CMA CGM's $440 Million Acquisition Of Turkish Logistics Firm

Table of Contents

Strategic Rationale Behind CMA CGM's Investment

CMA CGM, a leading global shipping and logistics company, consistently seeks strategic acquisitions to strengthen its market position and expand its global reach. This acquisition perfectly embodies this strategy. Turkey, strategically located at the crossroads of Europe and Asia, presents a lucrative market with immense growth potential in the logistics sector. The acquired Turkish firm (the name of the firm should be inserted here if known), with its established network and expertise in the region, offers CMA CGM several key advantages:

- Increased market share in Turkey and surrounding regions: The acquisition significantly boosts CMA CGM's presence in a key geographical area, allowing it to capture a larger share of the rapidly growing Turkish logistics market.

- Access to new customer base and distribution networks: The acquisition grants CMA CGM access to a substantial new customer base and established distribution networks within Turkey, expanding its operational reach and client portfolio.

- Strengthened logistics capabilities in a key geographic area: By integrating the acquired firm's capabilities, CMA CGM strengthens its overall logistics infrastructure and expertise in a critical region for global trade.

- Potential for cost efficiencies and operational improvements: Synergies between the two companies can lead to streamlined operations, reduced costs, and improved efficiency across the supply chain. This includes potential economies of scale in warehousing, transportation, and other logistics services.

Impact on the Global Shipping and Logistics Landscape

CMA CGM's acquisition has significant implications for the global shipping and logistics landscape. This move signifies the ongoing trend of consolidation within the industry, where larger players are acquiring smaller companies to enhance their market share and competitive advantage.

- Increased consolidation within the shipping industry: This acquisition fuels the ongoing trend of mergers and acquisitions, further shaping the competitive landscape of the global shipping industry.

- Potential for higher shipping rates in certain regions: While not necessarily a direct consequence, increased market concentration could potentially impact shipping rates in certain regions depending on market dynamics.

- Changes in service offerings for customers: Customers can expect enhanced service offerings, potentially including improved delivery times, more comprehensive logistics solutions, and expanded geographical coverage.

- Impact on smaller logistics companies in Turkey: The acquisition could increase competition for smaller logistics companies operating in Turkey, forcing them to adapt and innovate to maintain their market share.

Financial Aspects of the Acquisition

The $440 million investment represents a significant financial commitment for CMA CGM. While the precise breakdown of acquisition costs and financing methods may not be publicly available, it's clear that CMA CGM expects a substantial return on its investment.

- Acquisition cost breakdown (if available): Further details on the cost allocation (e.g., goodwill, assets, etc.) would provide a clearer picture of the financial structure of the deal. (Include details if available).

- Projected revenue increase for CMA CGM: The acquisition is expected to contribute significantly to CMA CGM's revenue growth in the coming years, bolstering its overall financial performance.

- Potential impact on CMA CGM's stock price: The market's reaction to the acquisition will likely influence CMA CGM's stock price, potentially leading to positive market sentiment if the integration proves successful.

- Long-term financial outlook: The acquisition is poised to strengthen CMA CGM's long-term financial outlook, positioning it for continued growth and profitability in the global shipping and logistics market.

The Future of CMA CGM's Turkish Operations

The integration of the acquired Turkish firm into CMA CGM's operations will be a crucial step in realizing the full potential of this acquisition. CMA CGM will likely focus on leveraging the acquired firm's expertise and infrastructure to expand its services and market share in Turkey.

- Expansion plans in Turkey: CMA CGM is likely to expand its operations in Turkey, potentially investing in new facilities, infrastructure, and technologies.

- New service offerings to customers: The integration will likely lead to new and enhanced services for customers, catering to the specific needs of the Turkish market.

- Expected growth in market share: CMA CGM aims for substantial growth in its market share in Turkey, capitalizing on the expanded network and operational capabilities.

- Job creation opportunities: The acquisition could lead to job creation opportunities in Turkey, contributing positively to the local economy.

Conclusion: CMA CGM's acquisition of the Turkish logistics firm represents a significant strategic move, solidifying its position in the global shipping and logistics industry and significantly expanding its footprint in a key growth market. This $440 million investment highlights the ongoing consolidation within the sector and promises a reshaping of the competitive landscape. By analyzing the strategic rationale, market impact, and financial aspects of this acquisition, we can gain a clearer understanding of the future of CMA CGM and its operations in Turkey. To stay informed about further developments in the global shipping and logistics market, continue to follow news and analysis on major acquisitions like this one, focusing on the strategic implications of CMA CGM's acquisitions and other key industry players.

