Compare Personal Loan Interest Rates Today: Top Lender Offers

Table of Contents

Factors Affecting Personal Loan Interest Rates

Several key factors influence the interest rate you'll receive on a personal loan. Understanding these factors is crucial for securing a competitive rate. The better you understand these elements, the better equipped you'll be to compare personal loan interest rates effectively.

-

Credit Score: Your credit score is arguably the most significant factor. Lenders view a high credit score as an indicator of your creditworthiness and repayment ability. A higher credit score (generally above 700) significantly improves your chances of securing a lower interest rate. Regularly checking your credit report from agencies like Equifax, Experian, and TransUnion for accuracy is essential. Addressing any errors can help boost your score.

-

Loan Amount: Generally, larger loan amounts may come with slightly higher interest rates. Lenders perceive a greater risk associated with larger loans.

-

Loan Term: The loan term (the length of time you have to repay the loan) also influences your interest rate. Longer loan terms (e.g., 60 months) result in lower monthly payments but higher overall interest paid. Shorter loan terms (e.g., 24 months) mean higher monthly payments but significantly less interest paid over the life of the loan.

-

Debt-to-Income Ratio (DTI): Your debt-to-income ratio (DTI) represents your monthly debt payments relative to your gross monthly income. A lower DTI demonstrates to lenders that you can comfortably manage your existing debt and the additional personal loan payments. Improving your DTI before applying can improve your chances of a lower rate.

-

Lender Type: Different types of lenders – banks, credit unions, and online lenders – offer varying interest rates and fees. Banks often have stricter lending criteria but may offer competitive rates for borrowers with excellent credit. Credit unions typically offer more favorable rates to their members. Online lenders offer convenience but may have higher fees or stricter requirements.

-

Interest Rate Types: Be aware of the difference between fixed and variable interest rates. A fixed interest rate remains constant throughout the loan term, providing predictability. A variable interest rate fluctuates based on market conditions, potentially leading to unpredictable monthly payments.

How to Effectively Compare Personal Loan Interest Rates

Comparing personal loan interest rates isn't simply about finding the lowest number. You need a strategic approach to ensure you're getting the best overall deal.

-

Use Online Comparison Tools: Many reputable websites offer personal loan comparison tools. These tools allow you to input your desired loan amount, term, and other criteria, and compare rates from multiple lenders simultaneously. This saves you valuable time and effort.

-

Check Lender Websites: While comparison tools are helpful, it's crucial to visit the websites of individual lenders to review their specific offers, fees, and terms and conditions directly. Don't rely solely on aggregated data.

-

Consider the APR: Don't just focus on the interest rate. The Annual Percentage Rate (APR) provides a more comprehensive picture of the loan's total cost, including interest and other fees. A lower APR indicates a better overall deal.

-

Read the Fine Print: Before committing to any loan, carefully read all the terms and conditions. Pay attention to prepayment penalties, late payment fees, and other potential charges that can impact the overall cost.

-

Pre-qualification: Many lenders offer pre-qualification options. This allows you to see what interest rates you qualify for without impacting your credit score. It gives you a good sense of your potential options before formally applying.

Top Lender Offers and Their Current Rates (Illustrative)

(Note: This section needs to be updated regularly to reflect current market conditions. The following are examples only. DO NOT take these as financial advice.)

- Example Lender 1: Example Bank – Illustrative APR Range: 7% - 12%

- Example Lender 2: Example Credit Union – Illustrative APR Range: 6% - 10%

- Example Lender 3: Example Online Lender – Illustrative APR Range: 8% - 14%

Disclaimer: Rates are subject to change and are for illustrative purposes only. Always check with the lender for the most up-to-date information.

Tips for Getting the Best Personal Loan Interest Rate

Several strategies can help you secure the most favorable personal loan interest rate.

-

Improve Your Credit Score: Before applying for a personal loan, work on improving your credit score. Paying down debt, correcting errors on your credit report, and consistently making on-time payments are all effective ways to achieve this.

