Condo Market Slump: Are Canadian Investors Losing Faith?

Table of Contents

Rising Interest Rates and Their Impact on Condo Investment

Higher interest rates are significantly impacting the Canadian condo market, creating a challenging environment for investors. This is primarily due to two key effects: increased mortgage payments and reduced buyer demand.

Increased Mortgage Payments

The Bank of Canada's recent interest rate hikes have directly translated into substantially higher monthly mortgage payments for condo buyers and investors. This increased financial burden reduces affordability and significantly impacts rental yields, a key factor in condo investment profitability.

- Example: A $500,000 condo mortgage with a 5% interest rate might have had monthly payments of approximately $2,680. With a 7% interest rate, that same mortgage could cost closer to $3,380 – a $700 increase per month.

- Impact on Cash Flow: This substantial increase in mortgage payments directly reduces the investor's positive cash flow, potentially pushing some into negative territory. This means less profit or even losses each month.

Reduced Buyer Demand

Higher interest rates act as a significant deterrent for potential condo buyers. The increased cost of borrowing makes purchasing a condo a less attractive proposition, leading to a decrease in demand.

- Statistics: (Insert relevant statistics here, e.g., "Sales volume in Toronto decreased by X% in the last quarter," or "Inventory levels in Vancouver have increased by Y%").

- Impact on Resale: This reduced buyer demand makes it more difficult for investors to sell their condos quickly and profitably, potentially resulting in significant capital losses.

Over-Saturation of the Condo Market in Certain Cities

Another significant contributor to the condo market slump is the oversupply of condos in specific Canadian cities. This oversaturation is largely a result of high-density construction projects undertaken in recent years.

High-Density Construction

Several major Canadian cities have experienced a surge in condo construction, leading to a considerable surplus of available units.

- Examples: (Cite specific cities experiencing oversupply, e.g., "Toronto, Vancouver, and Calgary have all seen a significant increase in condo inventory.")

- Construction Statistics: (Include data on new condo construction in these cities, potentially using a chart or graph to illustrate the scale of the problem).

Impact on Property Values

The oversupply of condos has a direct and negative impact on property values. With more units available than buyers, prices are naturally pressured downward.

- Price Drops: (Provide examples of price decreases in specific cities and neighbourhoods.)

- Rental Market Challenges: An over-saturated market also makes it more challenging to attract renters, further impacting the profitability of condo investments.

Shifting Investor Sentiment and Market Predictions

The current challenges in the Canadian condo market have led to a noticeable shift in investor sentiment. Many are reconsidering their investment strategies and exploring alternative options.

Investor Confidence Levels

Recent surveys and reports reveal a decline in investor confidence in the Canadian condo market.

- Survey Data: (Cite specific surveys or reports that reflect declining confidence levels among Canadian investors.)

- Expert Opinions: (Include quotes from real estate analysts or financial experts who are commenting on the current state and future predictions of the condo market.)

Alternative Investment Opportunities

Given the current state of the condo market, many Canadian investors are turning to alternative investment opportunities.

- Alternatives: (List various alternatives, such as stocks, bonds, rental properties in different sectors (e.g., single-family homes), or even REITs).

- Comparison: (Briefly compare and contrast the risks and potential returns of these alternatives versus condo investments.)

Conclusion

The Canadian condo market slump is a complex issue driven by several interconnected factors: rising interest rates increasing mortgage payments and decreasing buyer demand; an oversupply of condos in certain cities leading to price depreciation; and a noticeable shift in investor sentiment. These challenges present significant headwinds for Canadian condo investors. The potential for continued downward pressure on condo prices remains a significant concern.

Key Takeaways: Canadian condo investors are facing substantial challenges due to rising interest rates, market oversaturation, and declining confidence. Careful consideration of these factors is crucial for anyone contemplating condo investment.

Call to Action: Before making any condo market investment decisions, conduct thorough research and consider the current climate. For a comprehensive condo market analysis and to explore alternative investment strategies like rental properties outside of condos or other asset classes, consult with a financial advisor. Understanding the Canadian condo market outlook is critical for making informed investment choices.

