Conquering The AIMSCAP World Trading Tournament (WTT)

Table of Contents

Understanding the AIMSCAP WTT Rules and Regulations

Before diving into strategies, it's crucial to understand the AIMSCAP WTT's rules and regulations. Thorough knowledge is the cornerstone of success in this demanding competition.

Registration and Eligibility Criteria

Registering for the WTT involves several steps. Meeting the eligibility criteria is paramount; failure to do so will result in disqualification.

- Age: Participants must be 18 years or older.

- Residency: Specific residency requirements may apply; check the official rules for details.

- Account Minimums: A minimum account balance might be required before registration.

- Acceptable Identification: Valid government-issued identification is mandatory for verification.

Non-compliance with any of these rules can lead to immediate disqualification from the AIMSCAP World Trading Tournament, so ensure you carefully review all regulations before proceeding.

Tournament Structure and Scoring

The AIMSCAP WTT typically follows a structured format, often involving multiple rounds with defined trading periods. Understanding how scores are calculated is critical for effective strategy development.

- Rounds: The tournament might consist of preliminary rounds leading to a final round.

- Trading Periods: Each round will have specific trading periods during which participants can execute trades.

- Scoring System: Points are typically awarded based on profitability and risk-adjusted returns. Specific scoring systems may vary yearly, so consult the official rules.

Tie-breakers, if necessary, might involve considering factors like the highest single-day profit or the lowest drawdown.

Permitted Trading Instruments and Strategies

The AIMSCAP WTT specifies permitted trading instruments and may place restrictions on certain strategies. Knowing these limitations is crucial for crafting a compliant and successful strategy.

- Permitted Instruments: This might include forex pairs, indices, commodities, or other asset classes specified by AIMSCAP.

- Prohibited Instruments: Certain high-risk or volatile instruments might be disallowed.

- Permitted Strategies: While most strategies are permitted, certain automated high-frequency trading systems might be restricted.

- Prohibited Strategies: Market manipulation or strategies exploiting loopholes are strictly prohibited.

Successful strategies often involve a combination of fundamental and technical analysis adapted to the specific market conditions and permitted instruments during the tournament. Avoid overly aggressive strategies that increase your risk of substantial losses.

Developing a Winning Trading Strategy for the AIMSCAP WTT

Crafting a winning strategy is paramount for success. This involves careful planning, risk management, and adaptability.

Risk Management and Capital Allocation

Effective risk management is the cornerstone of successful tournament trading. Without it, even the most brilliant trading ideas can lead to devastating losses.

- Position Sizing: Never risk more than a small percentage of your capital on any single trade.

- Stop-Loss Orders: Always use stop-loss orders to limit potential losses on each trade.

- Diversification: Spread your trades across different instruments to reduce overall risk.

- Drawdown Management: Monitor your maximum drawdown and adjust your strategy to avoid excessive losses.

Tournament trading demands a more cautious approach than regular trading, so stringent risk management is crucial.

Technical and Fundamental Analysis for Tournament Trading

Successful tournament trading requires a blend of technical and fundamental analysis, tailoring your approach to the competition's timeframe.

- Technical Analysis: Use chart patterns, indicators (like moving averages, RSI, MACD), and candlestick analysis to identify trading opportunities.

- Fundamental Analysis: Analyze economic news, company earnings, and geopolitical events to anticipate market movements.

Thorough research and understanding of market dynamics are vital for making informed decisions during the AIMSCAP World Trading Tournament.

Adapting to Market Volatility and Unexpected Events

Market volatility is inevitable. Your trading plan must adapt to unexpected events and shifts in market sentiment.

- Volatility Management: During periods of high volatility, reduce your position size and increase your stop-loss levels.

- News Monitoring: Stay updated on economic news and geopolitical events that can significantly impact markets.

- Plan Adjustment: Be prepared to adjust your trading plan based on the evolving market conditions.

Flexibility and adaptability are keys to navigating unforeseen circumstances during the AIMSCAP WTT.

Mastering the AIMSCAP WTT Platform and Tools

Familiarity with the trading platform and available resources is essential for optimal performance.

Familiarization with the Trading Platform

Before the tournament begins, spend ample time familiarizing yourself with the specific trading platform used in the AIMSCAP WTT.

- Navigation: Understand how to place orders, set stop-loss and take-profit levels, and monitor your trades.

- Order Types: Become proficient in using various order types (market orders, limit orders, stop orders).

- Charting Tools: Utilize the charting tools effectively for technical analysis.

Practice using the platform extensively before the tournament starts to ensure seamless execution during the competition.

Utilizing Available Resources and Support

AIMSCAP typically provides various resources to support participants during the tournament. Utilize them effectively.

- FAQs: Review the frequently asked questions section for answers to common queries.

- Live Chat Support: Utilize live chat support for immediate assistance with platform issues or rule clarifications.

- Email Support: Use email support for more detailed inquiries or issues requiring a longer response time.

Leveraging these resources can greatly enhance your performance and address any challenges that may arise during the competition.

Conclusion

Conquering the AIMSCAP World Trading Tournament (WTT) demands a holistic approach: strategic planning, robust risk management, thorough understanding of the rules and platform, and adaptability to market dynamics. By mastering the techniques and strategies outlined in this guide, you'll significantly increase your chances of success in the AIMSCAP WTT. Consistent practice and disciplined execution are crucial. Don't delay – prepare yourself to conquer the AIMSCAP WTT and claim your victory today!

Featured Posts

-

How To Watch Peppa Pig Online Free Streaming Guide

May 21, 2025

How To Watch Peppa Pig Online Free Streaming Guide

May 21, 2025 -

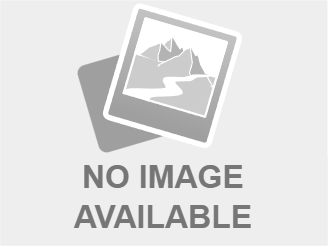

Canada Posts Financial Troubles A Call To Reform Mail Delivery

May 21, 2025

Canada Posts Financial Troubles A Call To Reform Mail Delivery

May 21, 2025 -

Abn Amro Rapport Te Grote Afhankelijkheid Van Goedkope Arbeidsmigranten In De Voedingsindustrie

May 21, 2025

Abn Amro Rapport Te Grote Afhankelijkheid Van Goedkope Arbeidsmigranten In De Voedingsindustrie

May 21, 2025 -

Switzerlands Cassis Denounces Deadly Pahalgam Terror Attack

May 21, 2025

Switzerlands Cassis Denounces Deadly Pahalgam Terror Attack

May 21, 2025 -

Report Recommends Ending Daily Canada Post Home Mail Delivery

May 21, 2025

Report Recommends Ending Daily Canada Post Home Mail Delivery

May 21, 2025