Continued Tariffs: Trump's 30% Duty On Chinese Goods Predicted Until Late 2025

Table of Contents

The Lingering Impact of Trump's 30% Tariffs

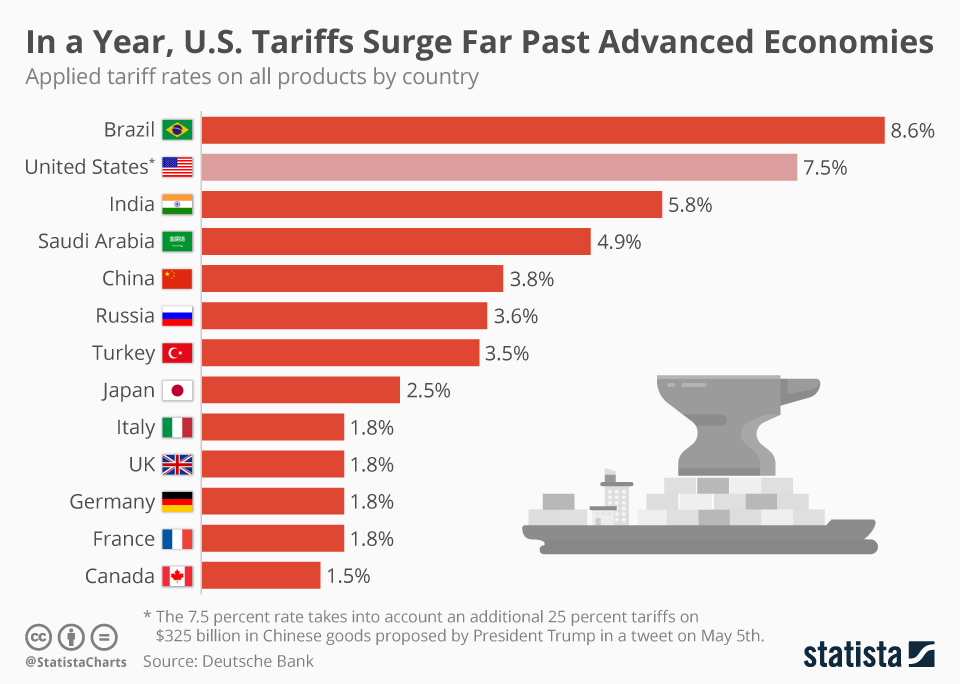

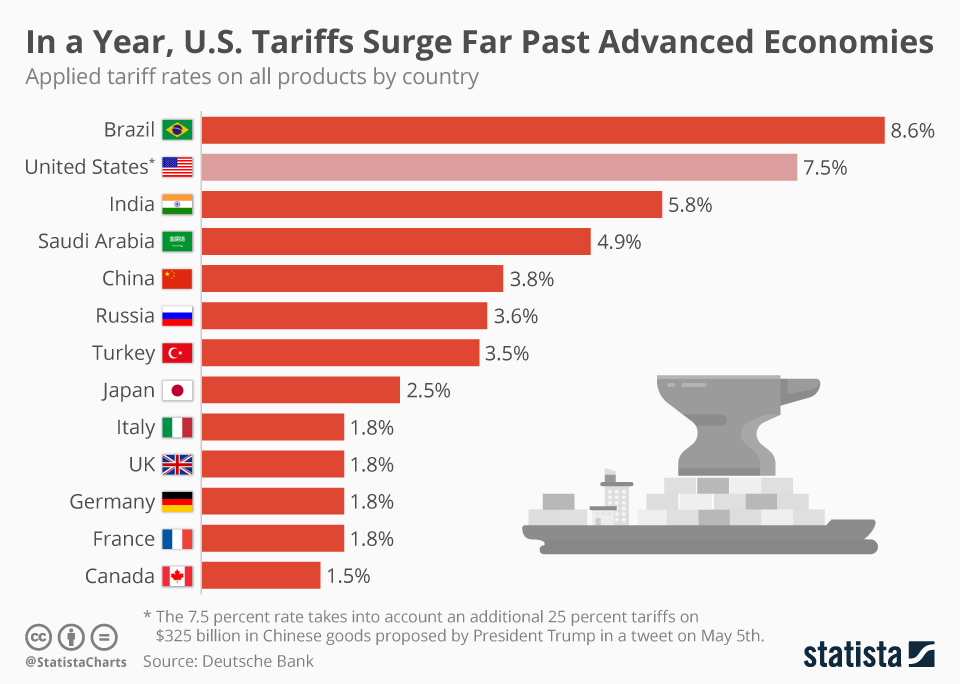

The 30% tariffs imposed on a wide range of Chinese goods during the Trump administration continue to reverberate through the global economy. Their impact extends far beyond simple import costs, creating complex ripple effects across various sectors.

Economic Consequences for US Businesses

The ongoing presence of these tariffs has imposed significant burdens on numerous US businesses.

- Increased import costs: Many US companies rely on importing goods from China. The 30% tariff directly increases these costs, squeezing profit margins and forcing price adjustments.

- Supply chain disruptions: The tariffs have prompted many businesses to restructure their supply chains, seeking alternative suppliers outside of China. This process is costly, time-consuming, and can lead to temporary shortages.

- Reduced competitiveness: US companies facing higher input costs due to tariffs are less competitive in both domestic and international markets, potentially leading to job losses and reduced market share.

- Price increases for consumers: Ultimately, many of these increased costs are passed on to consumers in the form of higher prices for a wide range of goods. This contributes to inflationary pressures within the US economy.

- Specific industries affected: Sectors heavily reliant on Chinese imports, such as manufacturing, electronics, and textiles, have been disproportionately affected by these tariffs.

The Ripple Effect on Global Trade

The impact of these tariffs extends far beyond US borders, significantly influencing global trade relationships.

