Conservative Revolt Delays GOP Tax Plan: Demands For Medicaid And Clean Energy Revisions

Table of Contents

The Core Tenets of the Original GOP Tax Plan

The original GOP tax plan aimed for comprehensive tax reform, promising significant tax cuts for businesses and individuals. The GOP tax reform package included several key features intended to stimulate economic growth. This GOP tax reform proposal encompassed:

- Corporate Tax Rate Reduction: A dramatic reduction in the corporate tax rate, from 35% to 20%, was a central pillar, intended to boost business investment and competitiveness.

- Individual Income Tax Adjustments: The plan proposed changes to individual income tax brackets, with varying levels of cuts depending on income levels. This aimed to provide relief to middle-class families while also benefiting higher earners. Specific adjustments to the individual income tax structure were heavily debated.

- Standard Deduction Increase: An increase in the standard deduction was designed to simplify the tax code and benefit a larger portion of taxpayers. This simplification was presented as a key benefit of the GOP tax reform.

- Elimination of Certain Deductions: To offset the cost of tax cuts, the plan also proposed the elimination or limitation of certain tax deductions and credits. These proposed changes sparked controversy and fueled opposition.

Conservative Opposition: Demands for Medicaid Reform

A significant source of the conservative opposition stems from concerns about the impact of the original GOP tax plan on Medicaid funding. Conservative factions argued that the plan's provisions did not adequately address healthcare spending and, in some cases, proposed Medicaid cuts. Their concerns centered on:

- Insufficient Medicaid Reform: Conservatives argued that the plan did not go far enough in reforming Medicaid, a crucial healthcare program for low-income individuals and families.

- Concerns about the Deficit: Some voiced fears that the tax cuts, without sufficient corresponding cuts in spending, would exacerbate the national deficit. This concern was directly linked to their anxieties about Medicaid cuts and healthcare spending.

- Demands for Block Grants: Instead of the current open-ended funding system, conservative groups proposed shifting to a block grant system for Medicaid, giving states more control over their spending and potentially reducing federal outlays. This proposal formed a cornerstone of their demand for Medicaid reform.

The Clean Energy Controversy: A Key Point of Contention

Adding fuel to the Conservative Revolt was the controversy surrounding the lack of robust clean energy provisions in the original GOP tax plan. The absence of significant clean energy tax credits became a major point of contention, highlighting a broader clash of philosophies within the Republican party.

- Conservative Opposition to Subsidies: Conservatives opposed the inclusion of incentives for renewable energy, arguing against government intervention in the energy market and viewing such subsidies as wasteful spending.

- Arguments for Free Market Solutions: Instead of government support, conservatives advocated for market-based solutions to promote energy innovation and efficiency.

- Calls for Tax Neutrality: They pushed for a tax code that did not favor specific energy sources, thereby maintaining tax neutrality across the energy sector. This viewpoint directly affected the debate over clean energy tax credits.

Political Ramifications and Potential Outcomes

The delay caused by the Conservative Revolt has significant political ramifications. The internal divisions within the Republican party are now starkly exposed, potentially weakening their position in upcoming elections and highlighting political gridlock.

- Impact on Republican Unity: The revolt has shaken the Republican party's unity, demonstrating the challenges of navigating internal disagreements on crucial policy issues.

- Effect on Midterm Elections: The failure to pass a timely tax plan could negatively impact Republican prospects in the midterm elections, eroding public confidence and providing ammunition for the opposition party.

- Potential Scenarios: Several scenarios could unfold: a negotiated compromise incorporating some conservative demands, further delays leading to legislative stalemate, or the complete abandonment of the tax plan. The legislative process is now at a critical juncture.

The Future of the GOP Tax Plan: A Call to Action

The Conservative Revolt against the original GOP Tax Plan, driven by concerns about Medicaid and Clean Energy provisions, has created a significant obstacle to its passage. The delay has substantial implications for both the economy and the political landscape. The future of the plan remains uncertain, highlighting the complexities of achieving legislative consensus on such a significant piece of legislation. Stay informed about developments in this ongoing saga; understanding the Conservative Revolt and its impact on the GOP Tax Plan is crucial for navigating the evolving political climate. Follow reputable news sources for updates on this important story. The debate's outcome will significantly shape the economic and political trajectory of the nation for years to come.

