Competition Heats Up: FMX Launches Treasury Futures Trading, Threatening CME's Market Share

Table of Contents

FMX's Entry into the Treasury Futures Market: A Game Changer?

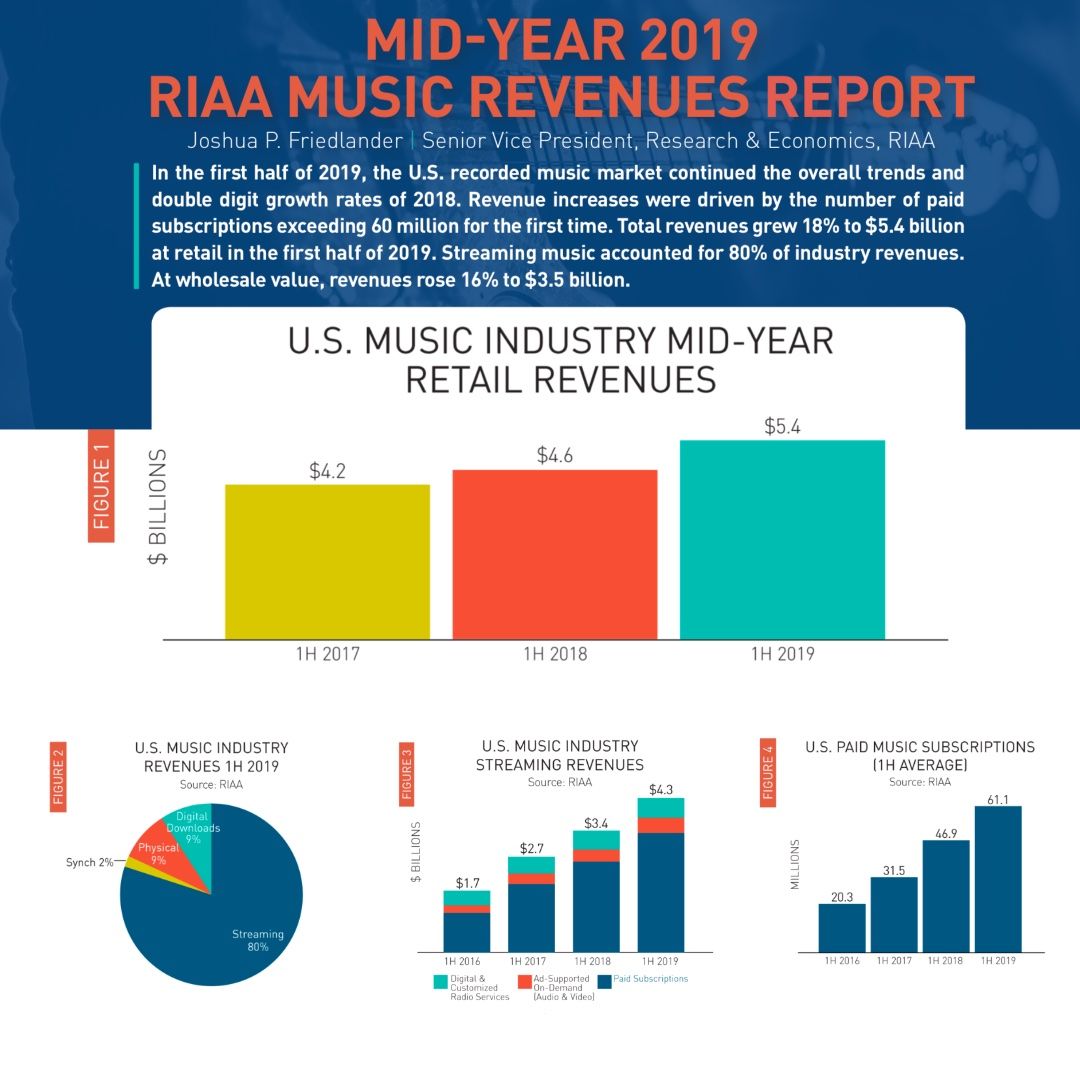

FMX, a relatively new player in the financial derivatives market, has made a bold strategic move by entering the lucrative Treasury futures trading arena. This traditionally CME-dominated market is now facing its first significant competitor in years. FMX's entry is driven by a combination of factors, including a perceived opportunity to capture market share by offering a compelling alternative to established players and leveraging advancements in technology and trading platforms.

Key features of FMX's offering include:

- Advanced Trading Platform: FMX boasts a cutting-edge, user-friendly trading platform designed for speed, efficiency, and seamless integration with other trading tools.

- Competitive Fee Structure: FMX is aggressively pricing its Treasury futures contracts, potentially offering lower fees than CME, attracting price-sensitive traders.