- Retaliatory tariffs from China: China responded to the US tariffs with its own retaliatory measures, impacting US exports and further complicating global trade.

- Impact on other countries involved in trade with the US and China: Countries involved in trade with both the US and China found themselves caught in the crossfire, experiencing disruptions to their own supply chains and trade relationships.

- Shifting global supply chains: The tariffs have accelerated the trend of companies diversifying their supply chains, moving production away from China and toward other countries in Southeast Asia, South America, and elsewhere.

- Uncertainty in international trade relations: The prolonged presence of these tariffs has created significant uncertainty in global trade, making it difficult for businesses to make long-term investment decisions.

Predictions for the Continuation of Tariffs Until Late 2025

While there's been hope for tariff removal, various factors suggest that these trade barriers will likely remain in place until at least late 2025.

Factors Contributing to the Extended Timeline

Several elements contribute to this prediction:

- Political considerations and potential changes in US trade policy: While future administrations might reconsider the tariffs, the political will to dismantle them completely in the near term remains uncertain.

- Economic factors and the ongoing trade imbalance: The persistent trade imbalance between the US and China provides a rationale for maintaining tariffs as a tool to address this issue.

- Geopolitical dynamics and the broader US-China relationship: The overall geopolitical tensions between the two countries play a major role in determining trade policy, influencing the likelihood of tariff removal.

- Analysis of expert opinions and forecasts: Many economic analysts and trade experts predict that the tariffs will persist for several more years, reflecting a consensus view on the current dynamics.

Potential Scenarios and Outcomes

Several scenarios are possible regarding the future of these tariffs:

- Complete removal of tariffs: A significant shift in US-China relations could lead to the complete removal of tariffs.

- Gradual reduction of tariffs: The tariffs might be reduced incrementally over time, providing a more gradual adjustment for businesses.

- Maintenance of the current tariff structure: The most likely scenario is the continued maintenance of the tariffs at their current levels for several years.

- Potential escalation of trade tensions: Continued disagreements and escalating tensions could lead to further increases in tariffs or the imposition of new trade restrictions.

Strategies for Businesses to Navigate the Extended Tariff Landscape

Businesses need to proactively adapt their strategies to manage the ongoing impact of these tariffs.

Adapting Supply Chains and Sourcing Strategies

Mitigating the impact requires a proactive approach to supply chain management:

- Diversifying sourcing: Businesses should explore alternative sources for their goods, reducing their reliance on Chinese suppliers.

- Negotiating with suppliers: Strong relationships with suppliers are essential in negotiating favorable pricing and terms.

- Investing in domestic production: Reshoring or nearshoring production can reduce reliance on imports and mitigate tariff risks.

- Exploring alternative trade routes: Businesses should explore alternative shipping routes and logistics solutions to minimize costs and disruptions.

Financial Planning and Risk Management

Strategic financial planning is crucial to weather the storm:

- Budgeting for increased import costs: Businesses should incorporate higher import costs into their budgets and financial forecasts.

- Hedging strategies to mitigate currency risks: Implementing hedging strategies can help reduce the impact of currency fluctuations.

- Insurance options to protect against potential losses: Exploring insurance options can help protect against potential losses due to tariff-related disruptions.

Conclusion

The continued impact of Trump's 30% tariffs on Chinese goods presents a significant ongoing challenge for businesses operating in the global economy. Predictions suggest these tariffs will remain in place until at least late 2025, necessitating proactive adaptation. Businesses must diversify their supply chains, implement robust financial planning, and actively manage risks to mitigate the negative effects. Staying informed about developments in US-China trade relations is critical. To successfully navigate the prolonged presence of the "Trump tariffs" and similar trade policy challenges, proactive research and strategic adaptation are crucial. Learn how to effectively manage Trump tariffs and mitigate tariff impacts to ensure the long-term health and success of your business in this evolving global trade landscape. The future of US-China trade requires careful planning and constant vigilance.

Featured Posts

-

Confortos Path To Following Hernandezs Dodgers Impact

May 18, 2025

Confortos Path To Following Hernandezs Dodgers Impact

May 18, 2025 -

Why Is Reddit Down Right Now Troubleshooting Guide

May 18, 2025

Why Is Reddit Down Right Now Troubleshooting Guide

May 18, 2025 -

How To See Taylor Swifts Eras Tour Wardrobe Up Close Photos And Details

May 18, 2025

How To See Taylor Swifts Eras Tour Wardrobe Up Close Photos And Details

May 18, 2025 -

Michael Conforto Overcoming Early Spring Slumps

May 18, 2025

Michael Conforto Overcoming Early Spring Slumps

May 18, 2025 -

Moncada And Sorianos Stellar Performances Secure Angels Win Against White Sox

May 18, 2025

Moncada And Sorianos Stellar Performances Secure Angels Win Against White Sox

May 18, 2025

Latest Posts

-

Stephen Millers Potential Appointment As National Security Advisor Reports Analyzed

May 18, 2025

Stephen Millers Potential Appointment As National Security Advisor Reports Analyzed

May 18, 2025 -

Analyzing The Economic Influence Of Large Scale Rave Concerts

May 18, 2025

Analyzing The Economic Influence Of Large Scale Rave Concerts

May 18, 2025 -

The Economic Powerhouse Exploring The Impact Of Huge Raves

May 18, 2025

The Economic Powerhouse Exploring The Impact Of Huge Raves

May 18, 2025 -

Snls Signal Leak Parody Mikey Madison And The Government Texts

May 18, 2025

Snls Signal Leak Parody Mikey Madison And The Government Texts

May 18, 2025 -

Large Rave Festivals A Boon For Local Economies

May 18, 2025

Large Rave Festivals A Boon For Local Economies

May 18, 2025