-

Shop Around and Compare: Don't settle for the first offer you receive. Compare rates and terms from multiple lenders to find the best fit for your financial situation.

-

Consider a Shorter Loan Term: Although monthly payments will be higher, a shorter loan term will result in paying significantly less interest overall.

-

Maintain a Low Debt-to-Income Ratio: Keeping your debt-to-income ratio low demonstrates financial responsibility to lenders and enhances your chances of securing a better interest rate.

-

Negotiate with Lenders: Don't hesitate to negotiate with lenders. They may be willing to offer a more competitive rate if you present a strong financial profile and shop around.

Conclusion

Comparing personal loan interest rates is crucial for securing the best possible deal. By understanding the factors influencing rates and using the comparison strategies outlined above, you can save significantly on interest payments. Remember to check your credit report, shop around, and read the fine print before signing any loan agreement. Start comparing personal loan interest rates today! Find the best loan offer tailored to your financial needs and secure the lowest possible interest rate. Don't delay – your ideal personal loan awaits!

Featured Posts

-

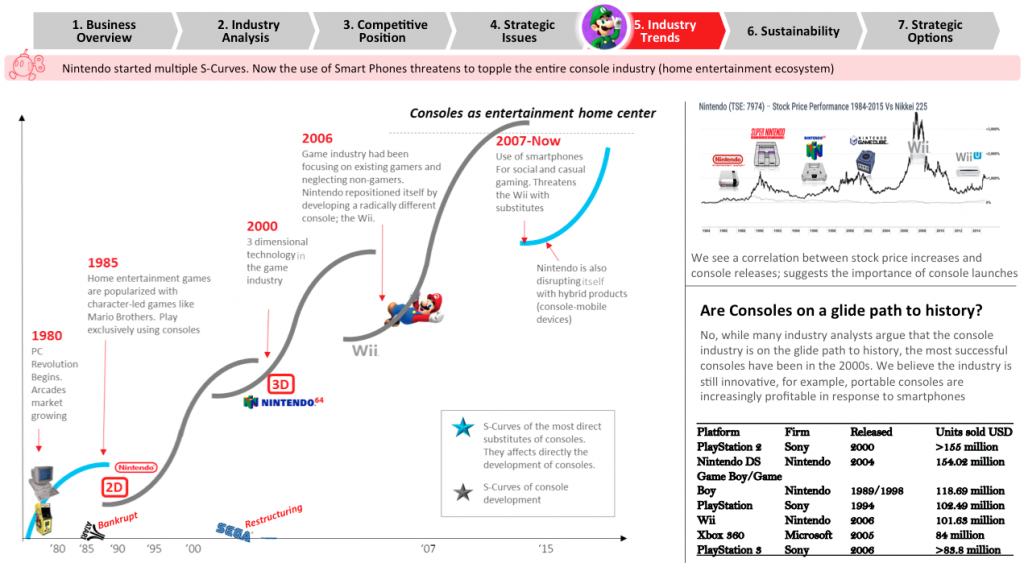

The Calculated Risks Of Nintendos Current Game Strategy

May 28, 2025

The Calculated Risks Of Nintendos Current Game Strategy

May 28, 2025 -

Us Money Management Under Scrutiny 65 Billion Dutch Investment Alert

May 28, 2025

Us Money Management Under Scrutiny 65 Billion Dutch Investment Alert

May 28, 2025 -

Follow The Euro Millions Live Draw E245 Million Jackpot On Friday

May 28, 2025

Follow The Euro Millions Live Draw E245 Million Jackpot On Friday

May 28, 2025 -

Ronaldo Portekiz Kampinda Fenerbahcelileri Sasirtti

May 28, 2025

Ronaldo Portekiz Kampinda Fenerbahcelileri Sasirtti

May 28, 2025 -

Pirates Recap Triolos Strong Performance Reliable Bullpen In Loss To Braves

May 28, 2025

Pirates Recap Triolos Strong Performance Reliable Bullpen In Loss To Braves

May 28, 2025