- Transparent Contract Specifications: FMX has clearly defined contract specifications, aiming for clarity and transparency to build trust and attract institutional investors.

- Access to Emerging Markets: FMX's network potentially offers access to specific niche markets or emerging economies that may not be as readily available through CME.

While precise market share data for FMX is still emerging, analysts predict a significant potential for market share gains, especially among traders seeking lower costs and a more technologically advanced platform. The success of FMX will depend heavily on its ability to attract both retail and institutional investors and build confidence in its platform's reliability and security.

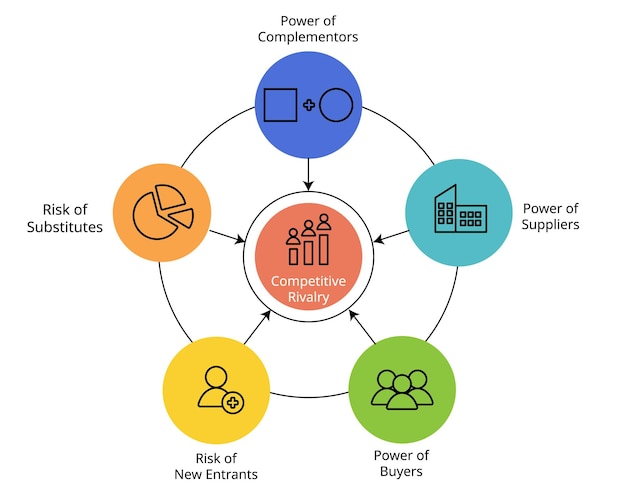

Analyzing CME Group's Response to Increased Competition in Treasury Futures Trading

CME Group, long the undisputed king of Treasury futures trading, is facing its first serious challenge in decades. Its historical dominance stems from its established brand reputation, vast network of market participants, and substantial market liquidity. However, FMX's aggressive entry is forcing CME to respond strategically.

CME's potential counter-strategies include:

- Fee Adjustments: Reducing fees on specific Treasury futures contracts to remain competitive.

- Technological Upgrades: Investing in platform improvements to enhance speed, functionality, and user experience.

- Product Diversification: Introducing new or enhanced Treasury futures products to differentiate its offering and attract a wider range of traders.

- Strategic Partnerships: Collaborating with other financial institutions to strengthen its market reach and appeal.

CME's strength lies in its established infrastructure and brand recognition. However, its weakness lies in potentially being perceived as less technologically innovative or adaptable to the evolving preferences of a new generation of traders. While CME hasn't publicly commented extensively on FMX's entry, market observers expect a multi-pronged response to maintain its market leadership.

The Impact on Investors and the Broader Market

The increased competition in Treasury futures trading promises significant implications for investors and the broader market.

Potential benefits for investors include:

- Lower Trading Costs: The competition between FMX and CME could drive down trading fees, ultimately benefiting investors.

- Increased Liquidity: The entry of a new competitor could increase overall market liquidity, leading to tighter spreads and more efficient price discovery.

- Greater Trading Options: Investors will have a broader choice of trading platforms and contract specifications.

Potential risks include:

- Increased Market Volatility: The increased competition could initially lead to higher market volatility as traders adjust to the new landscape.

- Fragmentation of Liquidity: If the market splits significantly between CME and FMX, it could potentially lead to less efficient price discovery in each individual market.

For market makers, brokers, and other market participants, the increased competition necessitates adapting to a more dynamic market environment and potentially adjusting their trading strategies to capitalize on new opportunities. The long-term effect on price discovery and market efficiency will largely depend on how the market shares evolve and whether the competition leads to healthy innovation or simply a price war.

The Future of Treasury Futures Trading: A Two-Horse Race or More?

The increased competition could potentially attract other exchanges to enter the Treasury futures trading market, creating a more fragmented yet potentially more innovative landscape. This increased competition could accelerate technological advancements and the development of new, more sophisticated trading products tailored to specific investor needs. Regulatory oversight will undoubtedly play a crucial role in ensuring fair competition and protecting market integrity.

Conclusion

The entry of FMX into Treasury futures trading marks a significant turning point in the market. While CME Group retains its dominant position, the increased competition promises to benefit investors through lower costs, improved technology, and greater choice. The long-term impact remains to be seen, but the current landscape indicates a more dynamic and competitive future for Treasury futures trading.

Call to Action: Stay informed about the evolving landscape of Treasury futures trading. Follow this blog for ongoing updates and analysis of the competition between FMX and CME, and other key players in this dynamic market. Learn more about the advantages and disadvantages of both exchanges and make informed decisions about your Treasury futures trading strategy.

