Cooling Spanish Inflation: Implications For The European Central Bank's Rate Decisions

Table of Contents

Factors Contributing to Cooling Spanish Inflation

Several key factors have contributed to the recent deceleration of Spanish inflation:

Easing Energy Prices

The decrease in energy costs has played a significant role in cooling overall inflation. This reduction is primarily attributable to:

- Natural gas prices: A significant drop in natural gas prices, largely due to increased supply and milder winter weather, has lessened the inflationary pressure previously exerted on household energy bills and industrial production. Statistics from the Spanish National Statistics Institute (INE) show a [Insert Percentage]% decrease in natural gas prices year-on-year.

- Electricity prices: Similarly, electricity prices have seen a notable decline, albeit less pronounced than natural gas. Government interventions, including temporary price caps and subsidies, have further mitigated the impact on consumers.

- Crude oil prices: Although less dramatic than gas, the moderation of crude oil prices has contributed to lower transportation and manufacturing costs, thus impacting overall inflation.

These energy price movements have significantly eased the burden on Spanish households and businesses, leading to a notable decrease in the headline inflation rate. Government subsidies, while effective in the short term, raise concerns about long-term fiscal sustainability and potential future inflationary pressures.

Moderating Demand

Cooling consumer spending and reduced investment activity have also contributed to the cooling of Spanish inflation.

- Rising interest rates: The ECB's interest rate hikes have increased borrowing costs for consumers and businesses, leading to a decrease in demand for credit and investment. This dampening effect on demand is reflected in slowing consumer confidence indices, showing a downturn in both willingness to spend and overall economic sentiment.

- Shifting consumer behavior: Consumers are exhibiting more cautious spending habits, prioritizing essential goods and services over discretionary purchases. This shift in consumer behavior is evidenced by a decline in retail sales in certain non-essential sectors.

- Weakening economic growth: Slower economic growth naturally translates to lower demand for goods and services, thus easing inflationary pressures. The INE's GDP growth figures for [Insert Quarter] reflect this moderation in economic activity.

Supply Chain Improvements

Improvements in global supply chains have also alleviated some inflationary pressures in Spain.

- Reduced bottlenecks: The easing of global supply chain disruptions has led to better availability of goods, reducing shortages and price hikes. Sectors previously heavily affected, such as automotive manufacturing, are now experiencing improved supply chain efficiency.

- Increased production capacity: Improved logistics and increased production capacity in key industries have contributed to a greater supply of goods, further mitigating price pressures. This increased availability has led to a decrease in the cost of many imported goods.

- Global factors: The improved global economic outlook has positively impacted the resilience of supply chains, with improved shipping and transportation contributing to reduced delays and increased reliability.

Implications for ECB Rate Decisions

The cooling of Spanish inflation has significant implications for the ECB's future monetary policy decisions.

Impact on Eurozone Inflation

Spain's economy represents a substantial portion of the Eurozone, making its inflation trends highly relevant to the overall Eurozone inflation picture. A cooling Spanish inflation rate reduces the overall average Eurozone inflation and influences the ECB's assessment of the broader inflationary pressures. The weight of Spain's economy within the Eurozone means that its inflation trends have a noticeable impact on overall Eurozone inflation calculations.

Future ECB Interest Rate Adjustments

The cooling Spanish inflation could influence the ECB to moderate the pace of interest rate hikes or even consider pausing rate increases altogether. The ECB will carefully balance the need to control inflation against the risk of triggering a recession through overly aggressive monetary tightening. The ECB's inflation targets will be a key determinant of future policy. Market forecasts currently anticipate [Insert Forecast].

Uncertainty and Risks

Despite the current trend, significant uncertainties remain regarding the future trajectory of Spanish inflation.

- Geopolitical factors: Global geopolitical events, such as the ongoing war in Ukraine, could unexpectedly impact energy prices and resurface inflationary pressures.

- Unforeseen economic shocks: Unexpected economic shocks, such as a sudden surge in demand or further supply chain disruptions, could lead to a resurgence of inflation. Such scenarios require the ECB to remain vigilant and adapt its monetary policy as needed.

- Wage pressures: While currently subdued, rising wages could potentially fuel future inflation. The ECB will closely monitor wage growth to assess its impact on price stability.

Conclusion

The cooling of Spanish inflation presents a complex picture for the European Central Bank. While it offers some respite in the fight against rising prices, the ECB must carefully weigh this development against other economic indicators across the Eurozone. Future interest rate decisions will depend on a multifaceted assessment considering the persistence of inflationary pressures, the strength of economic growth, and the potential for unforeseen shocks. Continued monitoring of Spanish inflation, alongside broader Eurozone trends, remains crucial for effective monetary policy. Stay informed on the latest developments regarding Spanish inflation to better understand the ECB's strategic responses and the implications for your investments and economic planning.

