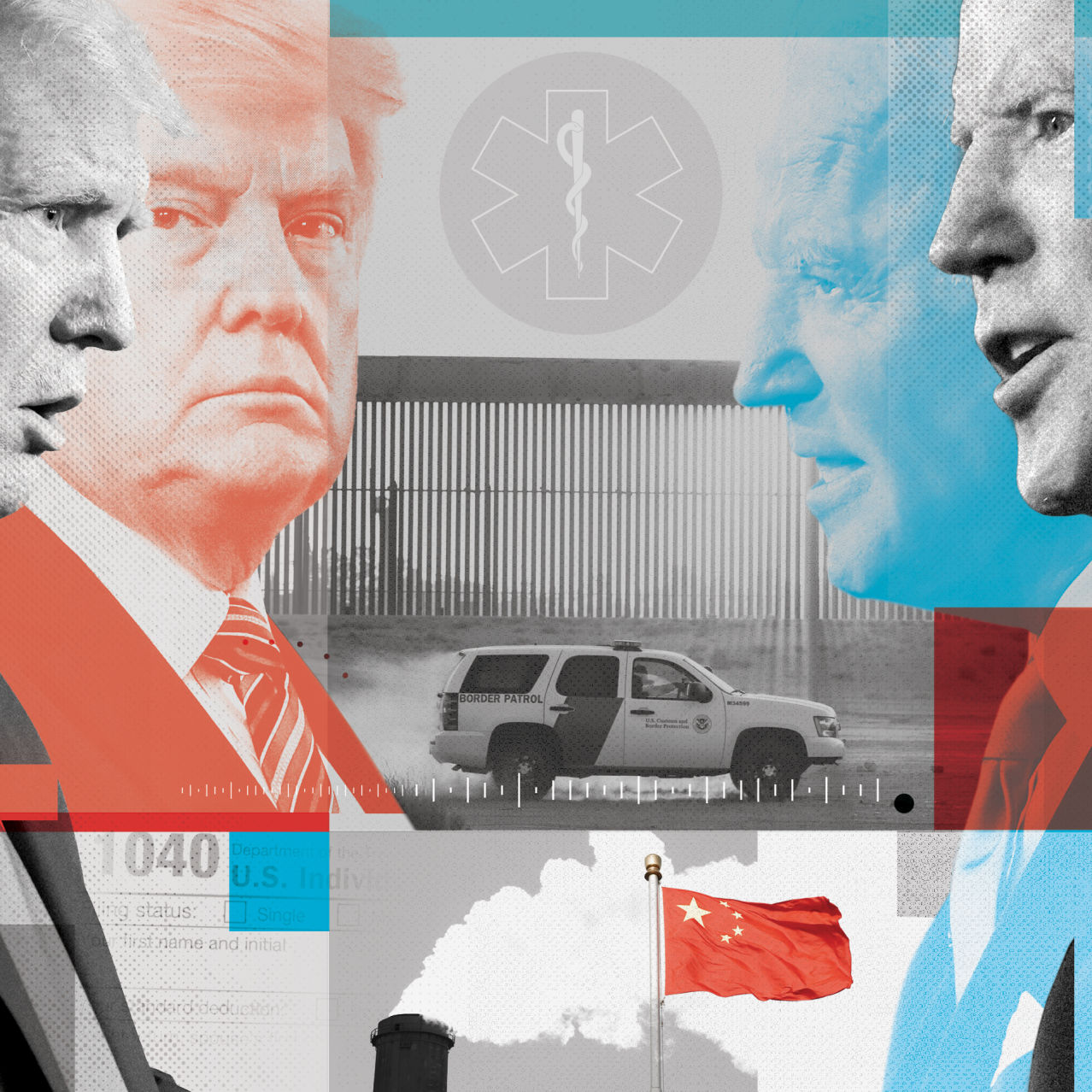

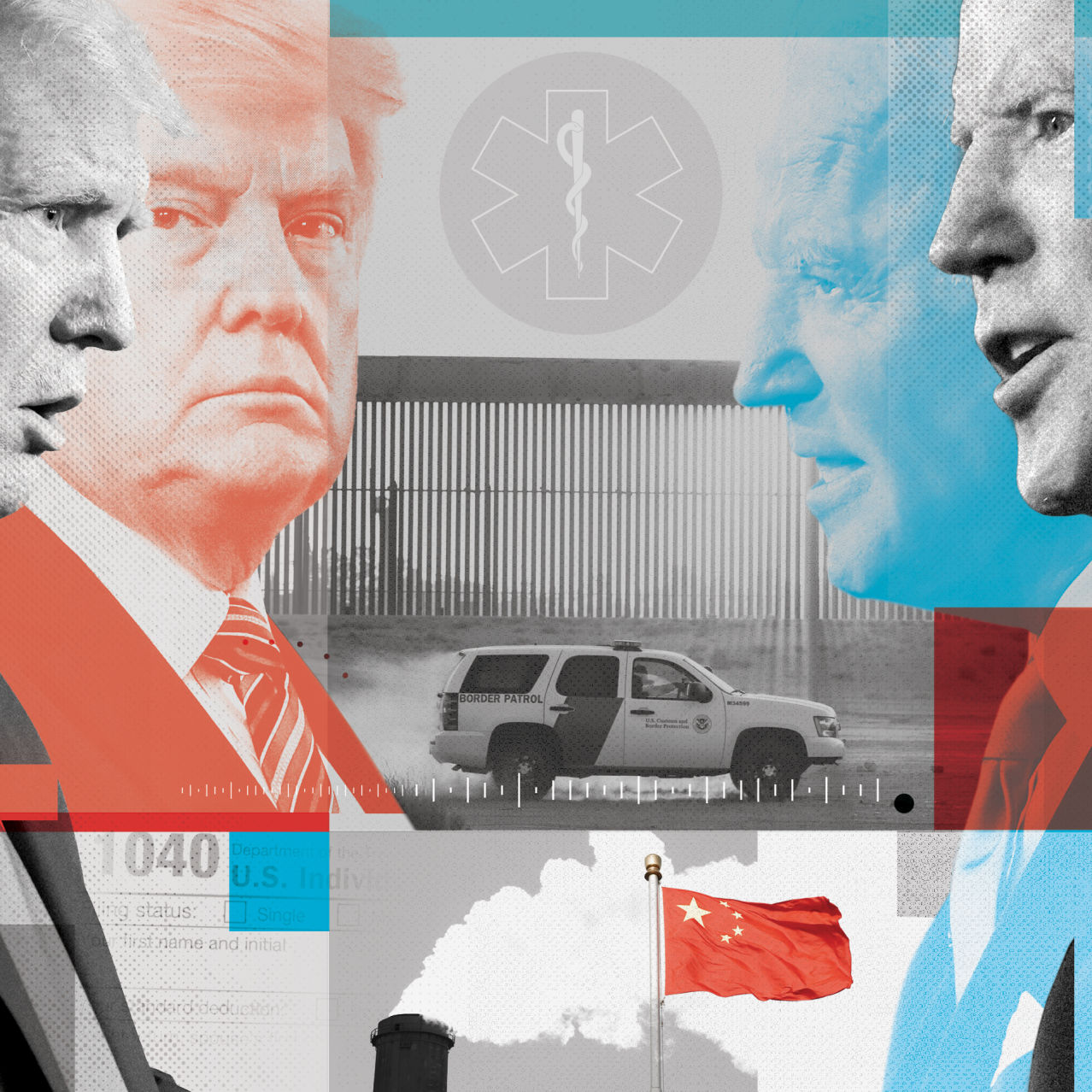

Comparing Trump And Biden's Economic Policies And Their Impacts

Table of Contents

H2: Tax Policies: A Tale of Two Approaches

The divergence in tax policies under Trump and Biden exemplifies their fundamentally different economic viewpoints.

H3: Trump's Tax Cuts and Jobs Act of 2017:

This landmark legislation significantly lowered both corporate and individual income tax rates. The intended goal was to stimulate economic growth through increased business investment and job creation – a supply-side economics approach.

- Intended Goals: Boost economic growth, incentivize investment, and create jobs.

- Actual Impacts: While the economy experienced a short-term boost, critics point to a substantial increase in the national debt as a major consequence. The long-term effects remain a subject of ongoing economic debate, with some arguing that the benefits were short-lived and outweighed by the increased debt.

- Key Features:

- Reduced the corporate tax rate from 35% to 21%, the lowest in decades.

- Standardized deductions for individuals, simplifying the tax code for some but eliminating deductions for others.

- The resulting deficit increase fueled concerns about long-term fiscal sustainability.

H3: Biden's Tax Plan: Reversing Course?

President Biden's tax proposals represent a shift towards a more progressive approach. His plan focuses on increasing taxes on corporations and high-income earners to fund infrastructure projects, reduce income inequality, and ultimately lower the national debt.

- Intended Goals: Fund infrastructure investment, reduce income inequality, and address the national debt.