Featured Posts

-

Did Taylor Swift Cost Kanye West A Super Bowl Performance

May 18, 2025

Did Taylor Swift Cost Kanye West A Super Bowl Performance

May 18, 2025 -

Kanye West And Bianca Censori Spain Dinner Date After Breakup Claims

May 18, 2025

Kanye West And Bianca Censori Spain Dinner Date After Breakup Claims

May 18, 2025 -

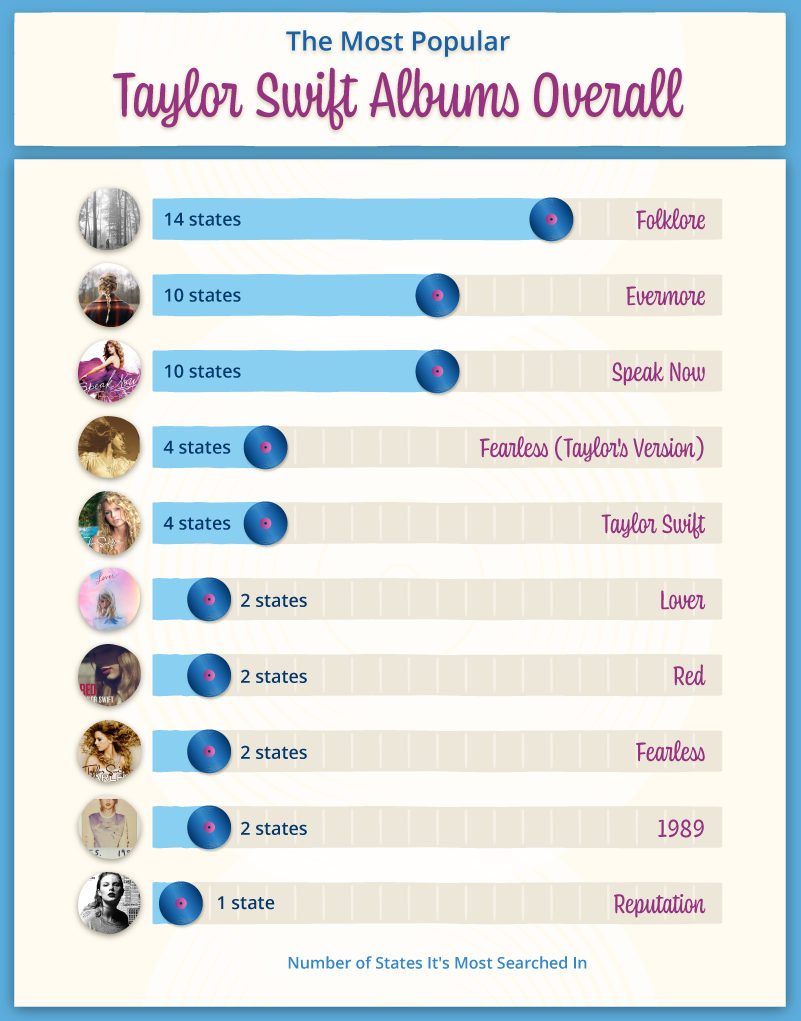

The Ultimate Taylor Swift Album Ranking 11 Albums Reviewed

May 18, 2025

The Ultimate Taylor Swift Album Ranking 11 Albums Reviewed

May 18, 2025 -

Groeiende Internationale Spanningen Stimuleren Steun Voor Nederlandse Defensie Industrie

May 18, 2025

Groeiende Internationale Spanningen Stimuleren Steun Voor Nederlandse Defensie Industrie

May 18, 2025 -

Analyse Steun Voor Uitbreiding Nederlandse Defensie Industrie

May 18, 2025

Analyse Steun Voor Uitbreiding Nederlandse Defensie Industrie

May 18, 2025

Latest Posts

-

Analyzing The Economic Influence Of Large Scale Rave Concerts

May 18, 2025

Analyzing The Economic Influence Of Large Scale Rave Concerts

May 18, 2025 -

The Economic Powerhouse Exploring The Impact Of Huge Raves

May 18, 2025

The Economic Powerhouse Exploring The Impact Of Huge Raves

May 18, 2025 -

Snls Signal Leak Parody Mikey Madison And The Government Texts

May 18, 2025

Snls Signal Leak Parody Mikey Madison And The Government Texts

May 18, 2025 -

Large Rave Festivals A Boon For Local Economies

May 18, 2025

Large Rave Festivals A Boon For Local Economies

May 18, 2025 -

Michelle Williams And Marcello Hernandezs Clasp Scene Unanswered Questions

May 18, 2025

Michelle Williams And Marcello Hernandezs Clasp Scene Unanswered Questions

May 18, 2025