisters Shocking Cancer Claim A Plea For Help

May 07, 2025 -

Mastering Fortnite A Comprehensive Guide To Gameplay And Progression

May 07, 2025

Mastering Fortnite A Comprehensive Guide To Gameplay And Progression

May 07, 2025 -

Tragedia Na Przejezdzie Kolejowym Piecioosobowa Rodzina Zginela A Sprawcy Unikaja Odpowiedzialnosci

May 07, 2025

Tragedia Na Przejezdzie Kolejowym Piecioosobowa Rodzina Zginela A Sprawcy Unikaja Odpowiedzialnosci

May 07, 2025

Latest Posts

-

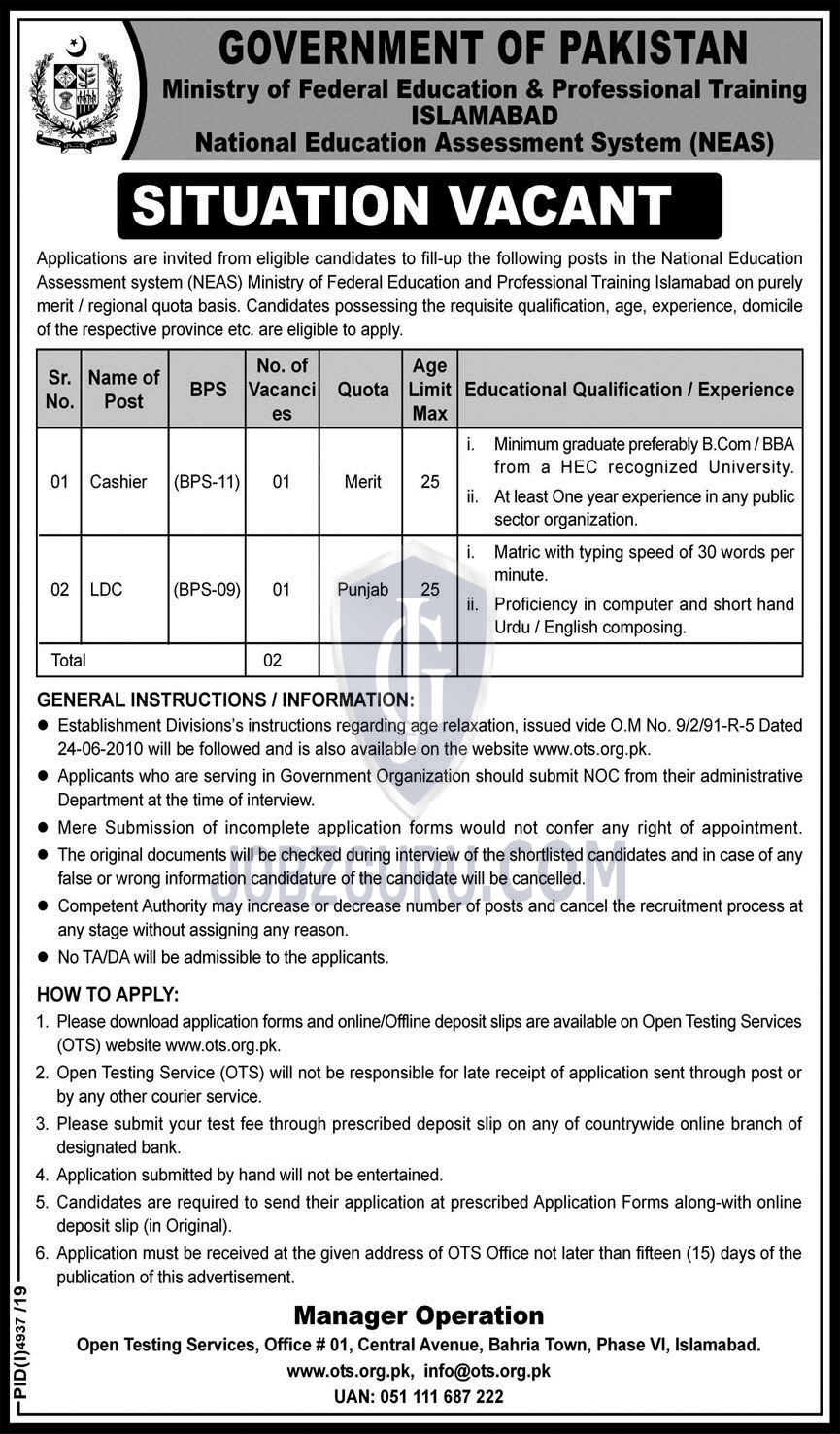

Progress Towards Ldc Graduation Governments Commitment To Success

May 07, 2025

Progress Towards Ldc Graduation Governments Commitment To Success

May 07, 2025 -

Commerce Advisor Highlights Governments Role In Ldc Graduation

May 07, 2025

Commerce Advisor Highlights Governments Role In Ldc Graduation

May 07, 2025 -

Building A Resilient Future Outcomes From The Third Ldc Future Forum

May 07, 2025

Building A Resilient Future Outcomes From The Third Ldc Future Forum

May 07, 2025 -

Third Ldc Future Forum A Roadmap For Building Resilience

May 07, 2025

Third Ldc Future Forum A Roadmap For Building Resilience

May 07, 2025 -

Third Ldc Future Forum Building Resilience In Least Developed Countries

May 07, 2025

Third Ldc Future Forum Building Resilience In Least Developed Countries

May 07, 2025