Featured Posts

-

The Kardashian Censori Alliance Taking Down Kanye West

May 18, 2025

The Kardashian Censori Alliance Taking Down Kanye West

May 18, 2025 -

Trump Vs Springsteen A Heated Exchange Over Treasonous Accusation

May 18, 2025

Trump Vs Springsteen A Heated Exchange Over Treasonous Accusation

May 18, 2025 -

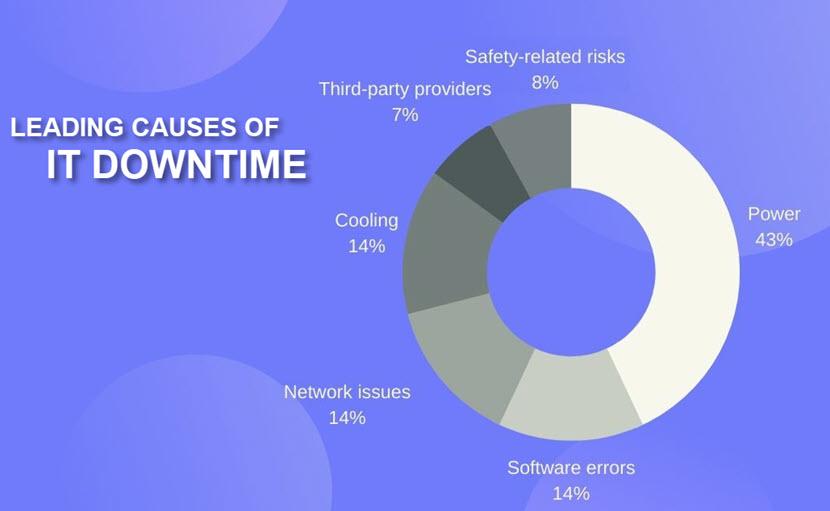

Global Reddit Outage Causes And Impact Of The Downtime

May 18, 2025

Global Reddit Outage Causes And Impact Of The Downtime

May 18, 2025 -

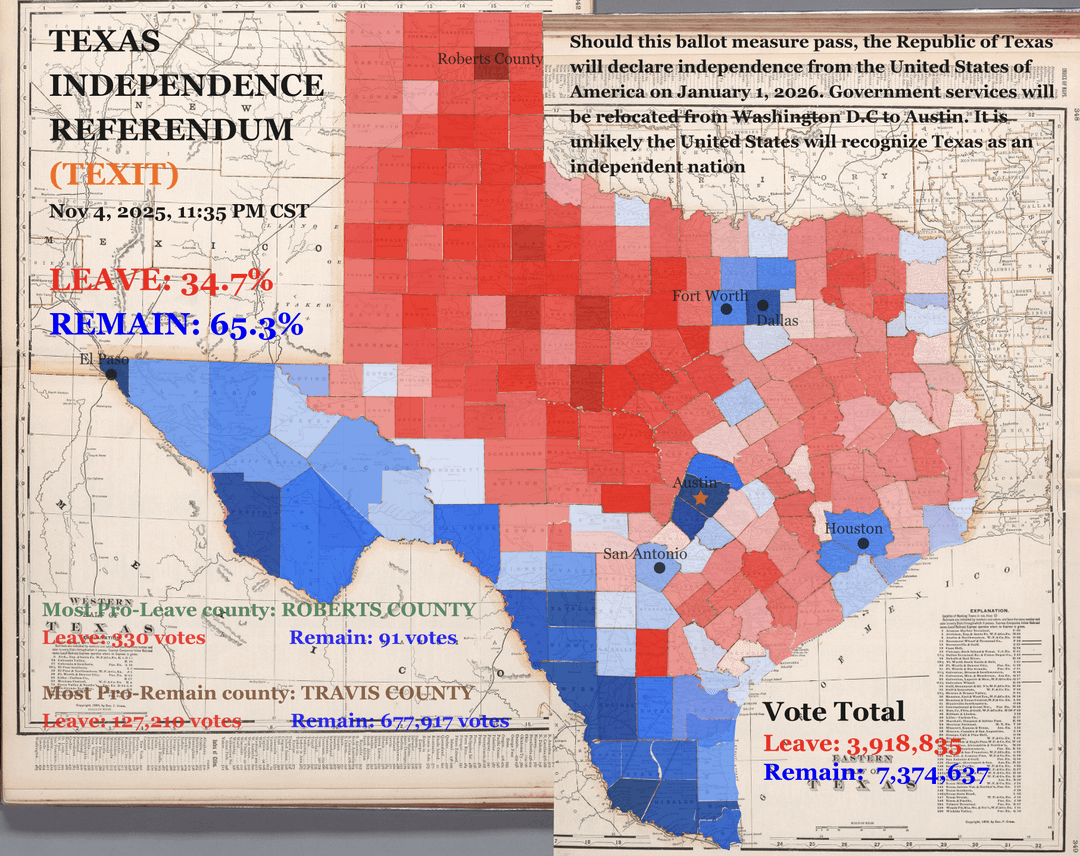

Understanding The 2025 Municipal Elections In Southeast Texas

May 18, 2025

Understanding The 2025 Municipal Elections In Southeast Texas

May 18, 2025 -

Fifteen Years Later Amanda Bynes Highly Anticipated Showbiz Comeback

May 18, 2025