Featured Posts

-

Trio Explosivo Jorge And Mateus E Felipe Amorim No 1 Dia De Carnaval

Apr 25, 2025

Trio Explosivo Jorge And Mateus E Felipe Amorim No 1 Dia De Carnaval

Apr 25, 2025 -

The Psychological Toll Of Cool Sculpting Linda Evangelistas Experience And Long Term Effects

Apr 25, 2025

The Psychological Toll Of Cool Sculpting Linda Evangelistas Experience And Long Term Effects

Apr 25, 2025 -

Hinh Anh Voi Trang Diem Kham Pha Bua Tiec Buffet Xa Hoa

Apr 25, 2025

Hinh Anh Voi Trang Diem Kham Pha Bua Tiec Buffet Xa Hoa

Apr 25, 2025 -

Traffic Alert Semi Truck Involved In Crash On Kilpatrick Turnpike

Apr 25, 2025

Traffic Alert Semi Truck Involved In Crash On Kilpatrick Turnpike

Apr 25, 2025 -

Pozitsiya Trampa Schodo Viyni V Ukrayini Analiz Ritoriki

Apr 25, 2025

Pozitsiya Trampa Schodo Viyni V Ukrayini Analiz Ritoriki

Apr 25, 2025

Latest Posts

-

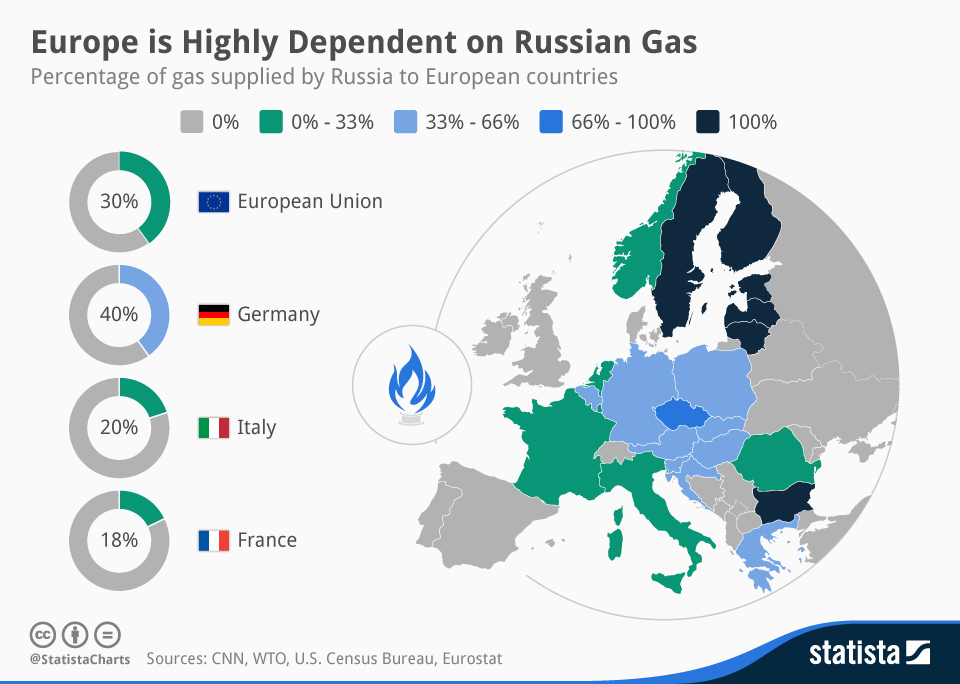

No Russian Gas Klingbeil Rejects Import Resumption For Germany

Apr 30, 2025

No Russian Gas Klingbeil Rejects Import Resumption For Germany

Apr 30, 2025 -

Trump Removes Doug Emhoff From Holocaust Memorial Council

Apr 30, 2025

Trump Removes Doug Emhoff From Holocaust Memorial Council

Apr 30, 2025 -

How Outdated Business Apps Hamper Ai Adoption

Apr 30, 2025

How Outdated Business Apps Hamper Ai Adoption

Apr 30, 2025 -

Germanys Klingbeil Stands Firm Against Resuming Russian Gas Imports

Apr 30, 2025

Germanys Klingbeil Stands Firm Against Resuming Russian Gas Imports

Apr 30, 2025 -

Der Architekt Des Scheiterns Wer Zieht Die Faeden In Den Koalitionsverhandlungen

Apr 30, 2025

Der Architekt Des Scheiterns Wer Zieht Die Faeden In Den Koalitionsverhandlungen

Apr 30, 2025