Featured Posts

-

Munguia Denies Doping Allegations After Positive Test

May 31, 2025

Munguia Denies Doping Allegations After Positive Test

May 31, 2025 -

When Do Glastonbury Coach Resale Tickets Go On Sale A Complete Guide

May 31, 2025

When Do Glastonbury Coach Resale Tickets Go On Sale A Complete Guide

May 31, 2025 -

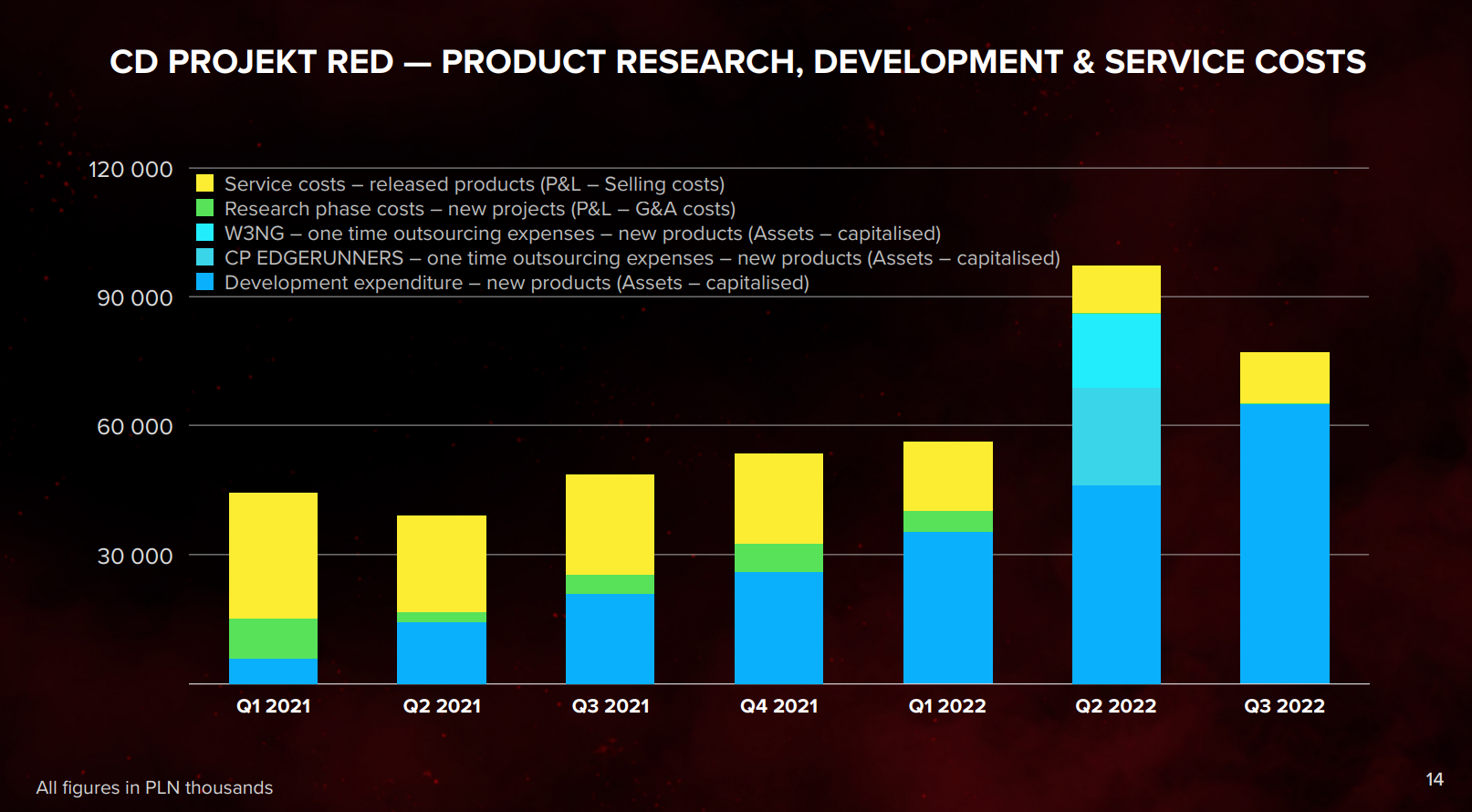

Cd Projekt Red On Cyberpunk 2 Development Updates And Expectations

May 31, 2025

Cd Projekt Red On Cyberpunk 2 Development Updates And Expectations

May 31, 2025 -

Munguias Positive Testosterone Test Surace Demands Win Overturned

May 31, 2025

Munguias Positive Testosterone Test Surace Demands Win Overturned

May 31, 2025 -

Princes Death Toxicology Report From March 26th Reveals High Fentanyl

May 31, 2025

Princes Death Toxicology Report From March 26th Reveals High Fentanyl

May 31, 2025