Fifteen Years Later Amanda Bynes Highly Anticipated Showbiz Comeback

May 18, 2025

Latest Posts

-

Bowen Yang Speaks Out The Painful Reality Of Conversion Therapy

May 18, 2025

Bowen Yang Speaks Out The Painful Reality Of Conversion Therapy

May 18, 2025 -

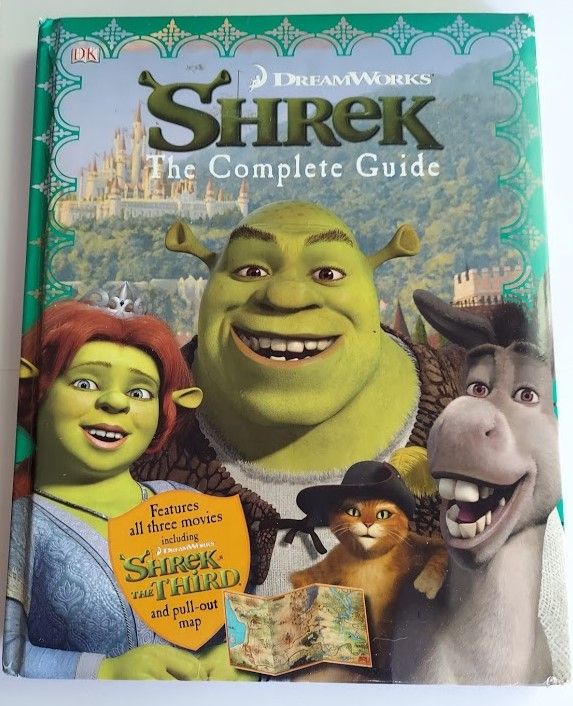

Find Shrek On Bbc Three Your Complete Tv Guide

May 18, 2025

Find Shrek On Bbc Three Your Complete Tv Guide

May 18, 2025 -

Bbc Three Shrek Schedule Full Episode Guide And Air Times

May 18, 2025

Bbc Three Shrek Schedule Full Episode Guide And Air Times

May 18, 2025 -

Where To Watch Shrek On Bbc Three A Complete Guide

May 18, 2025

Where To Watch Shrek On Bbc Three A Complete Guide

May 18, 2025 -

Gagas Critique Bowen Yangs Alejandro Tattoo Fails To Impress

May 18, 2025

Gagas Critique Bowen Yangs Alejandro Tattoo Fails To Impress

May 18, 2025