- Actual Impacts: The full impact of Biden's tax plan remains to be seen. While some argue that it will curb economic growth by discouraging investment, proponents claim it will promote fairness and long-term fiscal stability. The debate continues on whether the increased tax revenue will be sufficient to offset the costs of the ambitious infrastructure spending.

- Key Features:

- Proposed raising the corporate tax rate back to 28%.

- Increased tax rates for individuals earning over $400,000 annually.

- Increased investment in renewable energy and infrastructure, often funded by these tax increases.

H2: Regulation and Deregulation: Differing Philosophies

The approaches to government regulation under Trump and Biden reveal contrasting visions for the role of the state in the economy.

H3: Trump's Deregulatory Agenda:

The Trump administration pursued a significant deregulation agenda, aiming to reduce the burden of government oversight on businesses.

- Intended Goals: Reduce business costs, stimulate economic growth, and foster competition.

- Actual Impacts: The deregulation efforts sparked considerable controversy, particularly regarding environmental protections, consumer safety, and financial stability. The long-term economic consequences of these rollbacks are still being assessed.

- Key Actions:

- Rollbacks of environmental regulations, impacting areas like clean air and water standards.

- Easing of financial regulations, potentially increasing risks in the financial sector.

- Debates continue on the impact of these policies on job creation and the environment.

H3: Biden's Regulatory Approach:

President Biden has signaled a return to a more interventionist approach, prioritizing environmental protection, consumer safety, and worker rights.

- Intended Goals: Protect the environment, ensure consumer safety, and strengthen worker protections.

- Actual Impacts: Increased regulation may lead to higher business costs, but proponents argue that this is necessary for long-term sustainability and social well-being. The balance between economic growth and environmental/social responsibility remains a key point of contention.

- Key Actions:

- Rejoining the Paris Agreement on climate change.

- Strengthening environmental protection laws, such as those related to vehicle emissions and pollution control.

- Increased focus on worker safety, fair wages, and unionization.

H2: Infrastructure Spending: Investing in the Future

Infrastructure investment has been a focal point for both administrations, albeit with vastly different scales and approaches.

H3: Trump's Infrastructure Plan:

Despite campaign promises, Trump's administration made limited progress on a comprehensive infrastructure plan. Funding and legislative hurdles hampered the ambitious proposals.

H3: Biden's Infrastructure Investment and Jobs Act:

Biden's administration has overseen a massive investment in infrastructure, representing a significant departure from his predecessor's approach.

- Intended Goals: Modernize the nation's infrastructure, create jobs, and stimulate long-term economic growth.

- Actual Impacts: The long-term economic impact of this investment is yet to be fully realized, but it is projected to create jobs and improve productivity. The effectiveness of the spending in achieving stated goals is an ongoing area of analysis.

- Key Projects:

- Investment in roads, bridges, public transportation, and water systems.

- Expansion of broadband internet access across the country.

- Investments in renewable energy infrastructure to support the transition to a greener economy.

3. Conclusion:

Comparing Trump and Biden's economic policies reveals fundamentally different philosophies. Trump favored tax cuts and deregulation to stimulate growth, while Biden prioritizes investments in infrastructure, social programs, and environmental protection, funded through higher taxes on corporations and wealthy individuals. While the short-term impacts of Trump's policies are visible – a short-term economic boost coupled with increased national debt – the long-term effects of both administrations' policies remain subject to ongoing debate and analysis. The effectiveness and long-term implications of these contrasting approaches are crucial considerations for understanding the future trajectory of the US economy. We encourage you to continue researching and engaging in informed discussions about comparing Trump and Biden's economic policies and their lasting impacts on the American economy.

Featured Posts

-

Paddy Pimbletts Bold Prediction Ufc 314 And The Road To A Championship

May 15, 2025

Paddy Pimbletts Bold Prediction Ufc 314 And The Road To A Championship

May 15, 2025 -

Grizzlies Vs Warriors Your Guide To Tuesdays Nba Play In Game

May 15, 2025

Grizzlies Vs Warriors Your Guide To Tuesdays Nba Play In Game

May 15, 2025 -

Ge Force Now Game Lineup Expanded Halo Balatro Included

May 15, 2025

Ge Force Now Game Lineup Expanded Halo Balatro Included

May 15, 2025 -

Rare Kid Cudi Artifacts Command High Bids At Recent Auction

May 15, 2025

Rare Kid Cudi Artifacts Command High Bids At Recent Auction

May 15, 2025 -

Execs Office365 Accounts Targeted Millions Made From Data Breaches Feds Report

May 15, 2025

Execs Office365 Accounts Targeted Millions Made From Data Breaches Feds Report

May 15, 2025