Climate Risk: A Growing Factor In Mortgage Lending And Creditworthiness

Table of Contents

Rising Insurance Premiums and Unaffordability

The increased frequency and severity of climate-related events—from devastating hurricanes and wildfires to increasingly frequent and intense floods—are driving up homeowner's insurance premiums dramatically. This rise in cost has significant implications for mortgage lending and affordability.

- Higher premiums impacting affordability and mortgage approval: Many potential homeowners find themselves priced out of the market as insurance costs become a significant, and often unpredictable, addition to their monthly mortgage payments. Lenders, in turn, are factoring these increased premiums into their risk assessments, making it harder for some to secure a mortgage.

- Lenders considering insurance costs in loan-to-value (LTV) ratios: The cost of homeowners insurance is now a critical component in calculating the loan-to-value ratio (LTV), a key factor in determining mortgage approval. Higher premiums can push the LTV above acceptable limits, resulting in loan denials.

- Increased difficulty securing insurance in high-risk areas: In areas frequently affected by climate-related disasters, obtaining insurance can be extremely challenging, with some insurers refusing to offer coverage altogether. This significantly limits mortgage accessibility for those living in vulnerable regions.

- Examples of specific locations experiencing dramatic premium increases: Coastal communities facing rising sea levels and increased storm surge, and areas prone to wildfires, are experiencing some of the most dramatic increases in homeowners insurance costs. For example, premiums in parts of Florida and California have skyrocketed in recent years.

Property Value Depreciation Due to Climate Change

The risk of climate-related damage is not only driving up insurance costs but also causing property values to depreciate, impacting both borrowers and lenders.

- Decreased property values affecting loan-to-value ratios: Properties in high-risk areas are losing value as the perception of risk increases. This decrease in property value directly affects the LTV ratio, potentially leading to higher down payment requirements or loan denials.

- Increased risk of foreclosure due to decreased equity: If property values fall below the outstanding mortgage balance, borrowers risk foreclosure. Climate-related damage can accelerate this process, particularly if the homeowner lacks adequate insurance coverage.

- Impact of climate risk disclosures on property valuations: The growing trend of climate risk disclosures, which inform potential buyers about the environmental hazards associated with a property, is influencing appraisals and subsequently, property values.

- Examples of property types and locations most susceptible to devaluation: Coastal properties vulnerable to sea-level rise and erosion, properties in wildfire-prone areas, and those located in floodplains are especially susceptible to devaluation due to climate change.

Increased Scrutiny of Floodplains and High-Risk Zones

Lenders are becoming increasingly cautious about properties located in floodplains, wildfire zones, or other high-risk areas, resulting in stricter lending criteria.

- Stricter lending criteria for properties in vulnerable locations: Many lenders now require higher down payments, stricter underwriting standards, and more comprehensive insurance coverage for properties in high-risk zones.

- Increased use of climate risk assessment tools by lenders: Lenders are increasingly utilizing sophisticated climate risk assessment tools and models to better evaluate the long-term risks associated with specific properties.

- Availability of mortgages in high-risk areas decreasing: As a result of these stricter criteria and increased awareness of climate risk, the availability of mortgages in high-risk areas is declining.

- Government regulations and initiatives influencing lending practices: Government regulations, such as stricter flood insurance requirements and initiatives aimed at reducing climate risk, are further influencing lender practices.

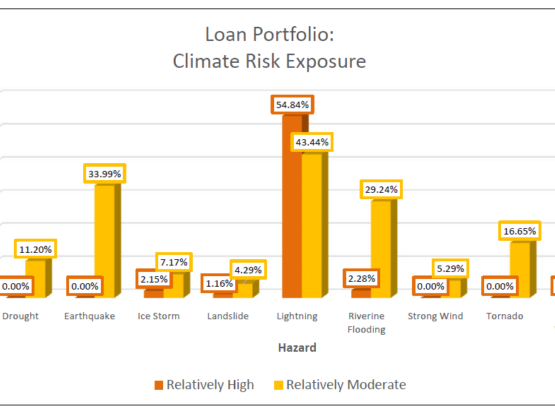

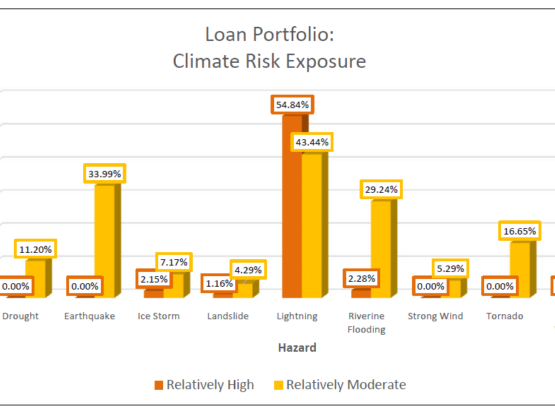

The Role of Climate Risk Scores and Modeling

The mortgage industry is increasingly relying on climate risk scores and predictive modeling to assess the long-term climate vulnerability of properties.