Featured Posts

-

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025

Charleston Tennis Pegula Triumphs Over Collins

Apr 27, 2025 -

Motherhood And Victory Belinda Bencics Wta Return

Apr 27, 2025

Motherhood And Victory Belinda Bencics Wta Return

Apr 27, 2025 -

Trumps Tariffs A Posthaste Threat To Canadian Auto Jobs

Apr 27, 2025

Trumps Tariffs A Posthaste Threat To Canadian Auto Jobs

Apr 27, 2025 -

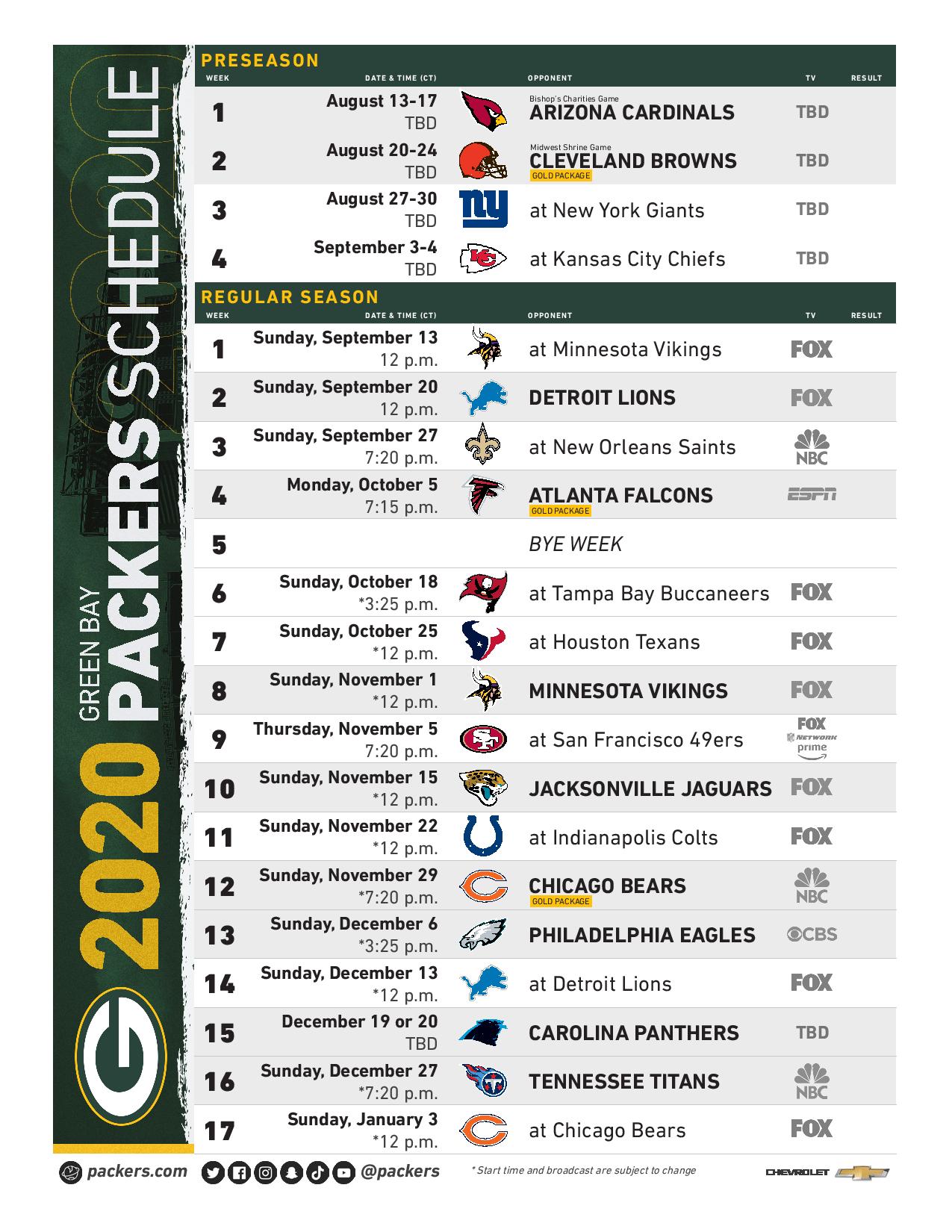

Packers 2025 International Game Possibilities Two Chances For Global Glory

Apr 27, 2025

Packers 2025 International Game Possibilities Two Chances For Global Glory

Apr 27, 2025 -

Brazil Bound Justin Herbert And The Chargers 2025 Season Start

Apr 27, 2025

Brazil Bound Justin Herbert And The Chargers 2025 Season Start

Apr 27, 2025

Latest Posts

-

Dwyane Wade Applauds Doris Burkes Expert Thunder Vs Timberwolves Breakdown

Apr 28, 2025

Dwyane Wade Applauds Doris Burkes Expert Thunder Vs Timberwolves Breakdown

Apr 28, 2025 -

Nba Analyst Dwyane Wade Highlights Doris Burkes Thunder Timberwolves Coverage

Apr 28, 2025

Nba Analyst Dwyane Wade Highlights Doris Burkes Thunder Timberwolves Coverage

Apr 28, 2025 -

Wades Take Doris Burkes Insightful Thunder Vs Timberwolves Breakdown

Apr 28, 2025

Wades Take Doris Burkes Insightful Thunder Vs Timberwolves Breakdown

Apr 28, 2025 -

Le Bron James Reaction To Richard Jeffersons Espn Interview

Apr 28, 2025

Le Bron James Reaction To Richard Jeffersons Espn Interview

Apr 28, 2025 -

Jetour Dashing Tampil Lebih Menarik Dengan Tiga Warna Baru Di Iims 2025

Apr 28, 2025

Jetour Dashing Tampil Lebih Menarik Dengan Tiga Warna Baru Di Iims 2025

Apr 28, 2025