- How these tools assess the long-term climate risk of a property: These models use a variety of data sources, including historical climate data, projected sea-level rise, and wildfire risk assessments, to generate scores indicating the level of climate risk associated with a specific property.

- The impact of these scores on loan approval and interest rates: Higher climate risk scores can lead to loan denials or higher interest rates, reflecting the increased risk for lenders.

- Data sources used in climate risk modeling: These models utilize data from various sources including government agencies (e.g., FEMA), insurance companies, and scientific research institutions.

- Benefits and limitations of using these scoring systems: While these tools provide valuable insights, they are not without limitations. Data accuracy, model limitations, and the potential for biases need to be carefully considered.

Conclusion

Climate risk is fundamentally altering the mortgage landscape. Rising insurance costs, property devaluation, increased scrutiny of high-risk zones, and the growing reliance on climate risk assessments are all impacting mortgage lending decisions and borrower creditworthiness. Understanding Climate Risk: A Growing Factor in Mortgage Lending and Creditworthiness is crucial for both borrowers and lenders. Take steps to proactively assess your climate risk exposure and make informed decisions about your mortgage application or future lending practices. Consider consulting with a financial advisor and researching properties in areas with lower climate risk. For further information on climate risk and its implications for the mortgage industry, consult resources from the Federal Housing Finance Agency (FHFA) and the National Flood Insurance Program (NFIP).

Featured Posts

-

Mega Tampoy I Megali Kontra Ektora Kai Persas

May 20, 2025

Mega Tampoy I Megali Kontra Ektora Kai Persas

May 20, 2025 -

Innovation Spatiale En Afrique Le Mass A Abidjan

May 20, 2025

Innovation Spatiale En Afrique Le Mass A Abidjan

May 20, 2025 -

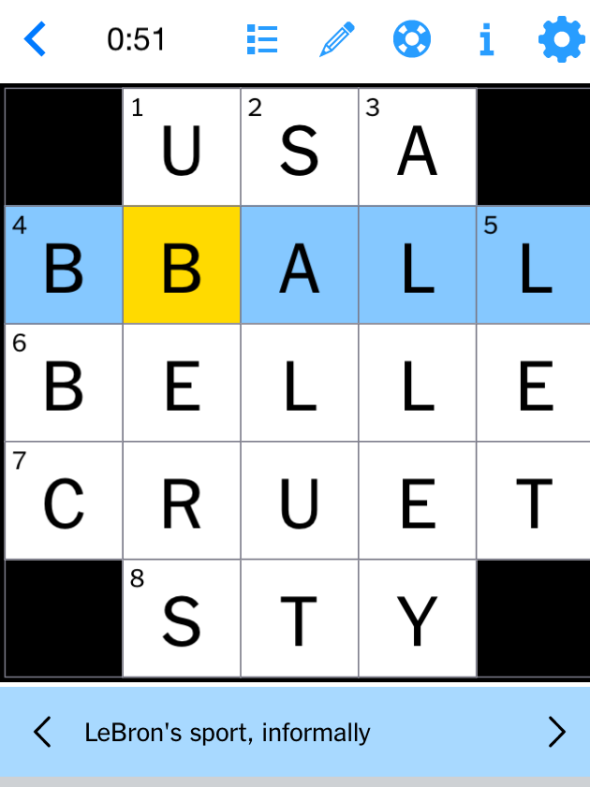

Nyt Mini Crossword Answers March 27 2024

May 20, 2025

Nyt Mini Crossword Answers March 27 2024

May 20, 2025 -

Hmrc Child Benefit Identifying And Responding To Official Communications

May 20, 2025

Hmrc Child Benefit Identifying And Responding To Official Communications

May 20, 2025 -

Schumacher O Noua Etapa In Viata Familiei Sale

May 20, 2025

Schumacher O Noua Etapa In Viata Familiei Sale

May 20, 2025

Latest Posts

-

Retired Navy Admirals Bribery Conviction 30 Year Sentence

May 20, 2025

Retired Navy Admirals Bribery Conviction 30 Year Sentence

May 20, 2025 -

Nyt Mini Crossword Solutions And Hints April 26 2025

May 20, 2025

Nyt Mini Crossword Solutions And Hints April 26 2025

May 20, 2025 -

Nyt Mini Crossword Clues April 26 2025

May 20, 2025

Nyt Mini Crossword Clues April 26 2025

May 20, 2025 -

April 26 2025 Nyt Mini Crossword Puzzle Hints

May 20, 2025

April 26 2025 Nyt Mini Crossword Puzzle Hints

May 20, 2025 -

Celebrating 50 Years Of Gma An Award From The Paley Center

May 20, 2025

Celebrating 50 Years Of Gma An Award From The Paley Center

May 20, 2025